This version of the form is not currently in use and is provided for reference only. Download this version of

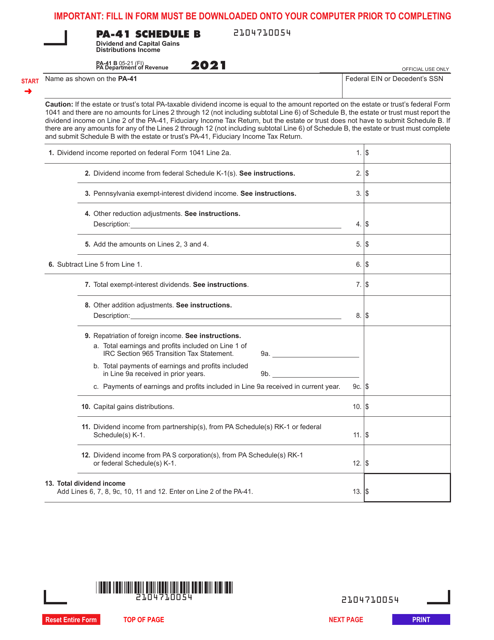

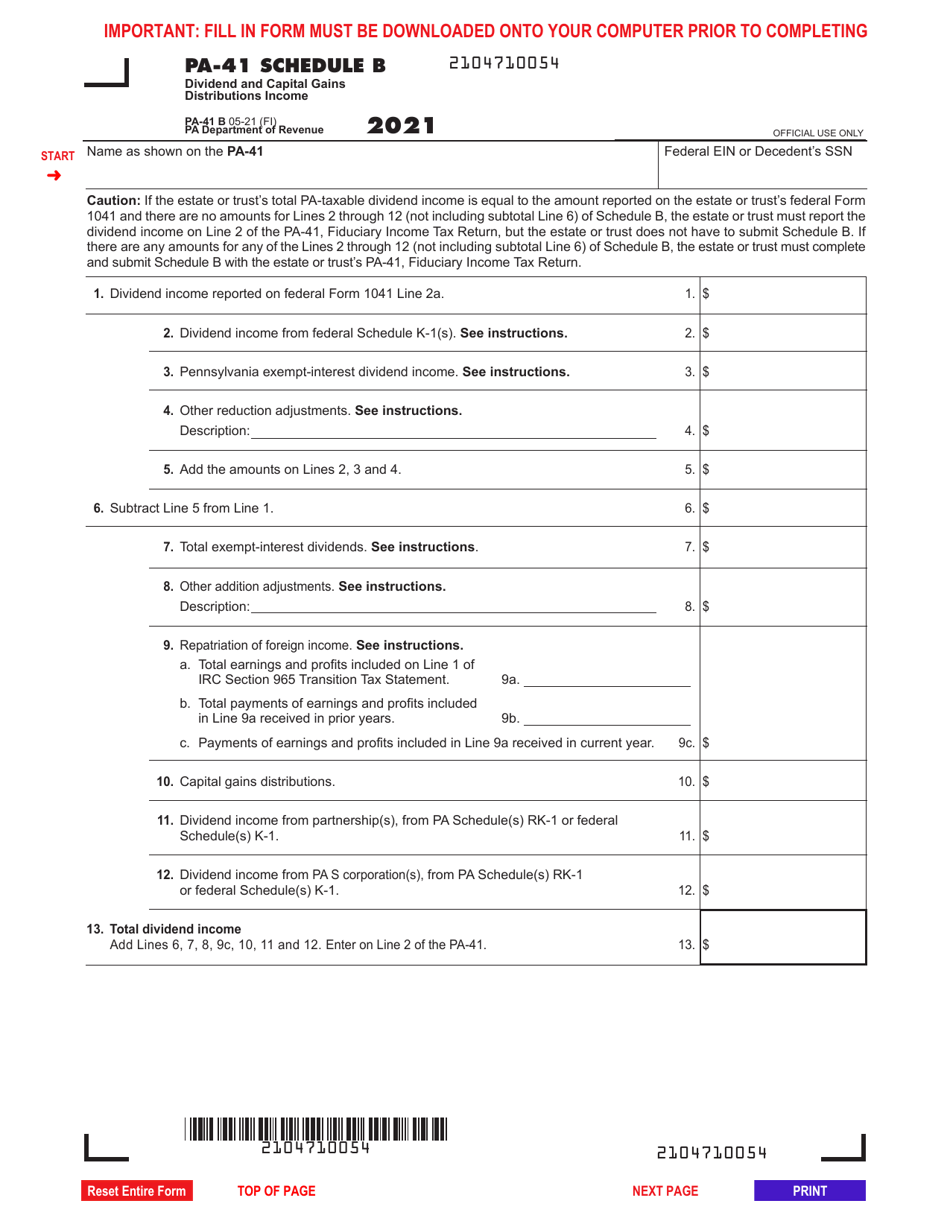

Form PA-41 Schedule B

for the current year.

Form PA-41 Schedule B Dividend and Capital Gains Distributions Income - Pennsylvania

What Is Form PA-41 Schedule B?

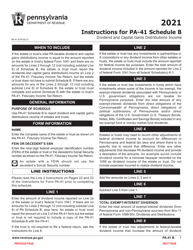

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-41, Pa Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PA-41 Schedule B?

A: PA-41 Schedule B is a form used to report dividend and capital gains distributions income in Pennsylvania.

Q: What types of income should be reported on PA-41 Schedule B?

A: PA-41 Schedule B should be used to report income from dividends and capital gains distributions.

Q: Who should file PA-41 Schedule B?

A: Pennsylvania residents who have received dividends and capital gains distributions income should file PA-41 Schedule B.

Q: What is the purpose of filing PA-41 Schedule B?

A: Filing PA-41 Schedule B allows the state of Pennsylvania to assess and collect taxes on dividend and capital gains distributions income.

Q: Is PA-41 Schedule B required for all taxpayers?

A: No, PA-41 Schedule B is only required for Pennsylvania residents who have received dividends and capital gains distributions income.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41 Schedule B by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.