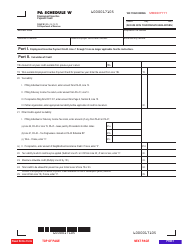

This version of the form is not currently in use and is provided for reference only. Download this version of

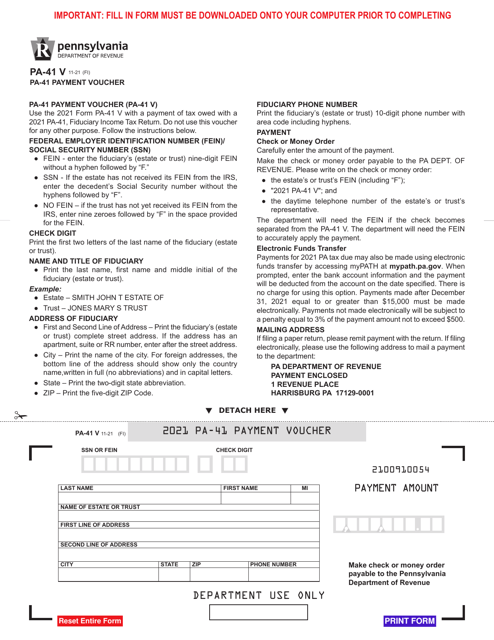

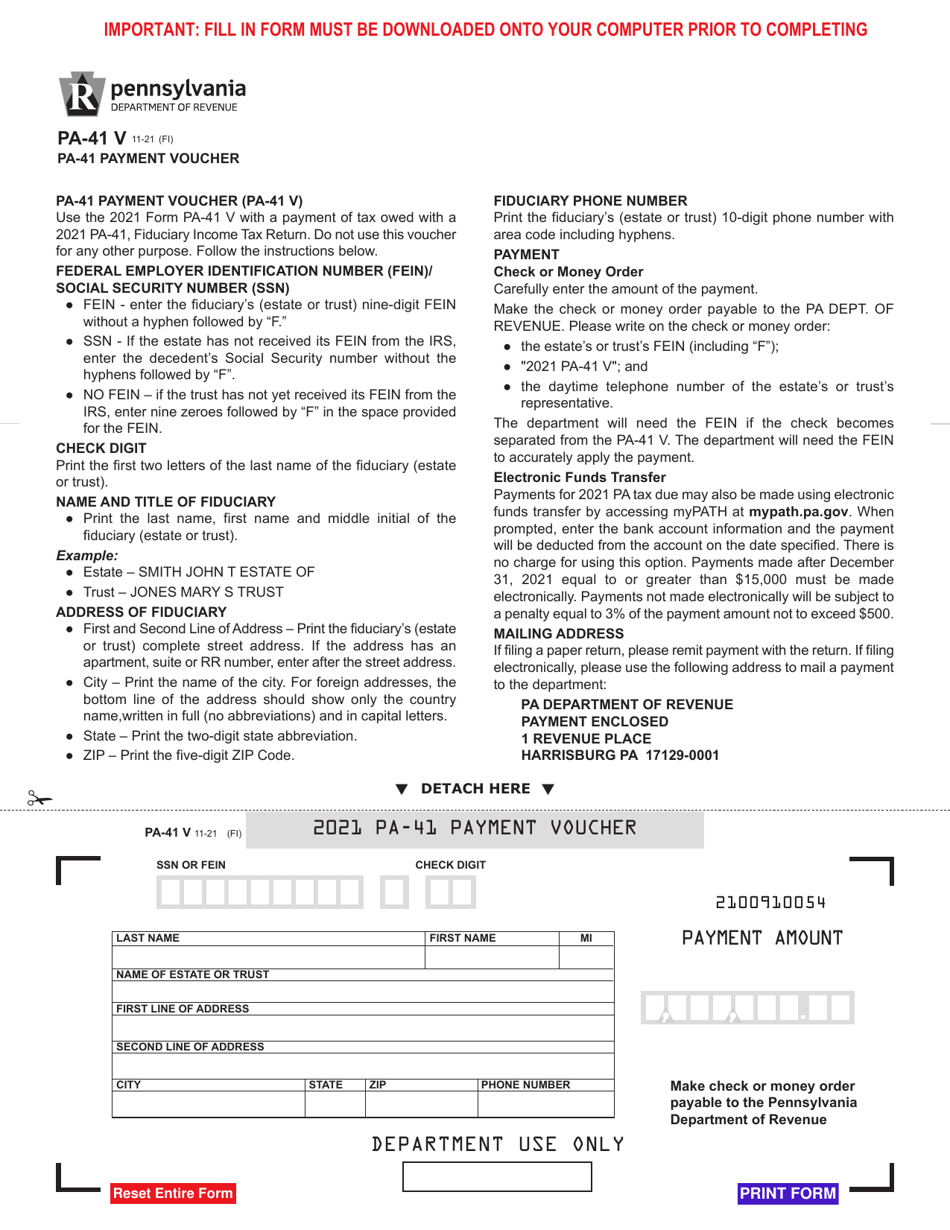

Form PA-41 V

for the current year.

Form PA-41 V Payment Voucher - Pennsylvania

What Is Form PA-41 V?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-41 V?

A: Form PA-41 V is a payment voucher for Pennsylvania state taxes.

Q: Who needs to use Form PA-41 V?

A: Form PA-41 V is required for individuals and businesses making a payment for their Pennsylvania state taxes.

Q: When should Form PA-41 V be used?

A: Form PA-41 V should be used when making a payment for Pennsylvania state taxes. It is typically used if you are filing your taxes by mail.

Q: How do I fill out Form PA-41 V?

A: To fill out Form PA-41 V, you will need to enter your name, address, Social Security number or taxpayer identification number, and the amount of your payment.

Q: What happens if I don't include Form PA-41 V with my payment?

A: If you do not include Form PA-41 V with your payment, your payment may not be properly credited to your tax account.

Q: Is Form PA-41 V the same as the PA-40 tax return?

A: No, Form PA-41 V is a payment voucher, while the PA-40 tax return is used to report your income and calculate your Pennsylvania state taxes.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41 V by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.