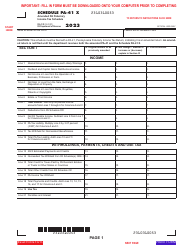

This version of the form is not currently in use and is provided for reference only. Download this version of

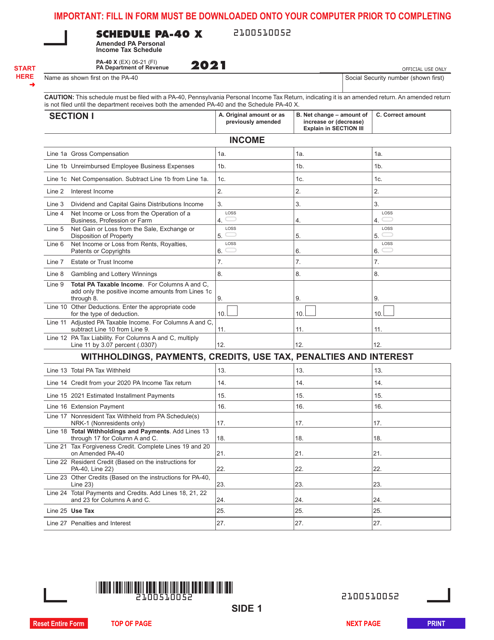

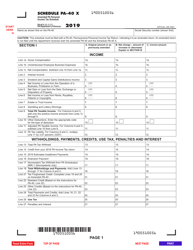

Form PA-40 Schedule X

for the current year.

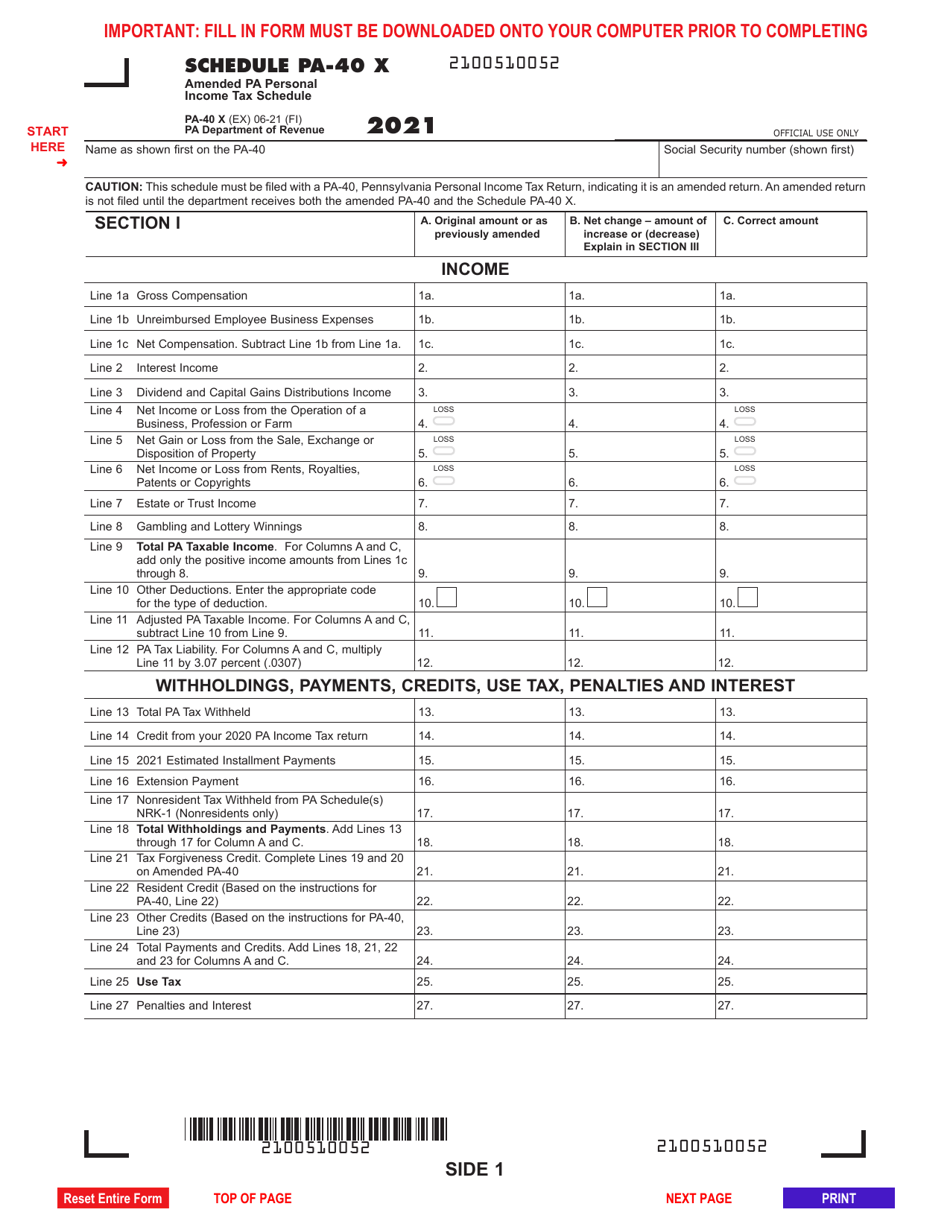

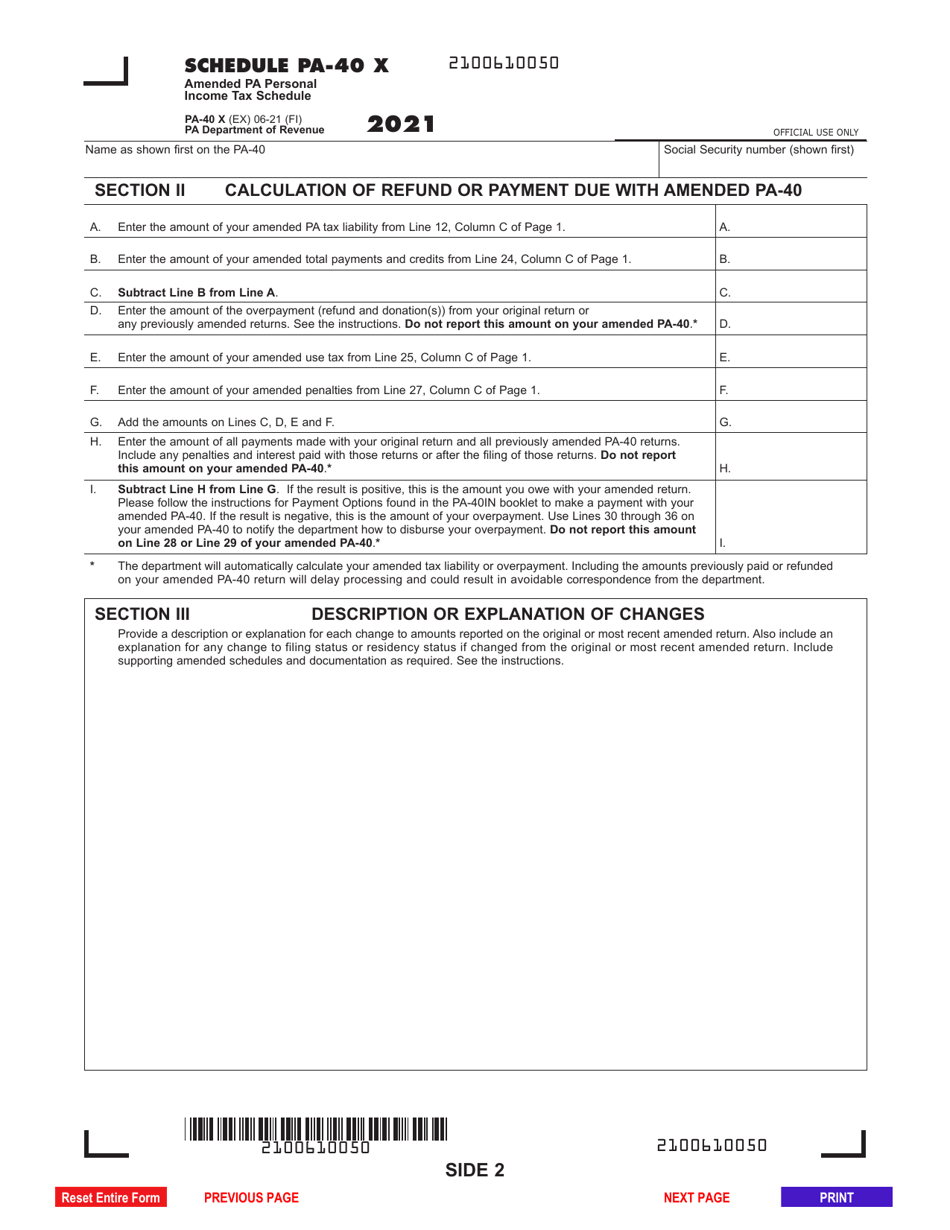

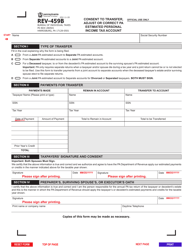

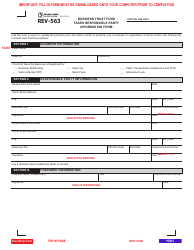

Form PA-40 Schedule X Amended Pa Personal Income Tax Schedule - Pennsylvania

What Is Form PA-40 Schedule X?

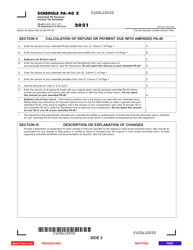

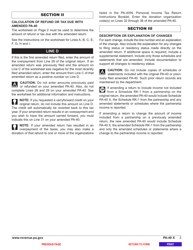

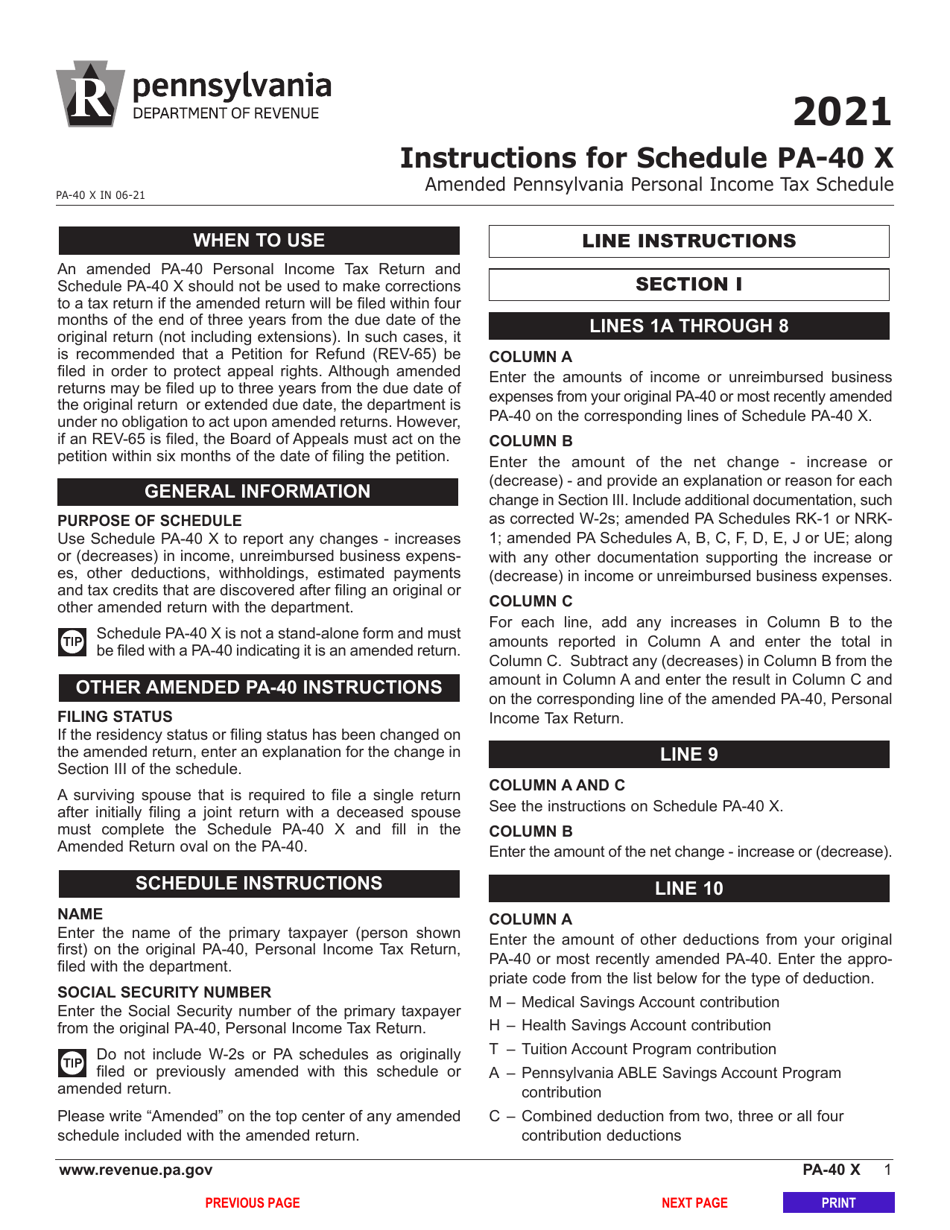

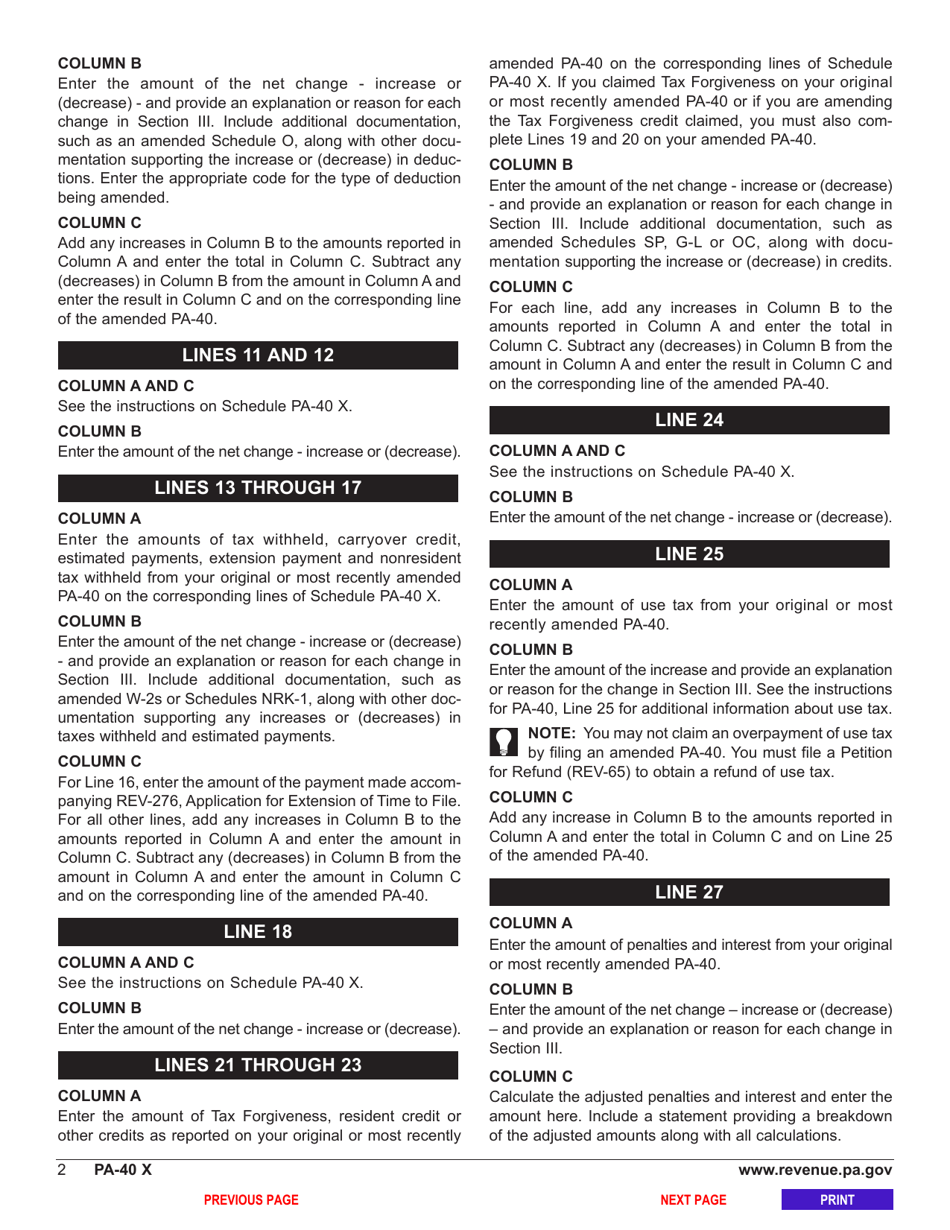

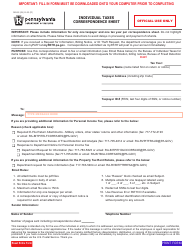

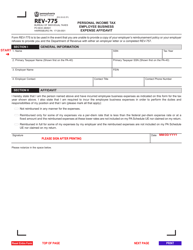

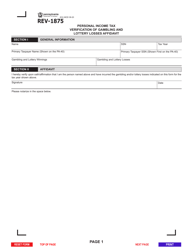

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

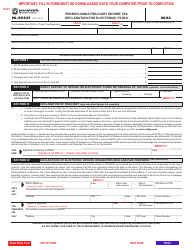

Q: What is Form PA-40 Schedule X?

A: Form PA-40 Schedule X is an amended Pennsylvania Personal IncomeTax Schedule.

Q: What is the purpose of Form PA-40 Schedule X?

A: The purpose of Form PA-40 Schedule X is to report changes or corrections to your previously filed Pennsylvania Personal Income Tax.

Q: When should I use Form PA-40 Schedule X?

A: You should use Form PA-40 Schedule X when you need to amend your Pennsylvania Personal Income Tax return.

Q: Do I need to include Form PA-40 with Form PA-40 Schedule X?

A: Yes, you must include a completed Form PA-40 with your Form PA-40 Schedule X.

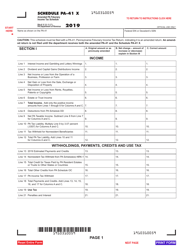

Q: Are there any fees for filing Form PA-40 Schedule X?

A: No, there are no fees for filing Form PA-40 Schedule X.

Q: Can I electronically file Form PA-40 Schedule X?

A: No, Form PA-40 Schedule X must be filed by mail.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule X by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.