This version of the form is not currently in use and is provided for reference only. Download this version of

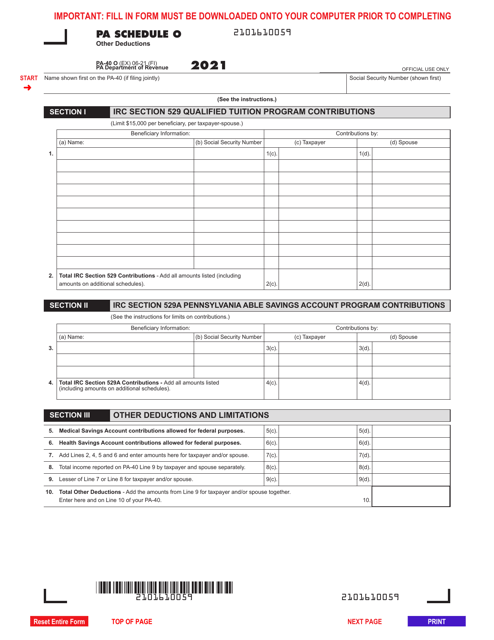

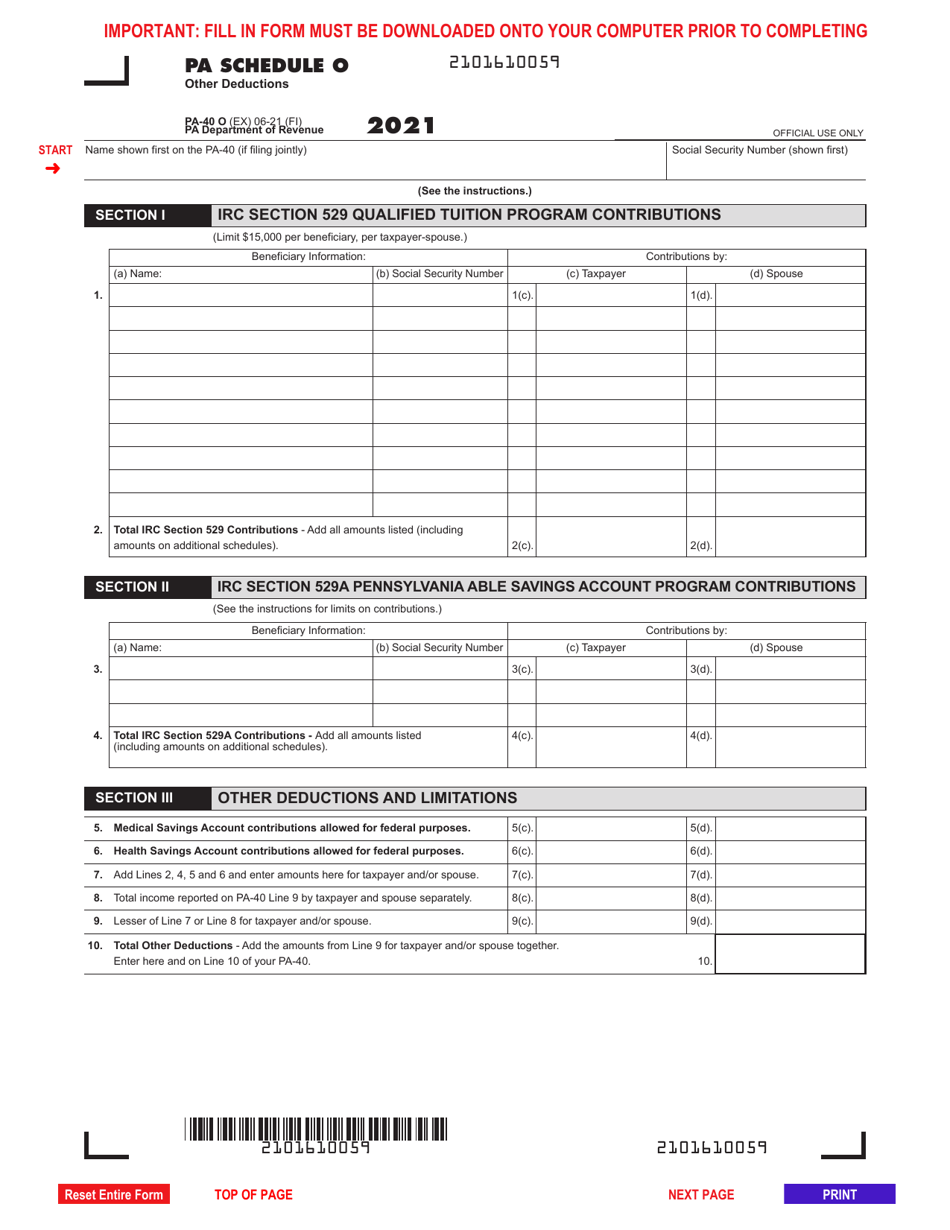

Form PA-40 Schedule O

for the current year.

Form PA-40 Schedule O Other Deductions - Pennsylvania

What Is Form PA-40 Schedule O?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PA-40 Schedule O?

A: PA-40 Schedule O is a form used by Pennsylvania residents to claim additional deductions on their state tax return.

Q: What are other deductions?

A: Other deductions refer to expenses that Pennsylvania residents can deduct from their taxable income, such as unreimbursed employee business expenses and certain educational expenses.

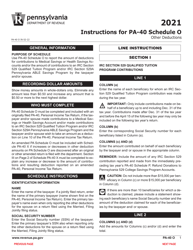

Q: How do I fill out PA-40 Schedule O?

A: You need to provide your personal information, including your name and Social Security number, and then enter the amounts for the applicable deductions in the appropriate sections of the form.

Q: What expenses can be claimed on PA-40 Schedule O?

A: Expenses that can be claimed on PA-40 Schedule O include gambling losses, investment expenses, certain home office expenses, and unreimbursed employee expenses.

Q: When is the deadline to file PA-40 Schedule O?

A: PA-40 Schedule O must be filed along with your Pennsylvania state tax return by the regular April filing deadline or the extended deadline if applicable.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule O by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.