This version of the form is not currently in use and is provided for reference only. Download this version of

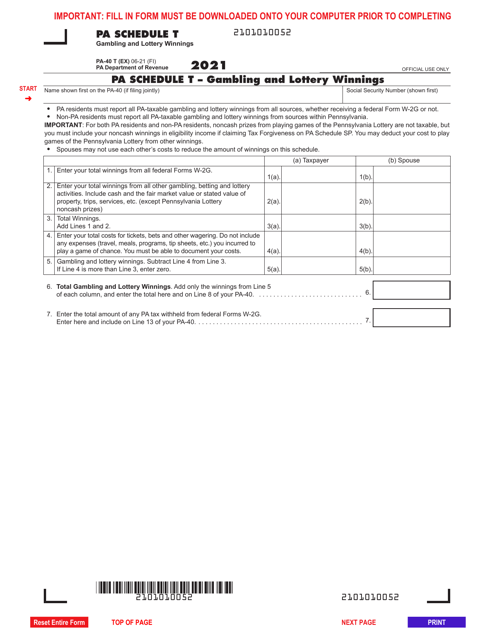

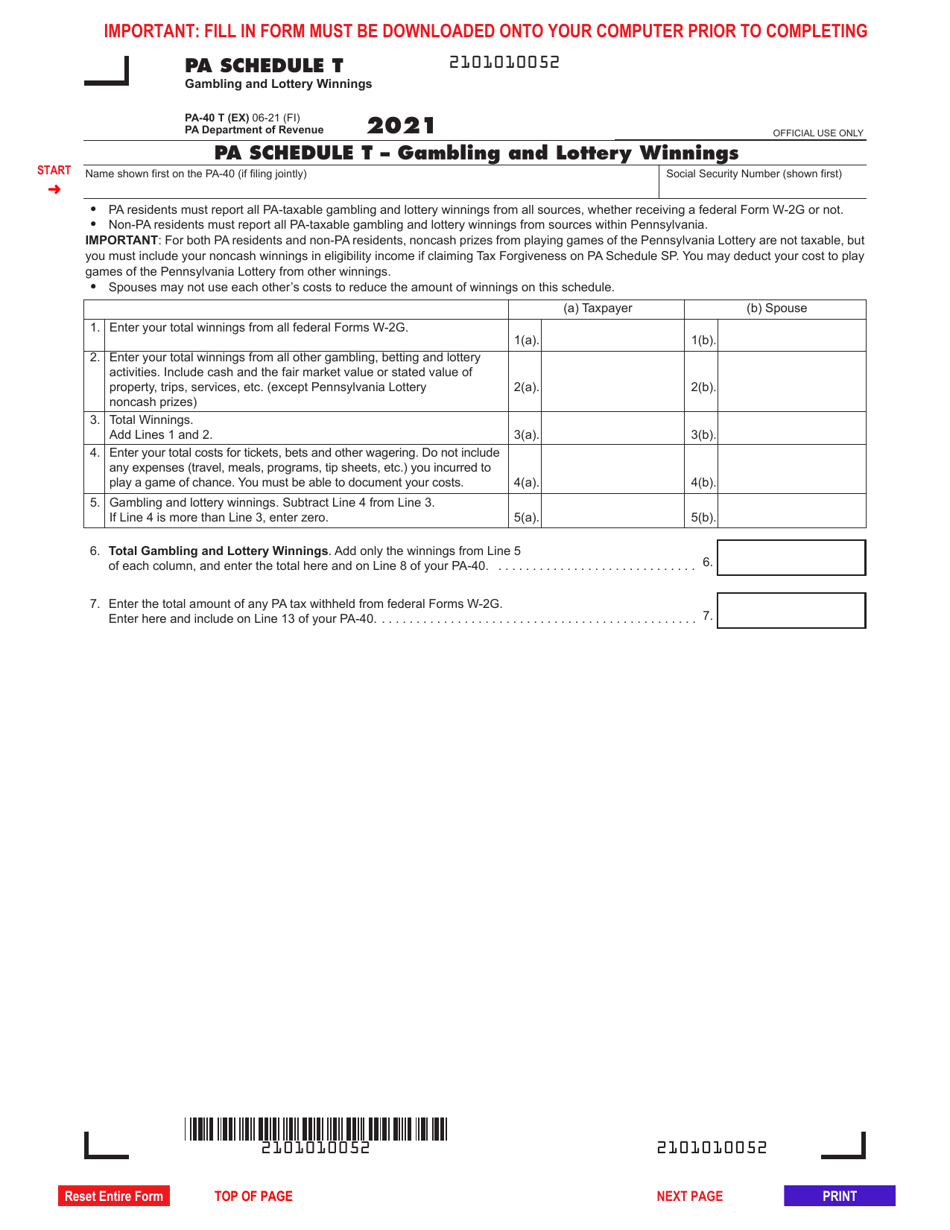

Form PA-40 Schedule T

for the current year.

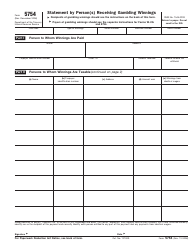

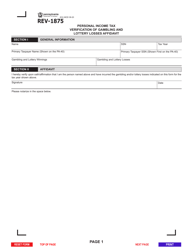

Form PA-40 Schedule T Gambling and Lottery Winnings - Pennsylvania

What Is Form PA-40 Schedule T?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

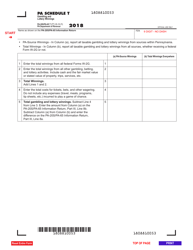

Q: What is Form PA-40 Schedule T?

A: Form PA-40 Schedule T is a tax form used in Pennsylvania to report gambling and lottery winnings.

Q: Who needs to file Form PA-40 Schedule T?

A: Individuals who won gambling or lottery winnings must file Form PA-40 Schedule T.

Q: What types of gambling and lottery winnings should be reported on Form PA-40 Schedule T?

A: All types of gambling and lottery winnings, including cash prizes, property, and non-cash prizes, should be reported on Form PA-40 Schedule T.

Q: Do I need to pay taxes on my gambling and lottery winnings?

A: Yes, gambling and lottery winnings are considered taxable income and must be reported on your state and federal tax returns.

Q: Is there a deadline to file Form PA-40 Schedule T?

A: Yes, Form PA-40 Schedule T must be filed by the same deadline as your PA-40 tax return, which is usually April 15th.

Q: What happens if I don't report my gambling and lottery winnings on Form PA-40 Schedule T?

A: Failing to report your gambling and lottery winnings can result in penalties and interest, and may trigger an audit by the Pennsylvania Department of Revenue.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule T by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.