This version of the form is not currently in use and is provided for reference only. Download this version of

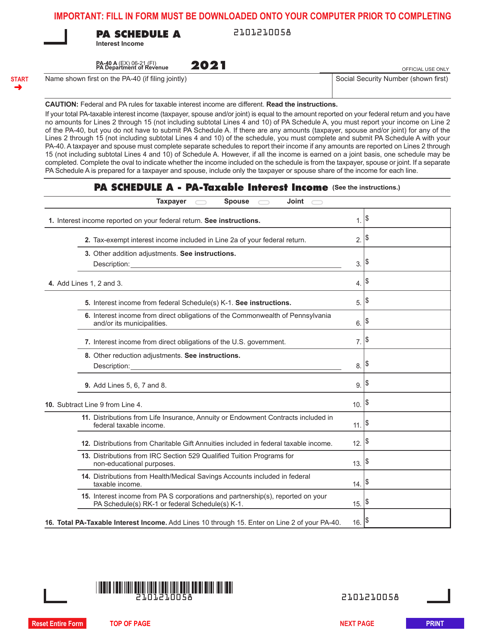

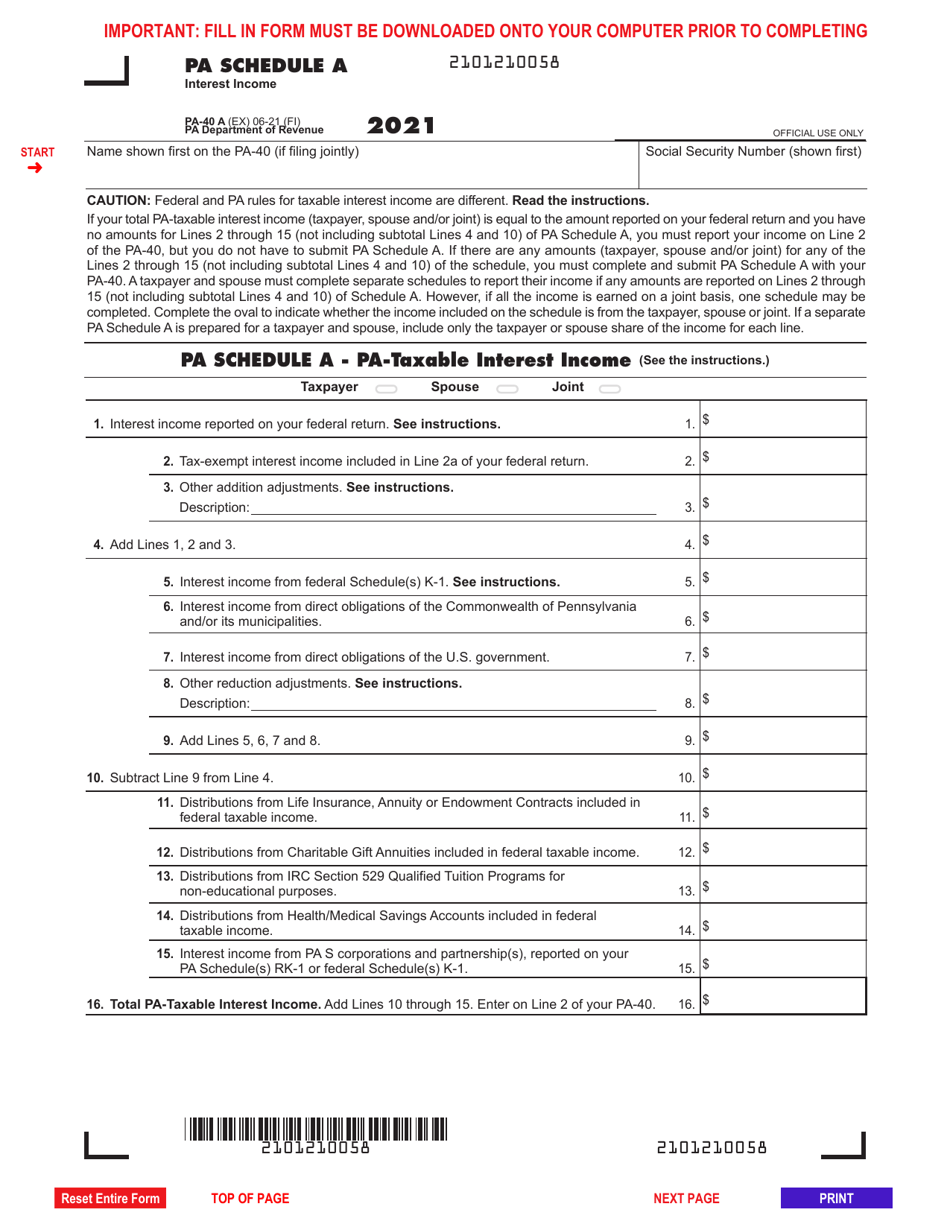

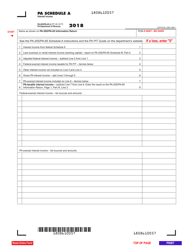

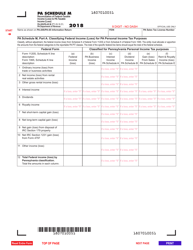

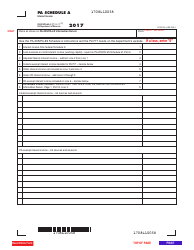

Form PA-40 Schedule A

for the current year.

Form PA-40 Schedule A Interest Income - Pennsylvania

What Is Form PA-40 Schedule A?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule A?

A: Form PA-40 Schedule A is a supplementary form used for reporting interest income in the state of Pennsylvania.

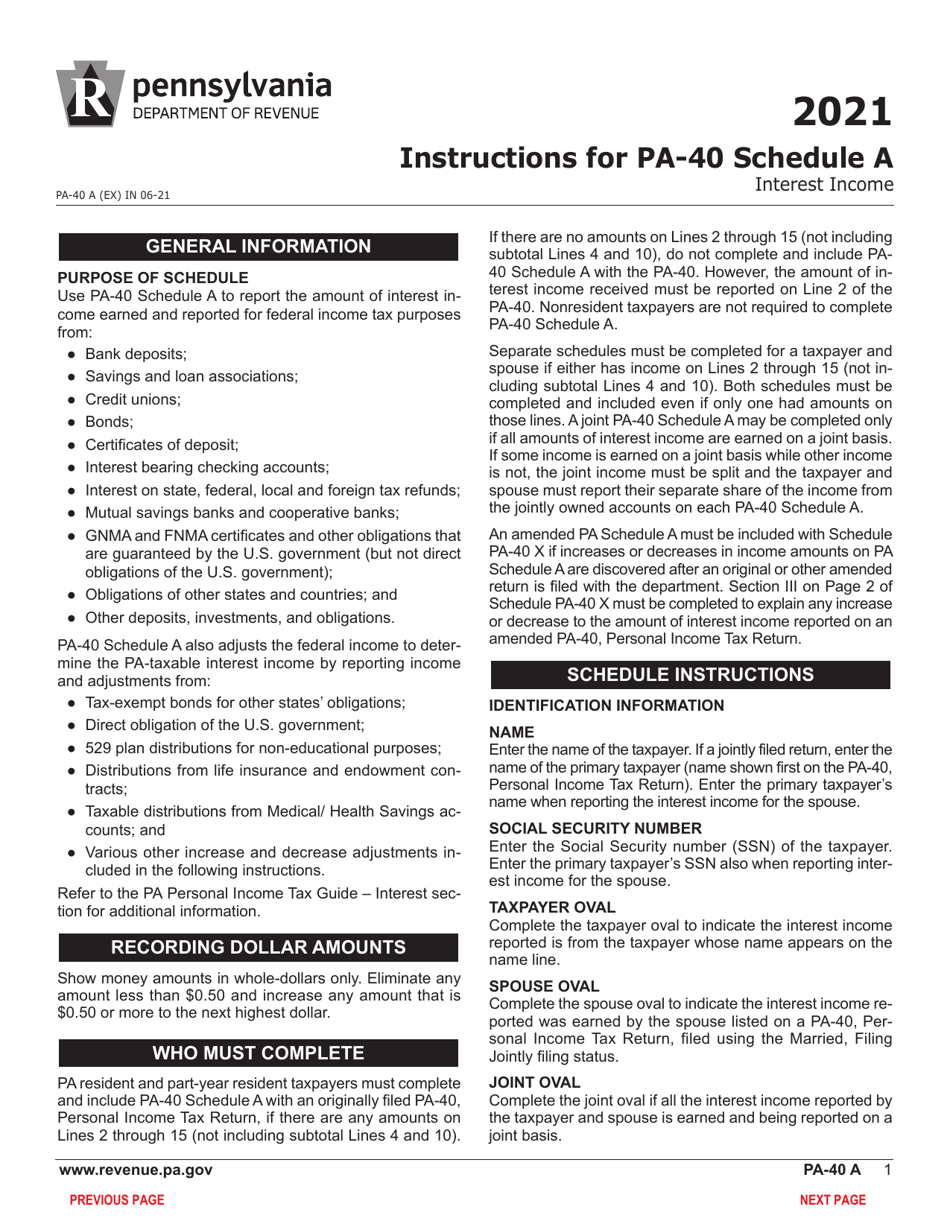

Q: Who needs to file Form PA-40 Schedule A?

A: Pennsylvania residents who have earned interest income during the tax year need to file Form PA-40 Schedule A.

Q: What is considered as interest income?

A: Interest income includes earnings from savings accounts, checking accounts, money market accounts, and certificates of deposit (CDs), among others.

Q: Do I need to report all of my interest income?

A: Yes, you need to report all of your interest income on Form PA-40 Schedule A, even if you received a 1099-INT form.

Q: When is the deadline to file Form PA-40 Schedule A?

A: The deadline to file Form PA-40 Schedule A is the same as the deadline for filing your Pennsylvania state income tax return, which is usually April 15th.

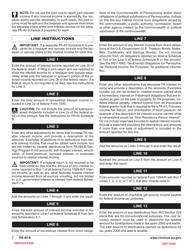

Q: Are there any specific instructions for filling out Form PA-40 Schedule A?

A: Yes, there are specific instructions provided with the form that guide you through the process of reporting your interest income.

Q: What happens if I don't file Form PA-40 Schedule A?

A: If you fail to file Form PA-40 Schedule A or report your interest income correctly, you may face penalties or additional taxes owed.

Q: Can I e-file Form PA-40 Schedule A?

A: Yes, you can e-file Form PA-40 Schedule A if you prefer to file your Pennsylvania state income tax return electronically.

Q: Is Form PA-40 Schedule A the same as the federal Schedule B?

A: No, Form PA-40 Schedule A is specific to Pennsylvania state taxes and is not the same as the federal Schedule B.

Q: Do I need to include copies of my interest statements with Form PA-40 Schedule A?

A: No, you do not need to include copies of your interest statements with Form PA-40 Schedule A, but you should keep them for your records.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule A by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.