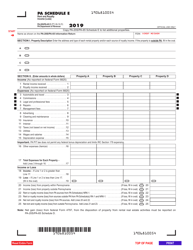

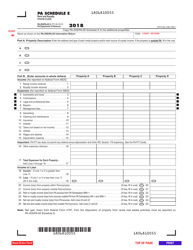

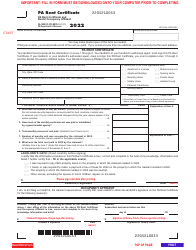

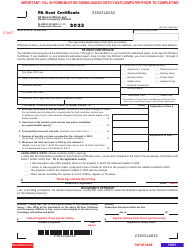

This version of the form is not currently in use and is provided for reference only. Download this version of

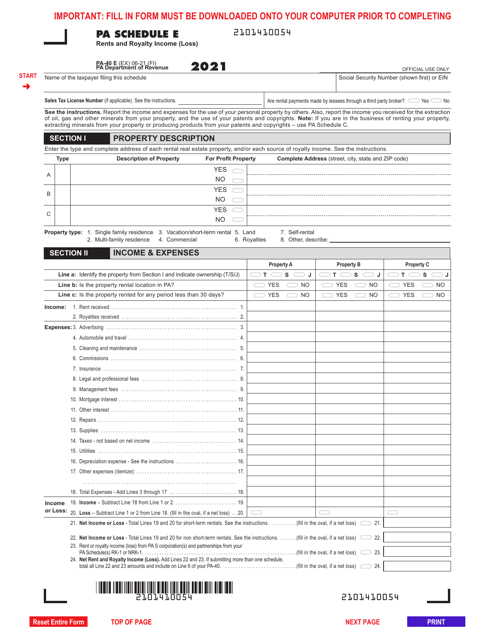

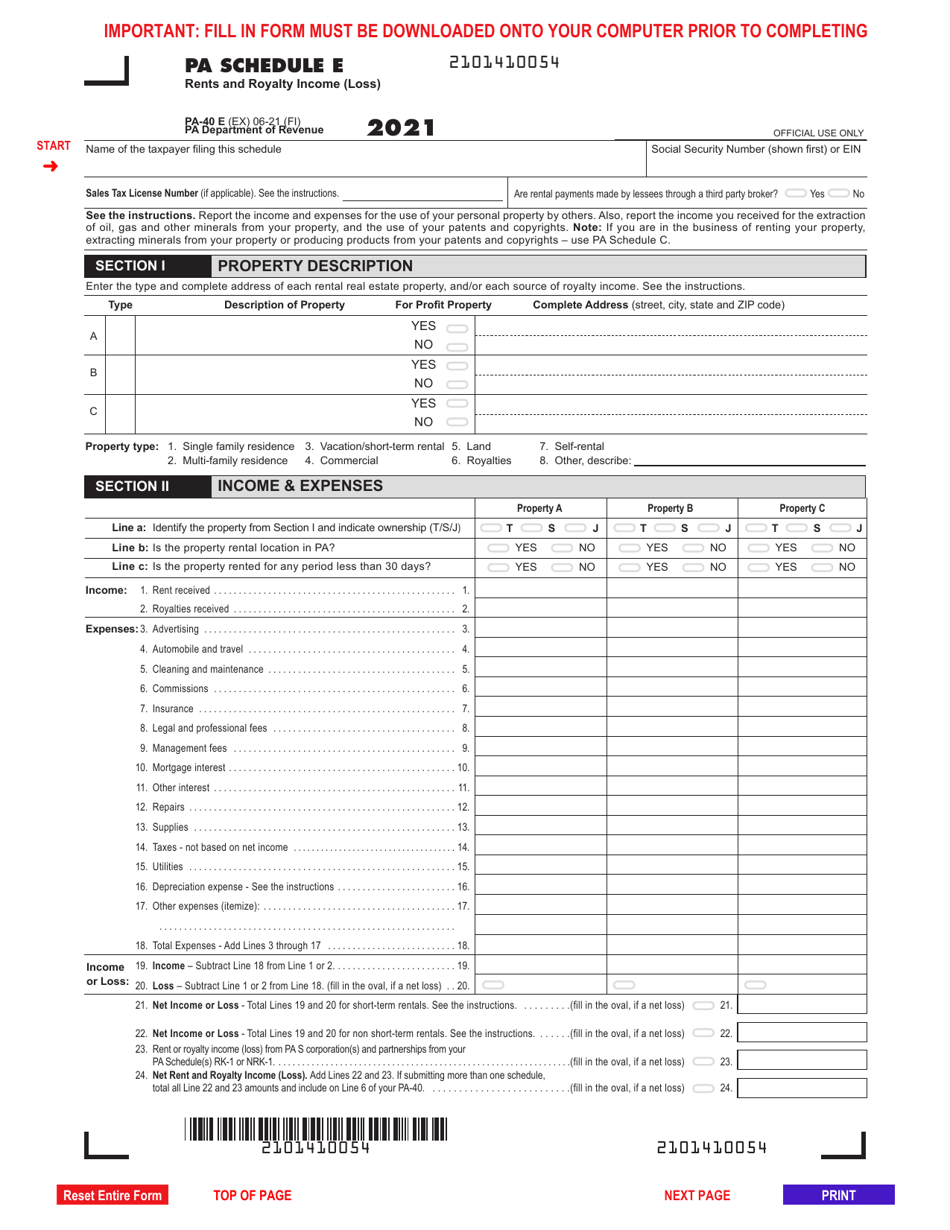

Form PA-40 Schedule E

for the current year.

Form PA-40 Schedule E Rents and Royalty Income (Loss) - Pennsylvania

What Is Form PA-40 Schedule E?

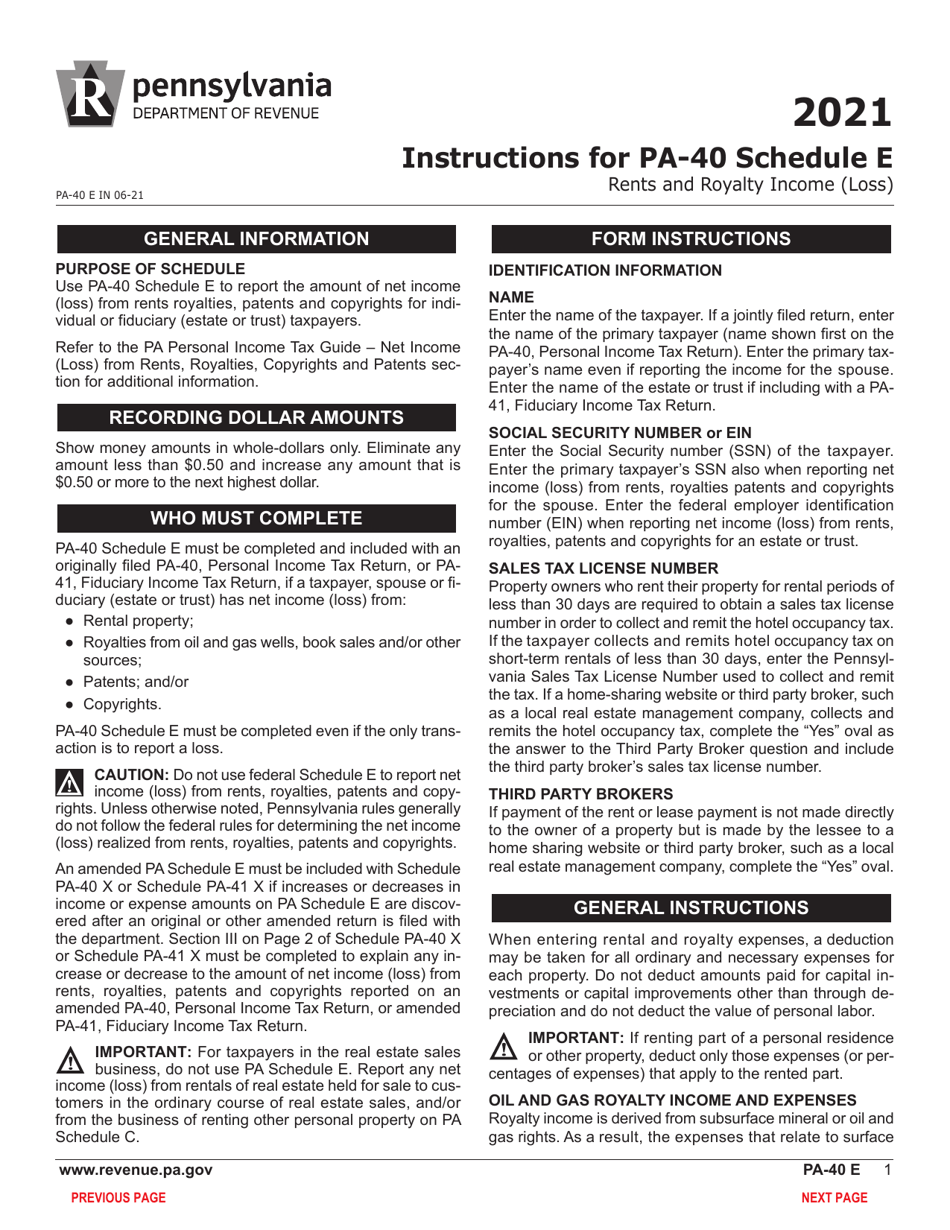

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule E?

A: Form PA-40 Schedule E is a tax form used in Pennsylvania to report rental income and income from royalties.

Q: Who needs to file Form PA-40 Schedule E?

A: Individuals who receive rental income or income from royalties in Pennsylvania need to file Form PA-40 Schedule E.

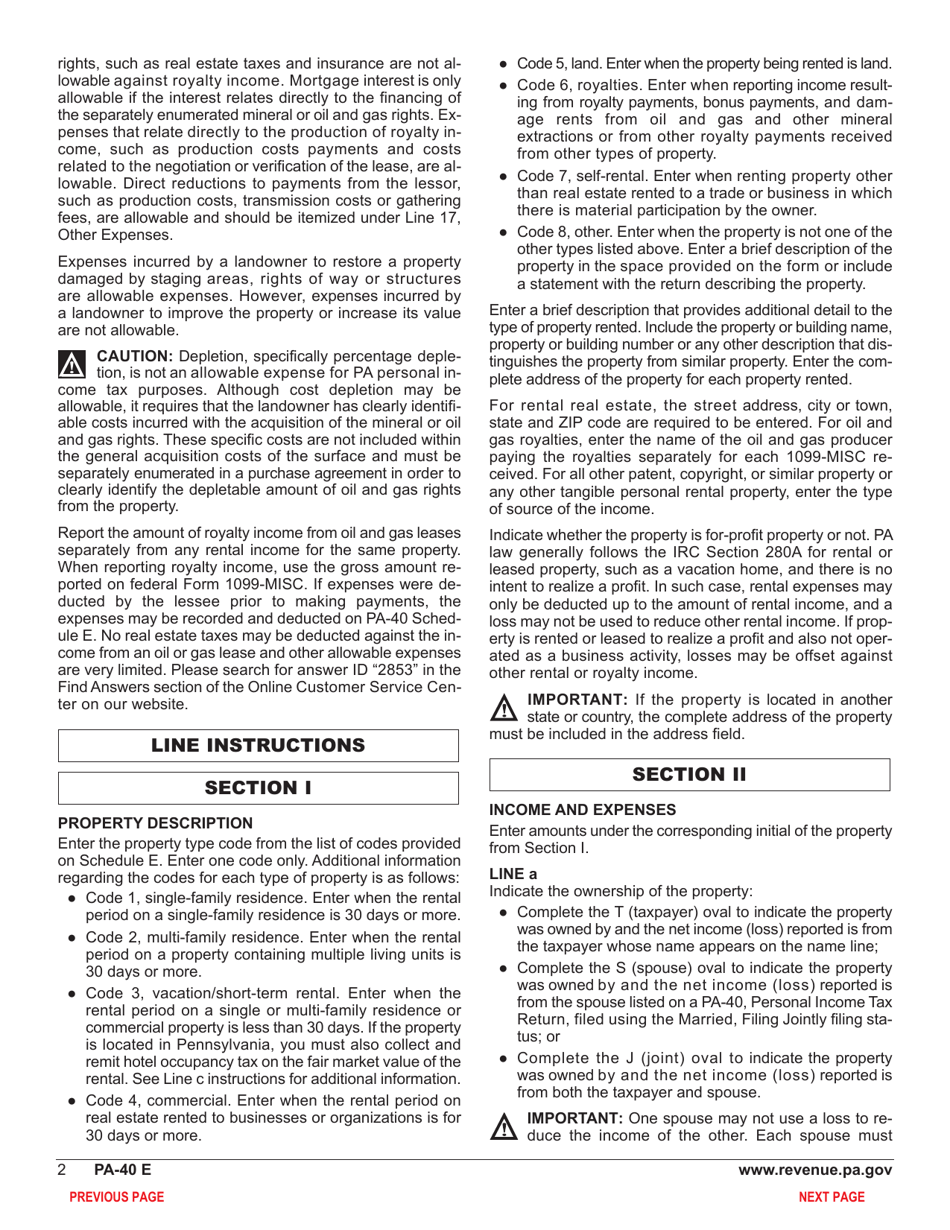

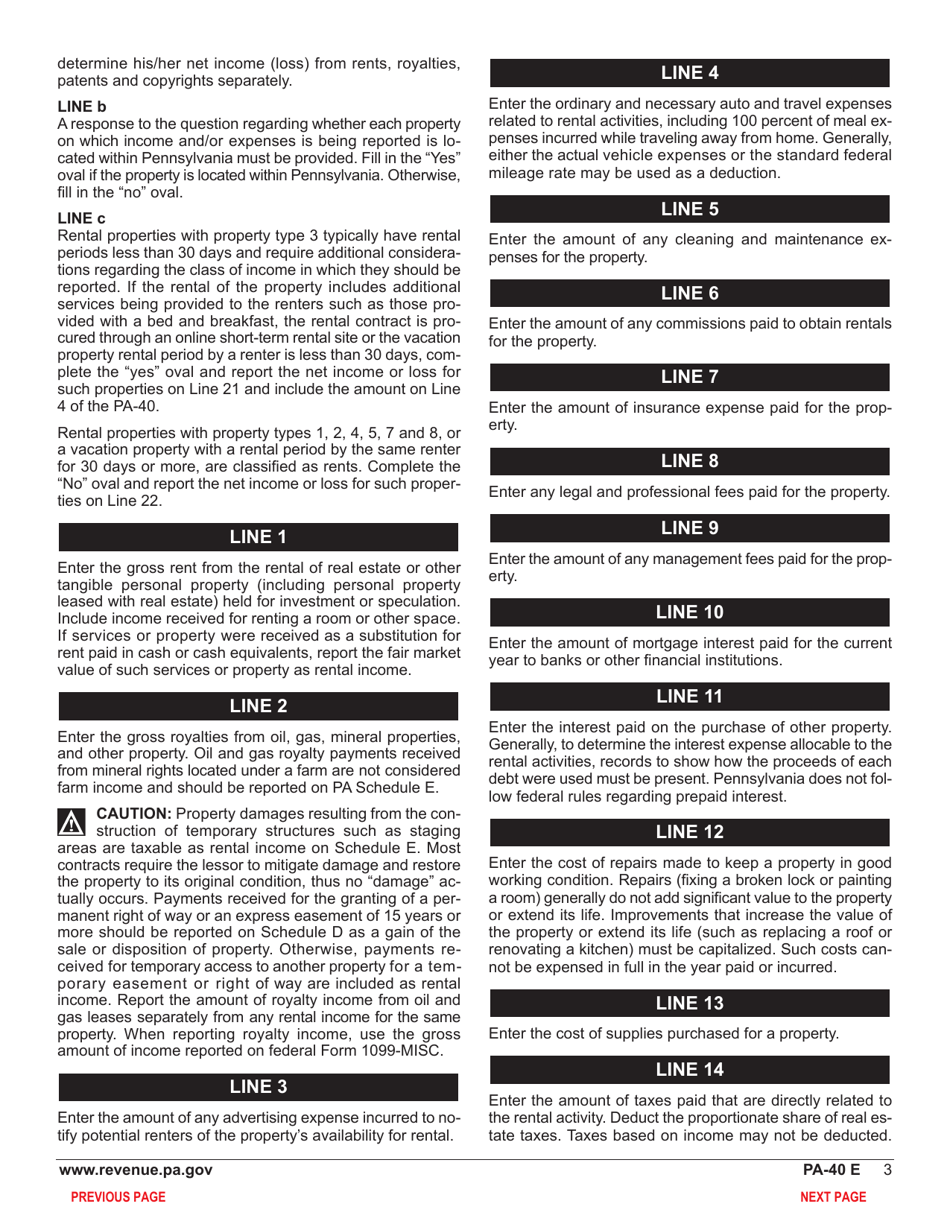

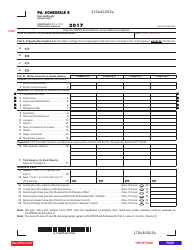

Q: What information is required to fill out Form PA-40 Schedule E?

A: To fill out Form PA-40 Schedule E, you will need to provide details about your rental income, expenses, and any royalty income.

Q: How do I fill out Form PA-40 Schedule E?

A: You can fill out Form PA-40 Schedule E by following the instructions provided by the Pennsylvania Department of Revenue. You will need to enter your rental income, deductible expenses, and calculate the net income or loss.

Q: When is the deadline to file Form PA-40 Schedule E?

A: The deadline to file Form PA-40 Schedule E is the same as the deadline for filing your Pennsylvania state tax return, which is typically April 15th.

Q: Do I need to include Form PA-40 Schedule E with my federal tax return?

A: No, Form PA-40 Schedule E is specific to Pennsylvania state taxes and should not be included with your federal tax return.

Q: Are there any penalties for not filing Form PA-40 Schedule E?

A: If you are required to file Form PA-40 Schedule E and fail to do so, you may face penalties and interest on any taxes owed.

Q: Can I e-file Form PA-40 Schedule E?

A: Yes, you can e-file Form PA-40 Schedule E using approved tax software or through a tax professional.

Q: Can I use Form PA-40 Schedule E to report income from other sources?

A: No, Form PA-40 Schedule E is specifically for reporting rental income and income from royalties. Other types of income may need to be reported on different forms.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule E by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.