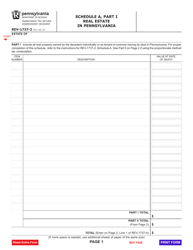

This version of the form is not currently in use and is provided for reference only. Download this version of

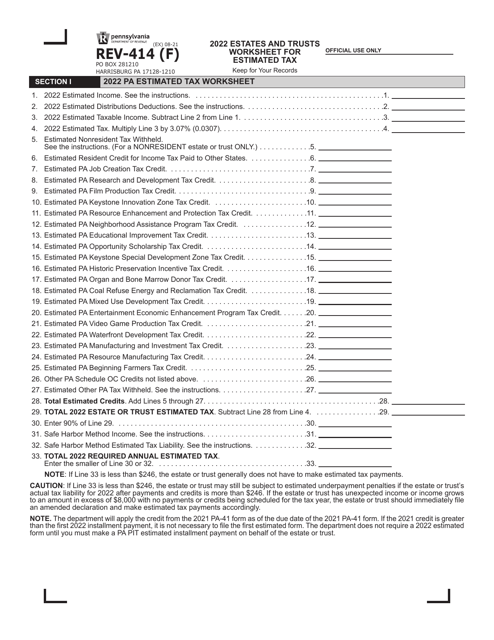

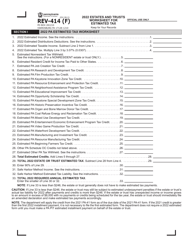

Form REV-414 (F)

for the current year.

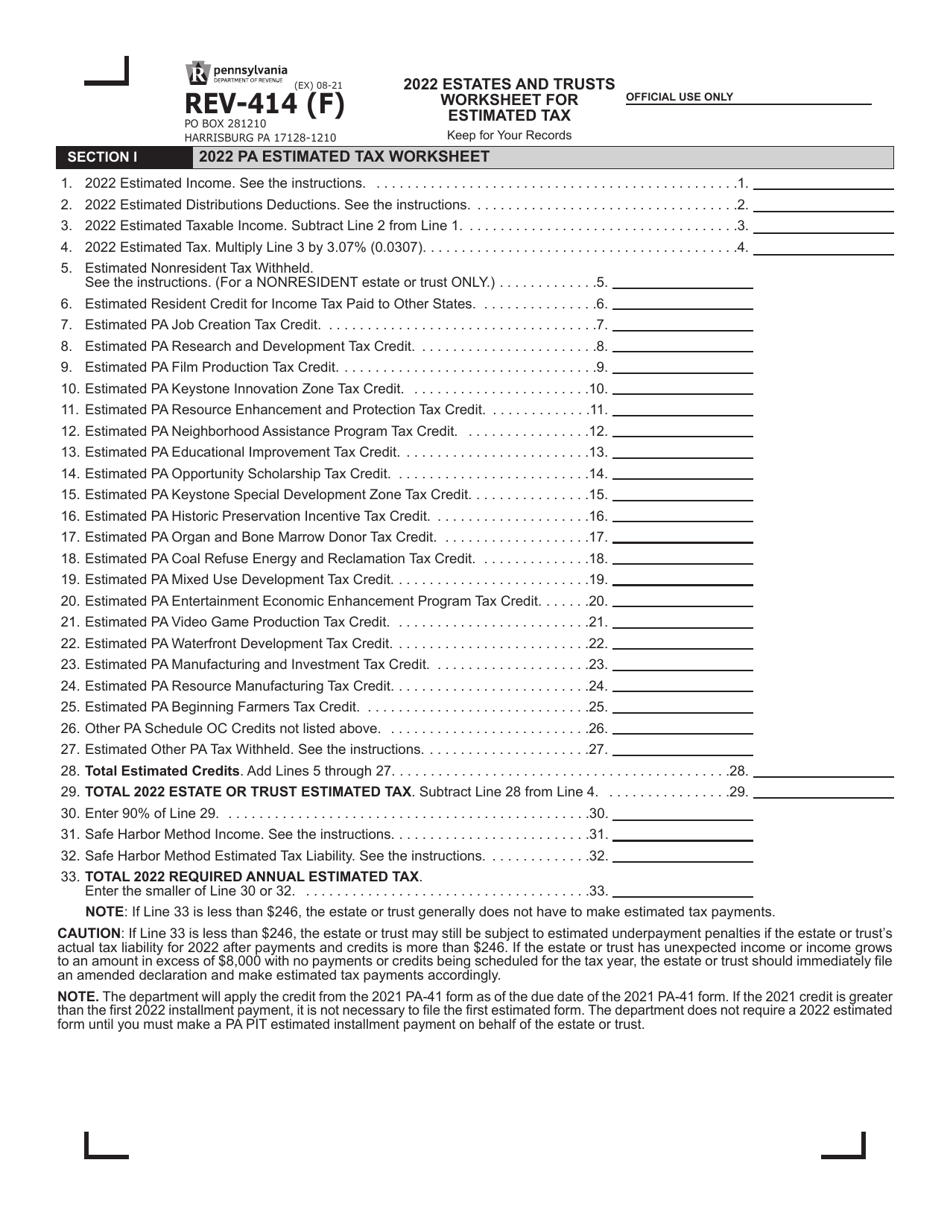

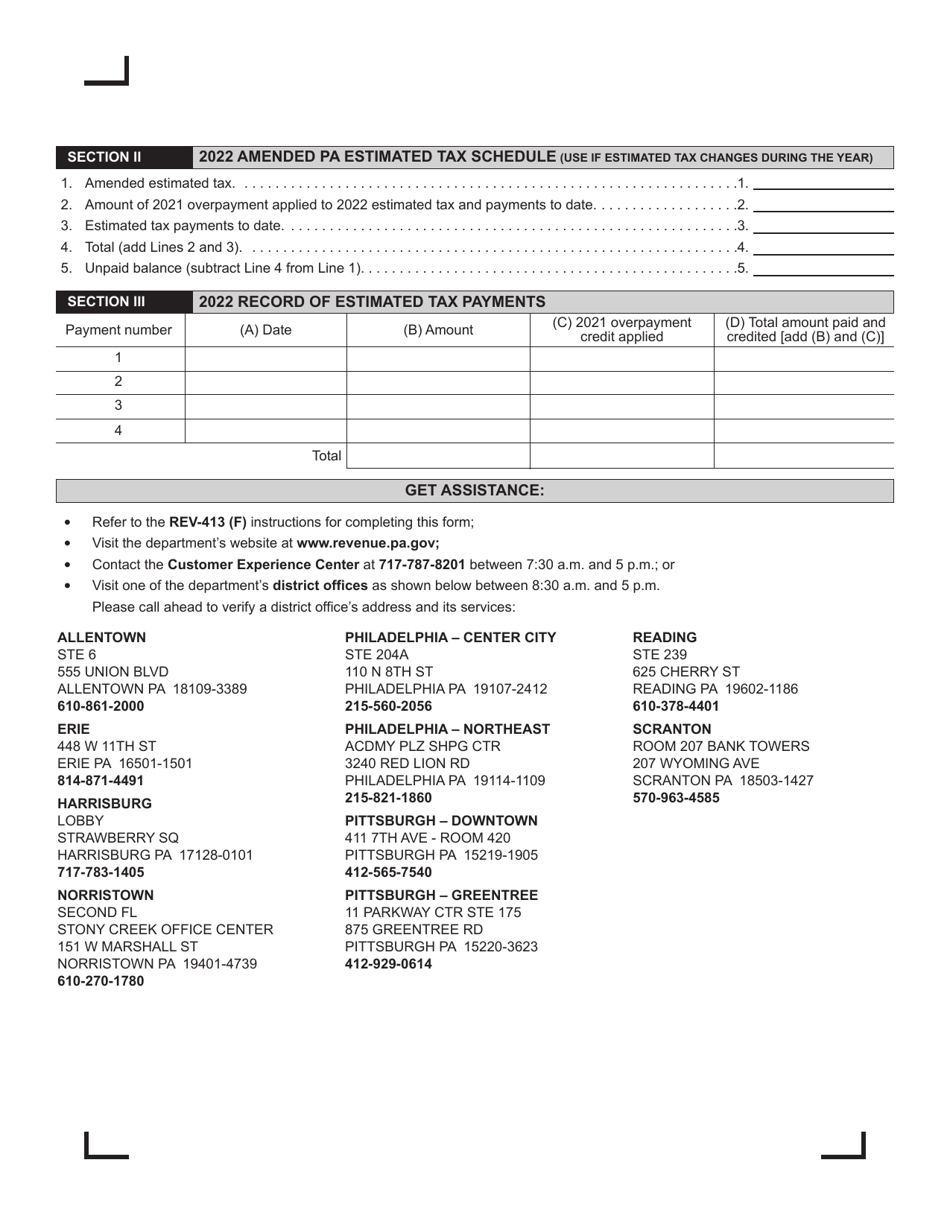

Form REV-414 (F) Estates and Trusts Worksheet for Estimated Tax - Pennsylvania

What Is Form REV-414 (F)?

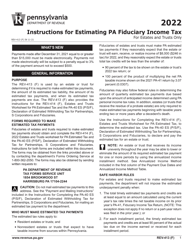

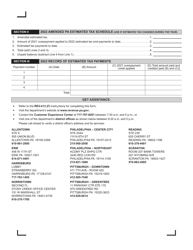

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form REV-414 (F)?

A: Form REV-414 (F) is the Estates and Trusts Worksheet for Estimated Tax in Pennsylvania.

Q: Who needs to use Form REV-414 (F)?

A: Form REV-414 (F) is used by estates and trusts in Pennsylvania to calculate and pay estimated tax.

Q: What is the purpose of Form REV-414 (F)?

A: The purpose of Form REV-414 (F) is to determine the estimated tax liability of estates and trusts in Pennsylvania.

Q: When is Form REV-414 (F) due?

A: Form REV-414 (F) is due on or before the 15th day of the fourth month following the close of the tax year.

Q: Are there any penalties for late filing of Form REV-414 (F)?

A: Yes, there may be penalties for late filing or underpayment of estimated tax, so it is important to submit the form on time.

Q: Can I file Form REV-414 (F) electronically?

A: Yes, estates and trusts can file Form REV-414 (F) electronically using the Pennsylvania Department of Revenue's e-Services platform.

Q: What information do I need to complete Form REV-414 (F)?

A: To complete Form REV-414 (F), you will need information about the estate or trust's income, deductions, and credits.

Q: How do I calculate the estimated tax on Form REV-414 (F)?

A: The estimated tax on Form REV-414 (F) is calculated based on the estate or trust's estimated taxable income for the current tax year.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV-414 (F) by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.