This version of the form is not currently in use and is provided for reference only. Download this version of

Form DQ-1

for the current year.

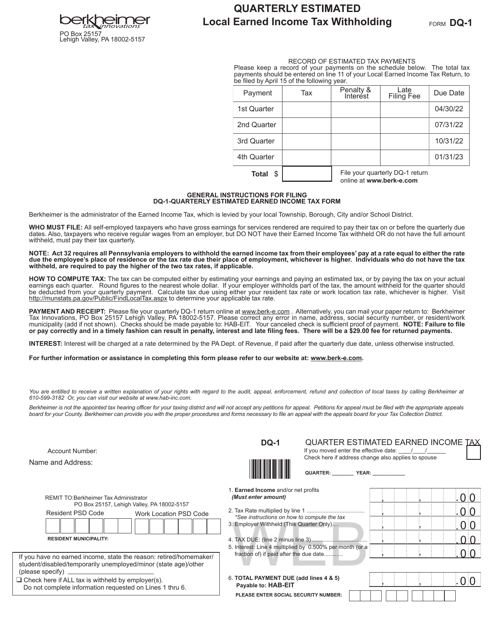

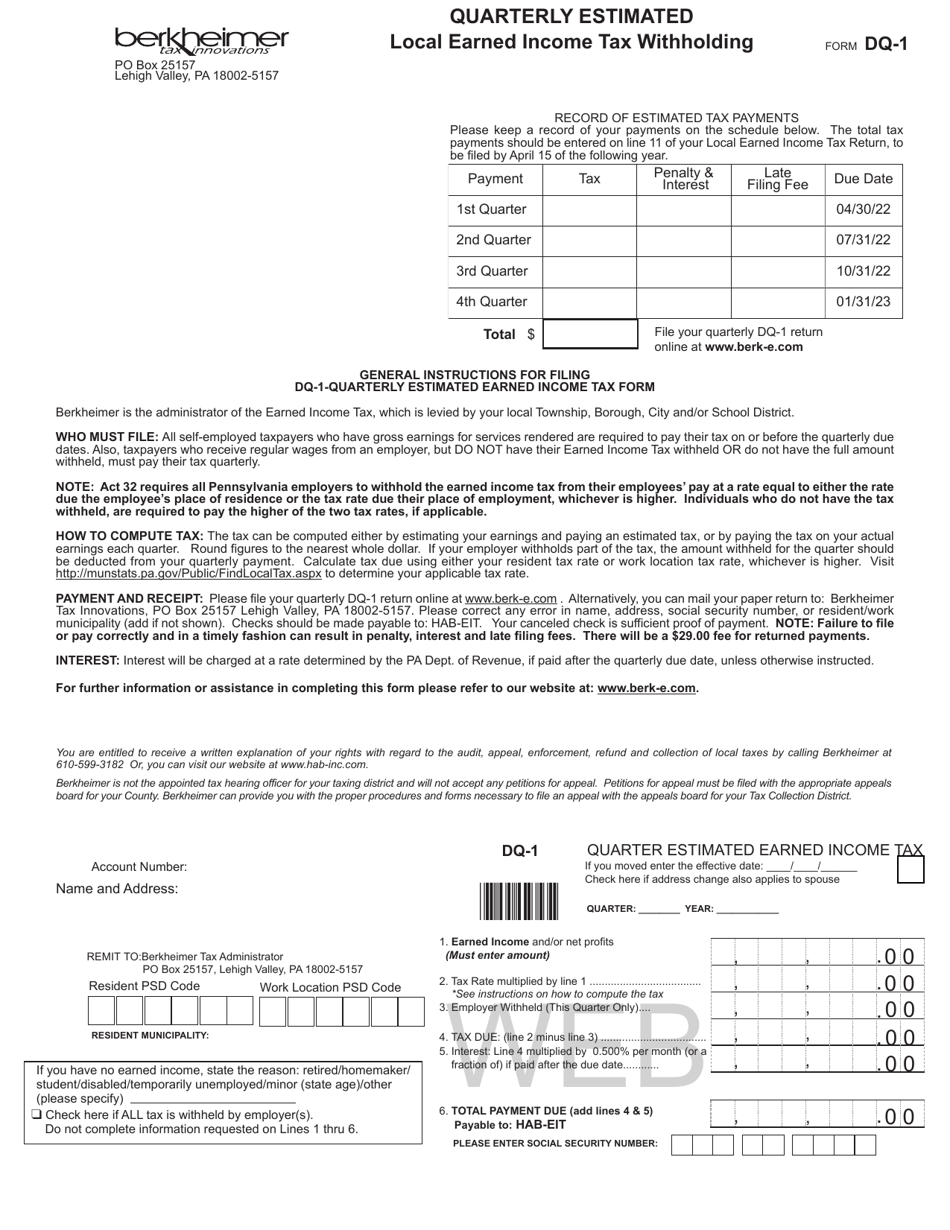

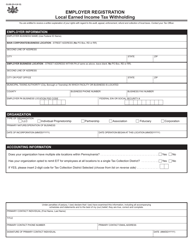

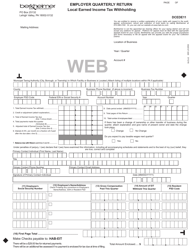

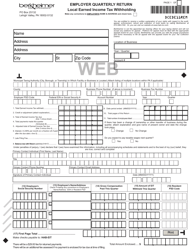

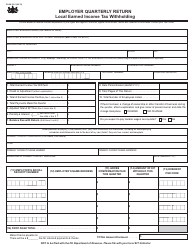

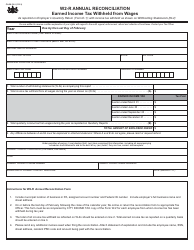

Form DQ-1 Quarterly Estimated Local Earned Income Tax Withholding - Pennsylvania

What Is Form DQ-1?

This is a legal form that was released by the Berkheimer Tax Administrator - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DQ-1?

A: Form DQ-1 is the Quarterly Estimated Local Earned Income Tax Withholding form.

Q: What is the purpose of Form DQ-1?

A: The purpose of Form DQ-1 is to calculate and withhold local earned income tax.

Q: Who needs to file Form DQ-1?

A: Employers in Pennsylvania need to file Form DQ-1.

Q: How often is Form DQ-1 filed?

A: Form DQ-1 is filed on a quarterly basis.

Q: What information is required on Form DQ-1?

A: Form DQ-1 requires information such as the employer's name, address, and tax account number, as well as the amount of wages subject to local earned income tax.

Q: Are there any penalties for not filing Form DQ-1?

A: Yes, there can be penalties for failing to file Form DQ-1, including interest and penalties on unpaid amounts.

Form Details:

- The latest edition provided by the Berkheimer Tax Administrator;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DQ-1 by clicking the link below or browse more documents and templates provided by the Berkheimer Tax Administrator.