This version of the form is not currently in use and is provided for reference only. Download this version of

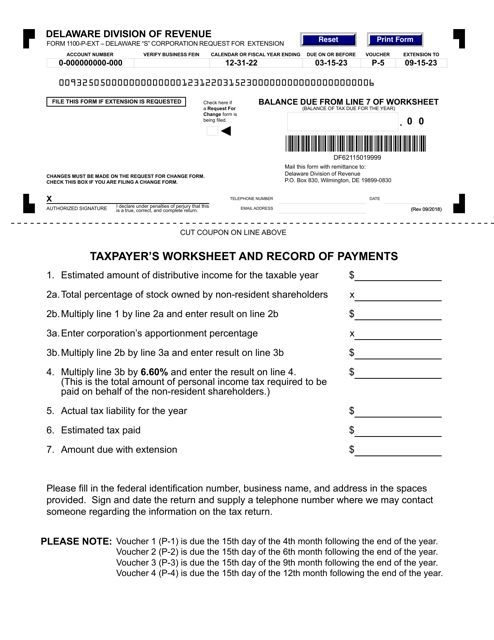

Form 1100-P-EXT

for the current year.

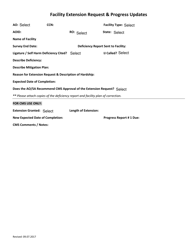

Form 1100-P-EXT Delaware S Corporation Request for Extension - Delaware

What Is Form 1100-P-EXT?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1100-P-EXT?

A: Form 1100-P-EXT is a request for extension for Delaware S Corporation tax returns.

Q: Who should file Form 1100-P-EXT?

A: Delaware S Corporations that need additional time to file their tax returns should file Form 1100-P-EXT.

Q: What is the purpose of Form 1100-P-EXT?

A: The purpose of Form 1100-P-EXT is to request an extension for filing the Delaware S Corporation tax return.

Q: Is there a deadline for filing Form 1100-P-EXT?

A: Yes, Form 1100-P-EXT must be filed on or before the original due date of the Delaware S Corporation tax return.

Q: What happens if I don't file Form 1100-P-EXT?

A: If you don't file Form 1100-P-EXT and fail to file the Delaware S Corporation tax return on time, you may face penalties and interest charges.

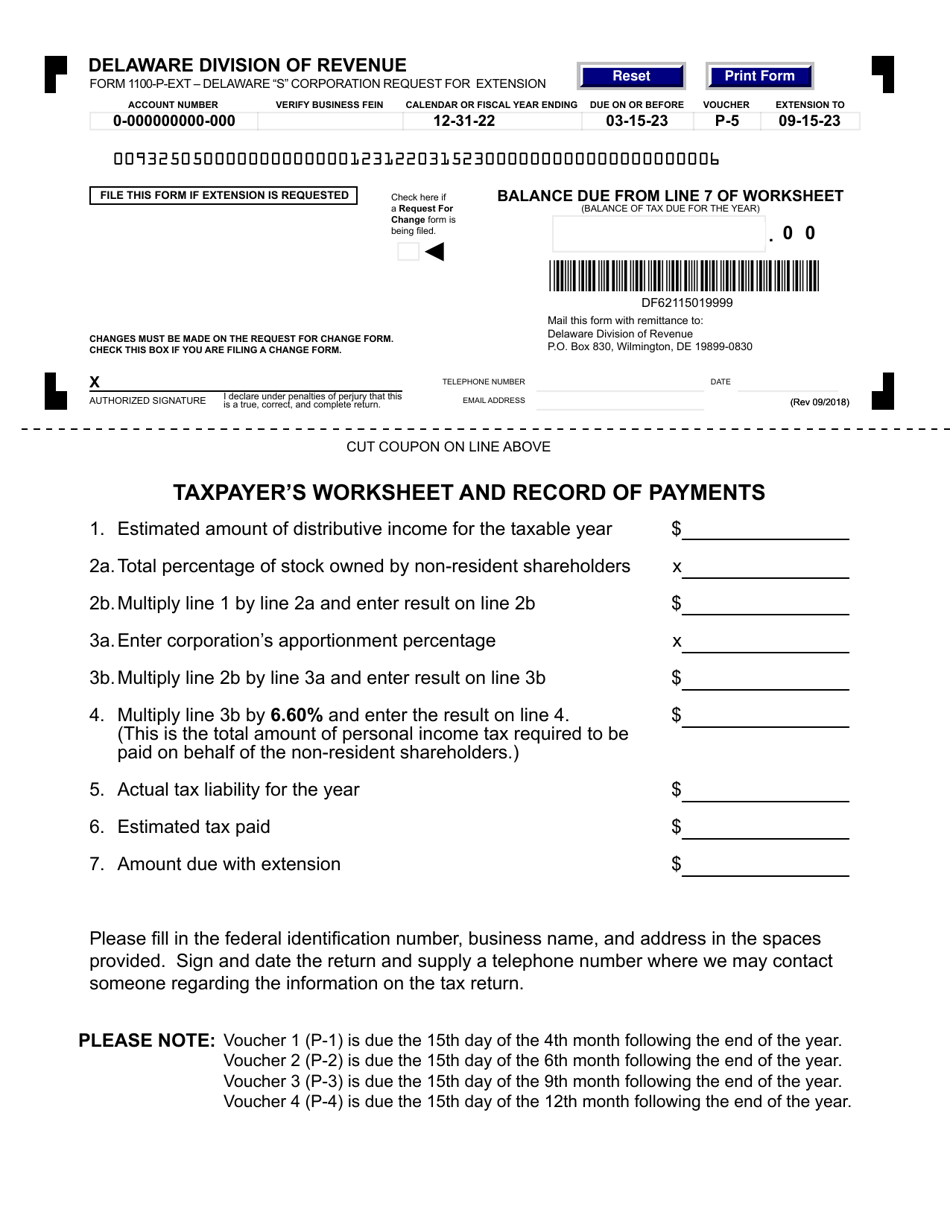

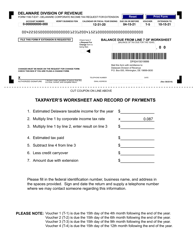

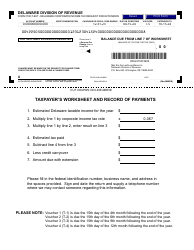

Q: What information is required on Form 1100-P-EXT?

A: Form 1100-P-EXT requires information such as the corporation's name, address, federal employer identification number, and estimate of tax liability.

Q: How do I submit Form 1100-P-EXT?

A: Form 1100-P-EXT can be submitted electronically or by mail to the Delaware Division of Revenue.

Q: Can I request multiple extensions using Form 1100-P-EXT?

A: No, Form 1100-P-EXT can only be used to request one extension for the Delaware S Corporation tax return.

Q: Can I use Form 1100-P-EXT for other types of entities?

A: No, Form 1100-P-EXT is specifically for Delaware S Corporations and cannot be used for other types of entities.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1100-P-EXT by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.