This version of the form is not currently in use and is provided for reference only. Download this version of

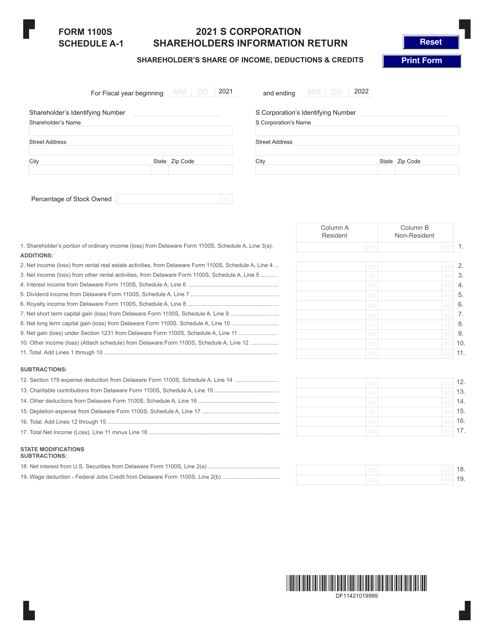

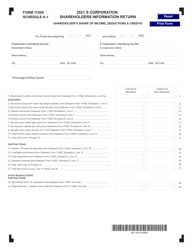

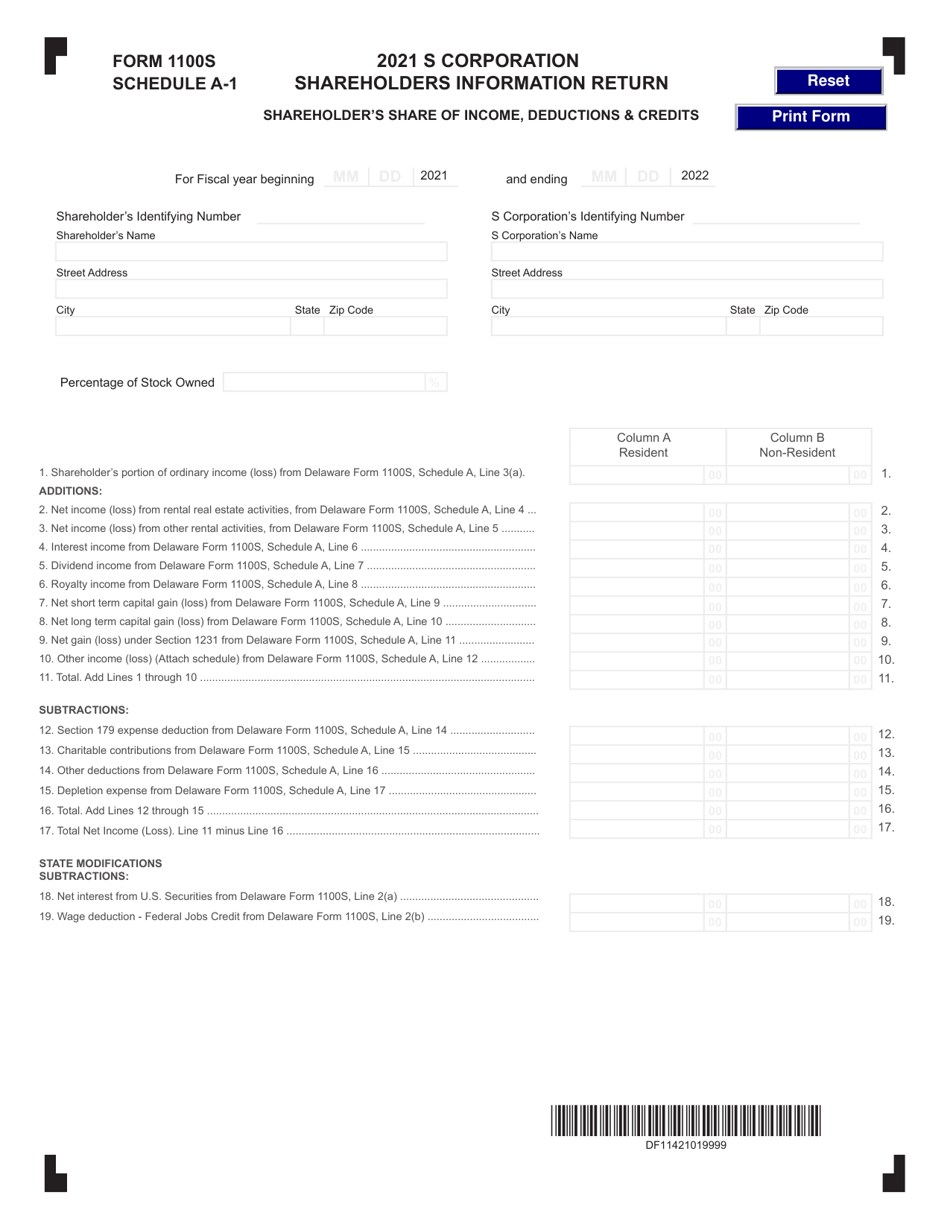

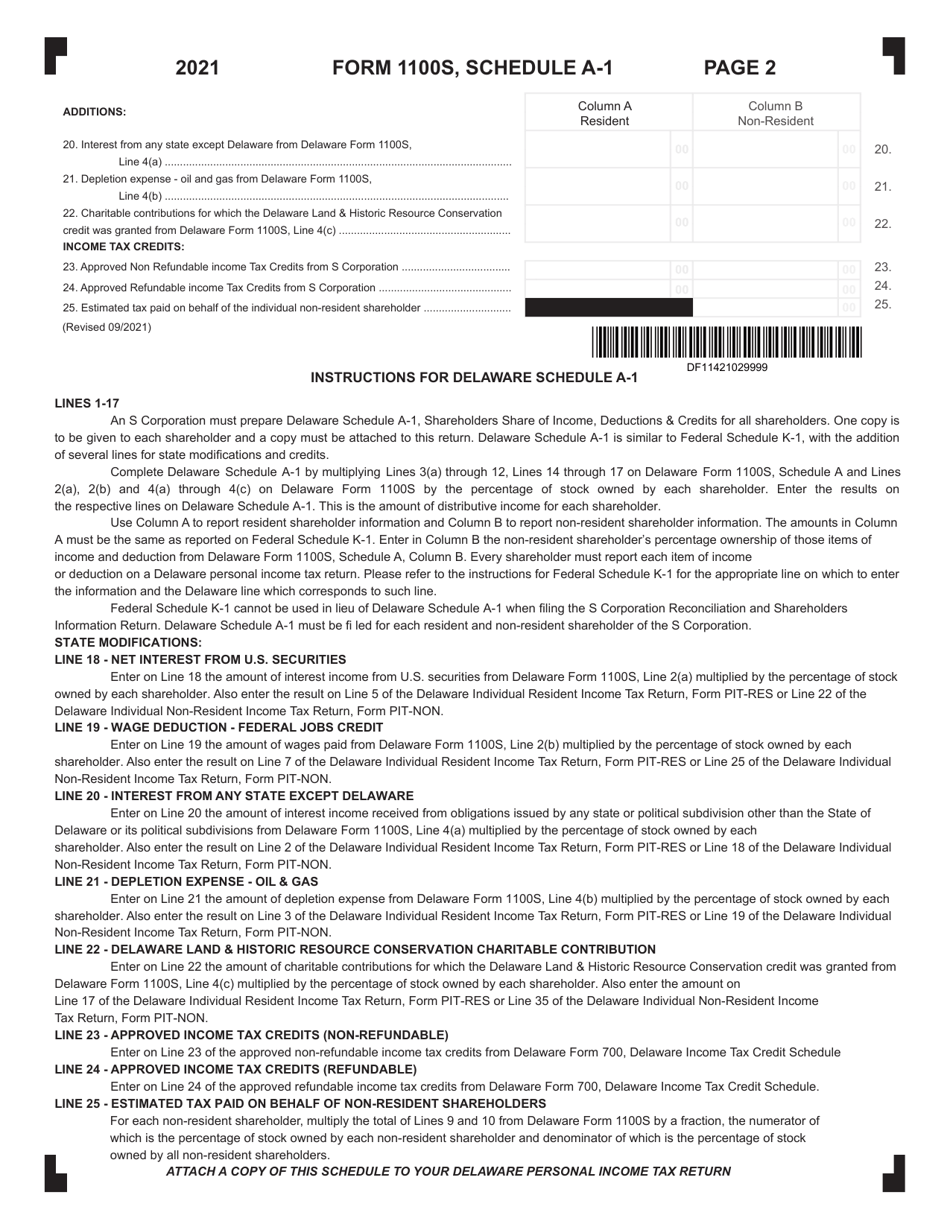

Form 1100S Schedule A-1

for the current year.

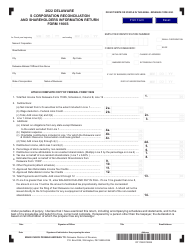

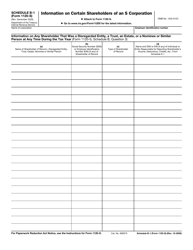

Form 1100S Schedule A-1 S Corporation Shareholders Information Return - Shareholder's Share of Income, Deductions & Credits - Delaware

What Is Form 1100S Schedule A-1?

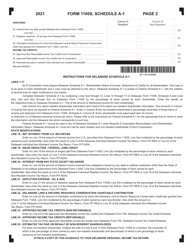

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1100S?

A: Form 1100S is the Information Return for Delaware S Corporation Shareholders.

Q: What is Schedule A-1?

A: Schedule A-1 is the section of Form 1100S that calculates the shareholder's share of income, deductions, and credits.

Q: Who needs to file Form 1100S?

A: Shareholders of S Corporations in Delaware need to file Form 1100S.

Q: What information is reported on Schedule A-1?

A: Schedule A-1 reports the shareholder's share of income, deductions, and credits from the S Corporation.

Q: Is Form 1100S specific to Delaware?

A: Yes, Form 1100S is specific to S Corporations in Delaware.

Q: What happens if I don't file Form 1100S?

A: Failure to file Form 1100S may result in penalties or legal consequences.

Q: When is the deadline to file Form 1100S?

A: The deadline to file Form 1100S is usually April 15th, but it may vary depending on any extensions granted.

Q: Can I e-file Form 1100S?

A: Yes, Form 1100S can be e-filed using approved software or through a tax professional.

Q: Are there any other forms I need to file along with Form 1100S?

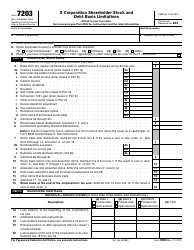

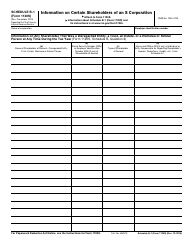

A: Depending on your situation, you may need to file additional forms such as Form 1120S or Schedule K-1.

Form Details:

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1100S Schedule A-1 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.