This version of the form is not currently in use and is provided for reference only. Download this version of

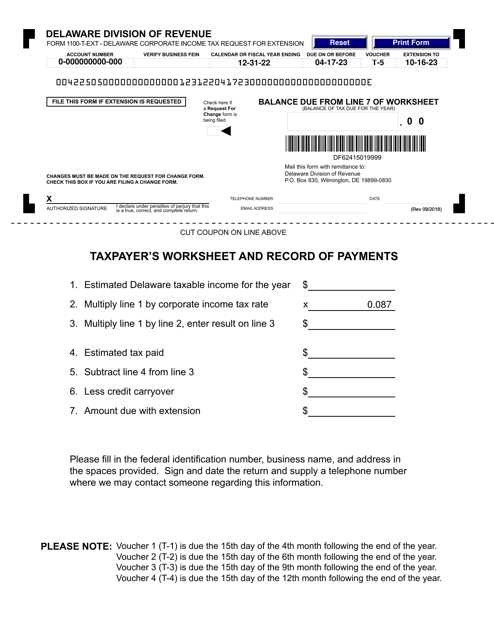

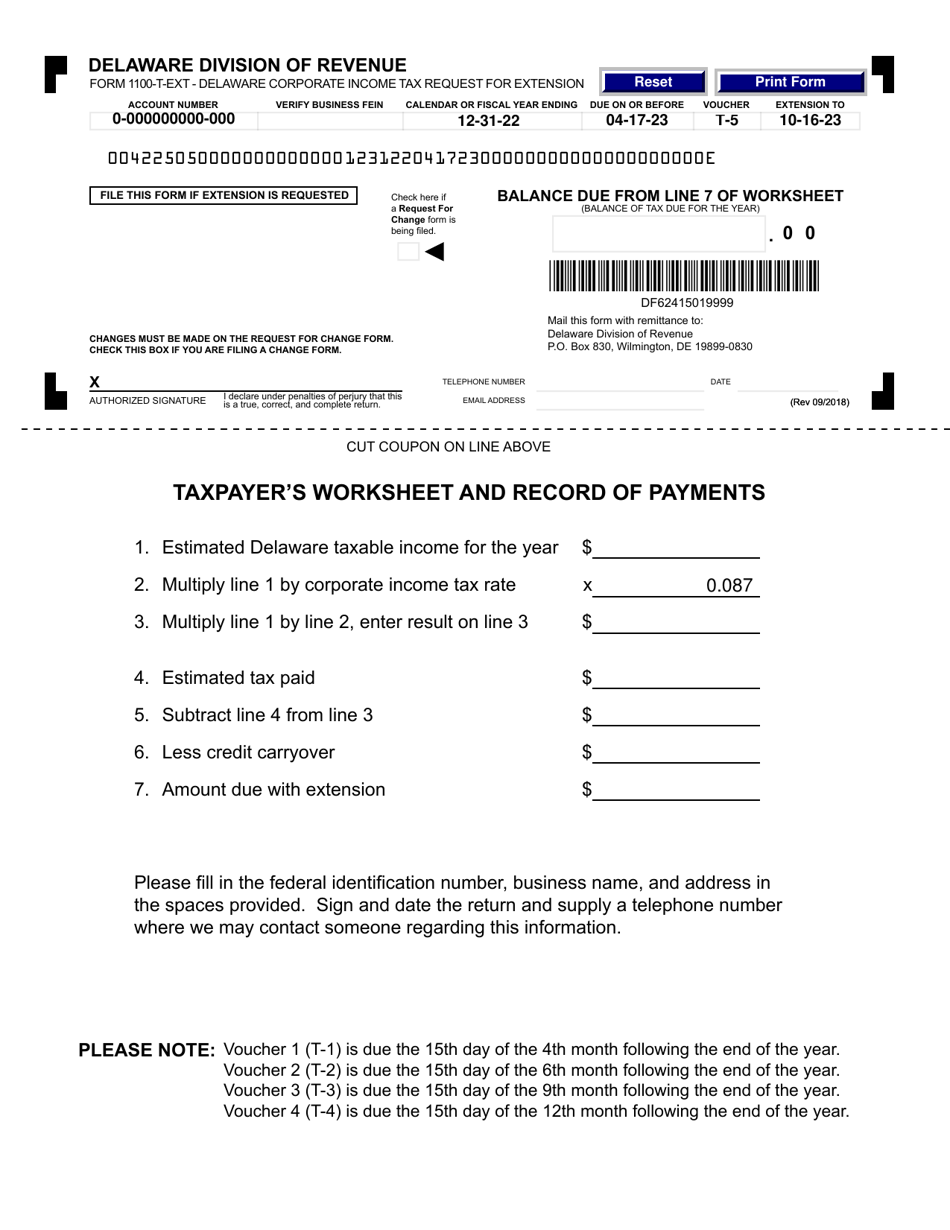

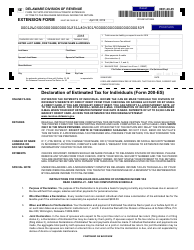

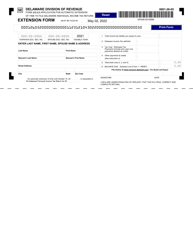

Form 1100-T-EXT

for the current year.

Form 1100-T-EXT Delaware Corporate Income Tax Request for Extension - Delaware

What Is Form 1100-T-EXT?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

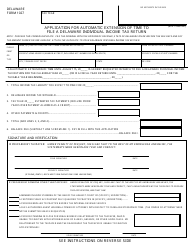

Q: What is Form 1100-T-EXT?

A: Form 1100-T-EXT is the Delaware Corporate Income TaxRequest for Extension.

Q: What is the purpose of Form 1100-T-EXT?

A: The purpose of Form 1100-T-EXT is to request an extension for filing the Delaware Corporate Income Tax return.

Q: Who needs to file Form 1100-T-EXT?

A: Any corporation that needs additional time to file their Delaware Corporate Income Tax return must file Form 1100-T-EXT to request an extension.

Q: When is Form 1100-T-EXT due?

A: Form 1100-T-EXT is due on the original due date of the Delaware Corporate Income Tax return, which is typically on or before March 15th.

Q: Is there a fee for filing Form 1100-T-EXT?

A: No, there is no fee for filing Form 1100-T-EXT.

Q: How long is the extension granted by Form 1100-T-EXT?

A: The extension granted by Form 1100-T-EXT is typically six months, extending the filing deadline to October 15th.

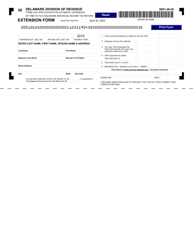

Q: What if I don't file Form 1100-T-EXT?

A: If you fail to file Form 1100-T-EXT and do not file your Delaware Corporate Income Tax return by the original due date, you may be subject to penalties and interest.

Q: Can I file for an additional extension beyond the six-month extension?

A: No, Delaware does not allow for additional extensions beyond the initial six-month extension granted by Form 1100-T-EXT.

Form Details:

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1100-T-EXT by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.