This version of the form is not currently in use and is provided for reference only. Download this version of

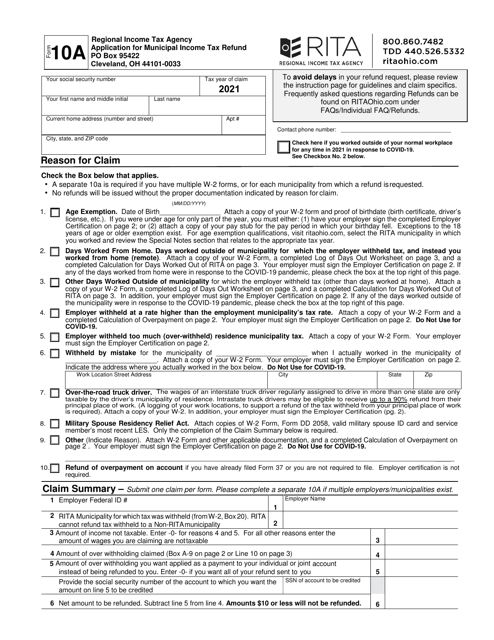

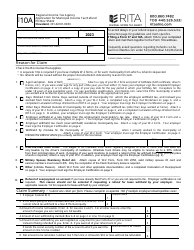

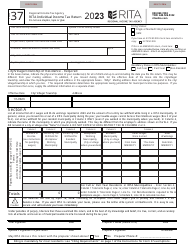

Form 10A

for the current year.

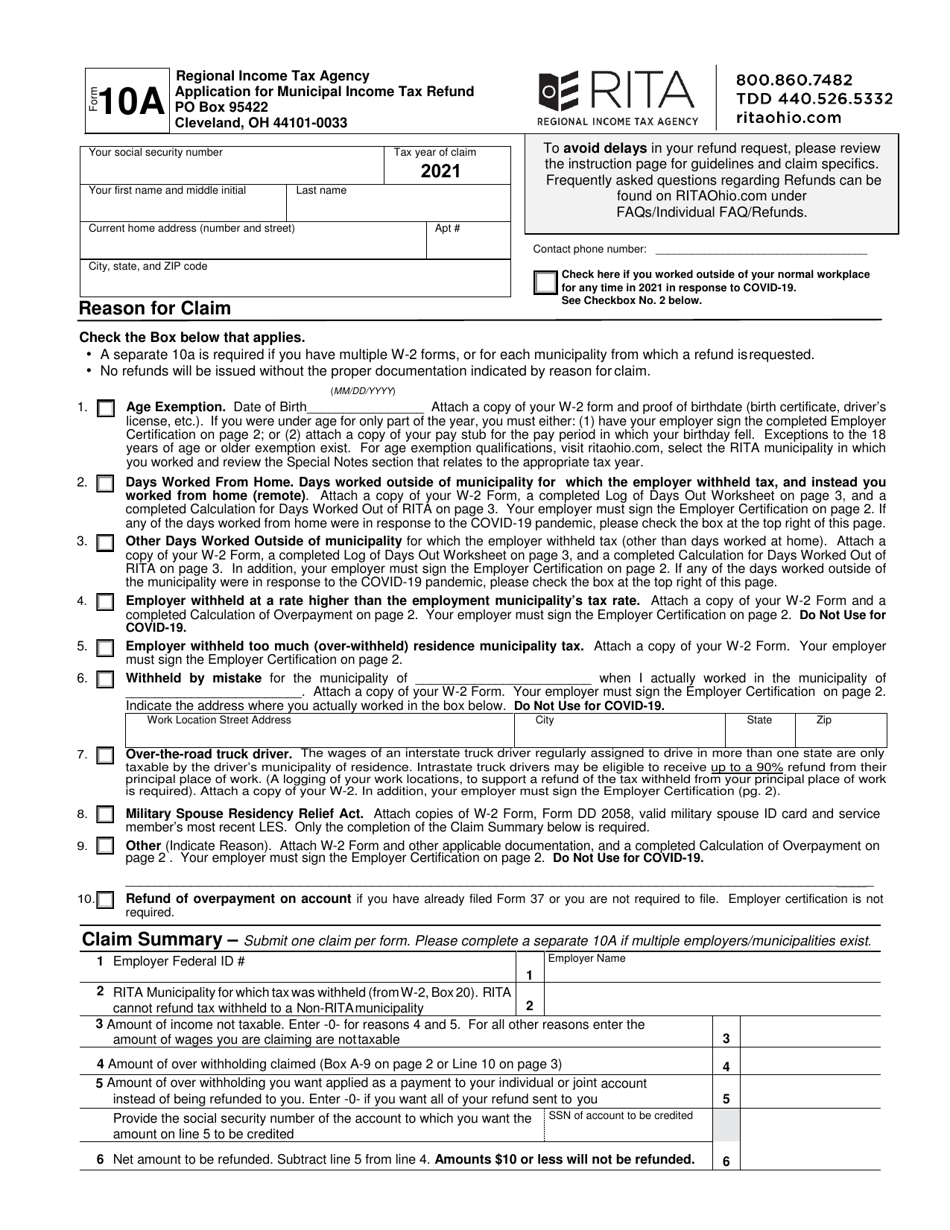

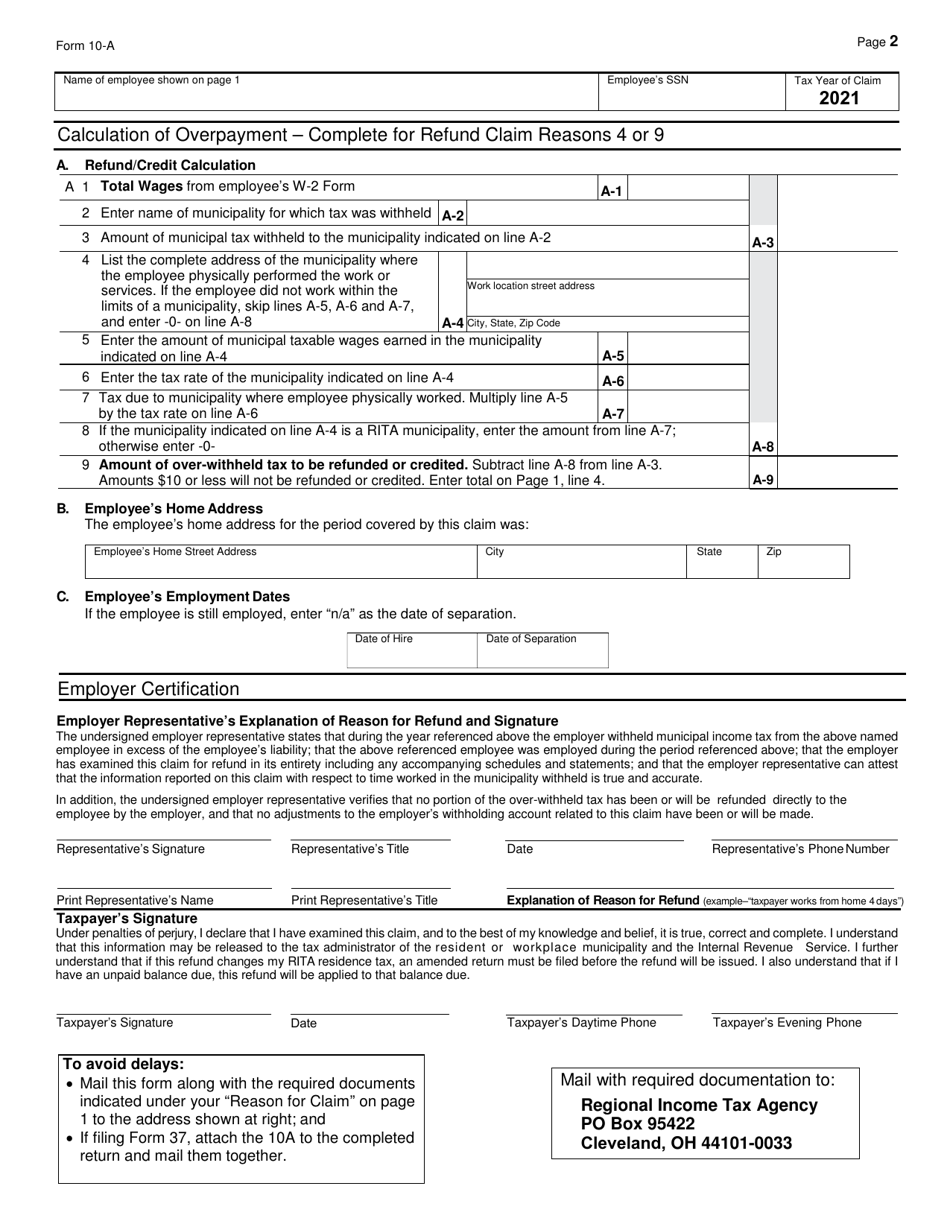

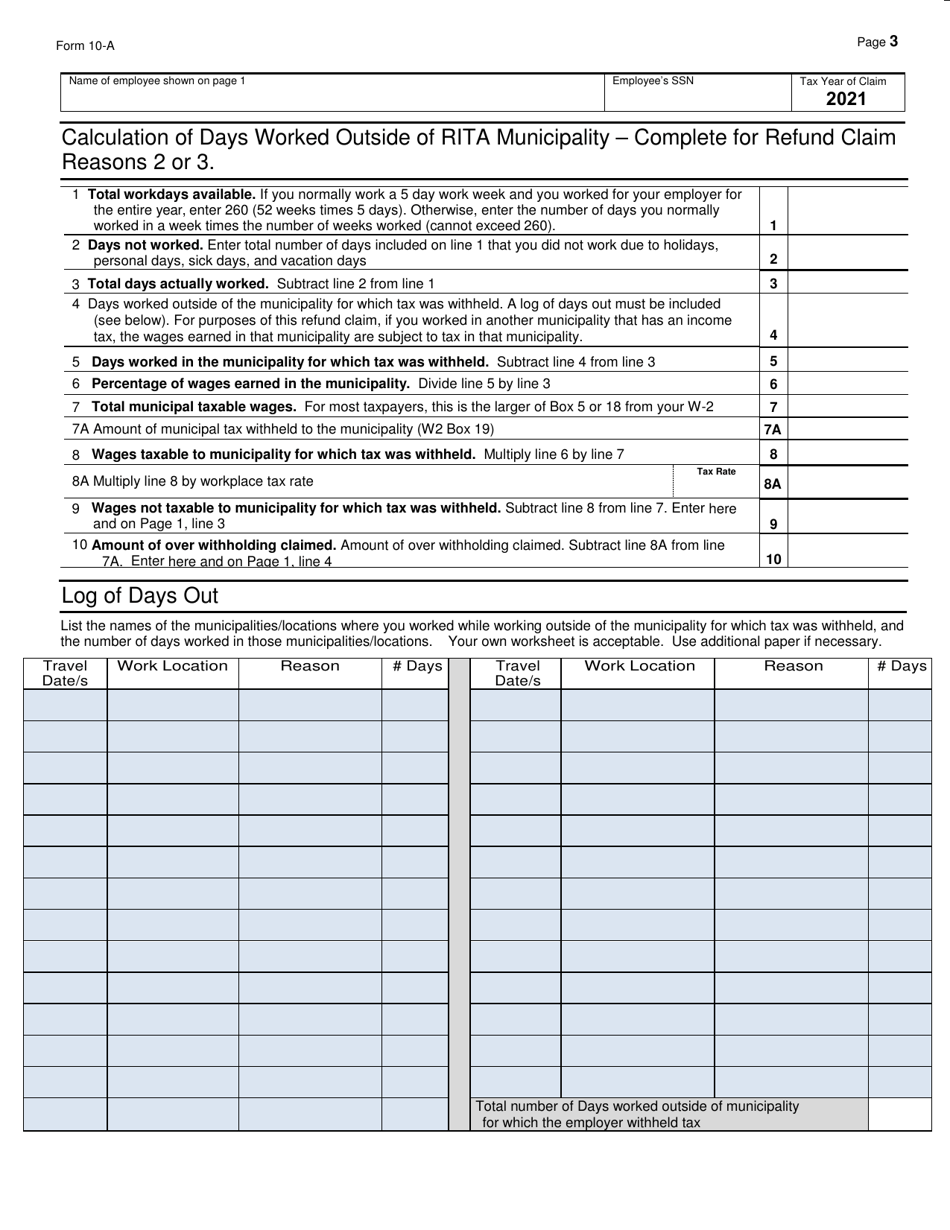

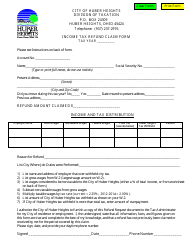

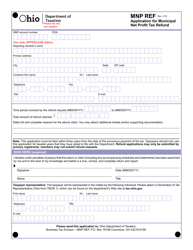

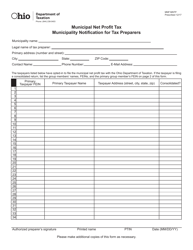

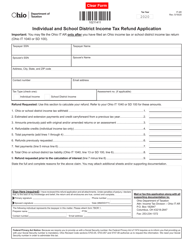

Form 10A Application for Municipal Income Tax Refund - Ohio

What Is Form 10A?

This is a legal form that was released by the Ohio Regional Income Tax Agency (RITA) - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

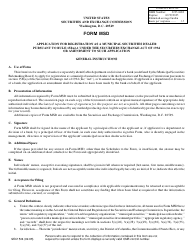

Q: What is Form 10A?

A: Form 10A is an application for Municipal Income Tax Refund in Ohio.

Q: Who should use Form 10A?

A: Anyone who wants to apply for a refund of municipal income taxes in Ohio should use Form 10A.

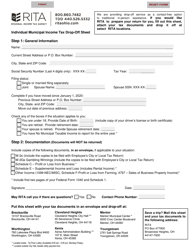

Q: What information do I need to fill out Form 10A?

A: You will need to provide your personal information, including your name, address, and Social Security Number, as well as details about your income and the municipality you are seeking a refund from.

Q: Is there a deadline to submit Form 10A?

A: Yes, the deadline to submit Form 10A is the same as the deadline for filing your municipal income tax return, which is typically April 15th.

Q: How long does it take to process Form 10A?

A: It usually takes about 60 days for the Ohio Department of Taxation to process a Form 10A application and issue a refund, if applicable.

Form Details:

- The latest edition provided by the Ohio Regional Income Tax Agency (RITA);

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 10A by clicking the link below or browse more documents and templates provided by the Ohio Regional Income Tax Agency (RITA).