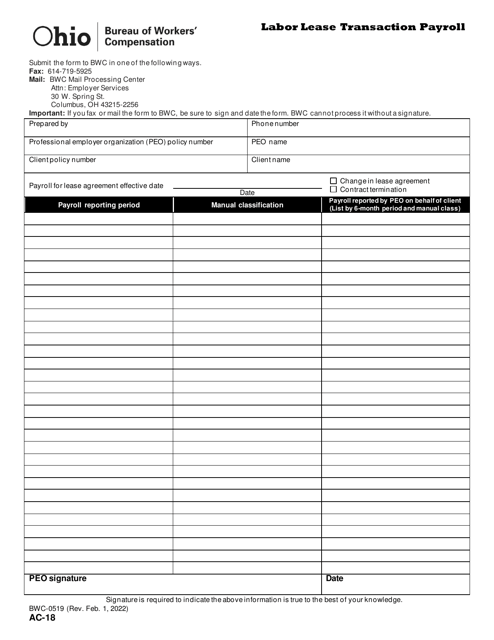

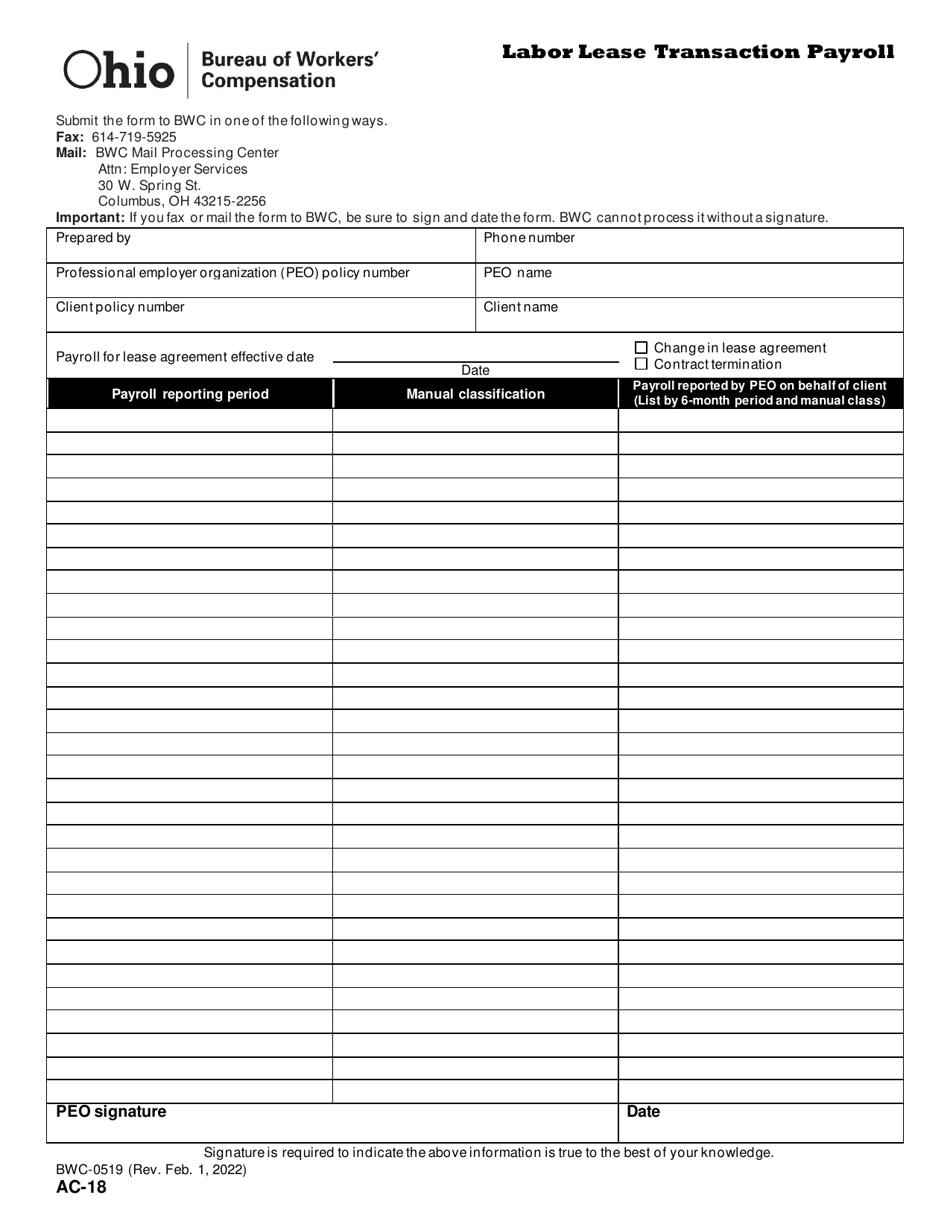

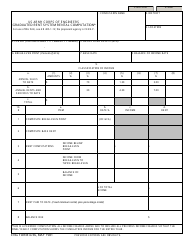

Form AC-18 (BWC-0519) Labor Lease Transaction Payroll - Ohio

What Is Form AC-18 (BWC-0519)?

This is a legal form that was released by the Ohio Bureau of Workers' Compensation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AC-18 (BWC-0519)?

A: Form AC-18 (BWC-0519) is a document used for reporting labor lease transaction payroll in Ohio.

Q: Who is required to file Form AC-18 (BWC-0519)?

A: Employers in Ohio who engage in labor lease transactions are required to file Form AC-18 (BWC-0519).

Q: What is a labor lease transaction?

A: A labor lease transaction occurs when an employer leases or contracts with another employer for the services of their employees.

Q: What information is required on Form AC-18 (BWC-0519)?

A: Form AC-18 (BWC-0519) requires information such as the name and address of the employer, the leased employee's name and social security number, and details of the labor lease transaction.

Q: When is Form AC-18 (BWC-0519) due?

A: Form AC-18 (BWC-0519) is due annually by the last day of February for the previous calendar year.

Q: Are there any penalties for not filing Form AC-18 (BWC-0519)?

A: Yes, failure to file Form AC-18 (BWC-0519) or filing a false or incomplete form may result in penalties and fines.

Q: Do I need to keep a copy of Form AC-18 (BWC-0519) for my records?

A: Yes, it is recommended to keep a copy of Form AC-18 (BWC-0519) for your records in case of future audits or inquiries.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the Ohio Bureau of Workers' Compensation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AC-18 (BWC-0519) by clicking the link below or browse more documents and templates provided by the Ohio Bureau of Workers' Compensation.