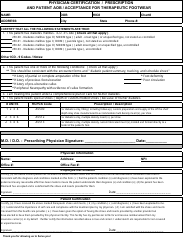

Dodd-Frank Certification Form

What Is a Dodd-Frank Certification Form?

The Dodd-Frank Certification Form is a legal document that must be completed by homeowners who wish to access housing and mortgages in a fast and easy way. This form was designed to protect consumers from fraudulent activities and make the mortgage industry fair. It is offered to clients by online banking institutions and other financial facilities as an extension service to assess the clients' financial credibility and history in loan borrowing.

This form was released by the U.S. Department of Treasury . You can download a fillable Dodd-Frank Certification Form through the link below.

Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010

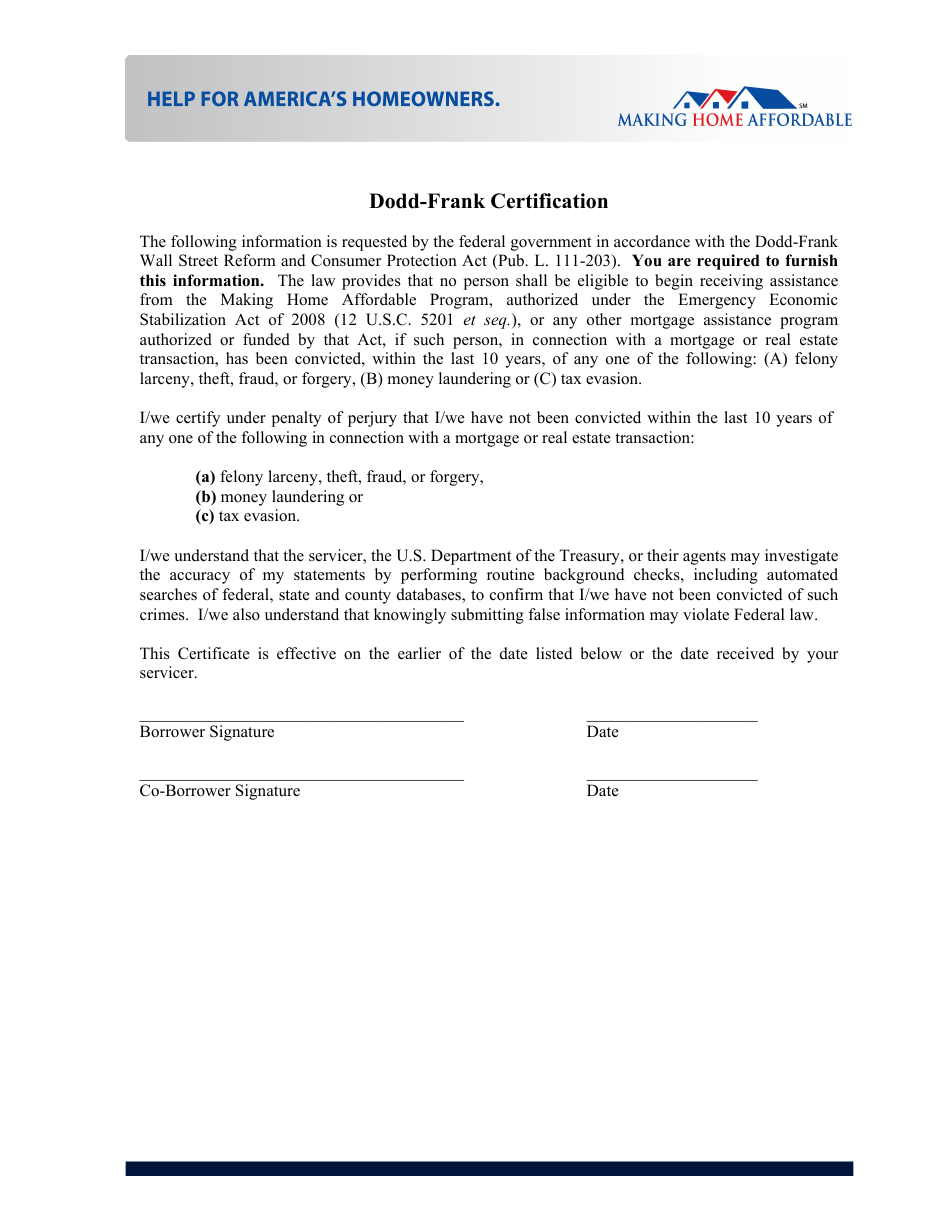

In 2009, the Making Home Affordable Program was introduced by the U.S. Department of Treasury to assist struggling house owners and stabilize the housing market. The Hardest Hit Fund , one of the components of this program, has been extended to 2020. If you wish to begin receiving assistance from this program or any other mortgage assistance program authorized by the Dodd-Frank Wall Street Reform and Consumer Protection Act, you are required to certify you have not been found guilty of a felony related to home loans or real estate at least in the past ten years.

When you sign the certification, you confirm you have not been convicted of felony larceny, theft, fraud, forgery, money laundering, or tax evasion. The Department of Treasury and their agents may investigate the accuracy of your statements, and if you submit false information you may violate federal law. The certification must be signed by the borrower and co-borrower (for instance, the spouse) and dated. This document is effective on and from the date that it is received by the servicer who verifies the eligibility of the borrower and co-borrower based on the total income of both.