This version of the form is not currently in use and is provided for reference only. Download this version of

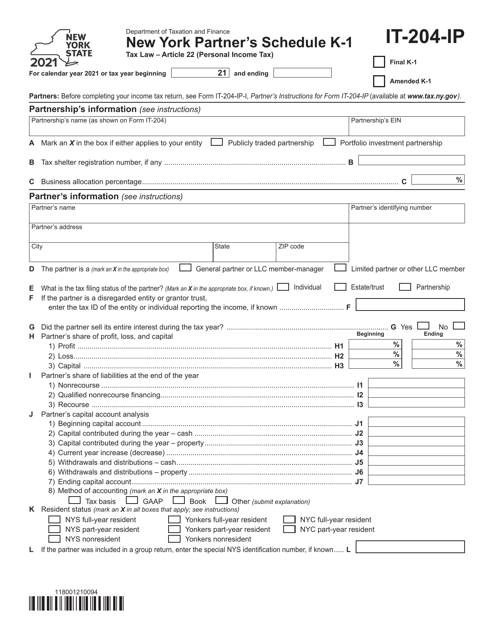

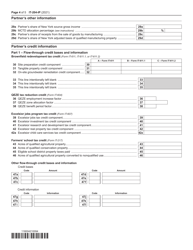

Form IT-204-IP Schedule K-1

for the current year.

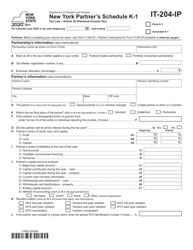

Form IT-204-IP Schedule K-1 New York Partner's Schedule - New York

What Is Form IT-204-IP Schedule K-1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-204-IP?

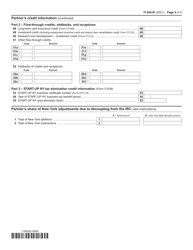

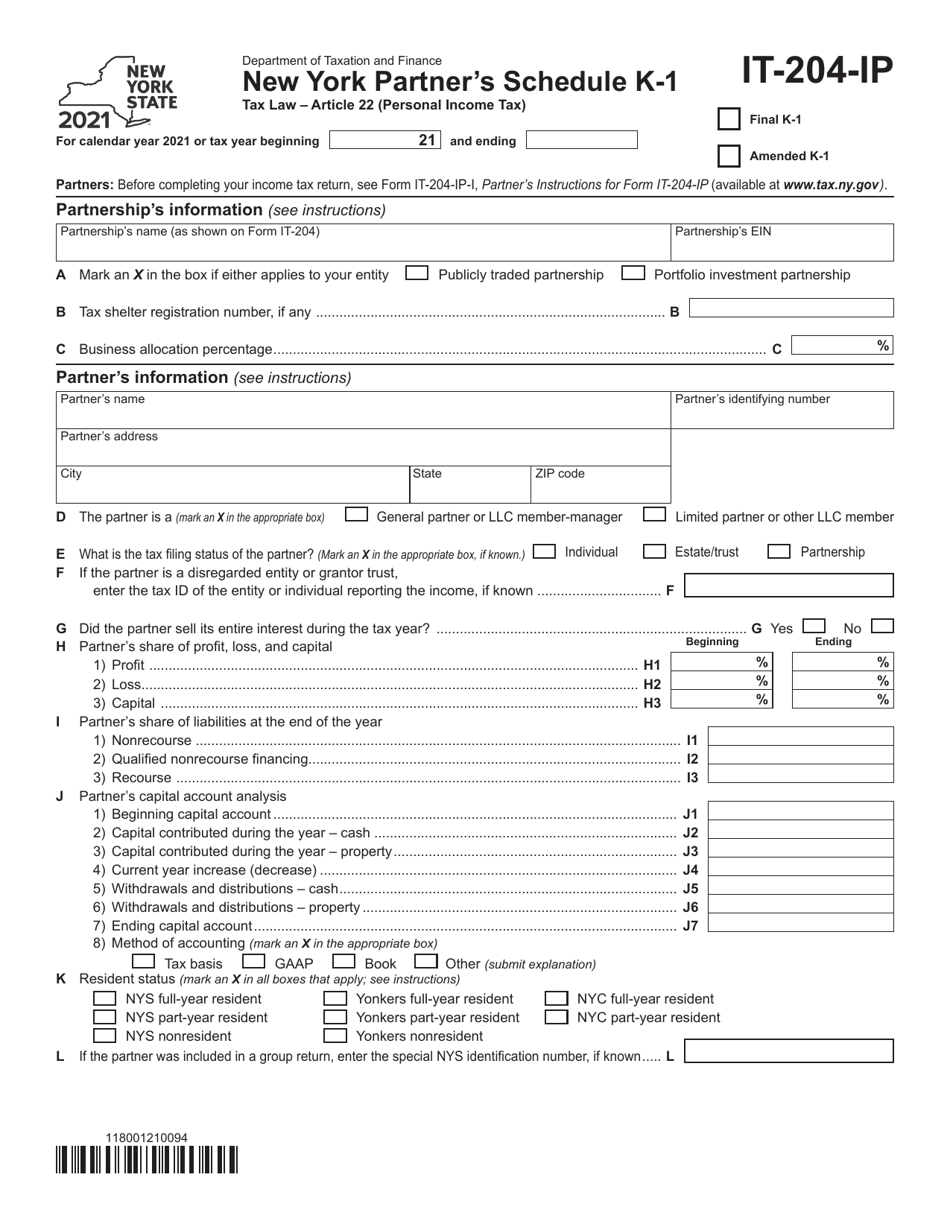

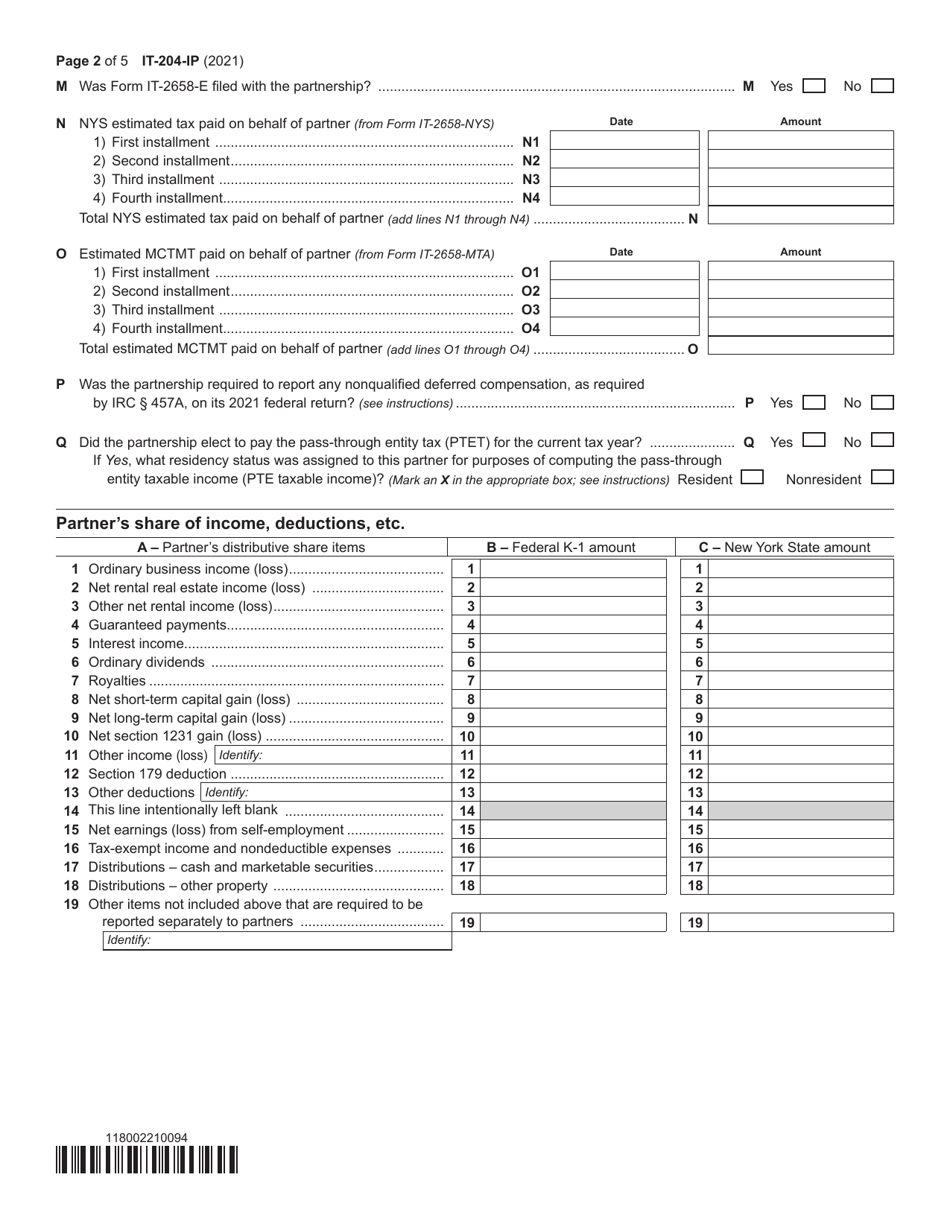

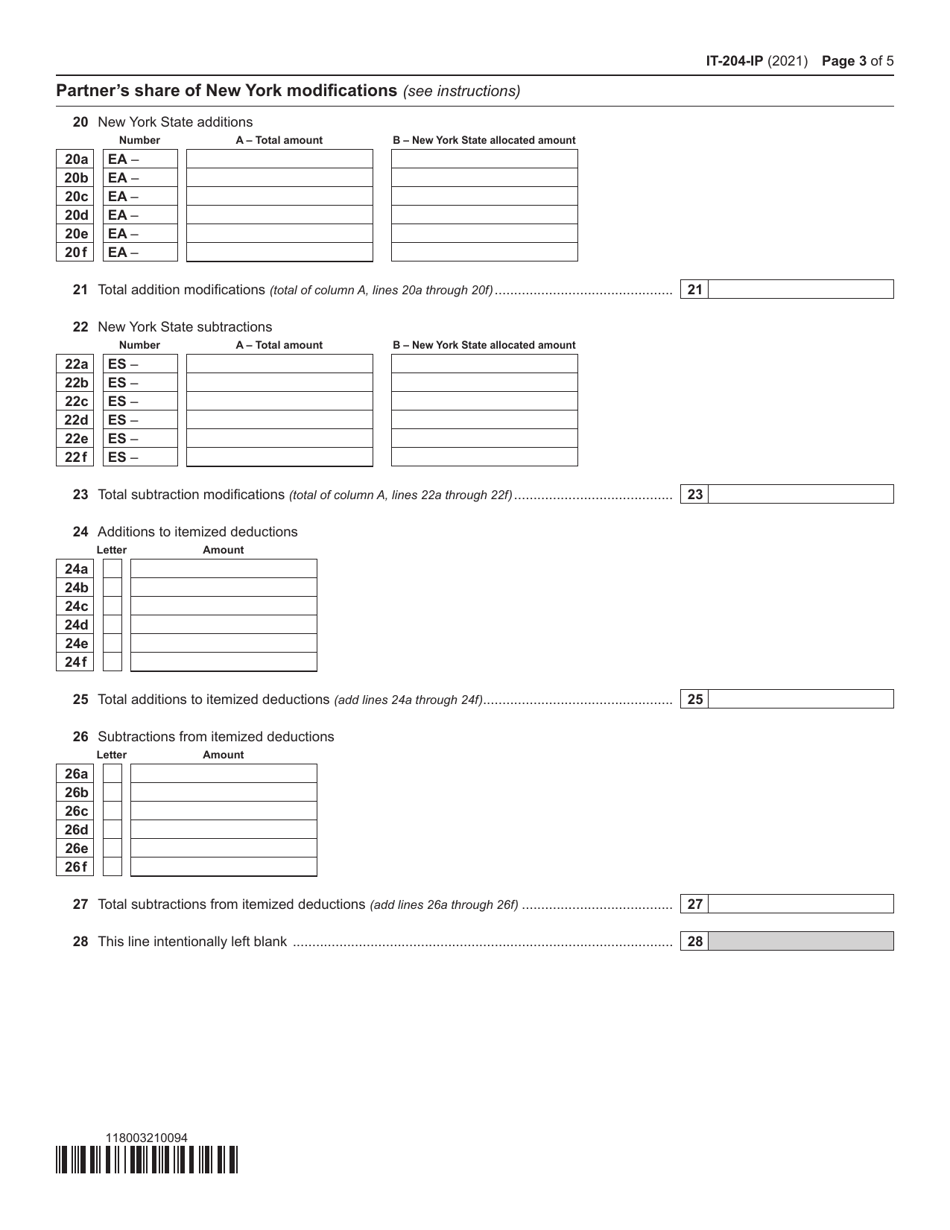

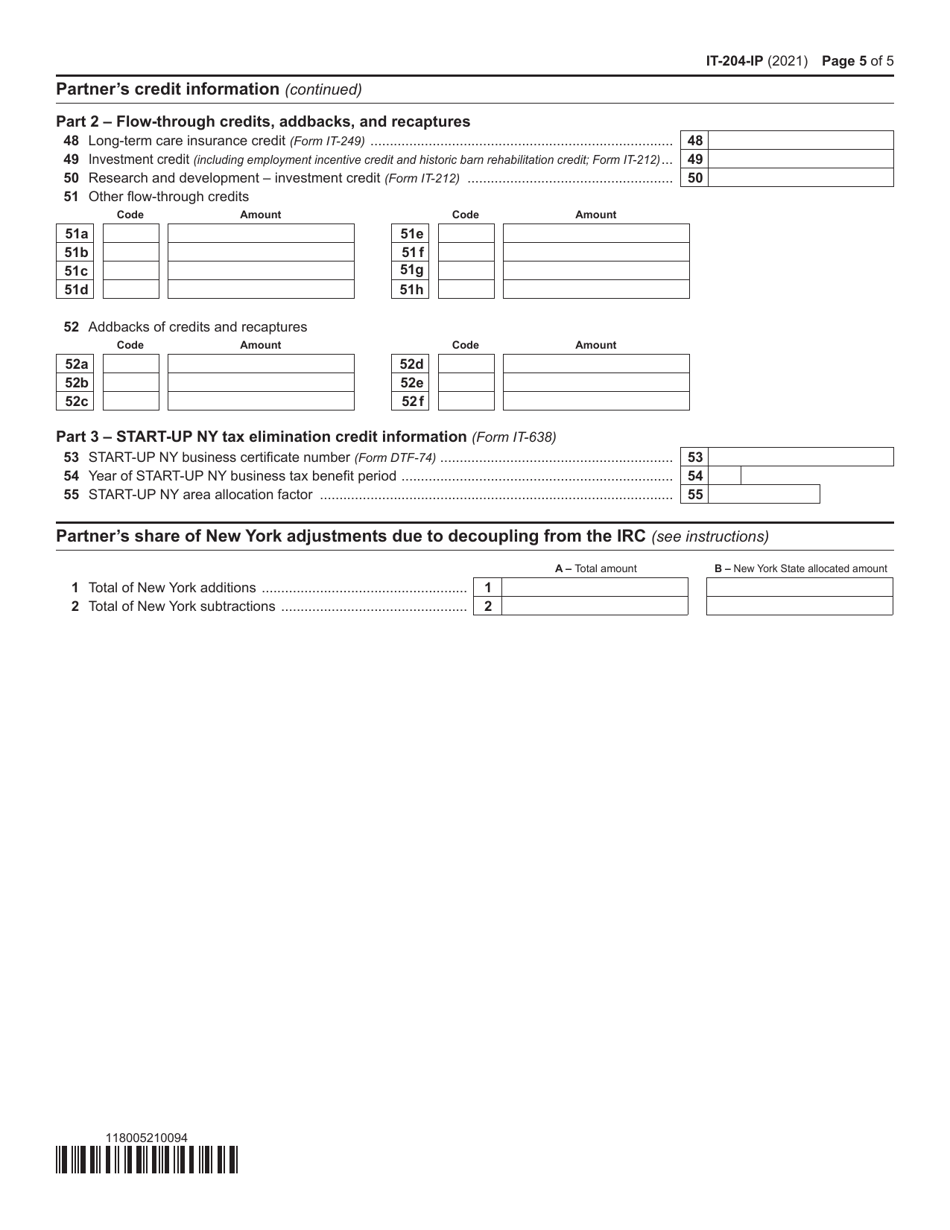

A: Form IT-204-IP is a tax form used by New York partners to report their share of income, deductions, and credits from a partnership or limited liability company (LLC) that is classified as a partnership for tax purposes.

Q: What is Schedule K-1?

A: Schedule K-1 is a specific part of Form IT-204-IP that partners use to report their share of partnership income, deductions, and credits.

Q: Who needs to file Form IT-204-IP Schedule K-1?

A: Any partner or member of a partnership or LLC classified as a partnership for tax purposes in New York needs to file Form IT-204-IP Schedule K-1 to report their share of income, deductions, and credits.

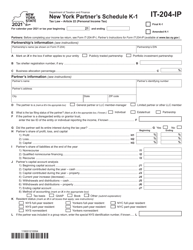

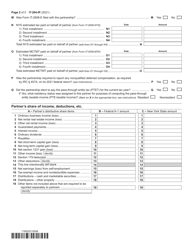

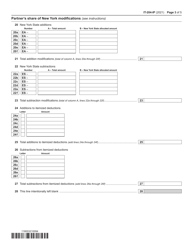

Q: What information is included in Schedule K-1?

A: Schedule K-1 includes information about the partner's share of ordinary business income, rental real estate income, net rental income, nonbusiness income, and various deductions and credits.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-204-IP Schedule K-1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.