This version of the form is not currently in use and is provided for reference only. Download this version of

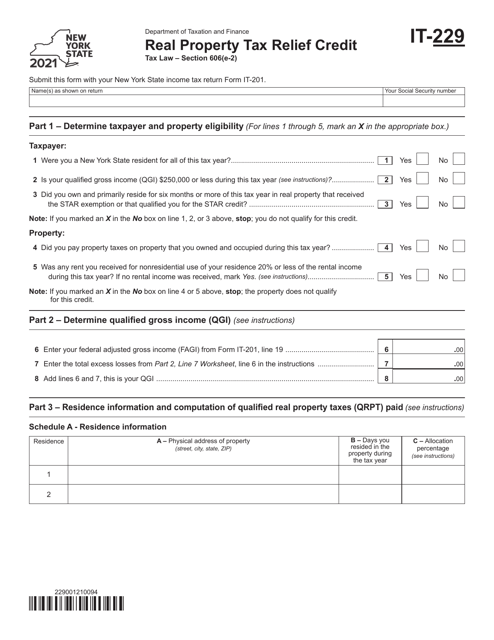

Form IT-229

for the current year.

Form IT-229 Real Property Tax Relief Credit - New York

What Is Form IT-229?

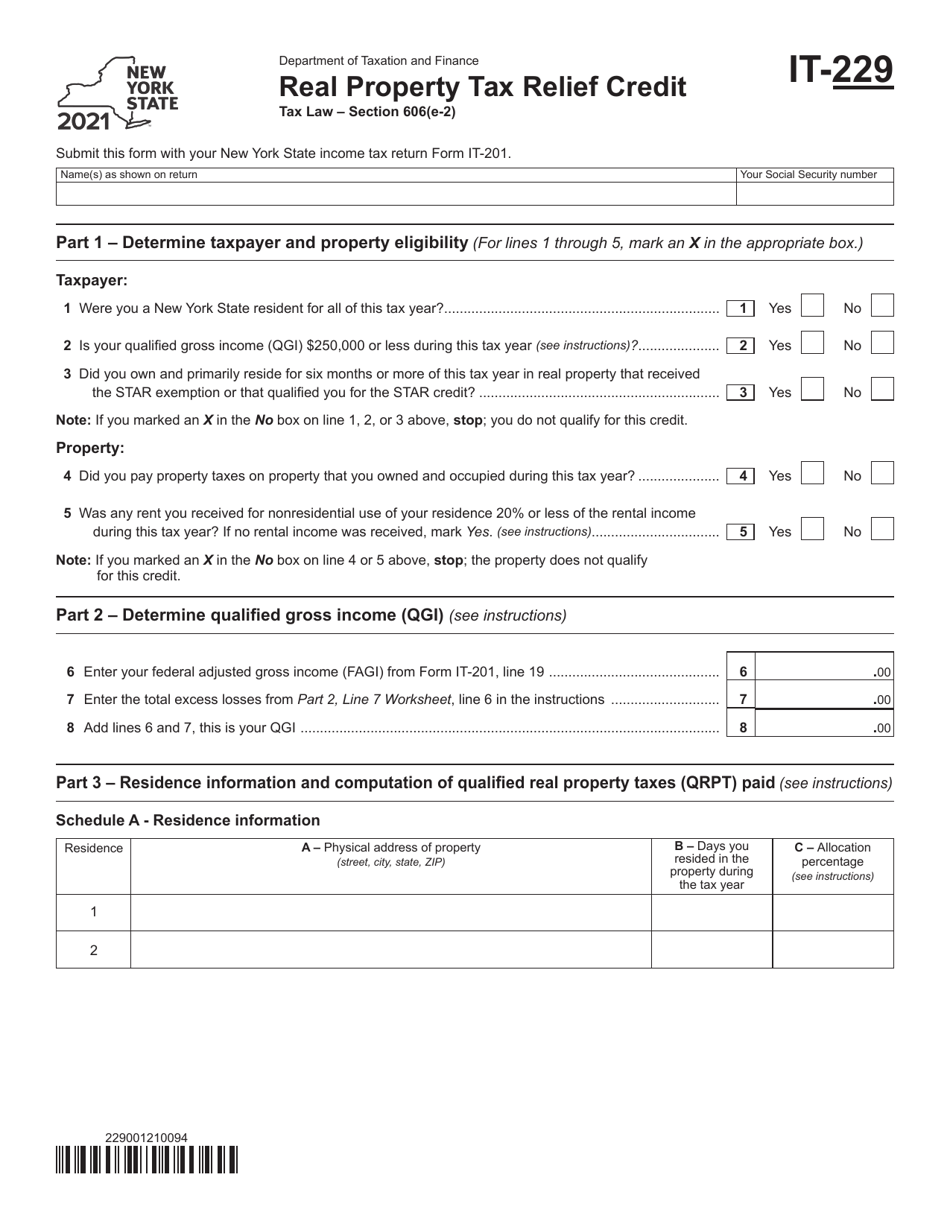

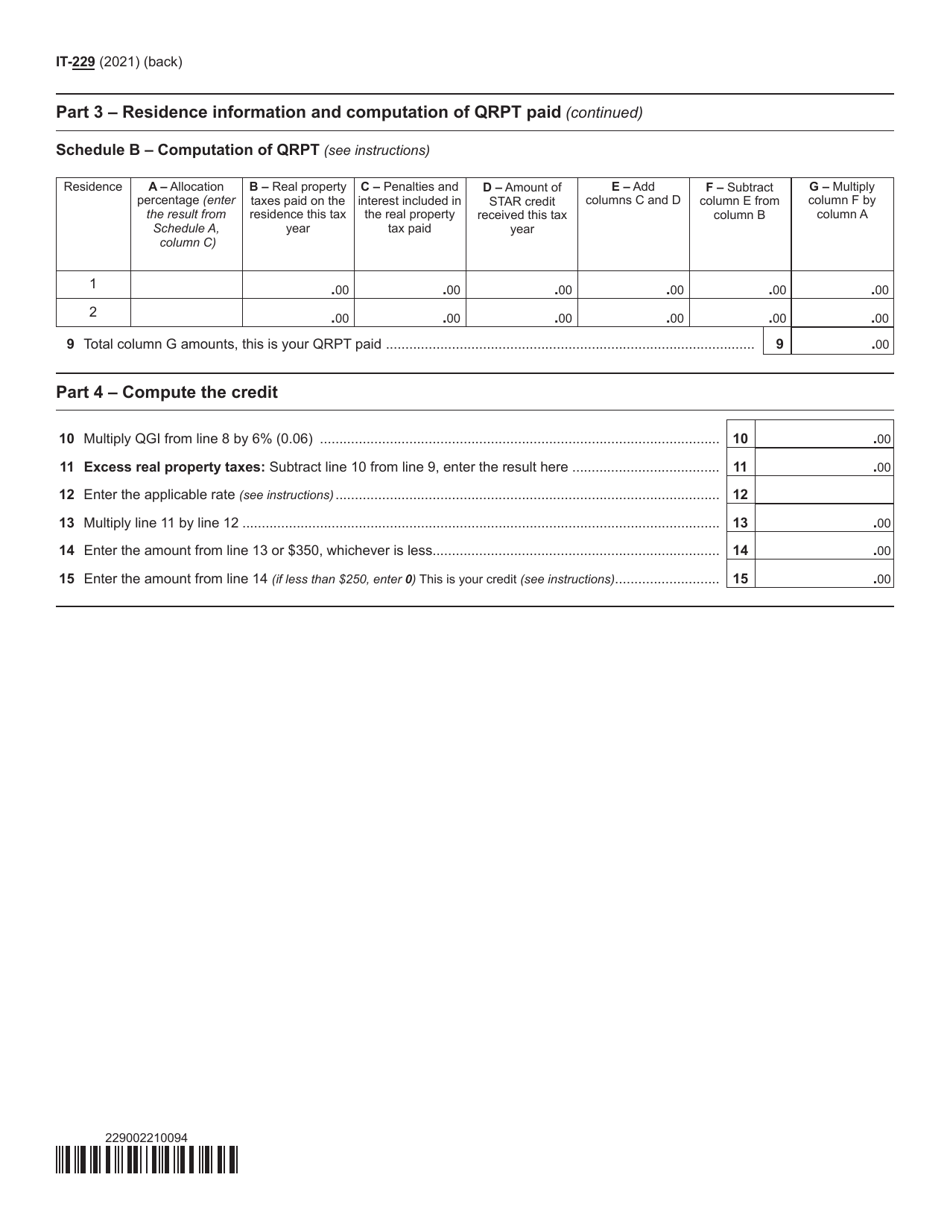

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-229?

A: Form IT-229 is the form used to claim the Real Property Tax Relief Credit in New York.

Q: What is the Real Property Tax Relief Credit?

A: The Real Property Tax Relief Credit is a credit available to eligible New York taxpayers to help offset property taxes.

Q: Who is eligible for the Real Property Tax Relief Credit?

A: To be eligible for the credit, you must meet certain income requirements and own property in New York.

Q: How do I claim the Real Property Tax Relief Credit?

A: To claim the credit, you must file Form IT-229 and include it with your New York state income tax return.

Q: What documents do I need to include with Form IT-229?

A: You should include a copy of your property tax bill or other documentation that shows the amount of property taxes paid.

Q: Is the Real Property Tax Relief Credit refundable?

A: No, the credit is non-refundable, which means it can only be used to offset your tax liability and any excess cannot be refunded.

Q: When is the deadline to file Form IT-229?

A: The deadline to file Form IT-229 is the same as the deadline to file your New York state income tax return, which is typically April 15th.

Q: Can I claim the Real Property Tax Relief Credit if I rent my property?

A: No, the credit is only available to property owners, not renters.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-229 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.