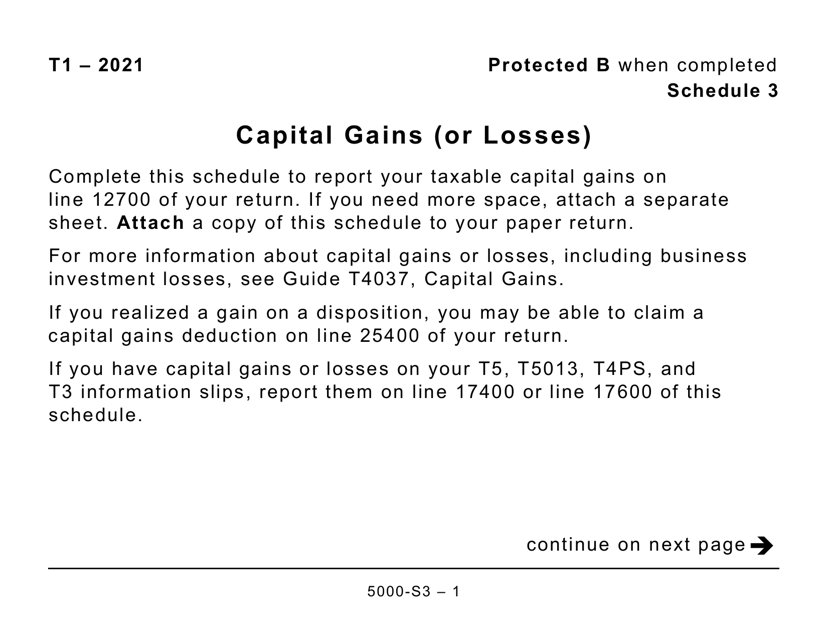

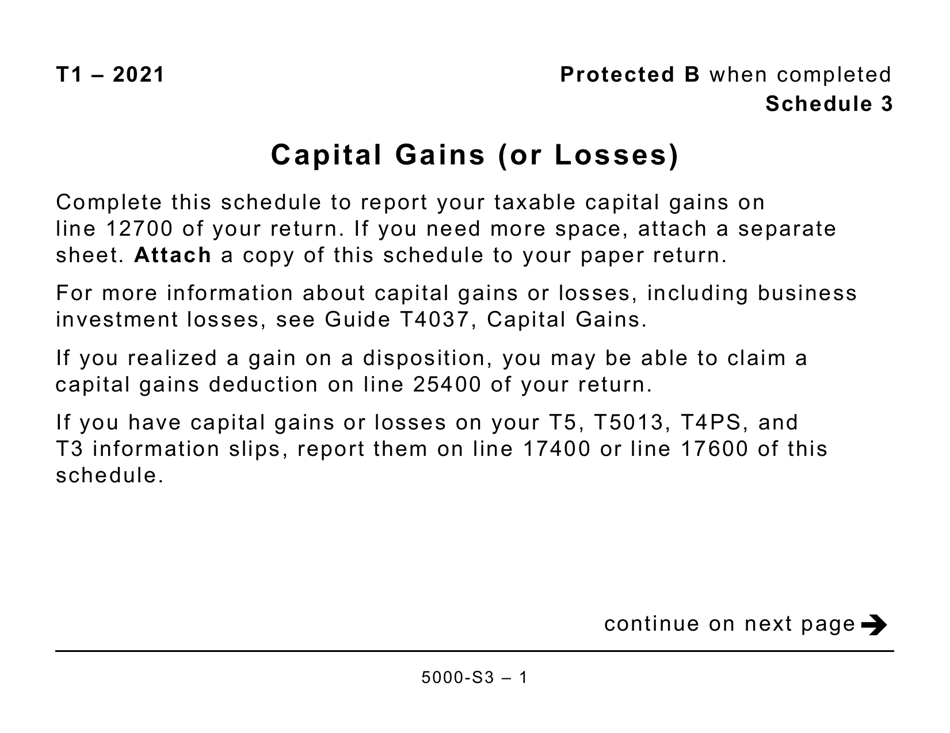

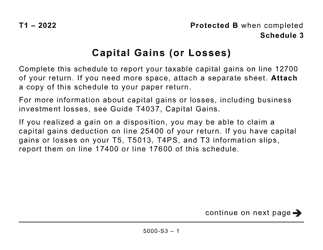

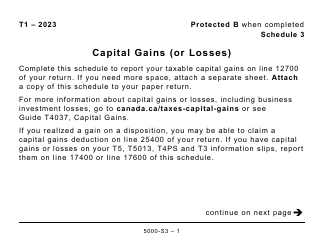

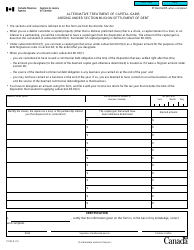

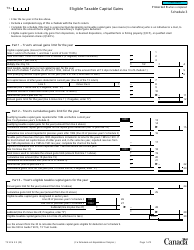

Form 5000-S3 Schedule 3 Capital Gains (Or Losses) - Large Print - Canada

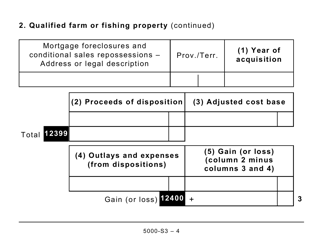

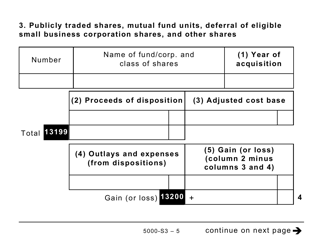

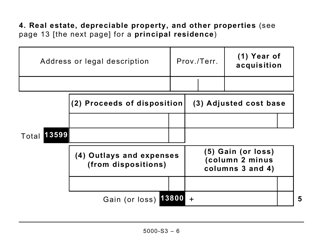

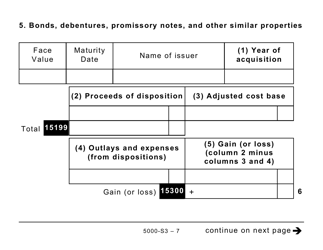

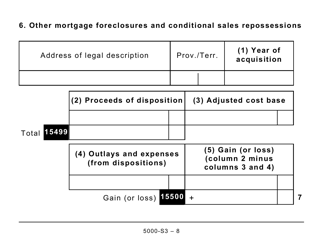

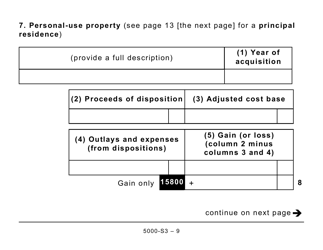

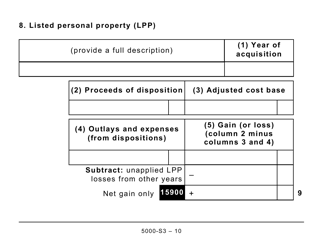

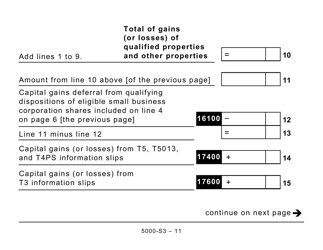

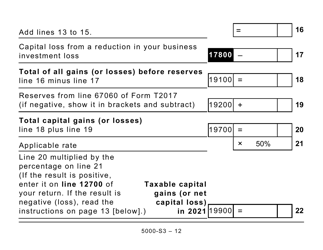

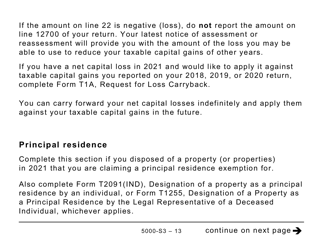

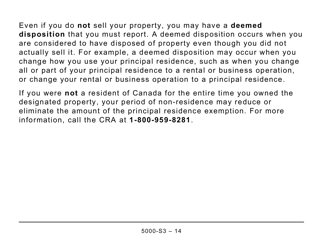

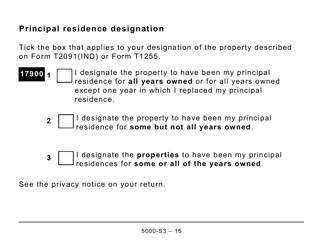

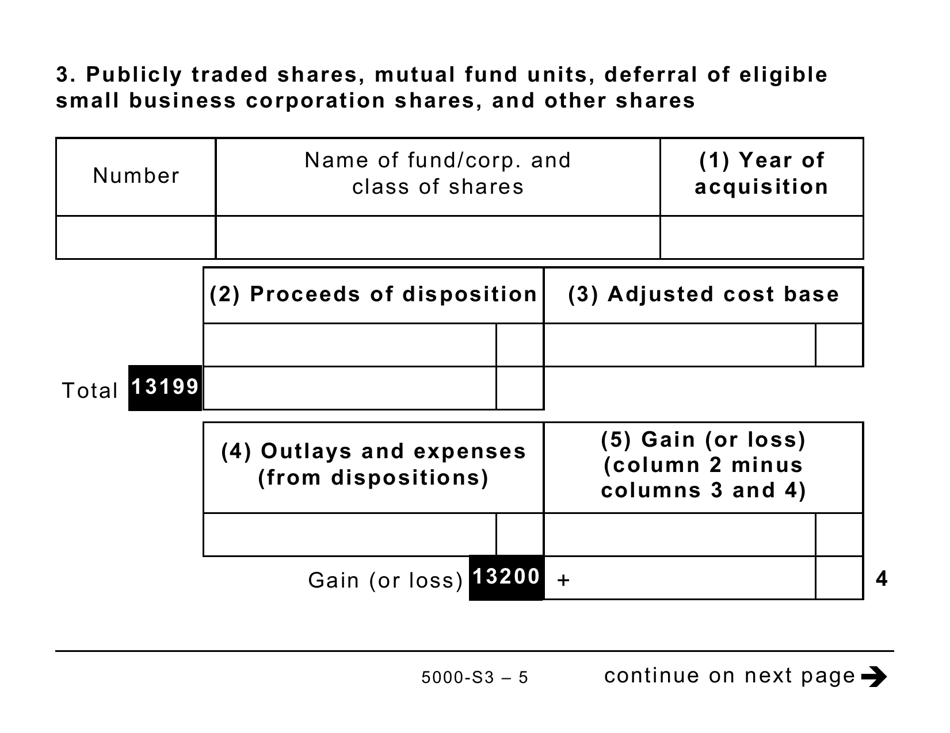

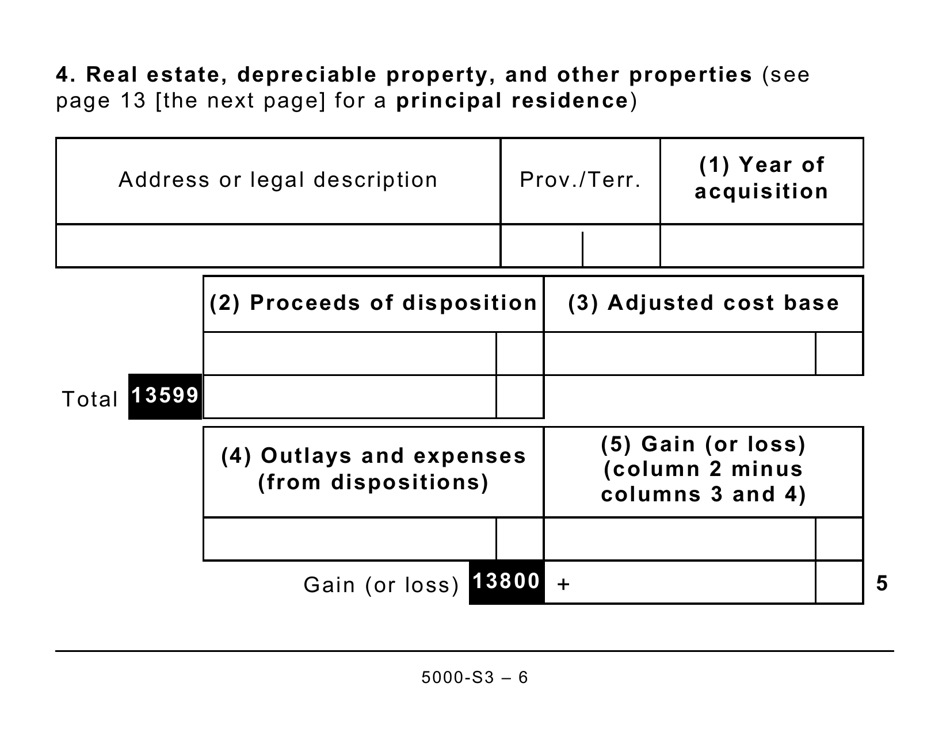

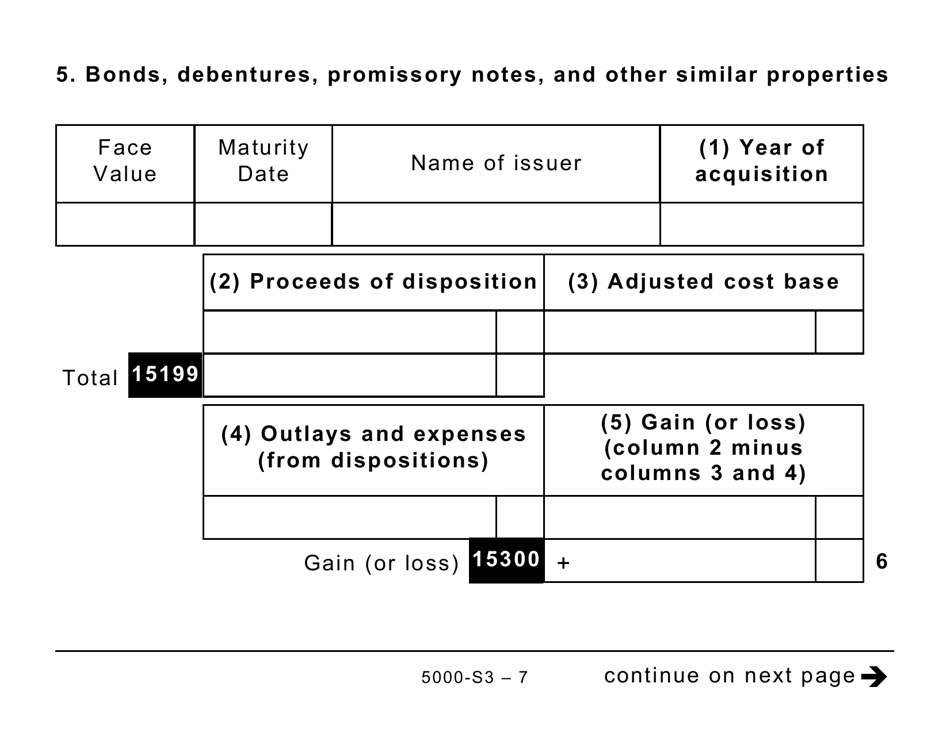

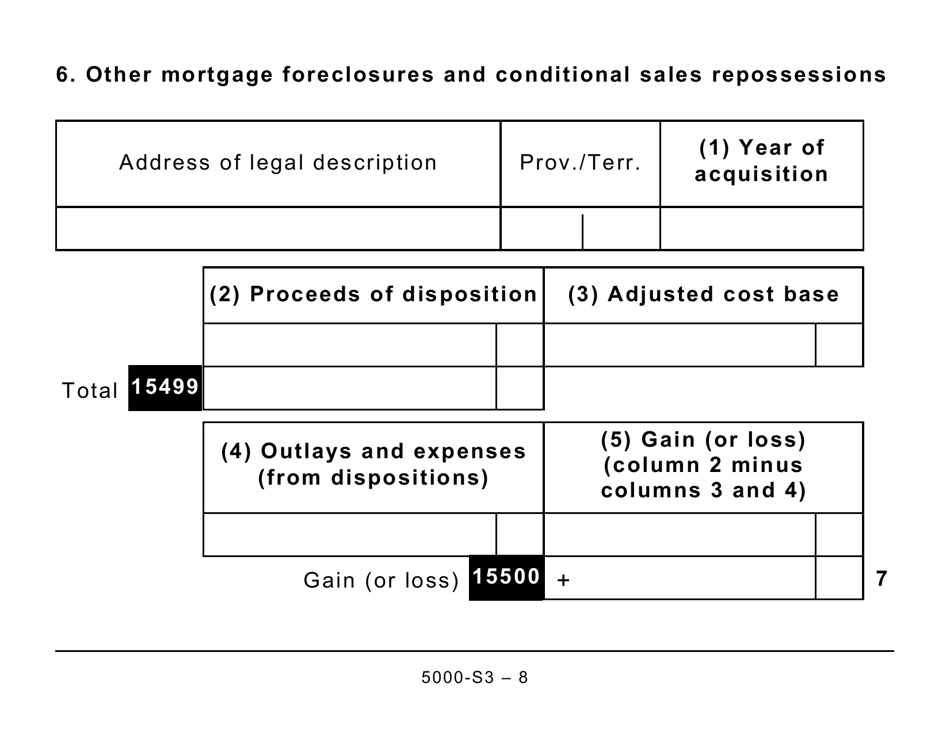

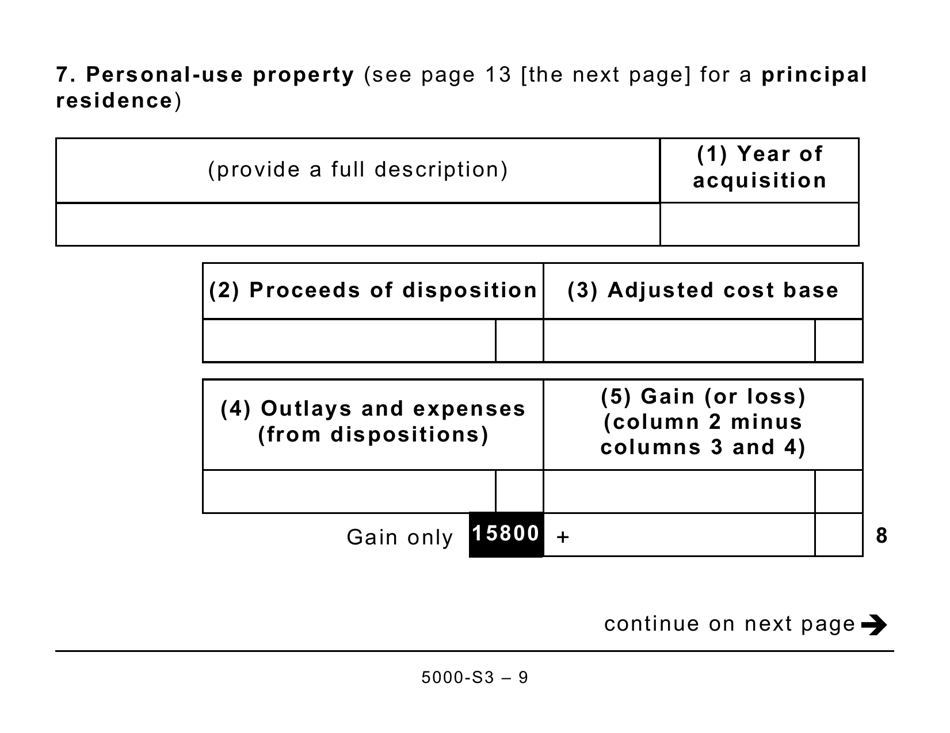

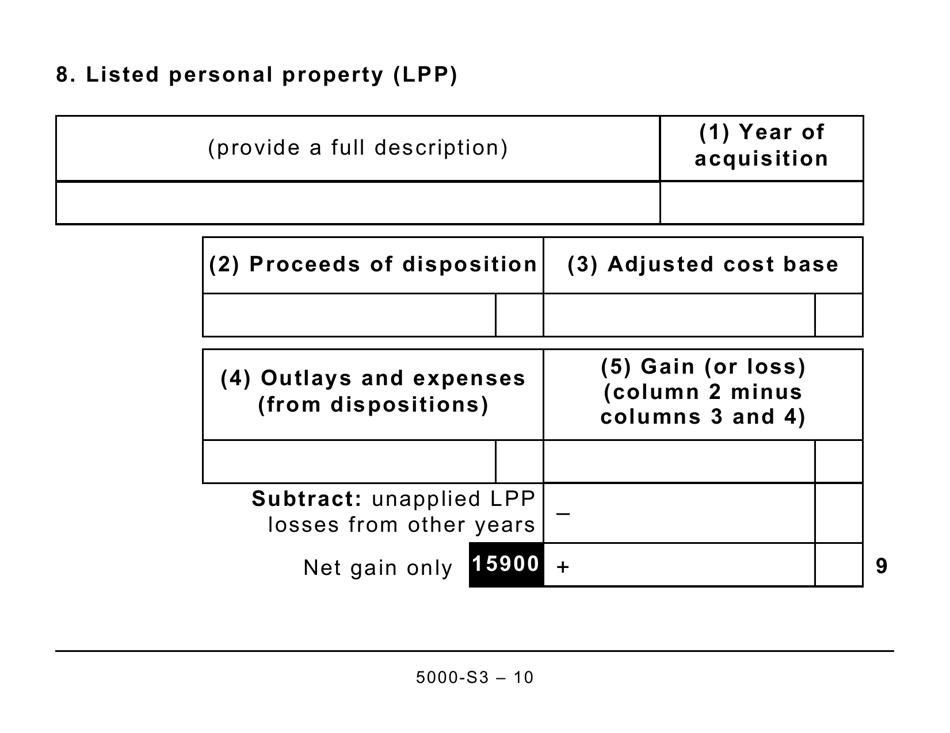

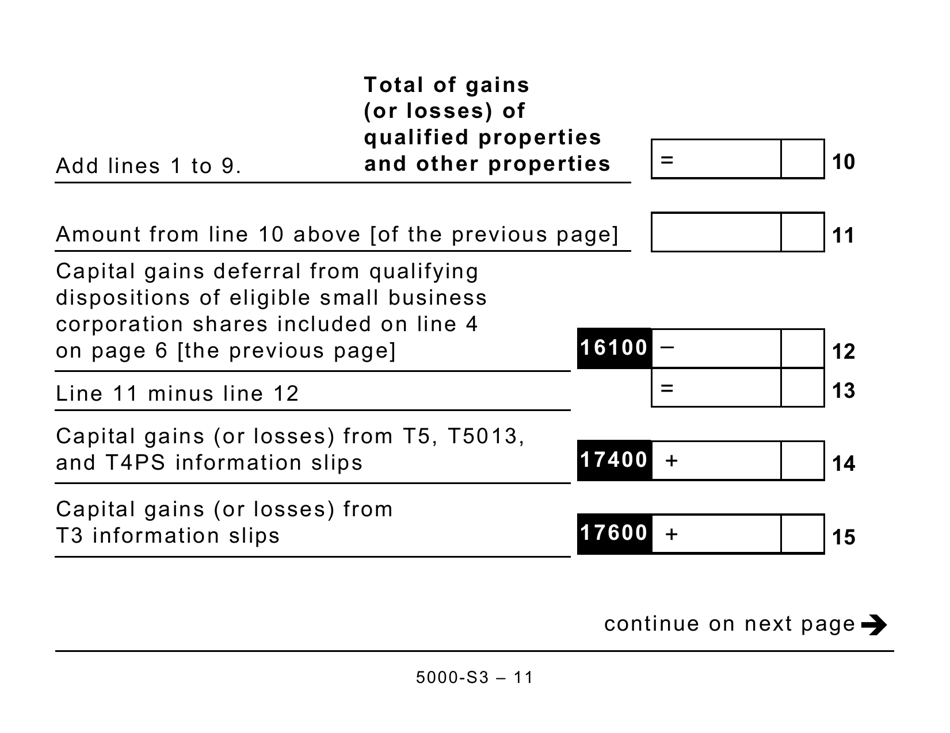

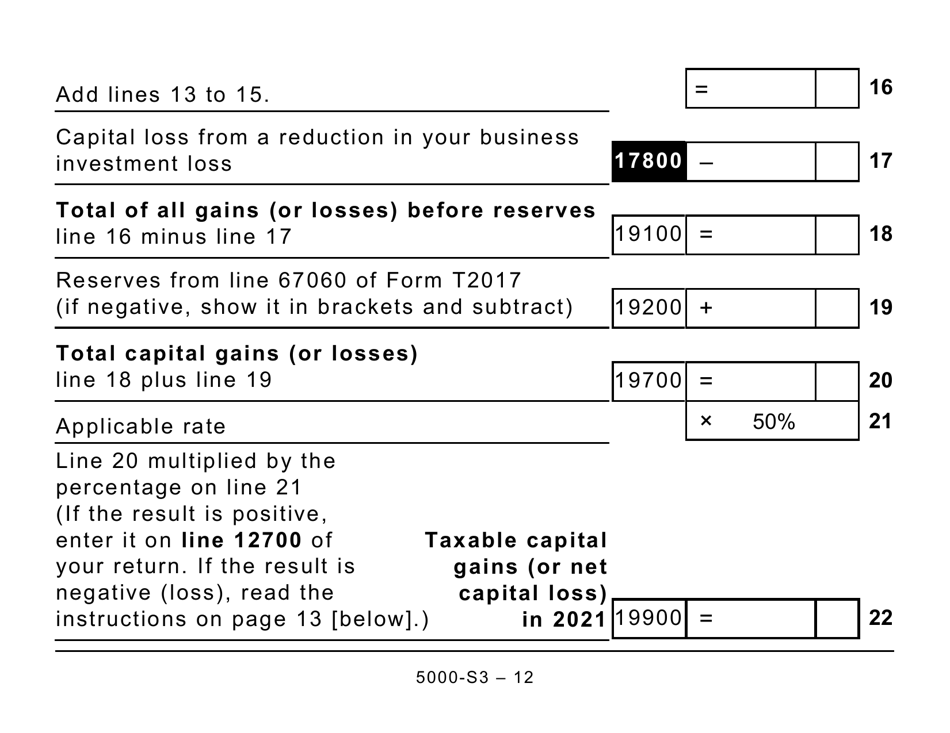

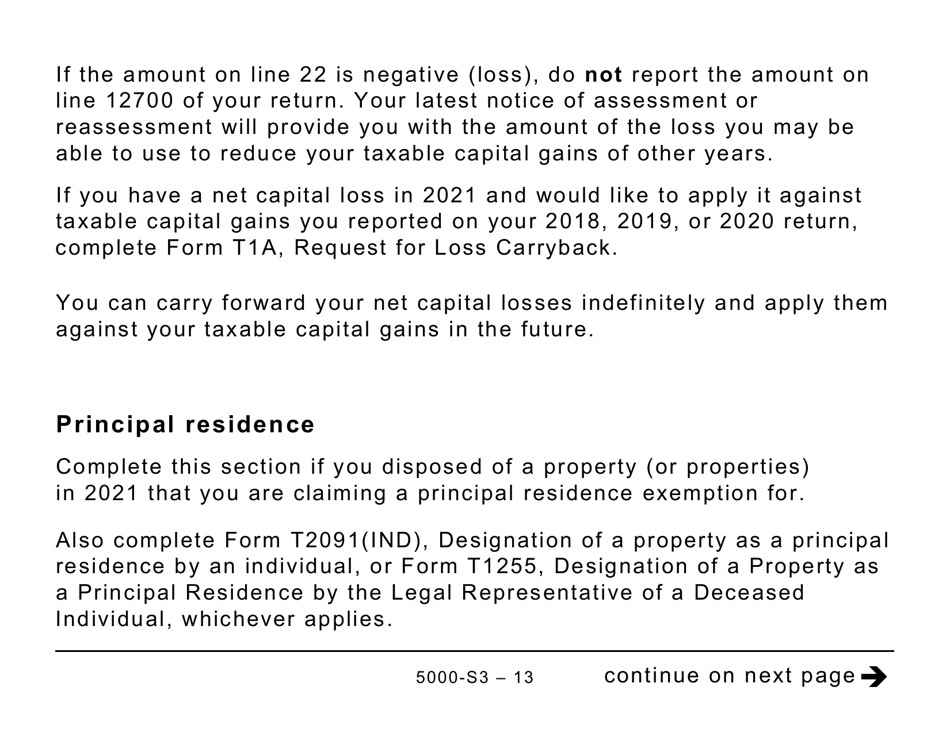

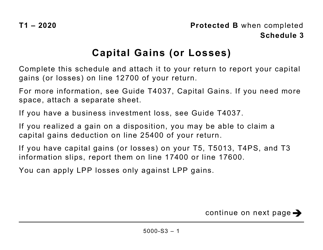

Form 5000-S3 Schedule 3 Capital Gains (or Losses) - Large Print is used in Canada for reporting capital gains or losses for tax purposes. It allows individuals to calculate and report any gains or losses they may have incurred from the sale of certain types of property or investments.

The Form 5000-S3 Schedule 3 Capital Gains (or Losses) - Large Print in Canada is filed by individuals who have capital gains or losses.

FAQ

Q: What is form 5000-S3 Schedule 3?

A: Form 5000-S3 Schedule 3 is a tax form used in Canada to report capital gains or losses.

Q: What is a capital gain?

A: A capital gain is the profit made from selling a capital asset, such as real estate or stocks.

Q: What is a capital loss?

A: A capital loss is the loss incurred from selling a capital asset for less than its purchase price.

Q: Why do I need to report capital gains or losses?

A: You need to report capital gains or losses for tax purposes, as they may be subject to taxation.

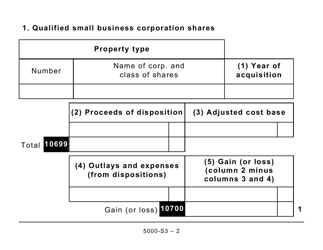

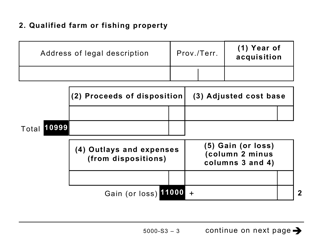

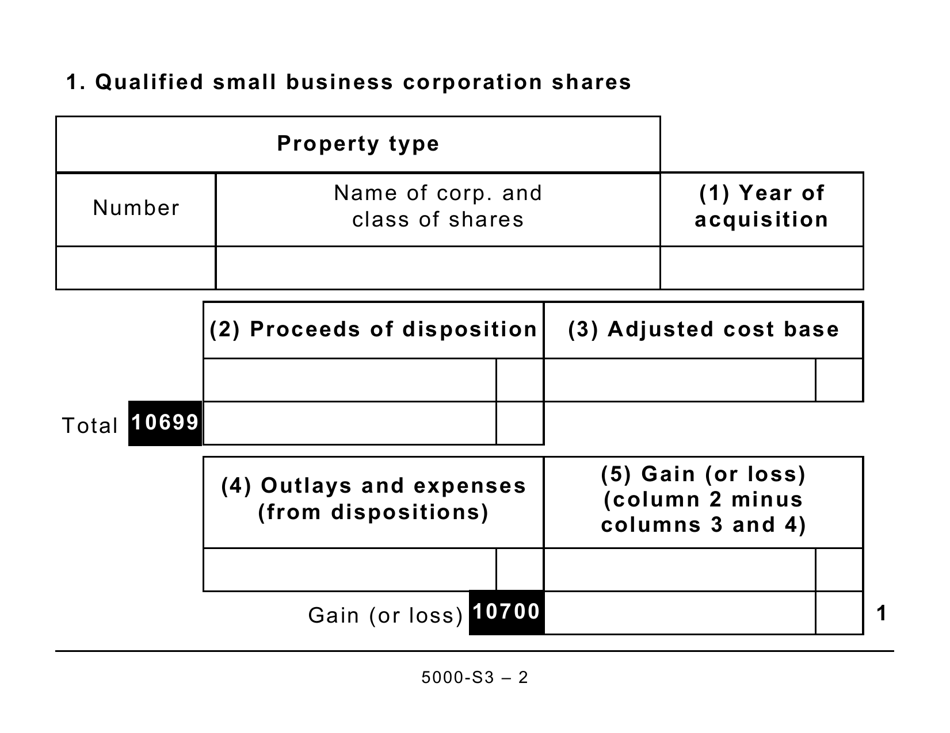

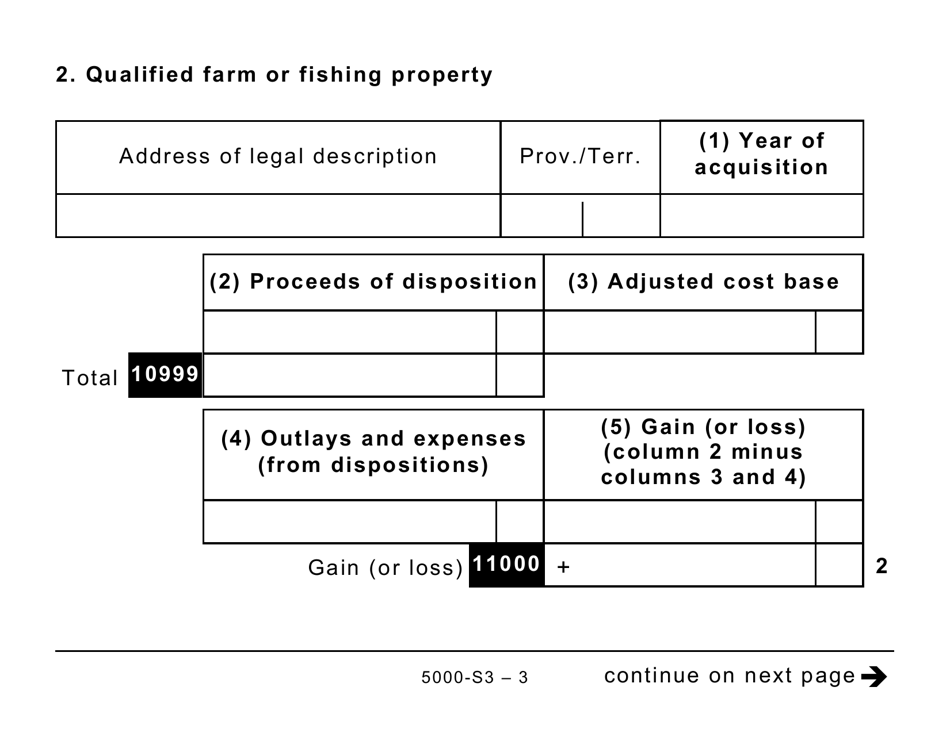

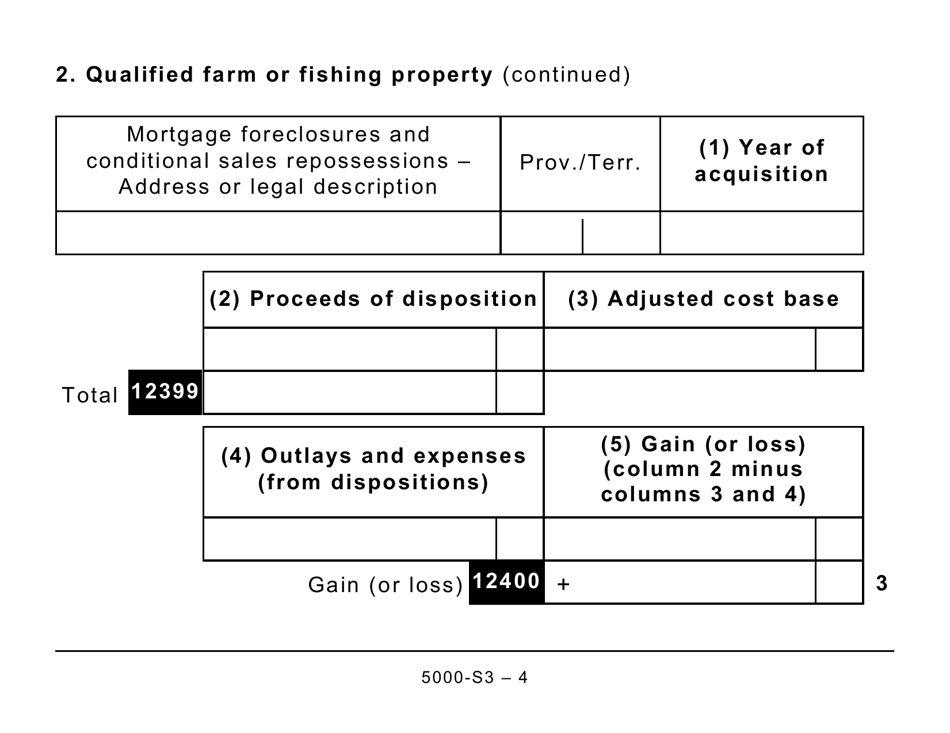

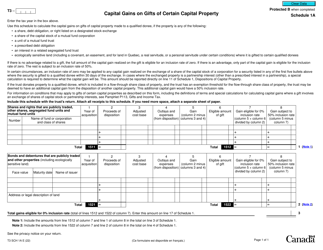

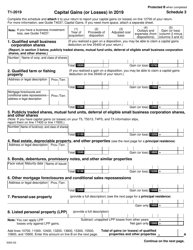

Q: How do I fill out form 5000-S3 Schedule 3?

A: You need to provide details of each capital gain or loss, including the date of acquisition and disposition, cost or proceeds, and any related expenses.

Q: Is form 5000-S3 Schedule 3 only for large print?

A: No, it is available in large print format, but it can also be obtained and filled out in regular print.

Q: When is the deadline to file form 5000-S3 Schedule 3?

A: The deadline to file form 5000-S3 Schedule 3 is generally the same as the deadline for filing your income tax return, which is April 30th (or June 15th for self-employed individuals). However, it's always best to check with the CRA for any specific deadlines or extensions.