This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5000-S3 Schedule 3

for the current year.

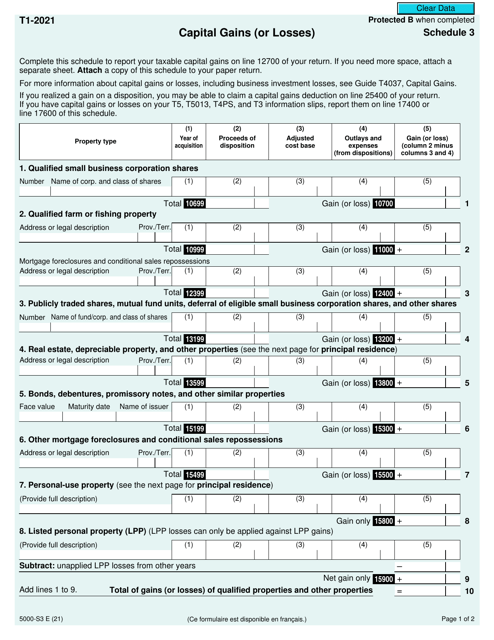

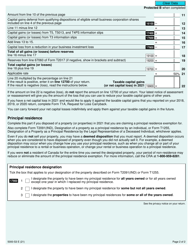

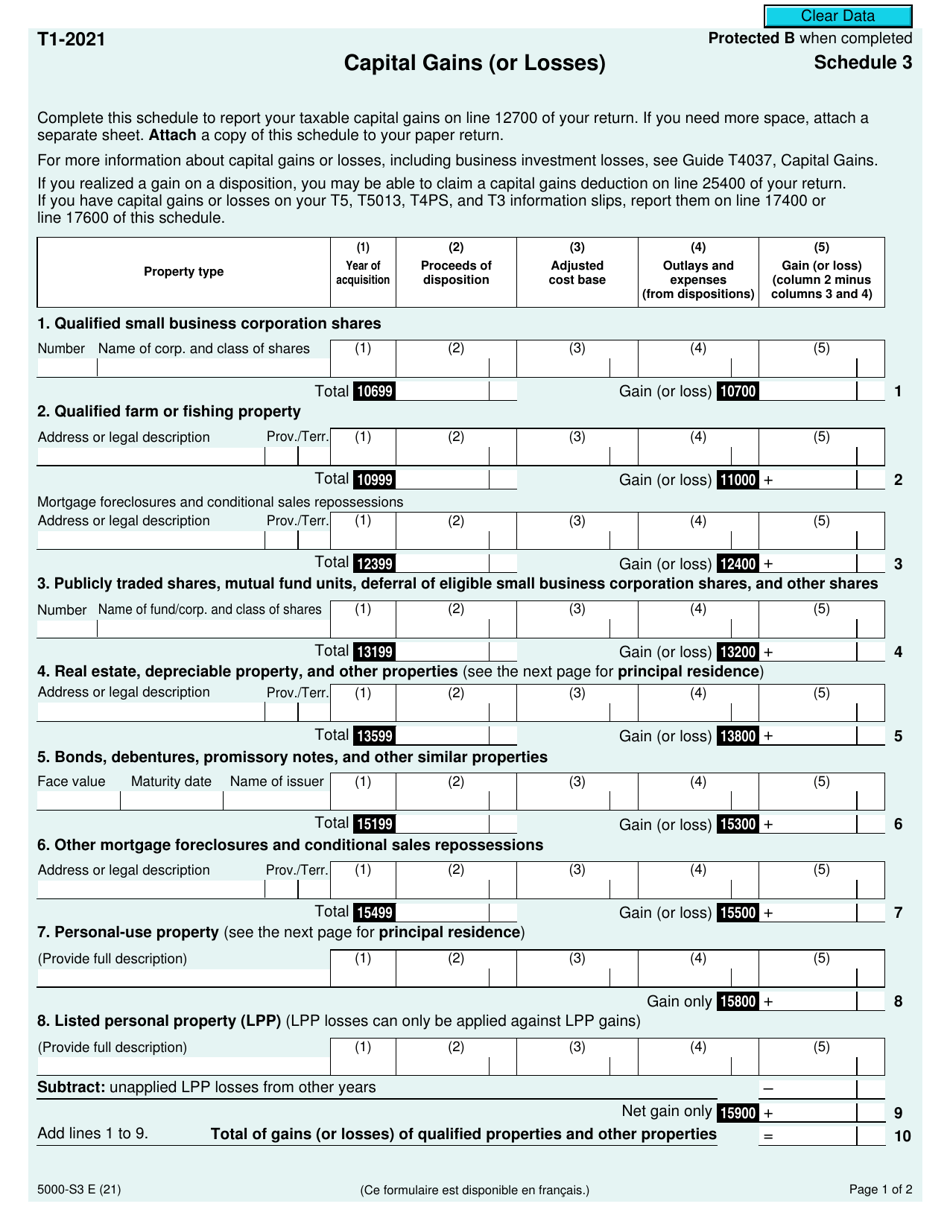

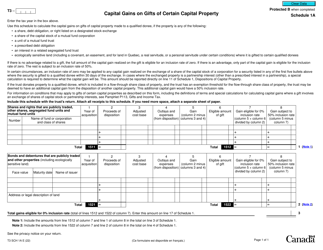

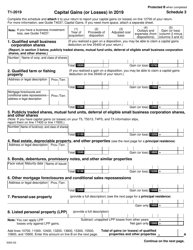

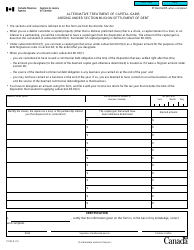

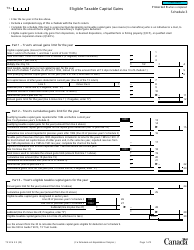

Form 5000-S3 Schedule 3 Capital Gains (Or Losses) - Canada

Form 5000-S3 Schedule 3 Capital Gains (Or Losses) - Canada is used to report capital gains or losses on investments or assets sold during the tax year. It helps calculate the amount of taxes owed or the amount that can be deducted for capital losses.

Individuals or corporations in Canada who have disposed of capital property during the tax year and have realized a capital gain or loss may file the Form 5000-S3 Schedule 3 Capital Gains (or Losses).

FAQ

Q: What is Form 5000-S3 Schedule 3?

A: Form 5000-S3 Schedule 3 is a tax form in Canada used to report capital gains or losses.

Q: Who needs to file Form 5000-S3 Schedule 3?

A: Anyone in Canada who has incurred capital gains or losses during the tax year needs to file Form 5000-S3 Schedule 3.

Q: What information is required on Form 5000-S3 Schedule 3?

A: Form 5000-S3 Schedule 3 requires you to provide details about the sale of capital properties, including the date of acquisition, proceeds of disposition, and adjusted cost base.

Q: How do I fill out Form 5000-S3 Schedule 3?

A: You need to fill out the form with accurate information about your capital gains or losses. Consult the instructions provided with the form for detailed guidance.

Q: When is the deadline to file Form 5000-S3 Schedule 3?

A: The deadline to file Form 5000-S3 Schedule 3 is April 30th of the following tax year, unless that day falls on a weekend or holiday, in which case the deadline is the next business day.

Q: What happens if I don't file Form 5000-S3 Schedule 3?

A: If you are required to file Form 5000-S3 Schedule 3 but fail to do so, you may face penalties or other consequences from the Canada Revenue Agency.

Q: Can I claim a capital loss on Form 5000-S3 Schedule 3?

A: Yes, Form 5000-S3 Schedule 3 allows you to claim capital losses, which can be used to offset capital gains in the same tax year or carried forward to future years.

Q: What documentation should I keep when filing Form 5000-S3 Schedule 3?

A: It is important to keep supporting documentation, such as receipts and records of purchase and sale, to substantiate the information reported on Form 5000-S3 Schedule 3.