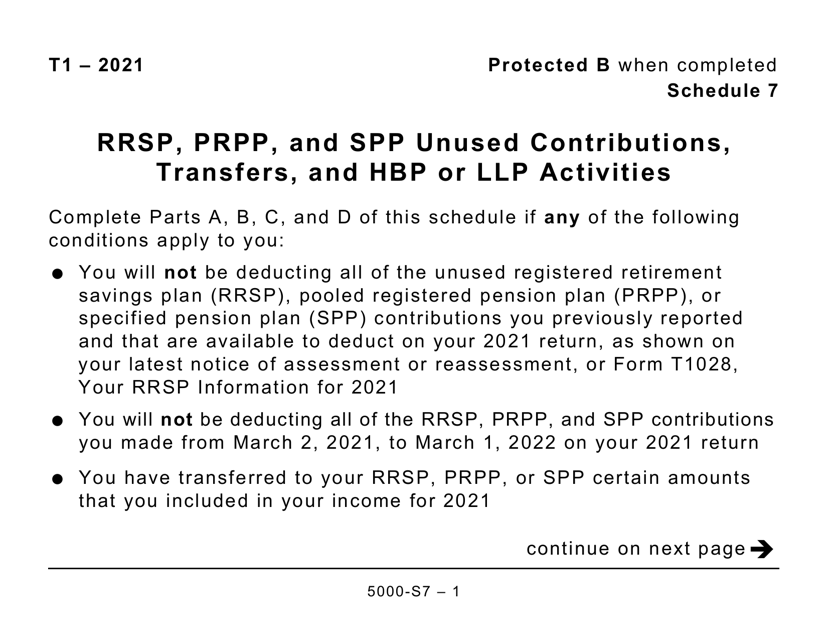

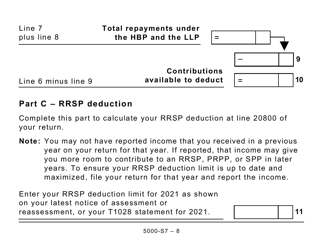

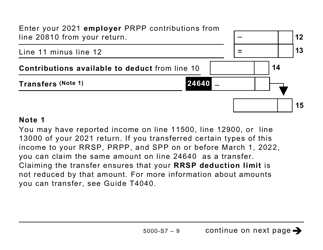

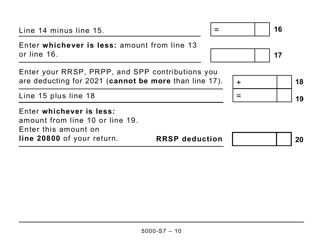

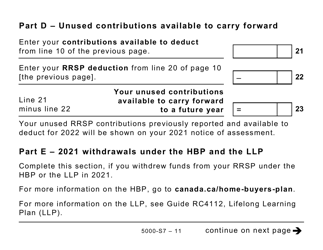

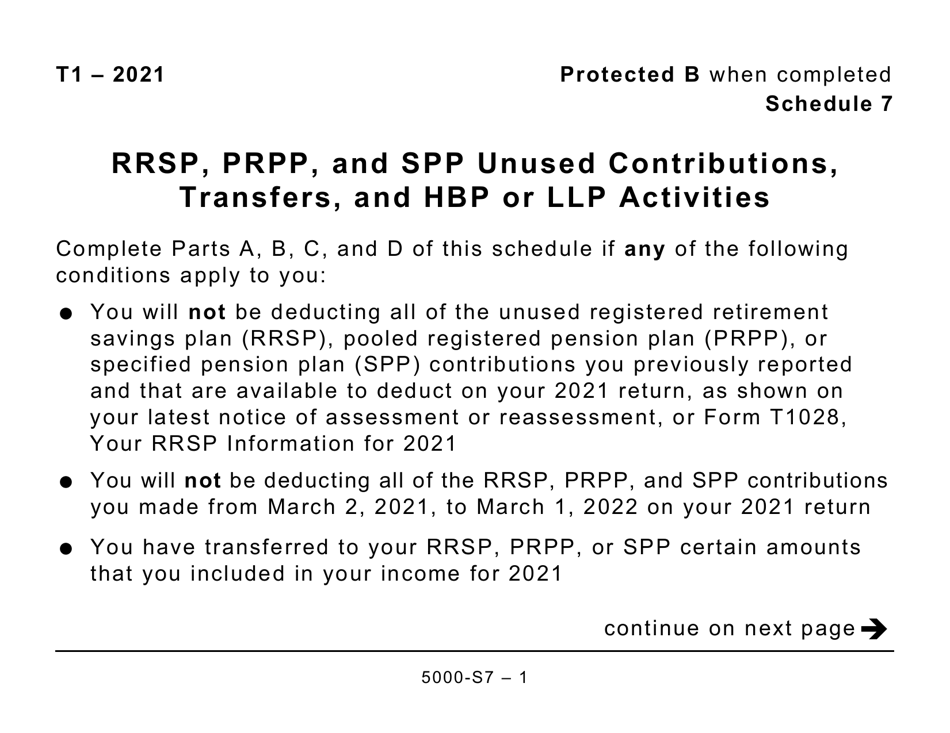

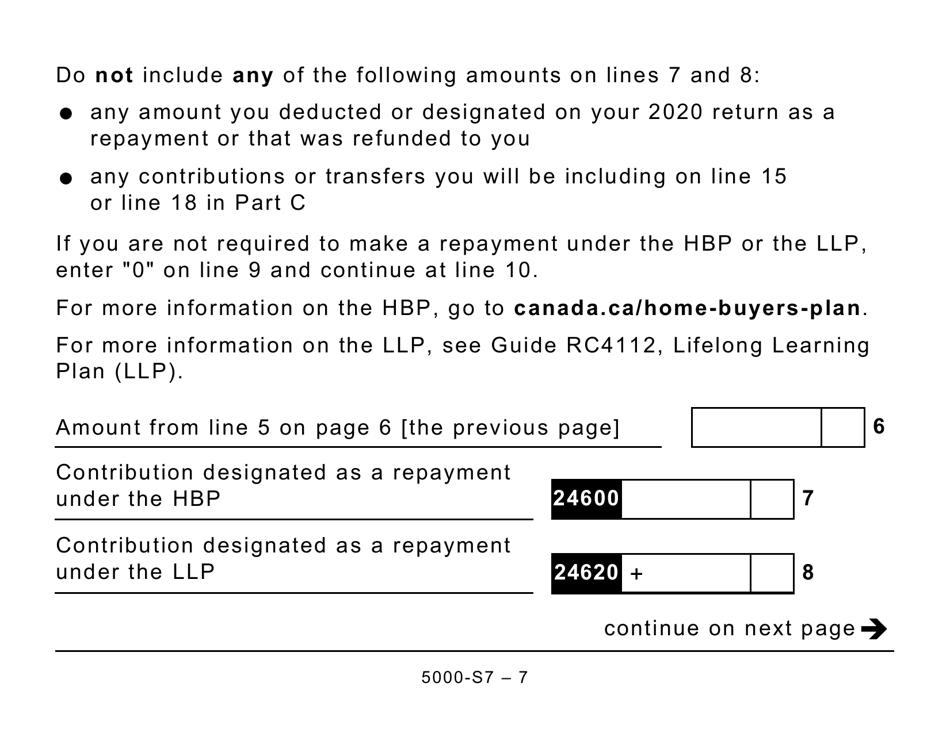

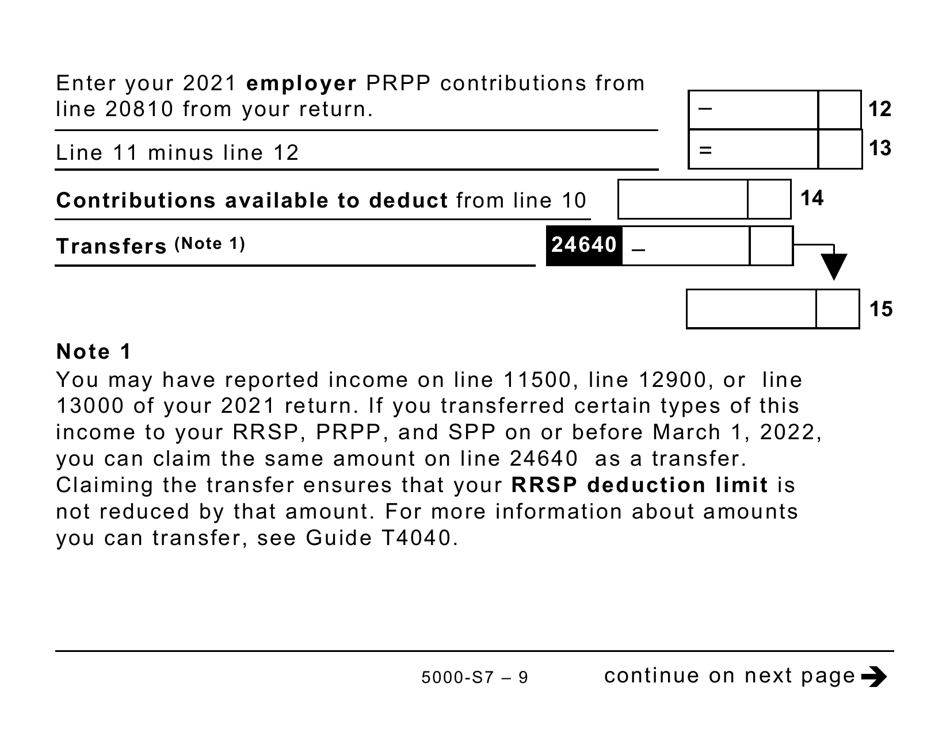

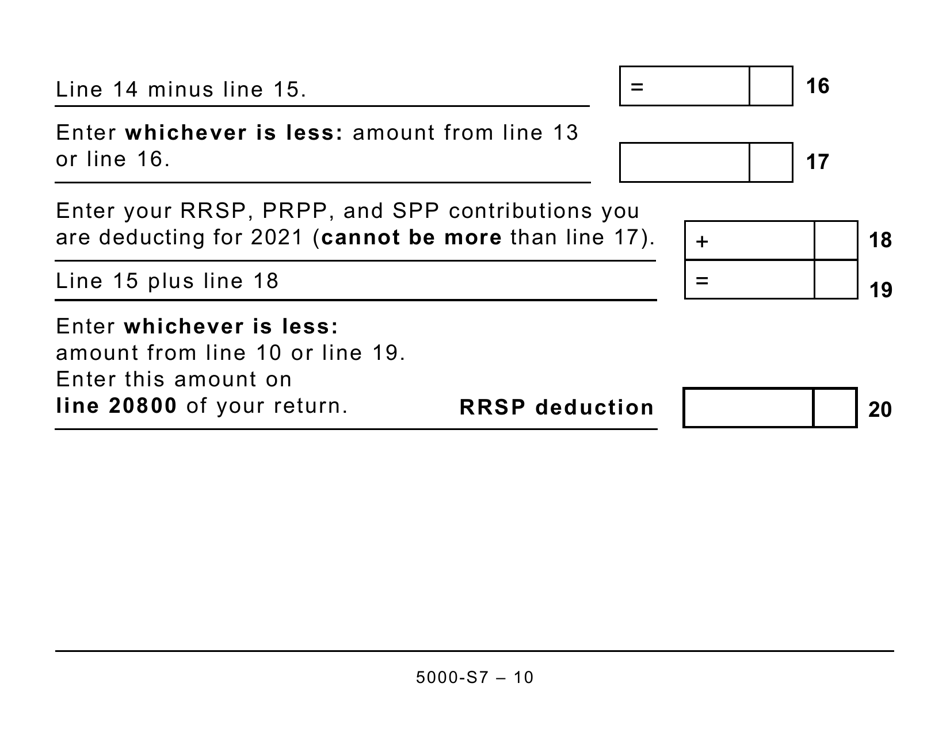

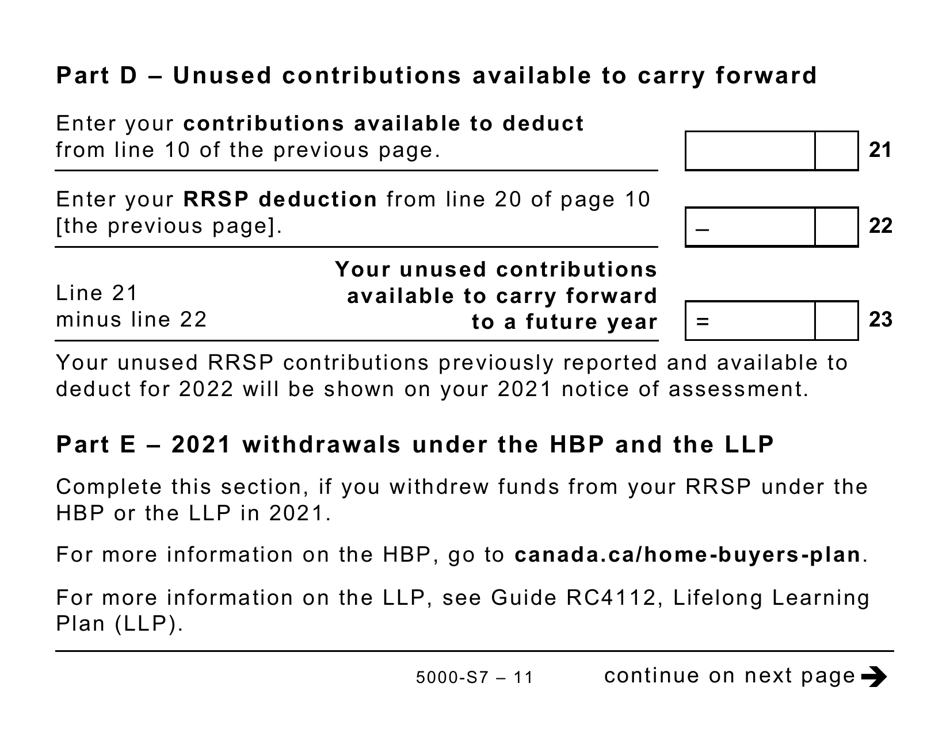

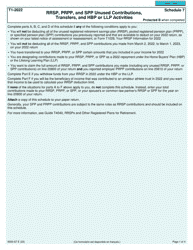

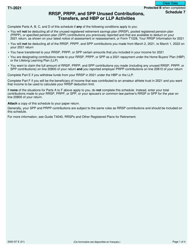

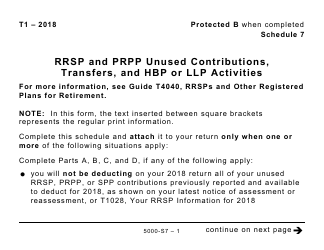

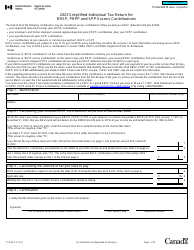

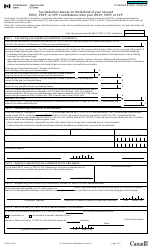

Form 5000-S7 Schedule 7 Rrsp, Prpp, and Spp Unused Contributions, Transfers, and Hbp or LLP Activities (Large Print) - Canada

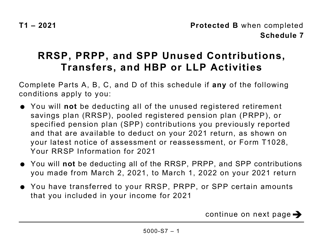

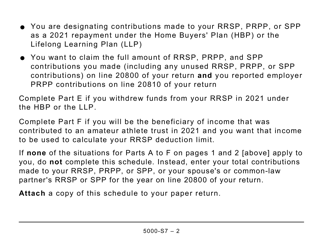

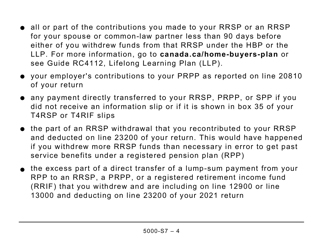

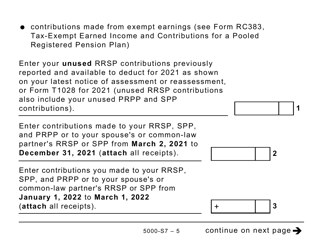

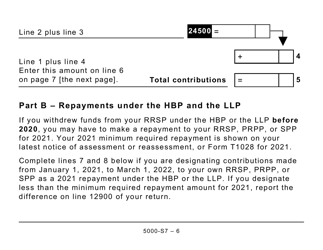

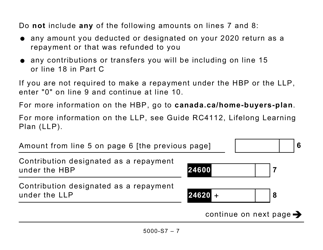

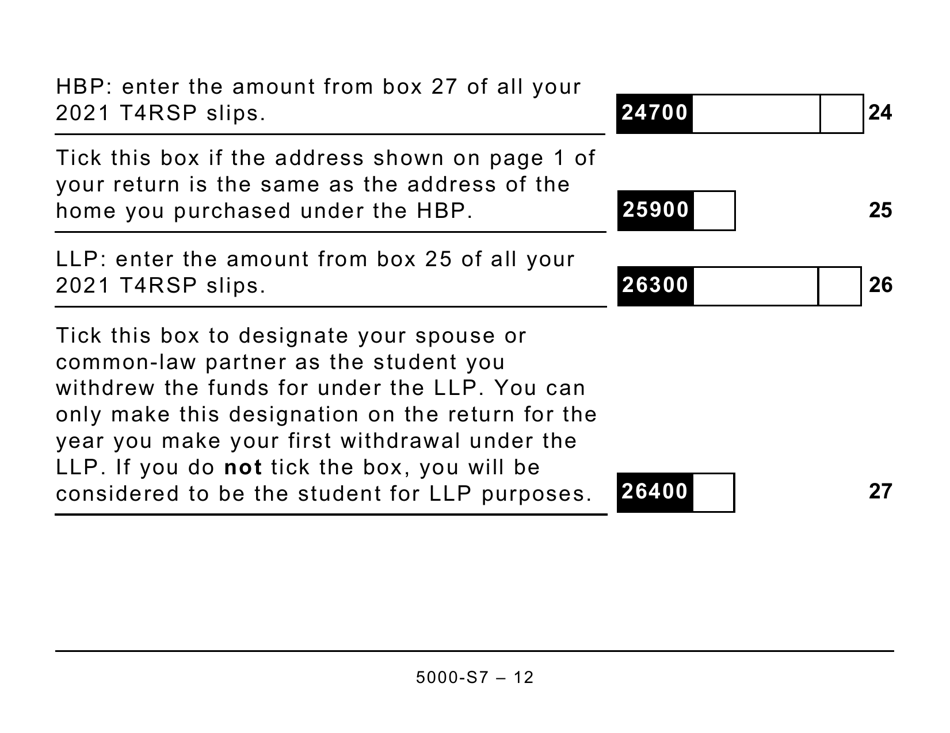

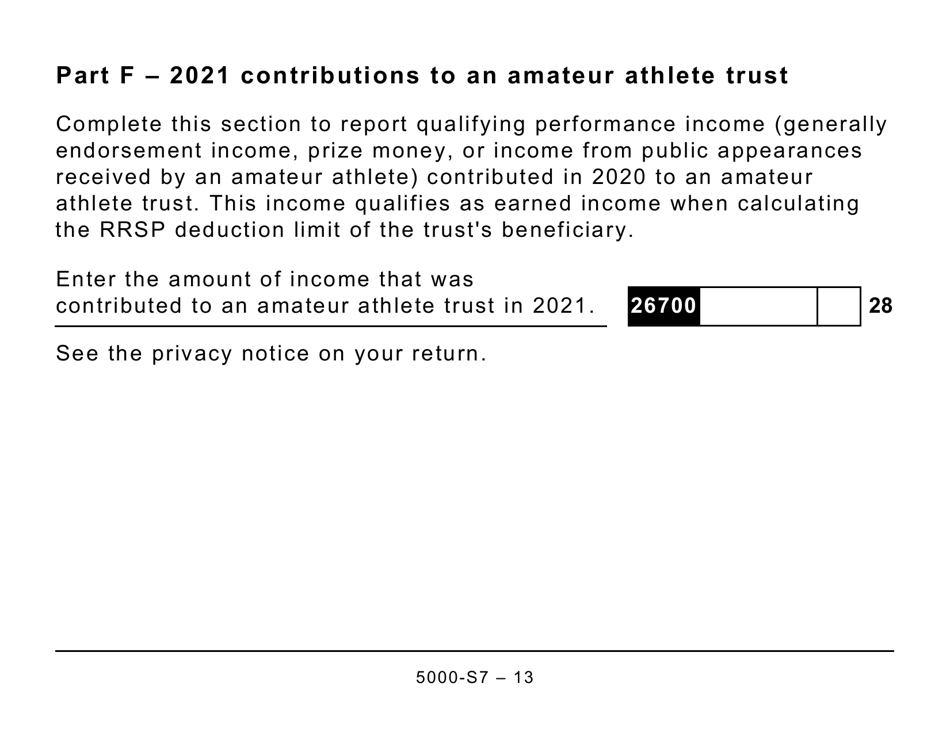

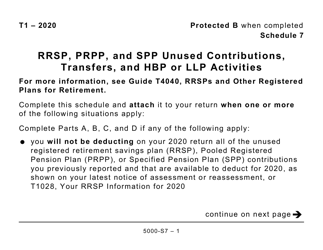

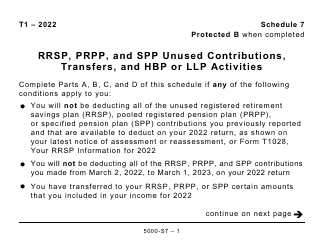

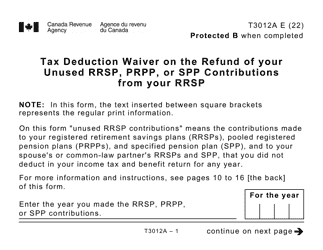

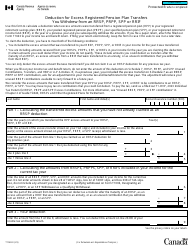

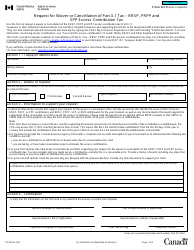

Form 5000-S7 Schedule 7 Rrsp, Prpp, and Spp Unused Contributions, Transfers, and Hbp or LLP Activities (Large Print) in Canada is used to report details about unused contributions, transfers, or Home Buyers’ Plan (HBP) or Lifelong Learning Plan (LLP) activities related to Registered Retirement Savings Plans (RRSPs), Pooled Registered Pension Plans (PRPPs), or Specified Pension Plans (SPPs).

The Form 5000-S7 Schedule 7 RRSP, PRPP, and SPP Unused Contributions, Transfers, and HBP or LLP Activities (Large Print) in Canada is filed by individuals who have made contributions to registered retirement savings plans (RRSPs), pooled registered pension plans (PRPPs), and specified pension plans (SPPs) and are reporting unused contributions, transfers, or activities related to the Home Buyers' Plan (HBP) or the Lifelong Learning Plan (LLP).

FAQ

Q: What is Form 5000-S7 Schedule 7?

A: Form 5000-S7 Schedule 7 is a tax form in Canada.

Q: What does Schedule 7 cover?

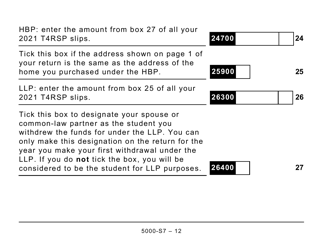

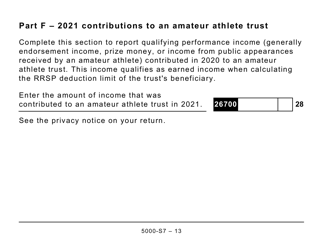

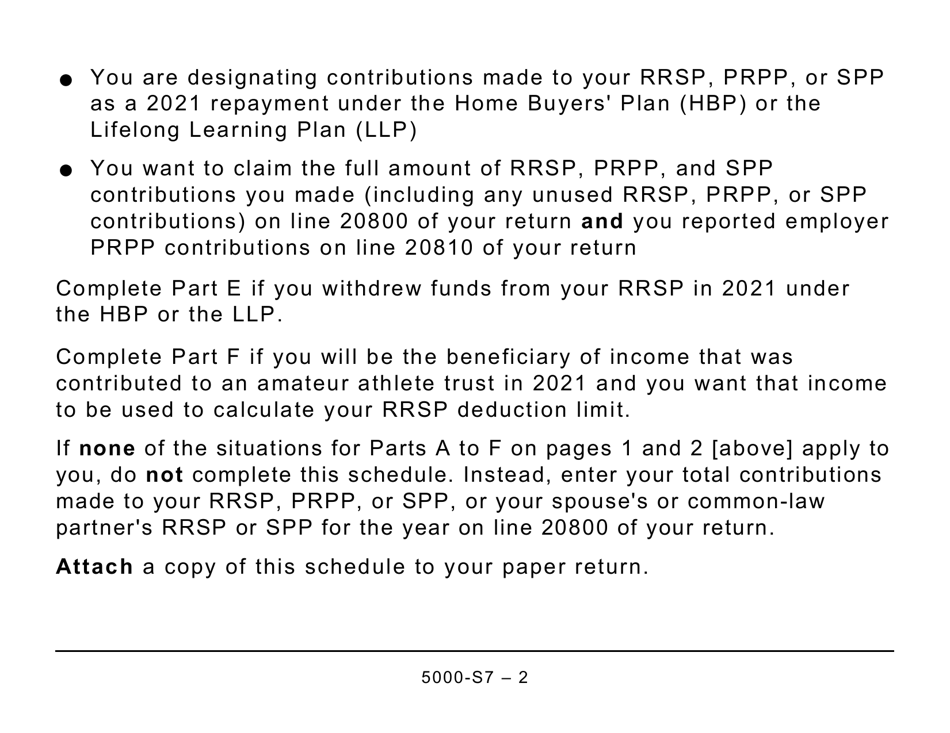

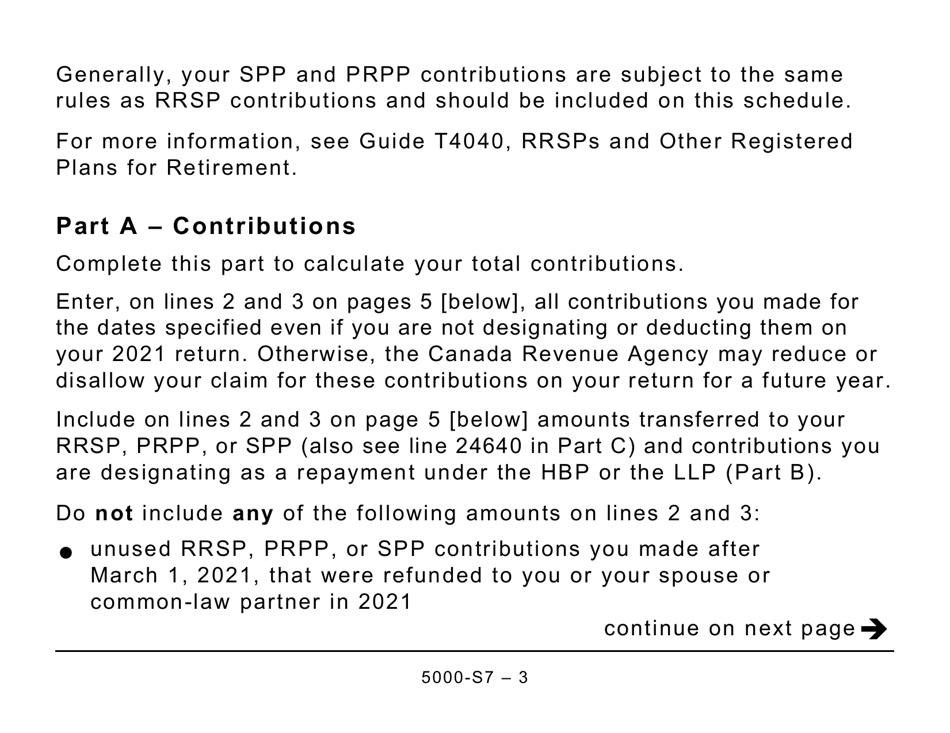

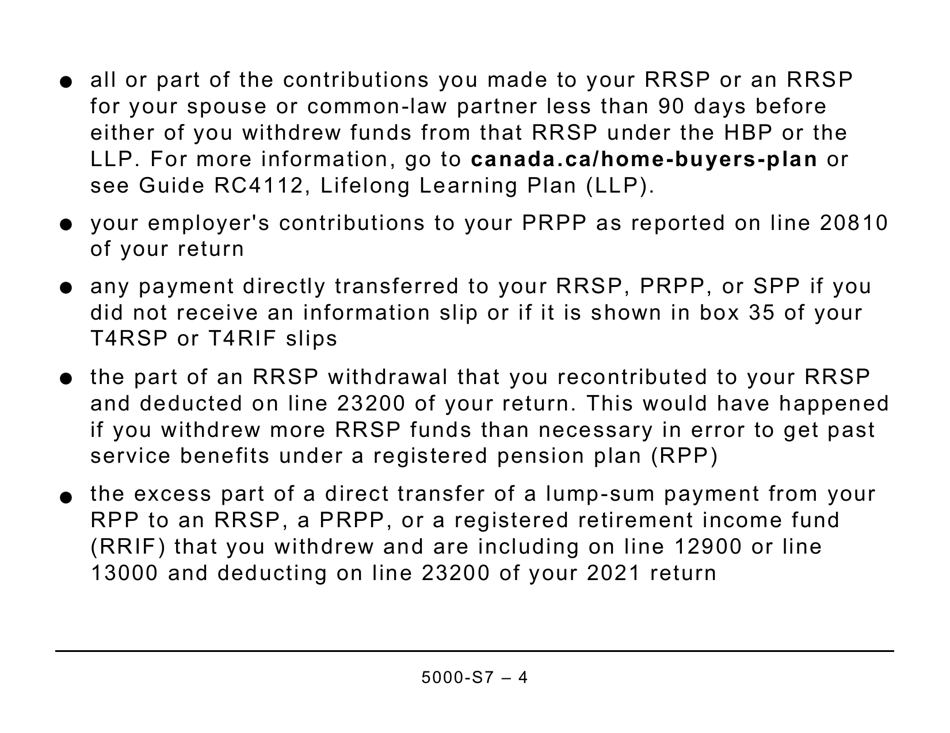

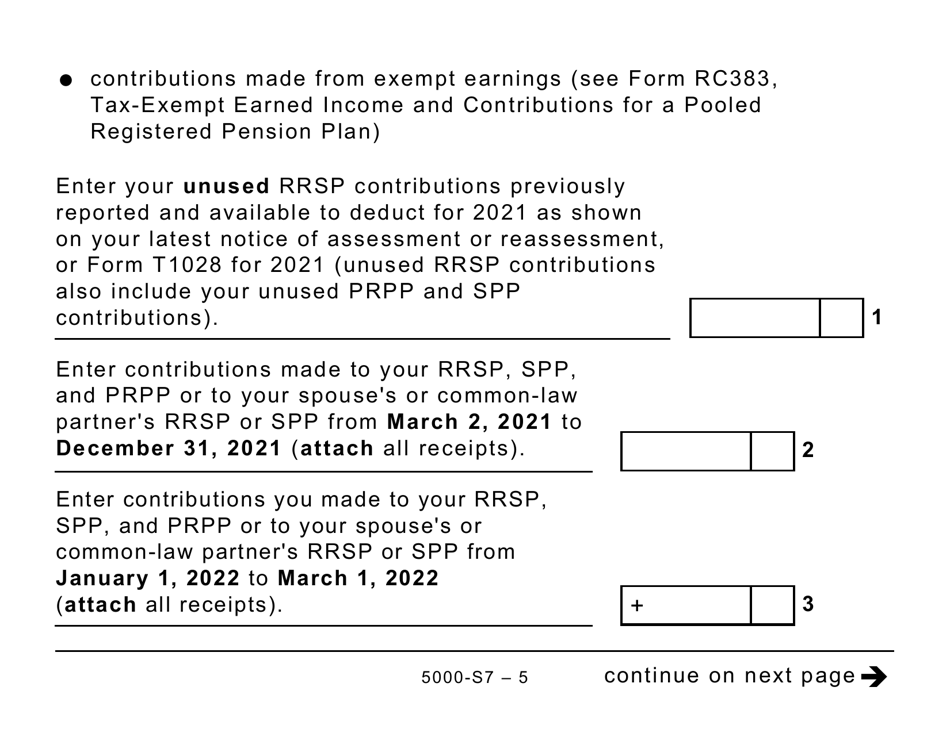

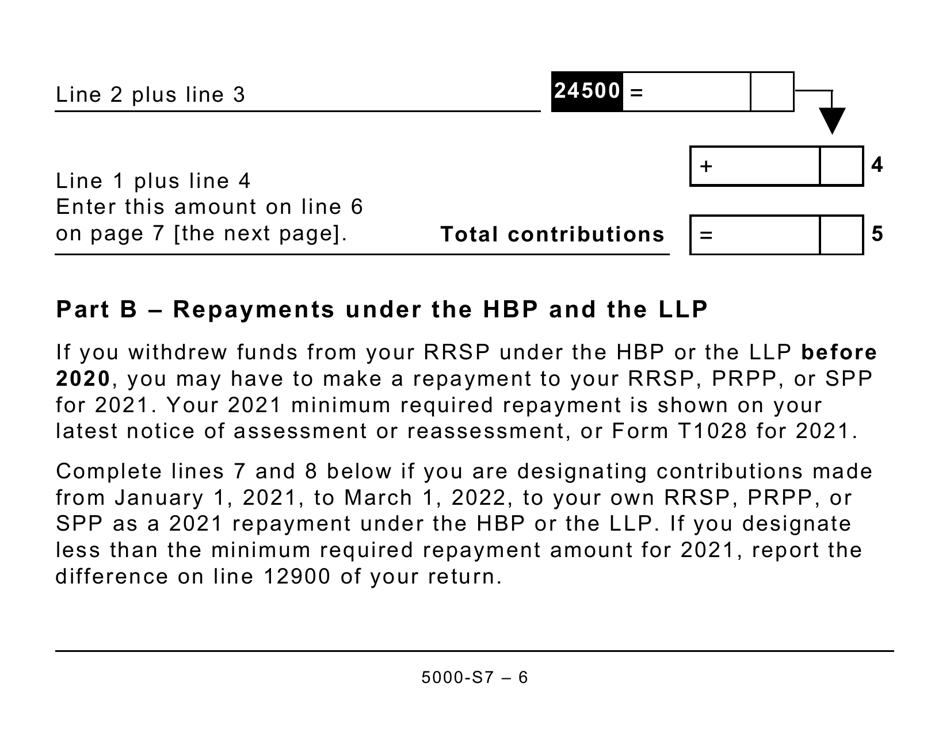

A: Schedule 7 covers RRSP, PRPP, and SPP unused contributions, transfers, and HBP or LLP activities.

Q: Who needs to fill out Schedule 7?

A: Individuals who have RRSP, PRPP, or SPP contributions, transfers, or HBP or LLP activities need to fill out Schedule 7.

Q: What information is required on Schedule 7?

A: Schedule 7 requires information about unused contributions, transfers, and HBP or LLP activities for RRSPs, PRPPs, and SPPs.