This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5009-S11 Schedule AB(S11)

for the current year.

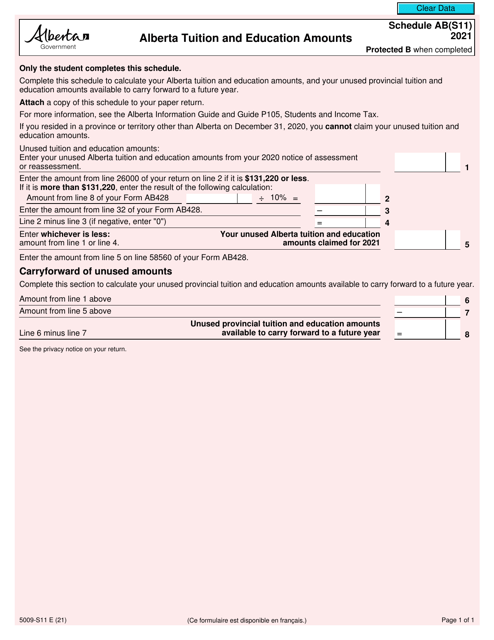

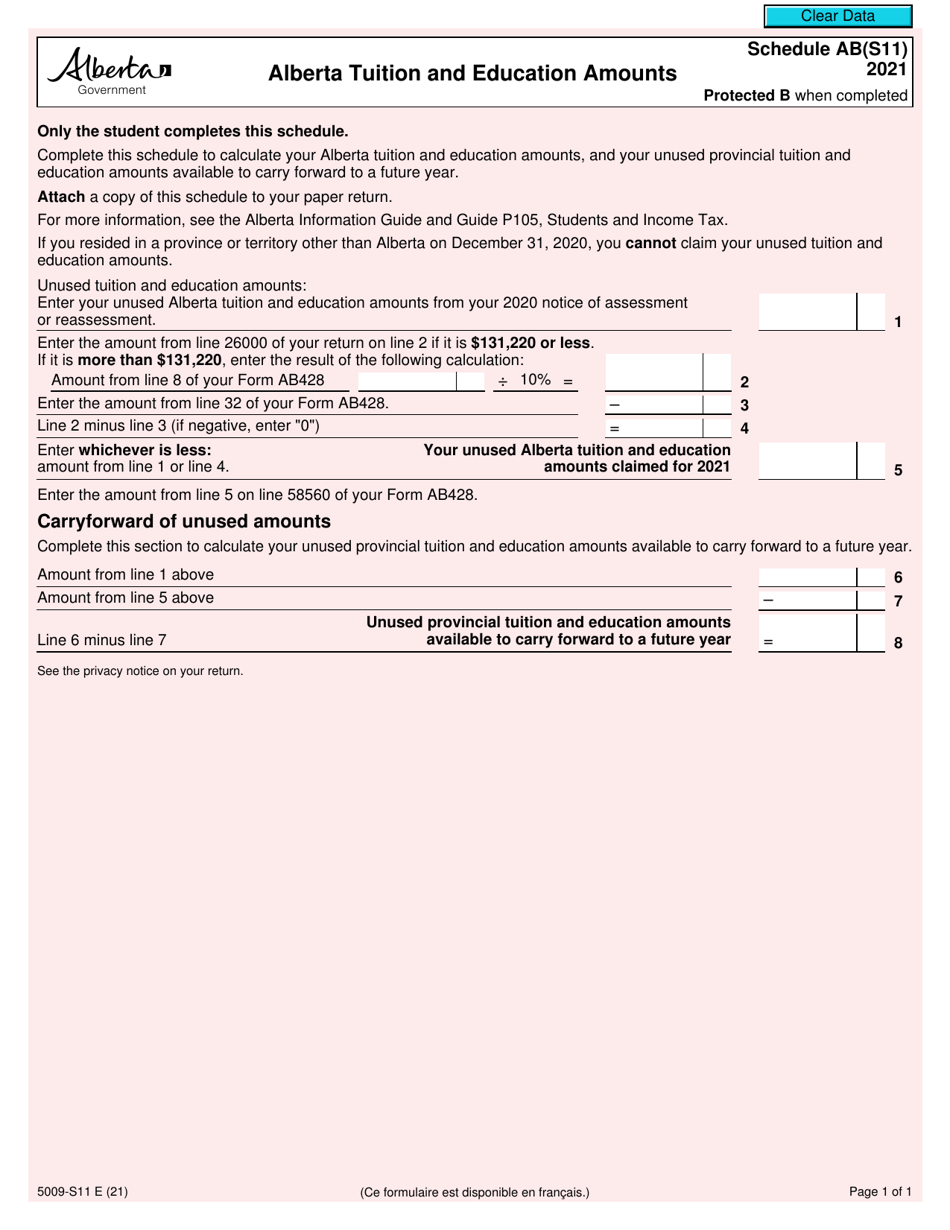

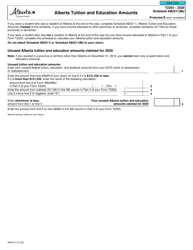

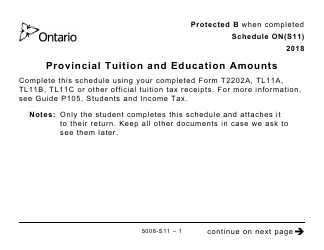

Form 5009-S11 Schedule AB(S11) Alberta Tuition and Education Amounts - Canada

Form 5009-S11 Schedule AB(S11) Alberta Tuition and Education Amounts is used in Canada for claiming tuition and education amounts specific to the province of Alberta.

The Form 5009-S11 Schedule AB(S11) Alberta Tuition and Education Amounts - Canada is typically filed by individuals who are residents of Alberta and want to claim tuition and education tax credits for expenses incurred for post-secondary education in Alberta.

FAQ

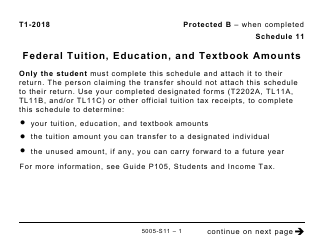

Q: What is Form 5009-S11?

A: Form 5009-S11 is a schedule for reporting Alberta Tuition and Education Amounts.

Q: What does Schedule AB(S11) refer to?

A: Schedule AB(S11) refers to the Alberta Tuition and Education Amounts.

Q: What is the purpose of Form 5009-S11?

A: The purpose of Form 5009-S11 is to report the education amounts for the province of Alberta.

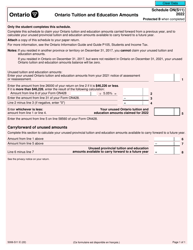

Q: Who needs to file Schedule AB(S11)?

A: Residents of Alberta who claim education amounts on their income tax return need to file Schedule AB(S11).

Q: When is the deadline for filing Schedule AB(S11)?

A: The deadline for filing Schedule AB(S11) is the same as the deadline for filing your income tax return, which is usually April 30th of the following year.

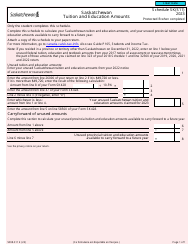

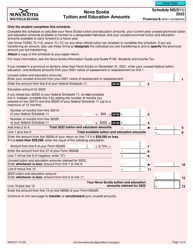

Q: What are the education amounts eligible for claiming on Schedule AB(S11)?

A: The education amounts eligible for claiming on Schedule AB(S11) include tuition fees, education amounts transferred from a spouse or common-law partner, and amounts carried forward from previous years.

Q: Can I claim education amounts from other provinces on Schedule AB(S11)?

A: No, Schedule AB(S11) is specifically for reporting education amounts from the province of Alberta. If you have education amounts from other provinces, you will need to use the corresponding schedules for those provinces.

Q: Is Schedule AB(S11) only for students?

A: No, Schedule AB(S11) can be used by both students and their supporting individuals, such as parents or grandparents, who are claiming the education amounts.

Q: What documentation do I need to support my claims on Schedule AB(S11)?

A: You should keep receipts and supporting documents for tuition fees and other education expenses in case the CRA asks for verification.