This version of the form is not currently in use and is provided for reference only. Download this version of

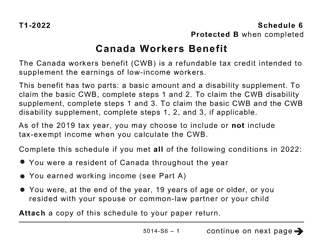

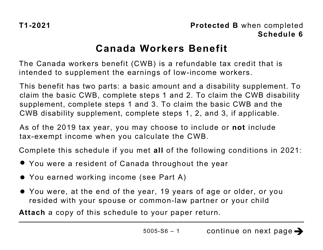

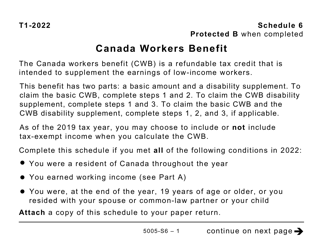

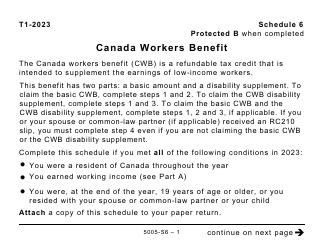

Form 5009-S6 Schedule 6

for the current year.

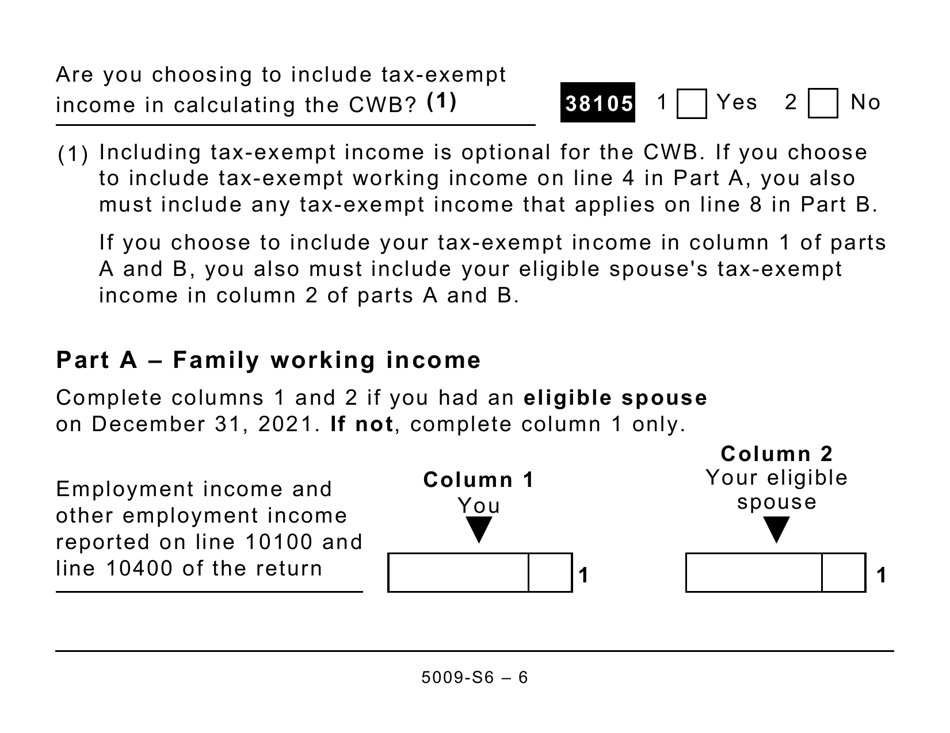

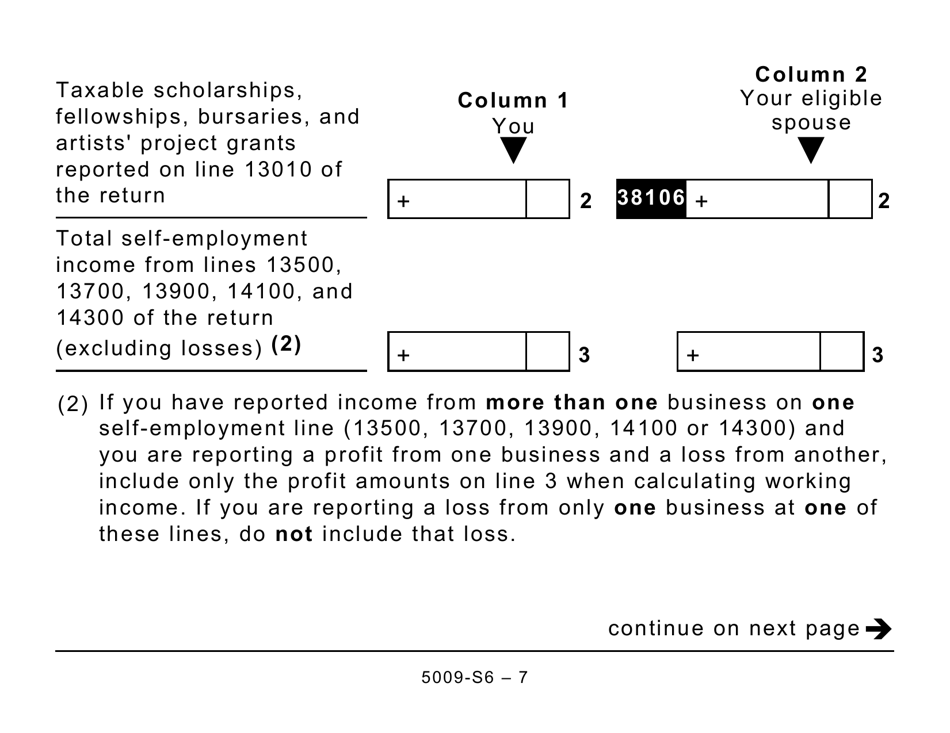

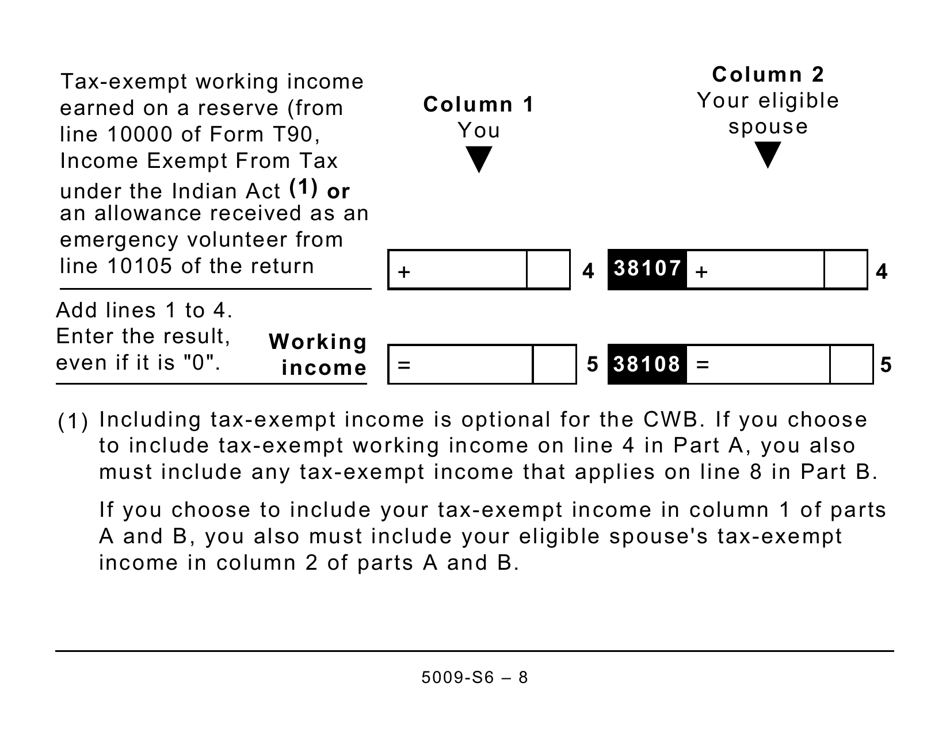

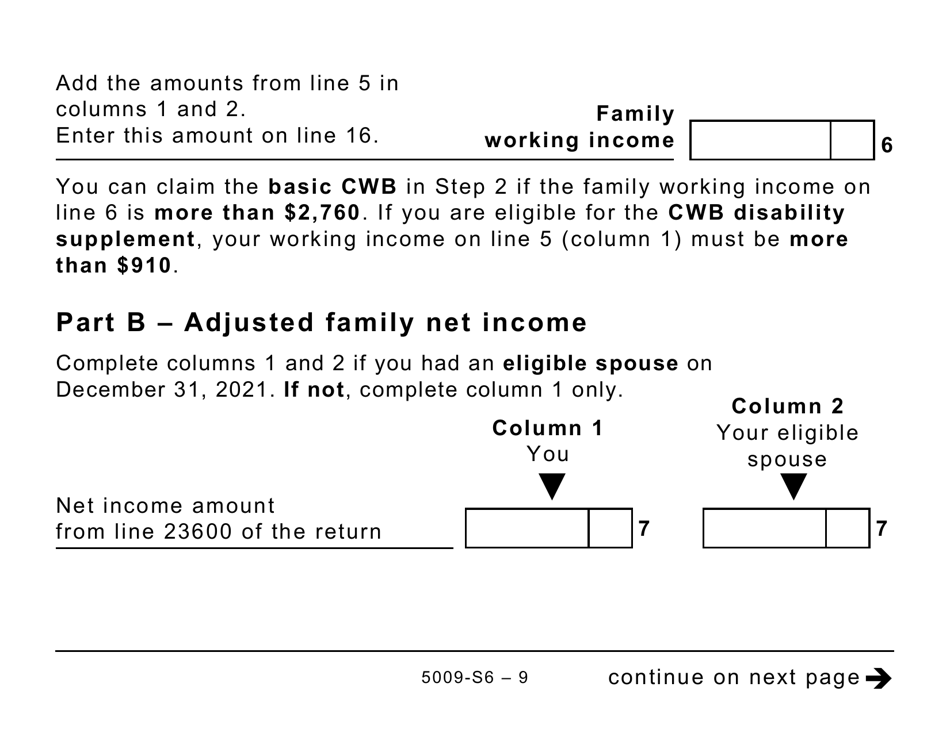

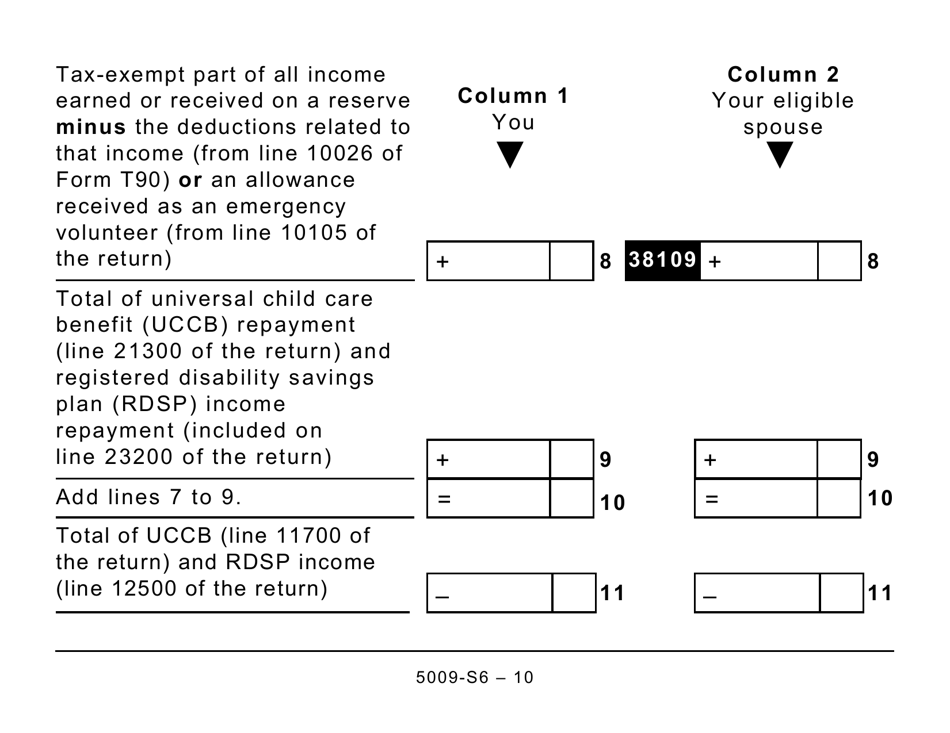

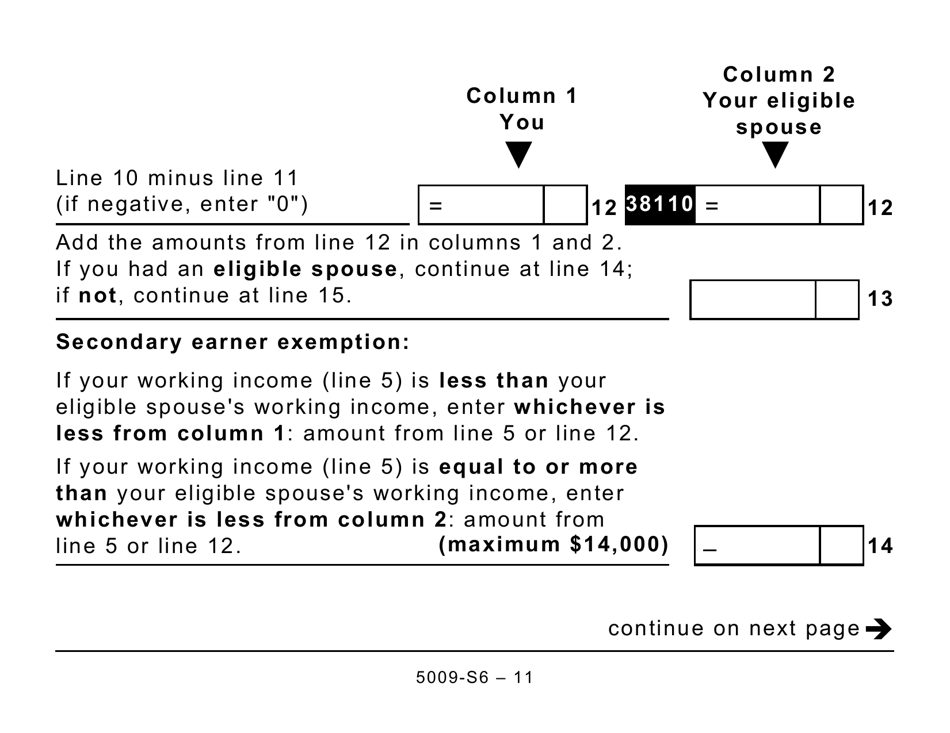

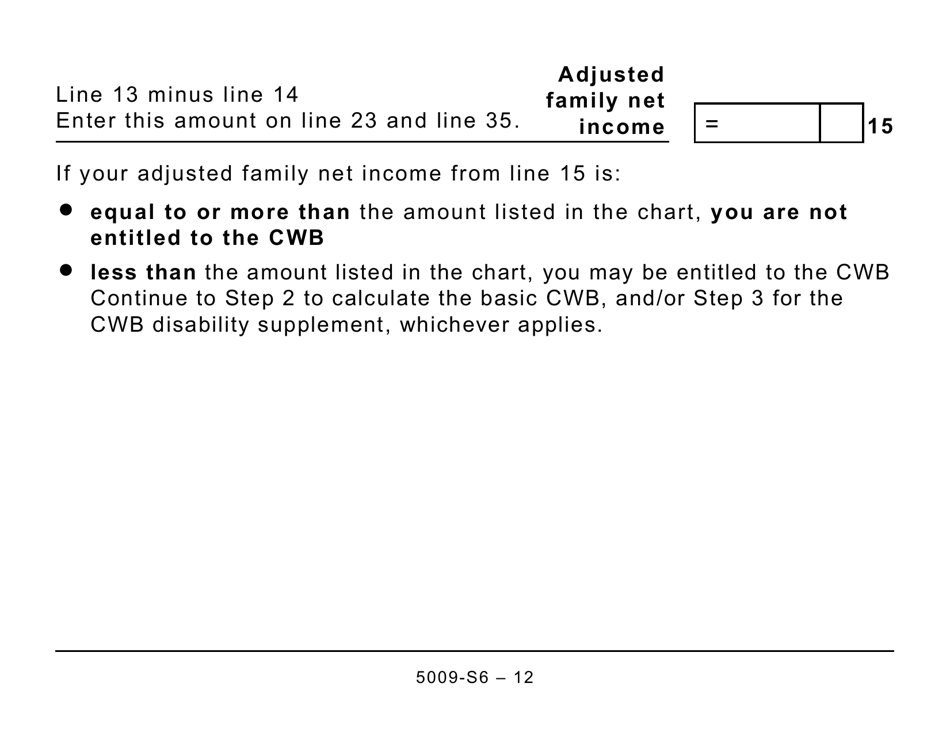

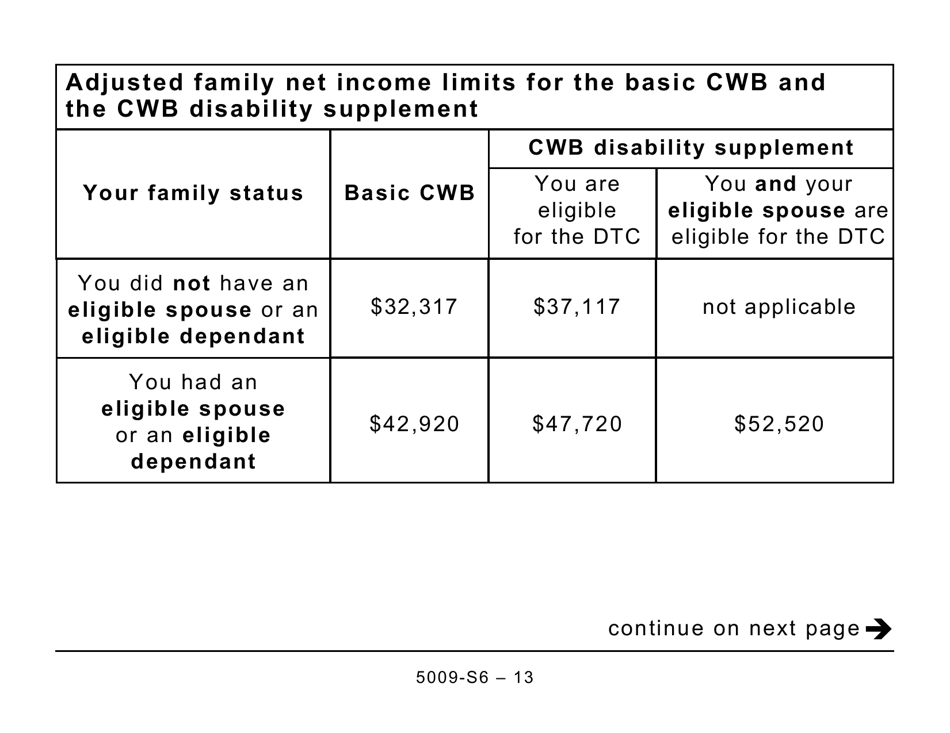

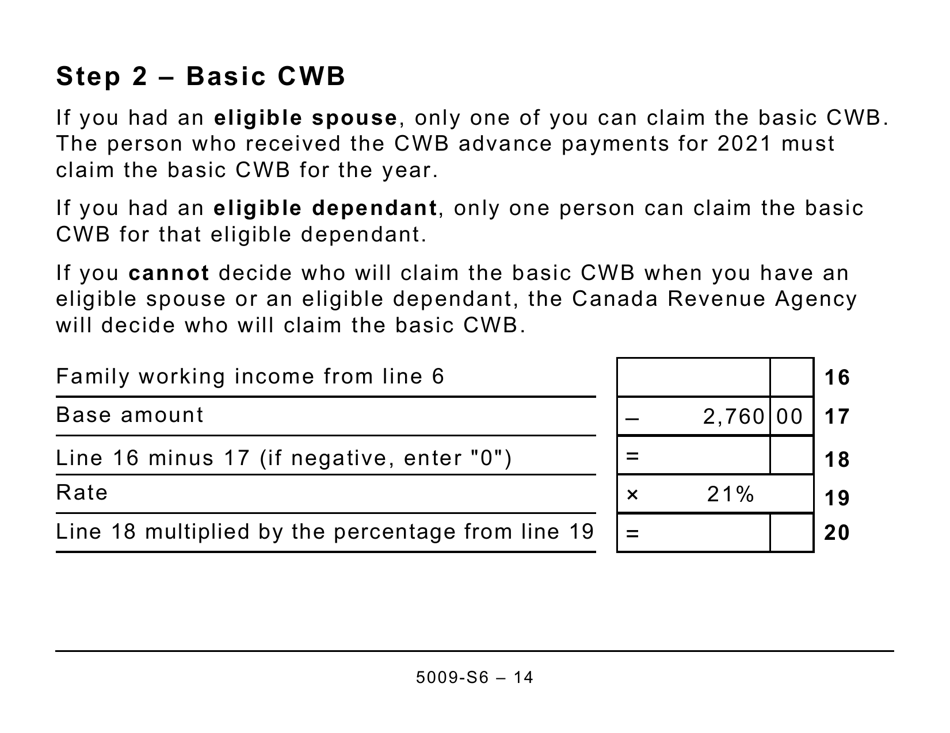

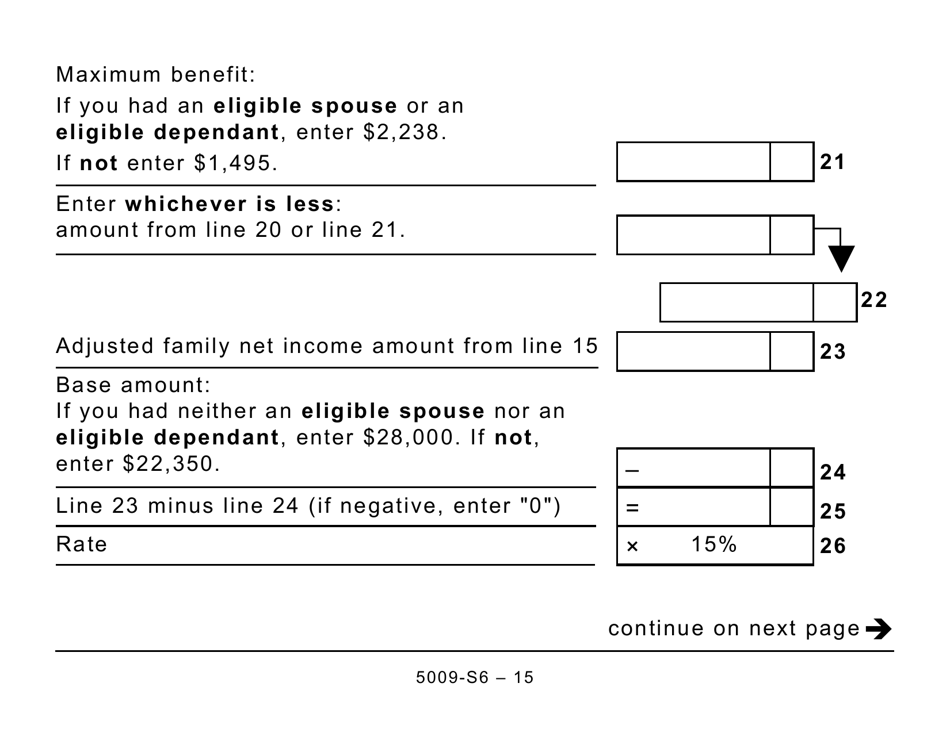

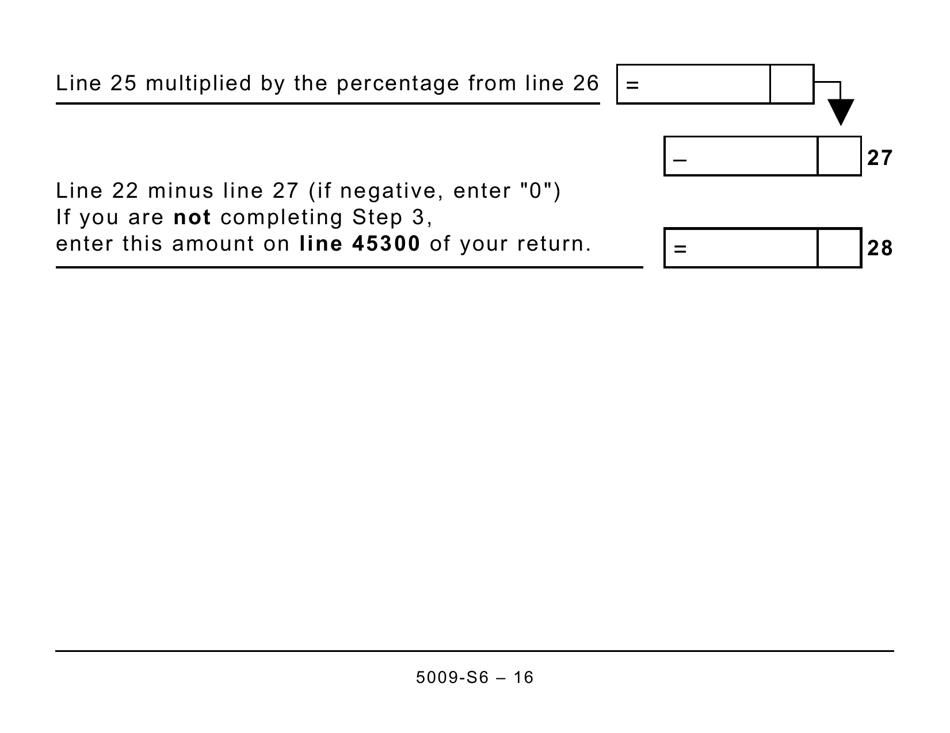

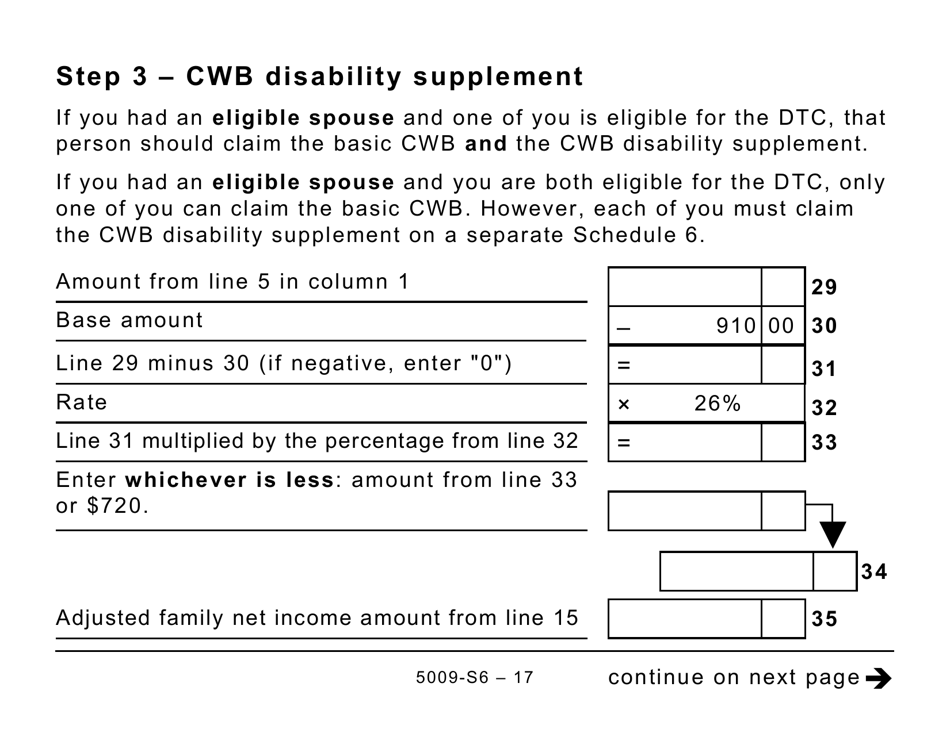

Form 5009-S6 Schedule 6 Canada Workers Benefit (Large Print) - Canada

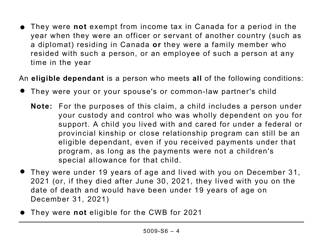

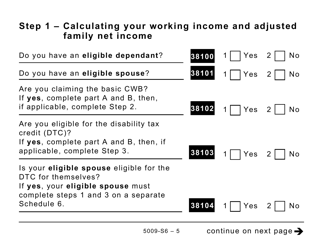

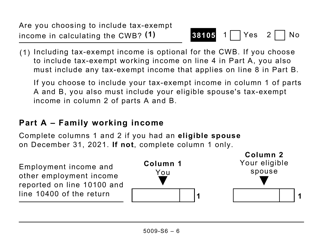

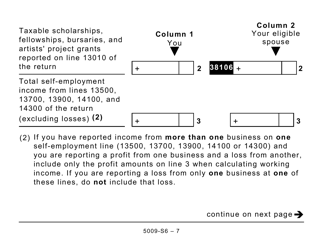

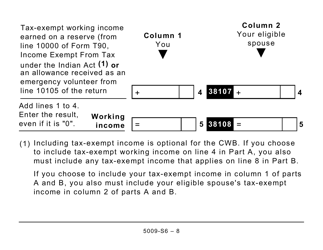

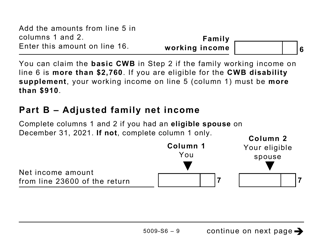

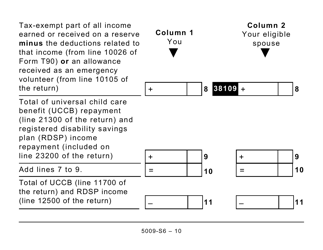

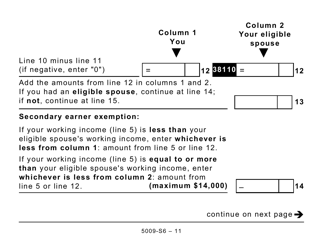

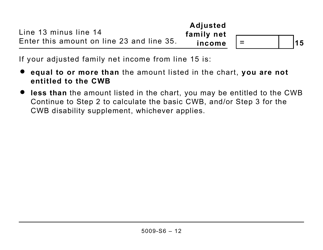

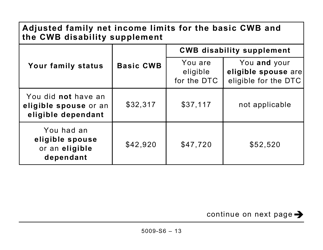

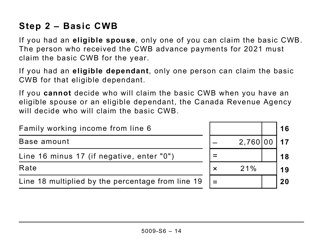

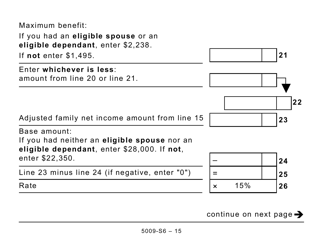

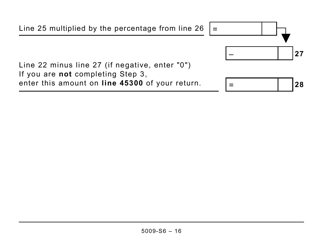

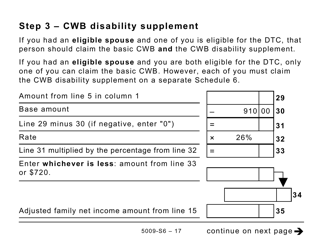

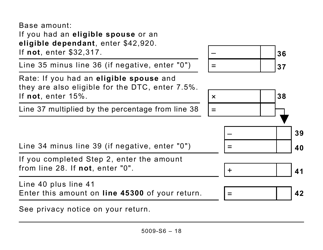

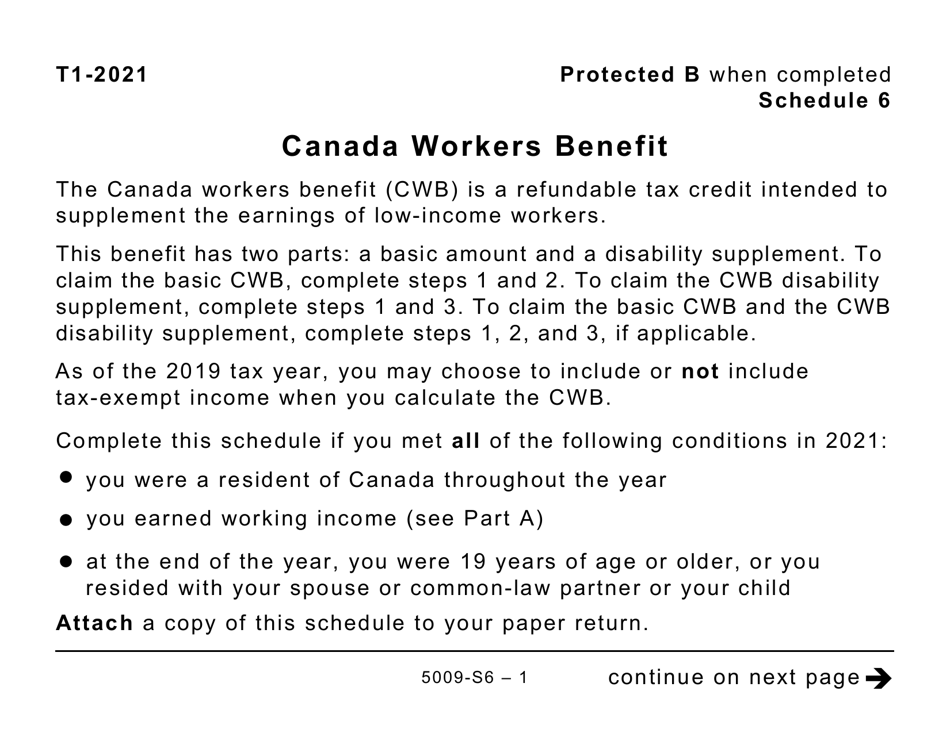

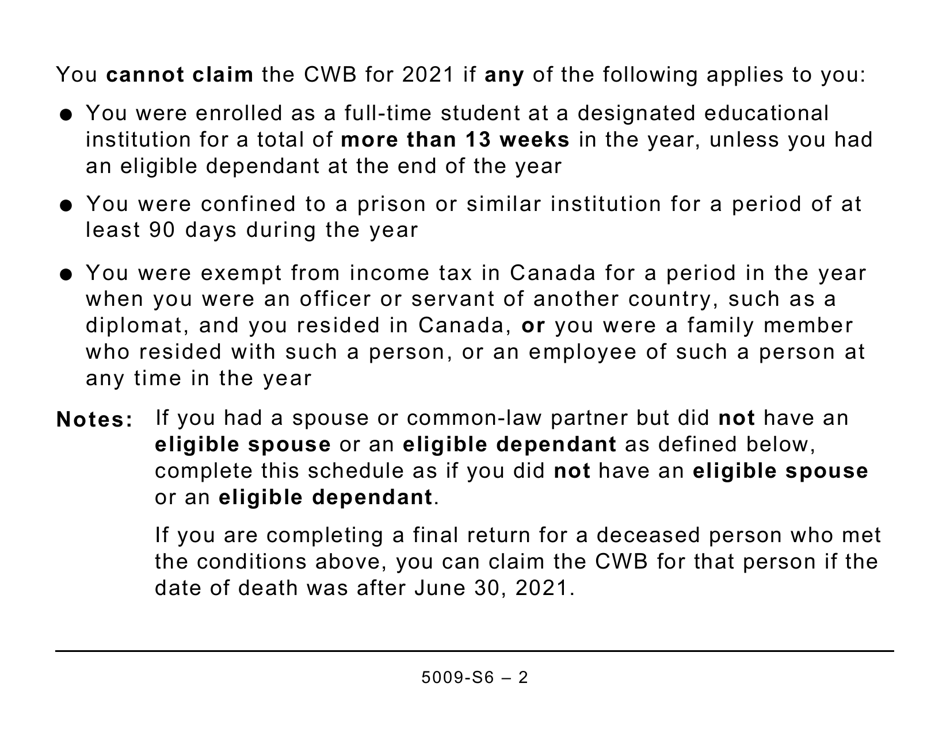

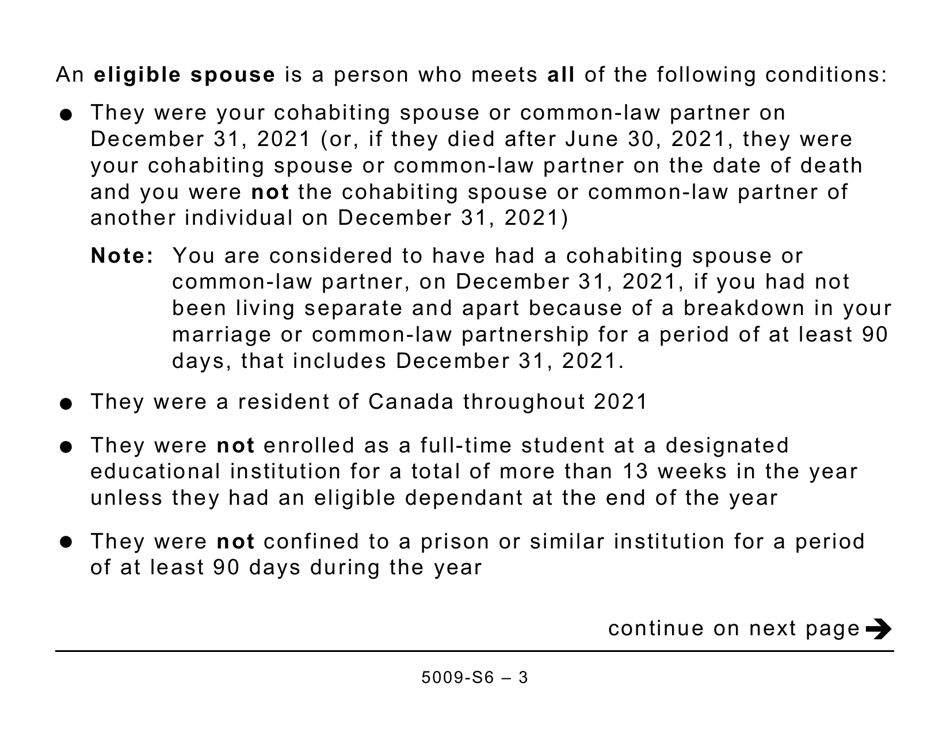

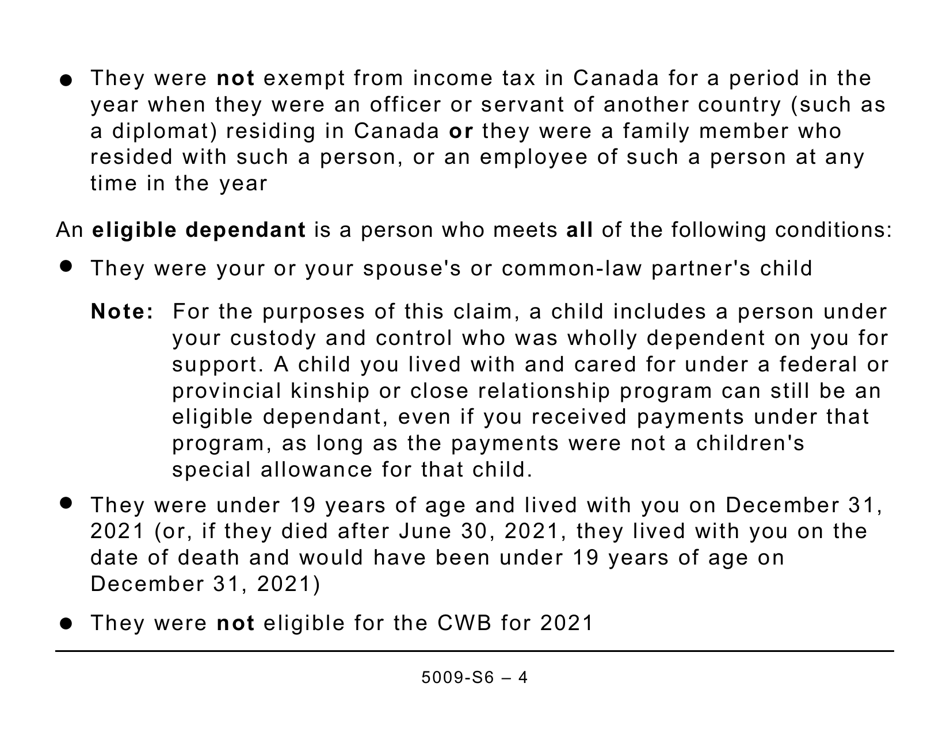

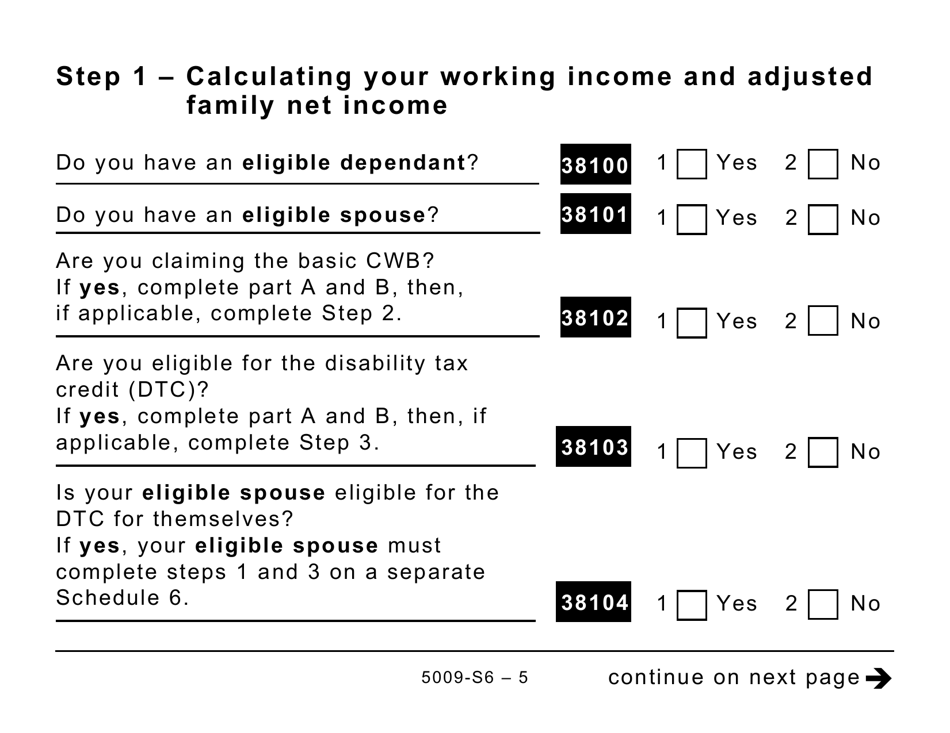

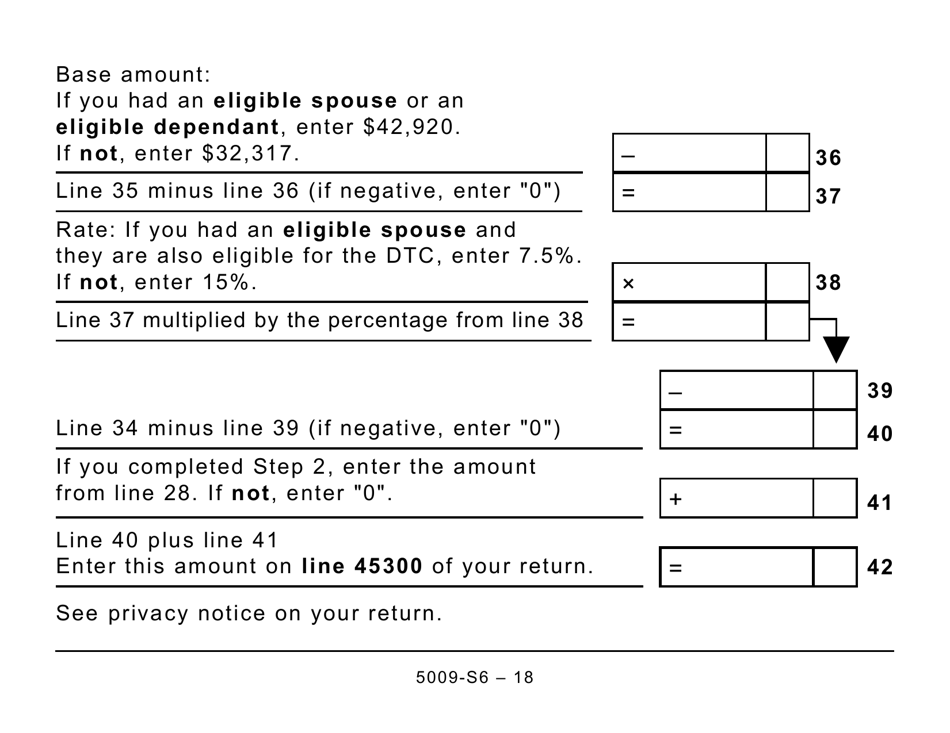

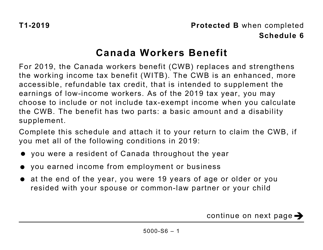

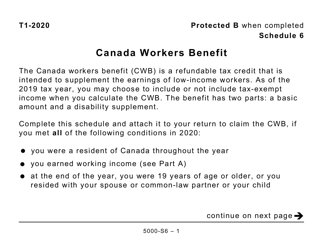

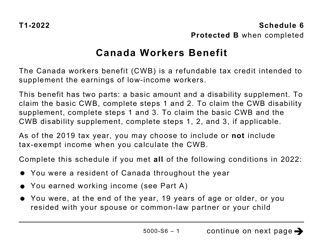

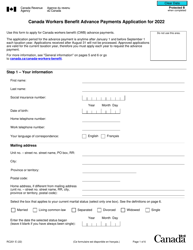

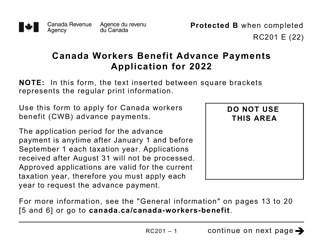

Form 5009-S6 Schedule 6 Canada Workers Benefit (Large Print) in Canada is used to calculate the Canada Workers Benefit, which is a refundable tax credit designed to help low-income individuals or families who are in the workforce. It is intended to provide support for eligible individuals or families to reduce their taxes payable and potentially increase their refund amount.

The form 5009-S6 Schedule 6 Canada Workers Benefit (Large Print) is filed by eligible individuals or families in Canada who want to claim the Canada Workers Benefit.

FAQ

Q: What is Form 5009-S6 Schedule 6?

A: Form 5009-S6 Schedule 6 is a document related to the Canada Workers Benefit.

Q: What is the Canada Workers Benefit?

A: The Canada Workers Benefit is a federal tax credit designed to help low-income workers.

Q: What is the purpose of Form 5009-S6 Schedule 6?

A: The purpose of this form is to calculate your eligibility and amount of Canada Workers Benefit.

Q: Who is eligible for the Canada Workers Benefit?

A: Individuals who have employment income and meet certain income thresholds may be eligible.