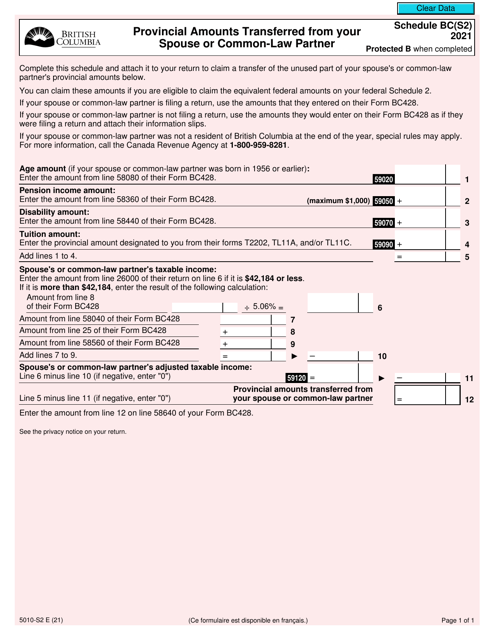

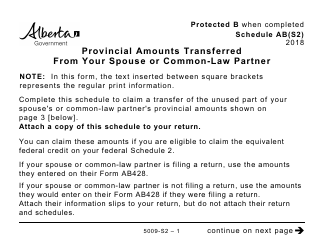

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5010-S2 Schedule BC(S2)

for the current year.

Form 5010-S2 Schedule BC(S2) Provincial Amounts Transferred From Your Spouse or Common-Law Partner - British Columbia - Canada

Form 5010-S2 Schedule BC(S2) in Canada is used to report the provincial amounts transferred from your spouse or common-law partner in British Columbia. It is a part of the Canadian tax system and is used to calculate and report income transfers between spouses or common-law partners.

The Form 5010-S2 Schedule BC(S2) is filed by residents of British Columbia, Canada, who want to report provincial amounts transferred from their spouse or common-law partner.

FAQ

Q: What is Form 5010-S2 Schedule BC(S2)?

A: Form 5010-S2 Schedule BC(S2) is a form used in Canada for reporting provincial amounts transferred from your spouse or common-law partner in the province of British Columbia.

Q: What is a provincial amount transfer?

A: A provincial amount transfer refers to the transfer of certain provincial amounts from your spouse or common-law partner's tax return to your tax return.

Q: What is British Columbia?

A: British Columbia is a province in Canada.

Q: Why would I need to fill out Form 5010-S2 Schedule BC(S2)?

A: You would need to fill out this form if you are eligible to transfer provincial amounts from your spouse or common-law partner's tax return in British Columbia.

Q: Are there any eligibility criteria for transferring provincial amounts in British Columbia?

A: Yes, there are specific eligibility criteria that must be met in order to transfer provincial amounts in British Columbia.

Q: Can I transfer provincial amounts from my spouse or common-law partner's tax return if they live in a different province?

A: No, you can only transfer provincial amounts from your spouse or common-law partner's tax return if they reside in the same province as you, in this case, British Columbia.

Q: What other forms or documents should I include with Form 5010-S2 Schedule BC(S2)?

A: You may need to include other supporting documents, such as your spouse or common-law partner's tax return, with Form 5010-S2 Schedule BC(S2). Please refer to the official instructions or consult with the Canada Revenue Agency (CRA) for specific requirements.

Q: Is there a deadline for filing Form 5010-S2 Schedule BC(S2)?

A: Yes, there is a deadline for filing Form 5010-S2 Schedule BC(S2). The deadline is usually the same as the deadline for filing your federal income tax return, which is April 30th of the following year. However, it is always recommended to check with the Canada Revenue Agency (CRA) for any changes or updates to the deadline.

Q: What happens if I don't file Form 5010-S2 Schedule BC(S2)?

A: If you are eligible to transfer provincial amounts in British Columbia and you fail to file Form 5010-S2 Schedule BC(S2), you may miss out on potential tax benefits or credits. It is important to accurately report all relevant information to ensure you are receiving all the tax benefits you are entitled to.