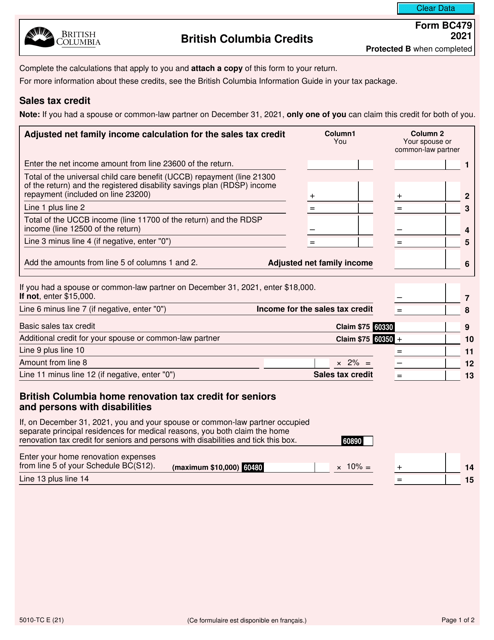

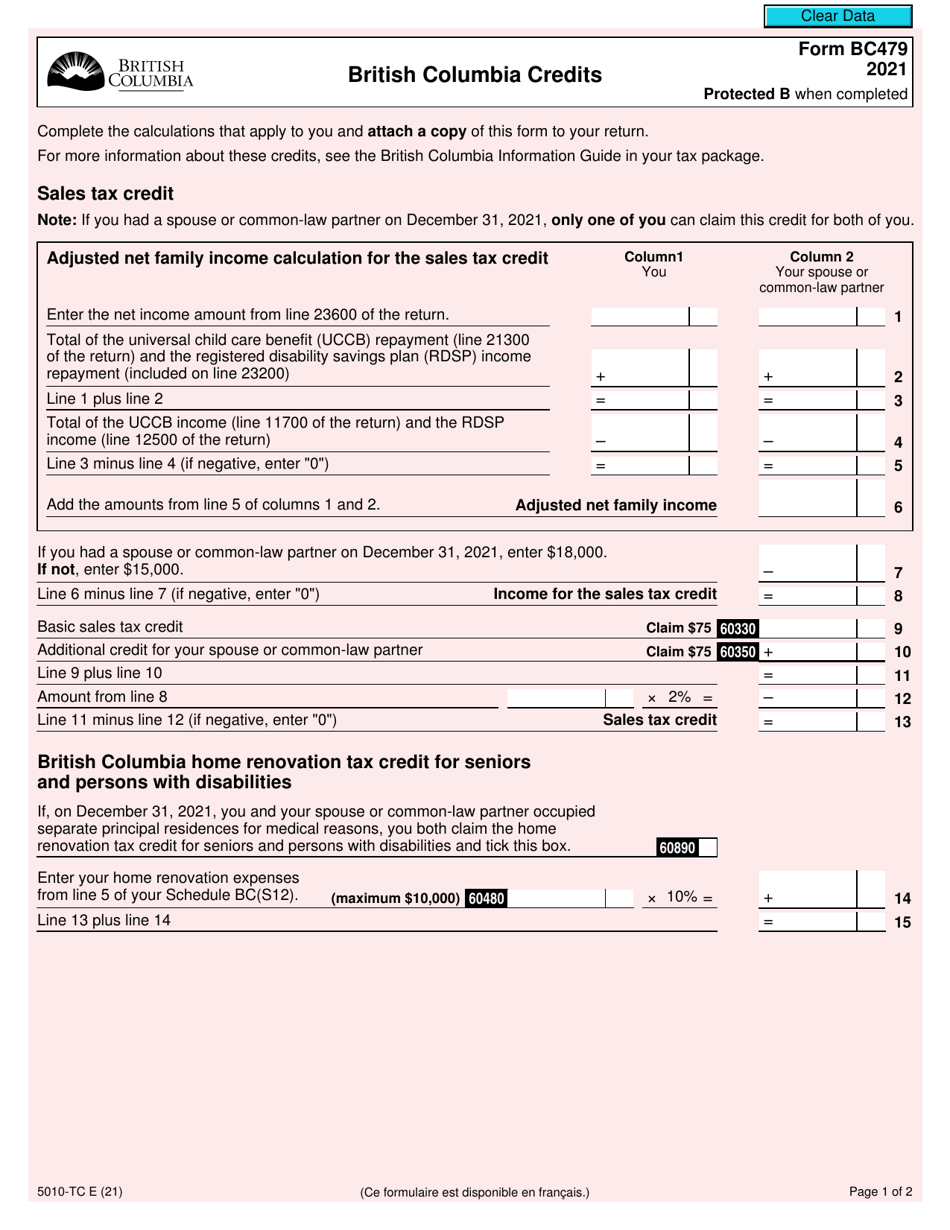

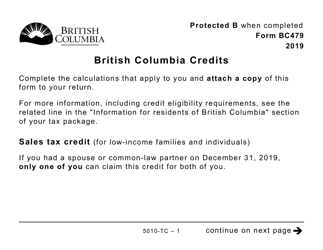

This version of the form is not currently in use and is provided for reference only. Download this version of

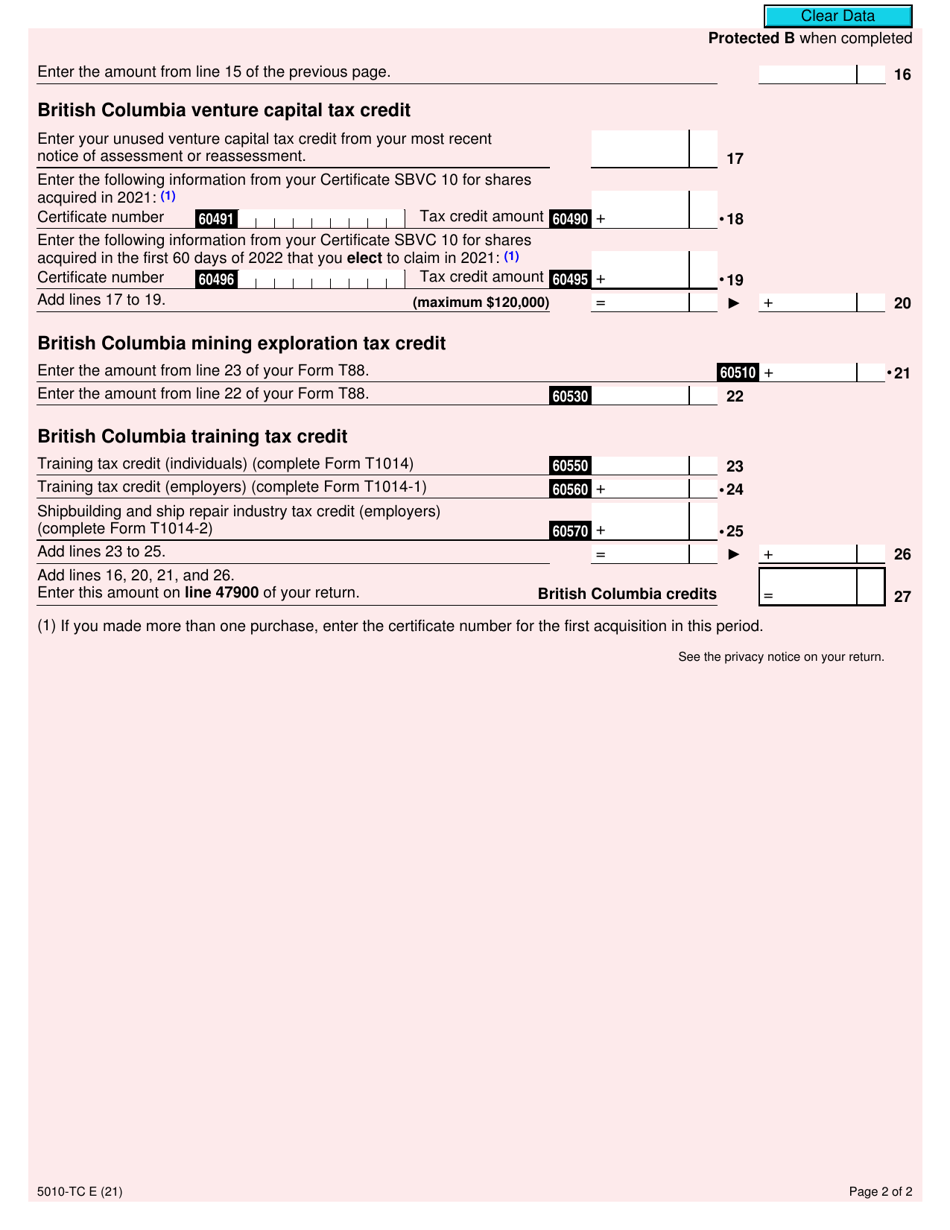

Form 5010-TC (BC479)

for the current year.

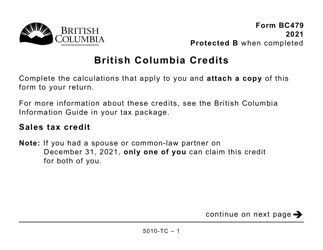

Form 5010-TC (BC479) British Columbia Credits - Canada

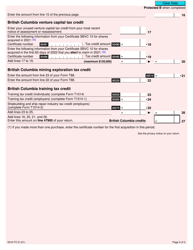

Form 5010-TC (BC479) British Columbia Credits - Canada is used to claim tax credits in British Columbia, Canada. It helps residents of British Columbia claim various credits and deductions on their federal income tax return.

The individual who is claiming British Columbia credits in Canada would file the Form 5010-TC (BC479).

FAQ

Q: What is form 5010-TC (BC479)?

A: Form 5010-TC (BC479) is a tax form used in British Columbia, Canada to claim various tax credits.

Q: What kind of tax credits can be claimed on form 5010-TC (BC479)?

A: Form 5010-TC (BC479) allows you to claim tax credits for expenses such as child care, tuition fees, medical expenses, and more.

Q: Who is eligible to use form 5010-TC (BC479)?

A: Residents of British Columbia, Canada who have eligible expenses can use form 5010-TC (BC479) to claim tax credits.

Q: When is form 5010-TC (BC479) due?

A: Form 5010-TC (BC479) is generally due on April 30th of the following year, but it's always best to check the specific due date with the tax authorities.