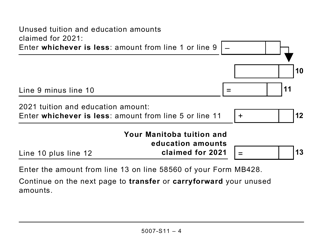

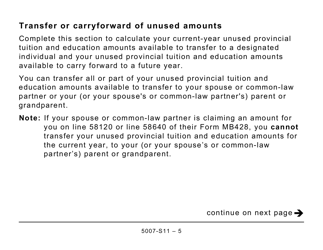

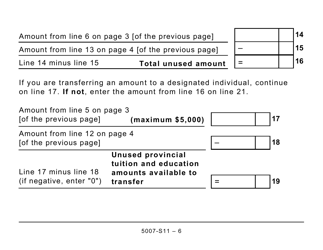

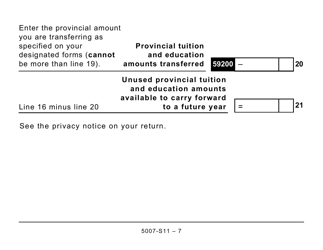

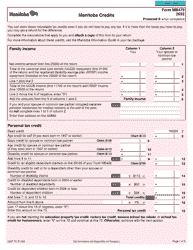

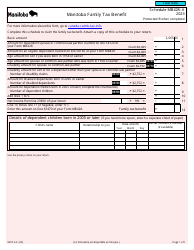

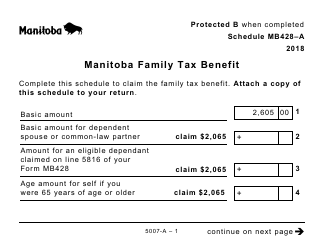

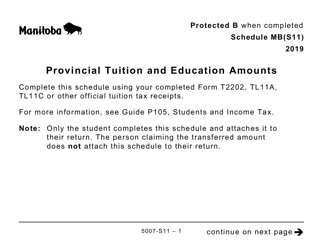

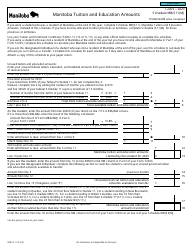

Form 5007-S11 Schedule MB(S11) Manitoba Tuition and Education Amounts (Large Print) - Canada

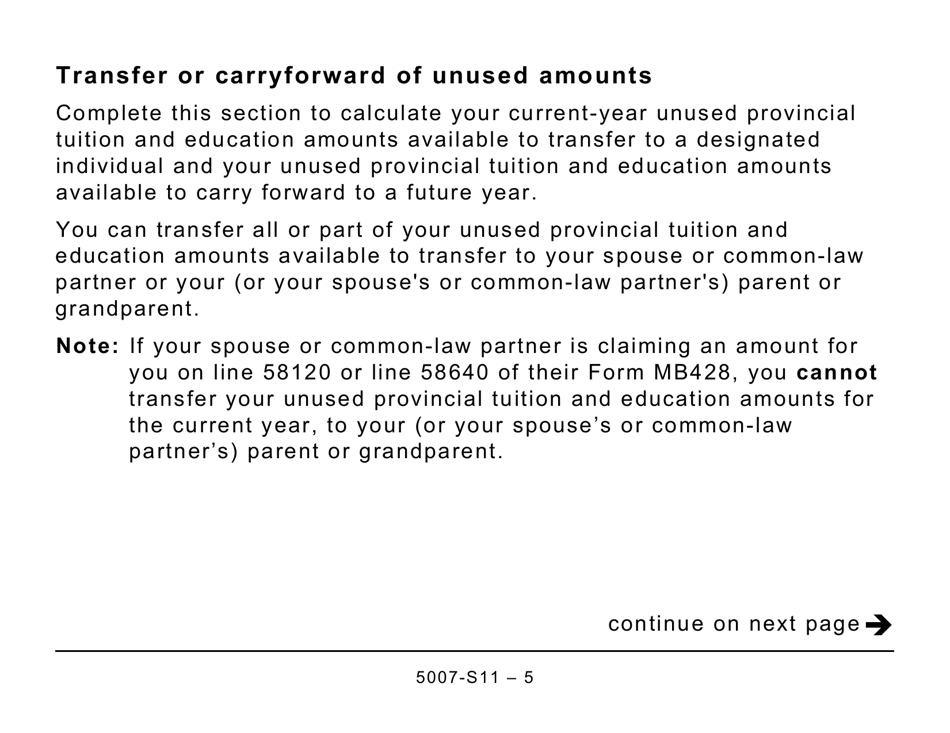

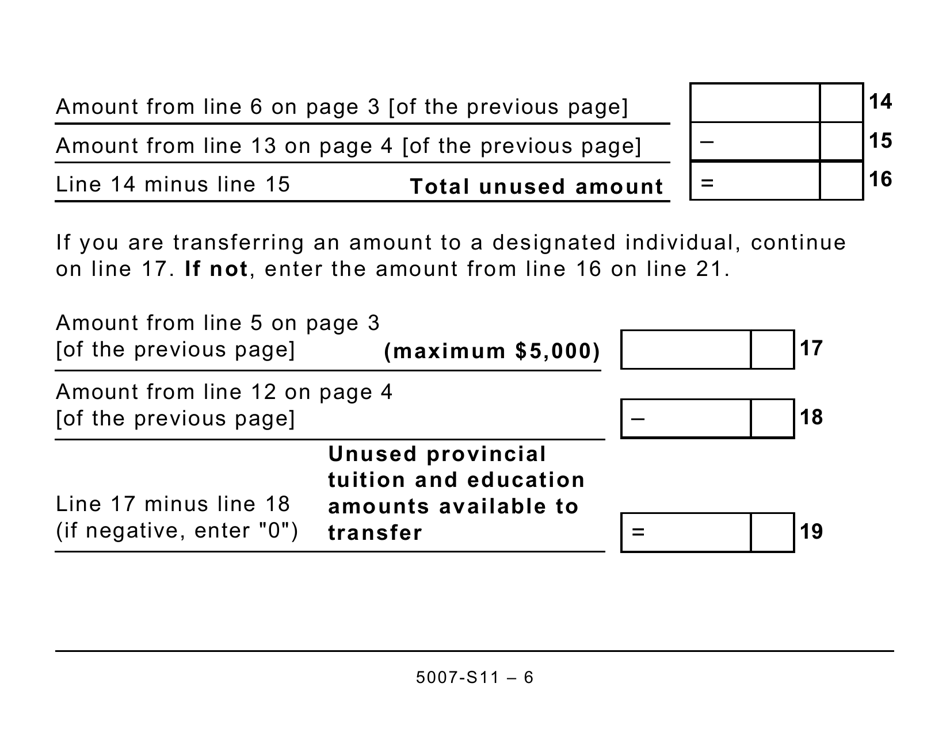

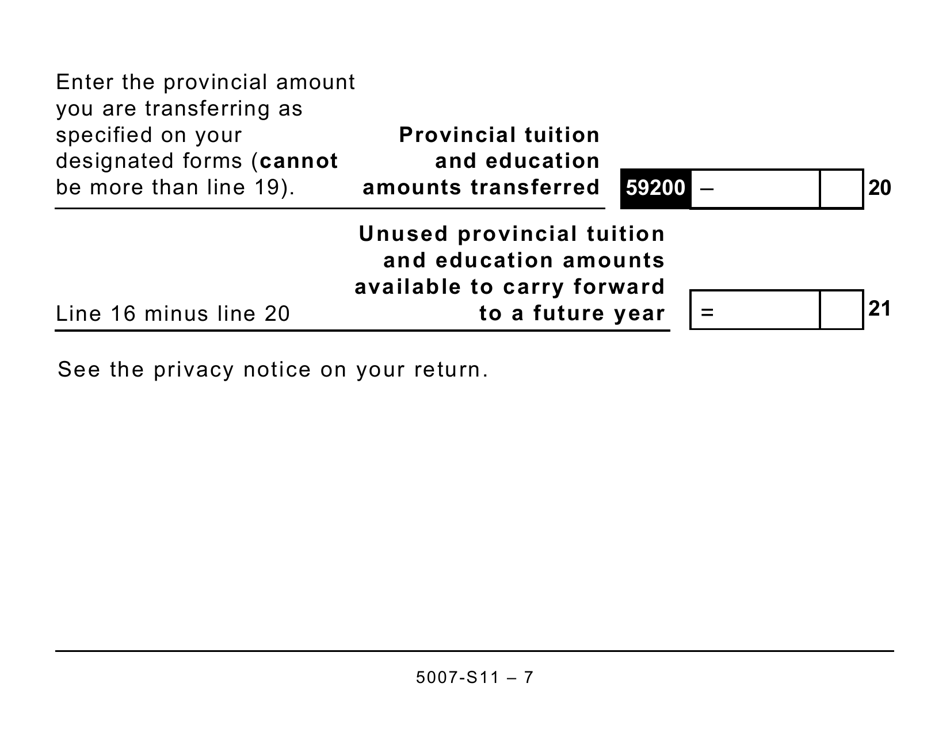

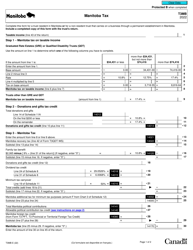

Form 5007-S11 Schedule MB(S11) Manitoba Tuition and Education Amounts (Large Print) is used in Canada for claiming tuition and education amounts specifically in the province of Manitoba.

FAQ

Q: What is Form 5007-S11 Schedule MB(S11)?

A: Form 5007-S11 Schedule MB(S11) is a tax form used in Canada specifically for claiming the Manitoba Tuition and Education Amounts.

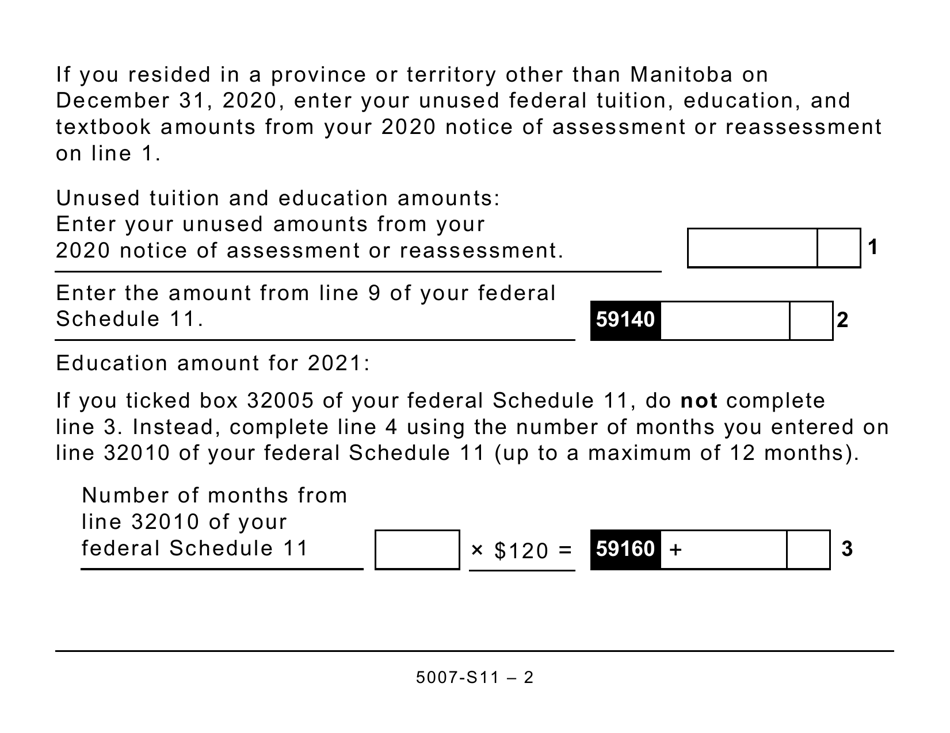

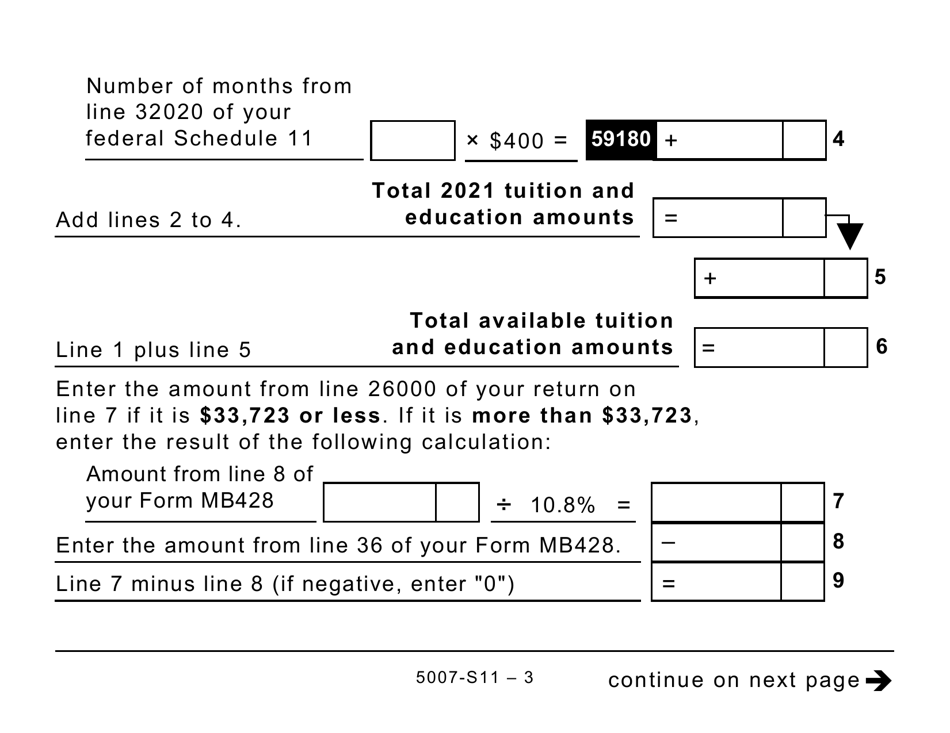

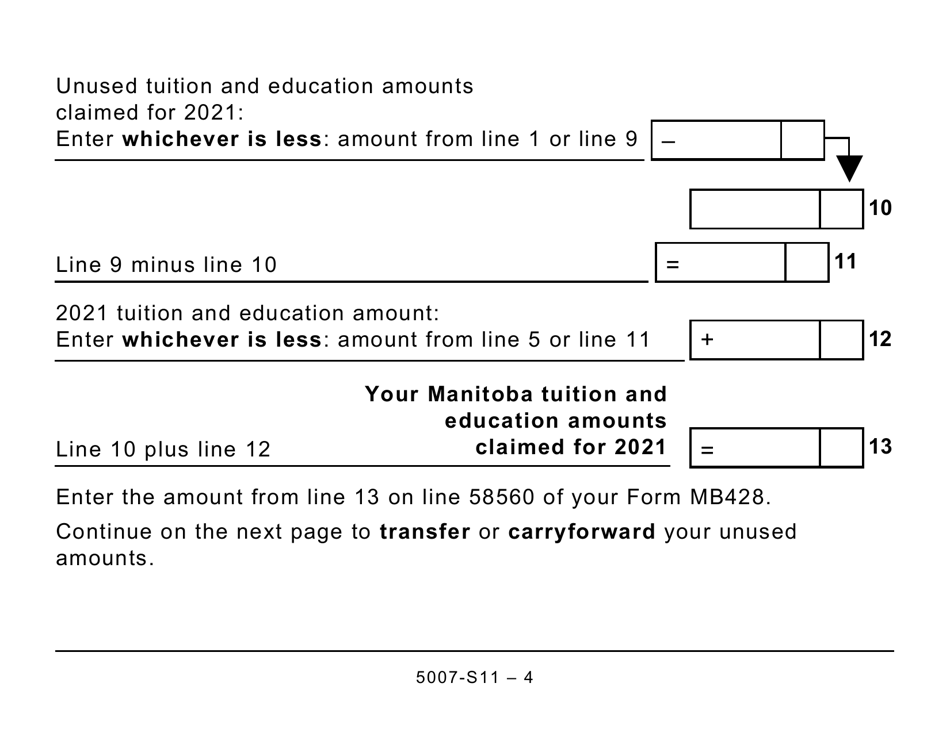

Q: What are the Manitoba Tuition and Education Amounts?

A: The Manitoba Tuition and Education Amounts are tax credits that eligible individuals can claim to reduce their taxable income.

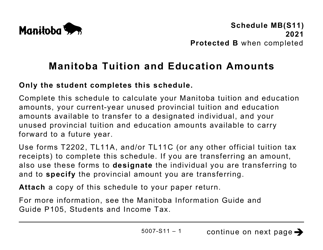

Q: Who is eligible to claim the Manitoba Tuition and Education Amounts?

A: Residents of Manitoba who have attended an eligible educational institution and paid tuition fees may be eligible to claim these amounts.

Q: What is the purpose of Form 5007-S11 Schedule MB(S11)?

A: The purpose of this form is to calculate and report the Manitoba Tuition and Education Amounts that can be claimed on your Canadian tax return.

Q: When is the deadline to file Form 5007-S11 Schedule MB(S11)?

A: The deadline to file this form is usually the same as the deadline for filing your Canadian tax return, which is April 30th or June 15th for self-employed individuals.

Q: Do I need to include supporting documentation when filing Form 5007-S11 Schedule MB(S11)?

A: You do not need to submit supporting documentation when filing this form, but you should keep all relevant documents in case the CRA asks for verification later on.