This version of the form is not currently in use and is provided for reference only. Download this version of

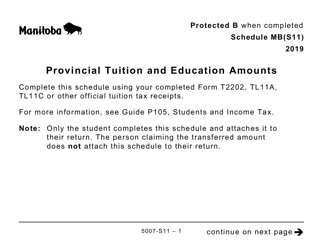

Form 5007-S11 Schedule MB(S11)

for the current year.

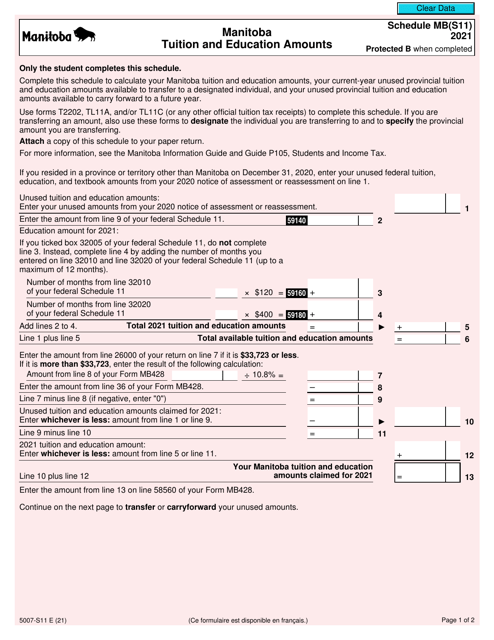

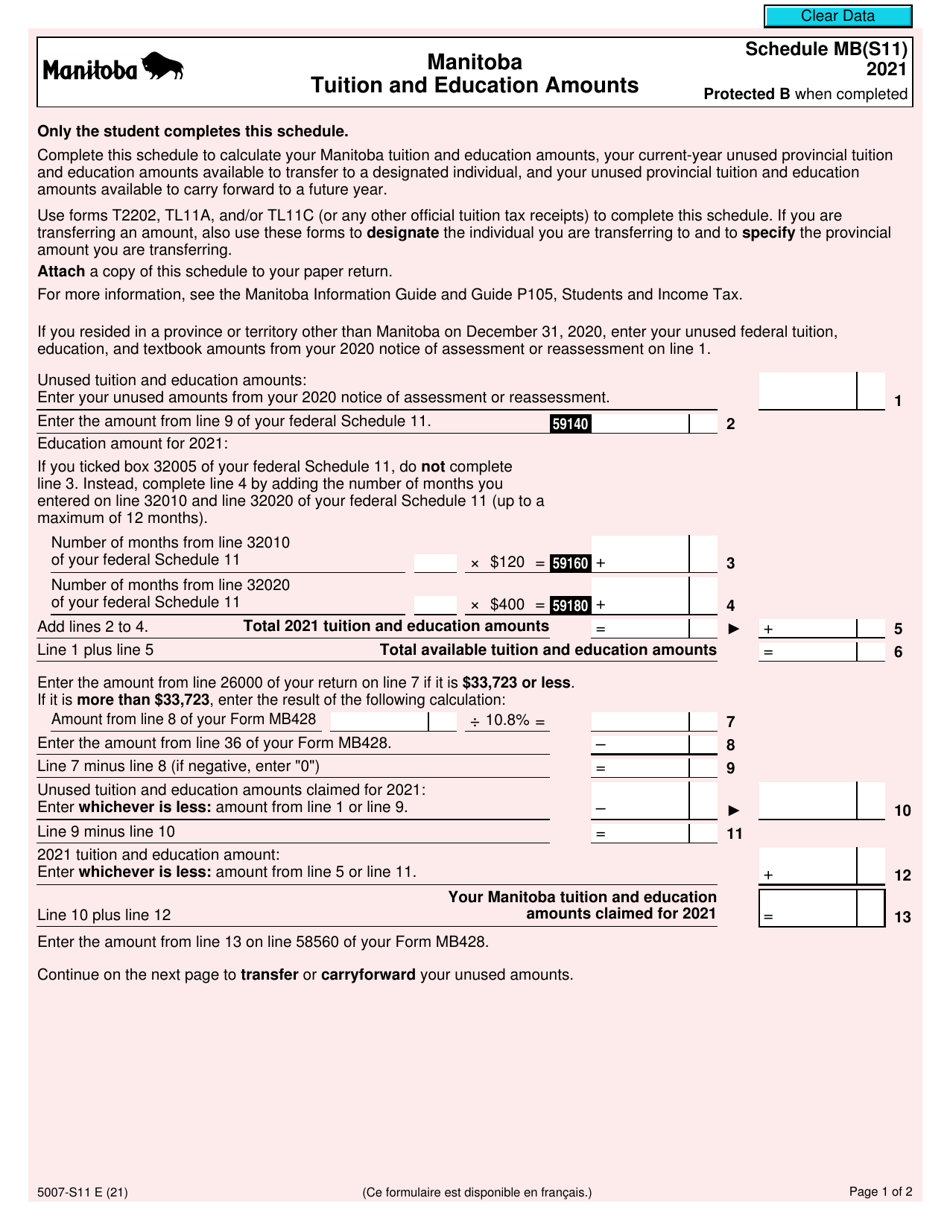

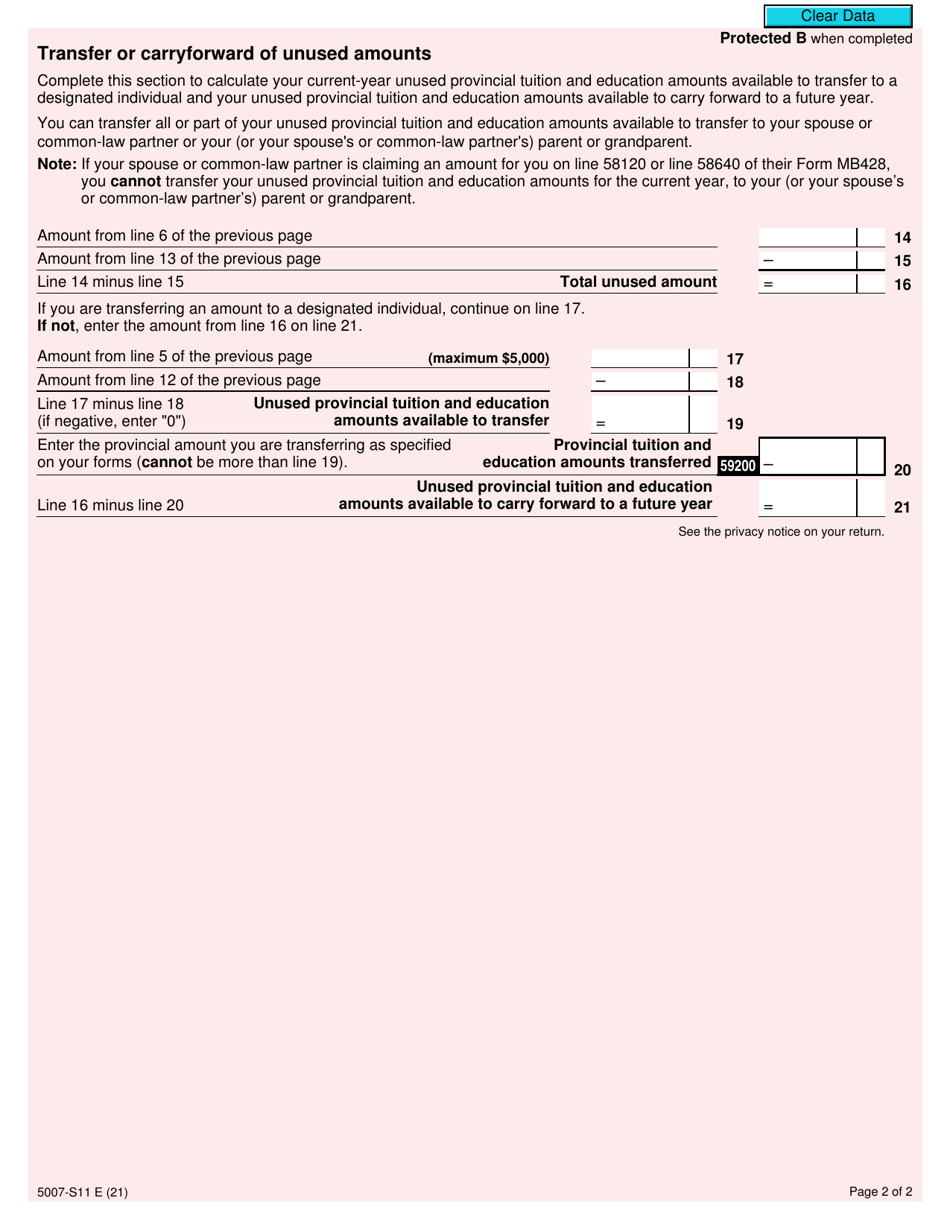

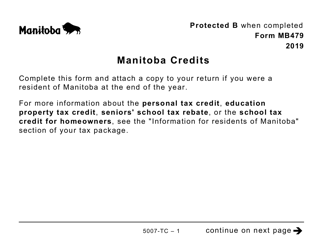

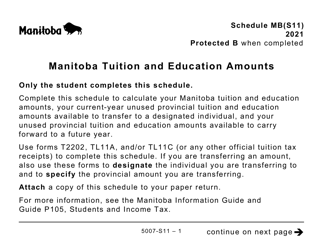

Form 5007-S11 Schedule MB(S11) Manitoba Tuition and Education Amounts - Canada

Form 5007-S11 Schedule MB(S11) is used in Canada for claiming Manitoba Tuition and Education Amounts.

The student files the Form 5007-S11 Schedule MB(S11) Manitoba Tuition and Education Amounts.

FAQ

Q: What is Form 5007-S11 Schedule MB(S11)?

A: Form 5007-S11 Schedule MB(S11) is a tax form in Canada.

Q: What is the purpose of Schedule MB(S11)?

A: The purpose of Schedule MB(S11) is to claim the Manitoba Tuition and Education Amounts on your Canadian tax return.

Q: Who should fill out Schedule MB(S11)?

A: Residents of Manitoba who have eligible tuition and education expenses should fill out Schedule MB(S11).

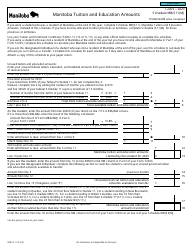

Q: How do I fill out Schedule MB(S11)?

A: You need to enter the required information about your tuition and education expenses in the designated sections of Schedule MB(S11).

Q: What are the benefits of filling out Schedule MB(S11)?

A: Filling out Schedule MB(S11) allows you to claim the Manitoba Tuition and Education Amounts, which can reduce your taxable income and potentially increase your tax refund.

Q: Are there any deadlines for filing Schedule MB(S11)?

A: The deadline for filing Schedule MB(S11) is the same as the deadline for filing your Canadian income tax return, which is usually April 30th of the following year.

Q: Do I need to keep a copy of Schedule MB(S11)?

A: Yes, it is recommended to keep a copy of Schedule MB(S11) for your records in case of any future inquiries from the Canada Revenue Agency.

Q: Can I claim both federal and provincial tuition and education amounts?

A: Yes, you can claim both federal and provincial tuition and education amounts. However, the amounts claimed may differ between the federal and provincial credits.

Q: Are there any eligibility criteria for claiming the Manitoba Tuition and Education Amounts?

A: Yes, there are eligibility criteria for claiming the Manitoba Tuition and Education Amounts. You must meet certain residency and enrollment requirements, and your educational institution must be eligible.

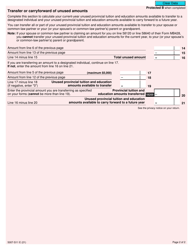

Q: Can I carry forward unused tuition and education amounts?

A: Yes, if you are unable to use all of your tuition and education amounts in the current year, you may be able to carry them forward and claim them in future years.