This version of the form is not currently in use and is provided for reference only. Download this version of

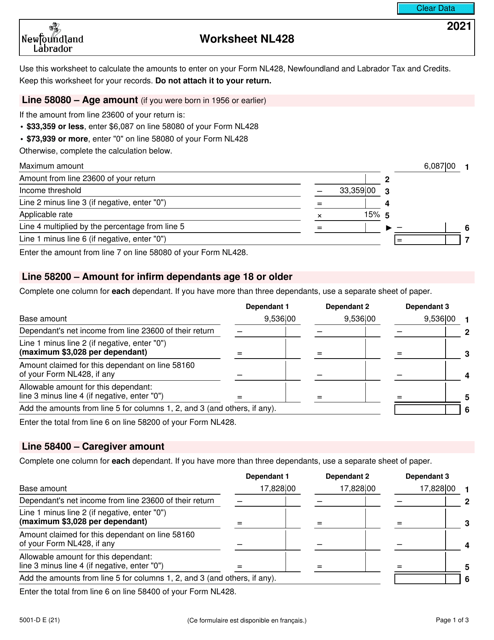

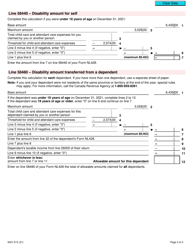

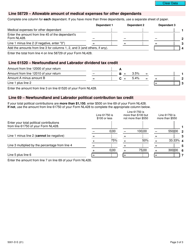

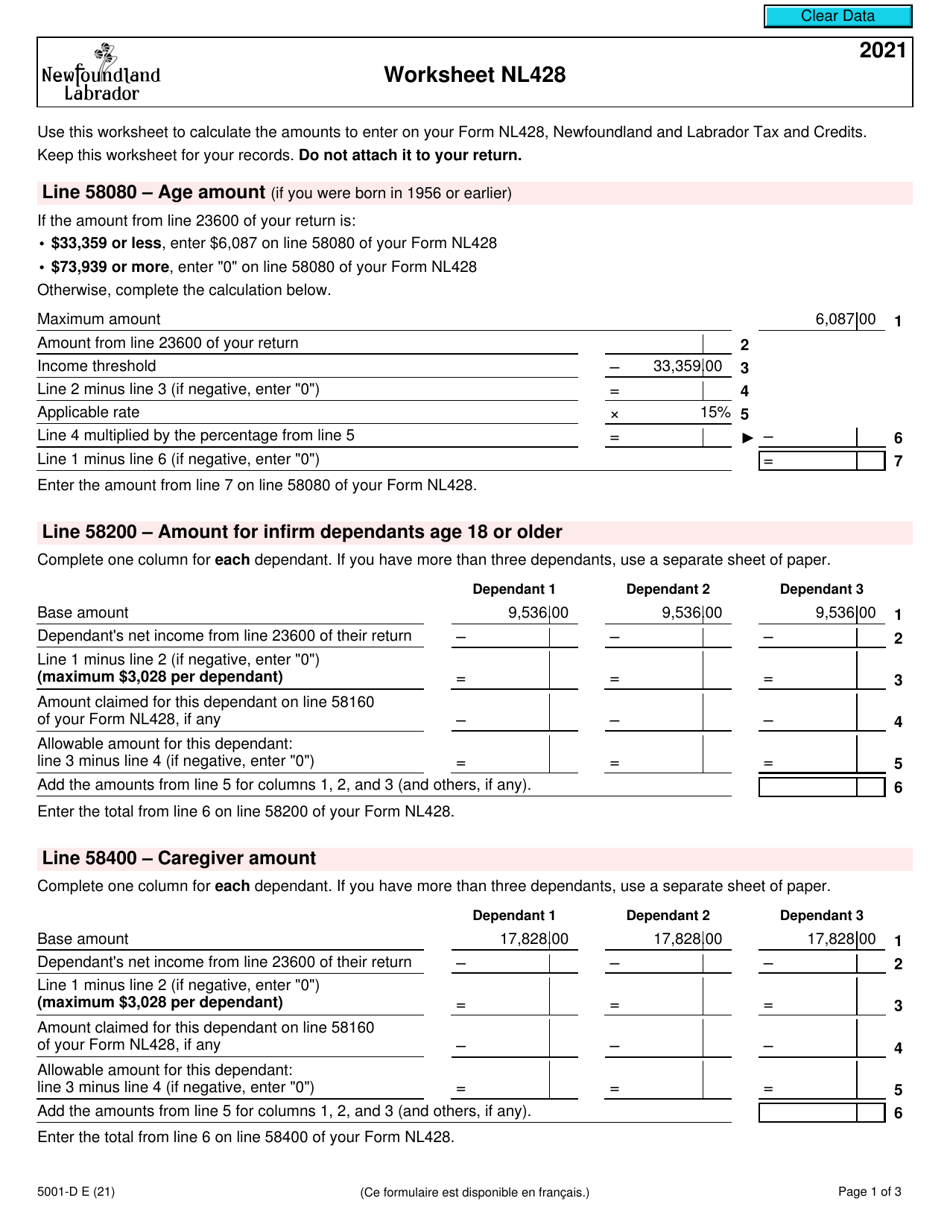

Form 5001-D Worksheet NL428

for the current year.

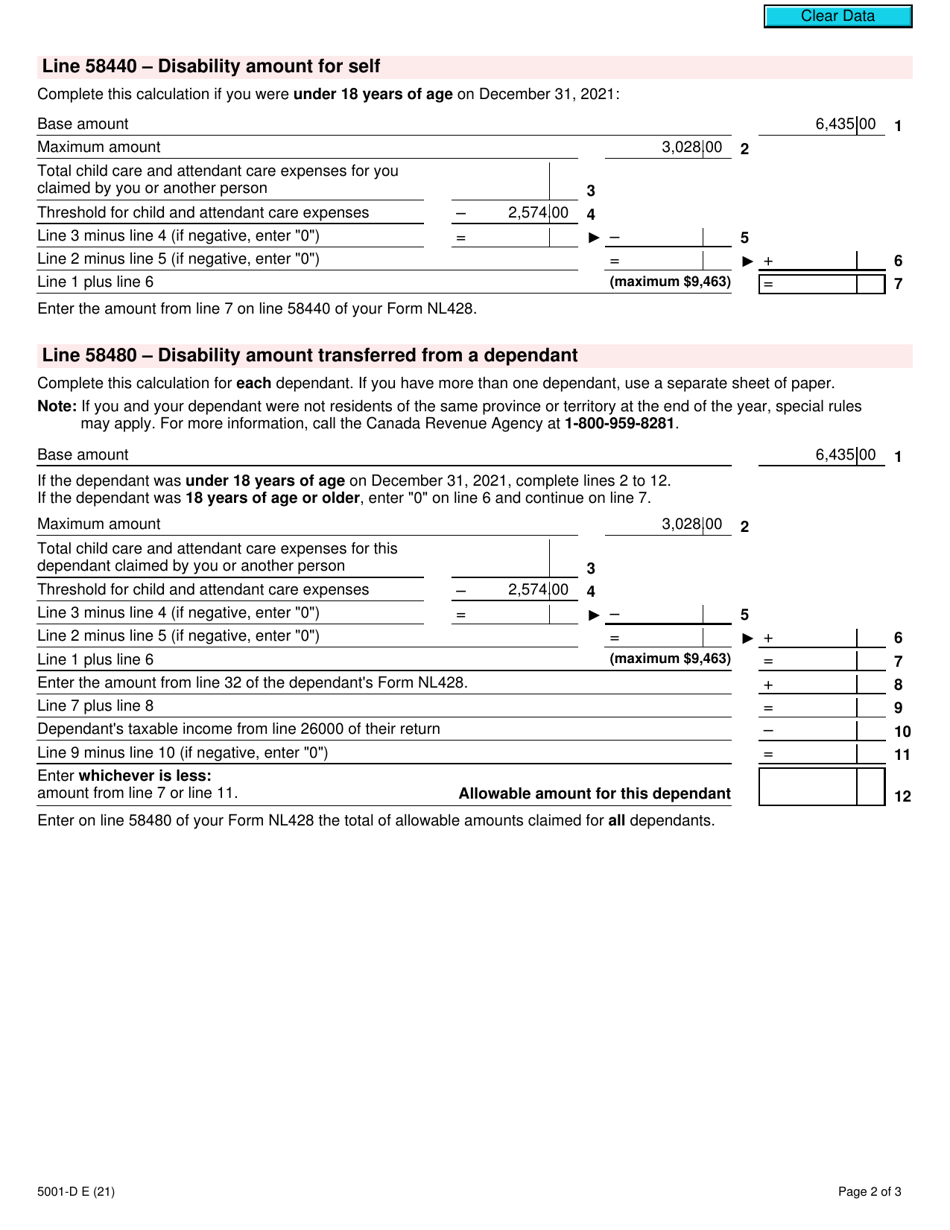

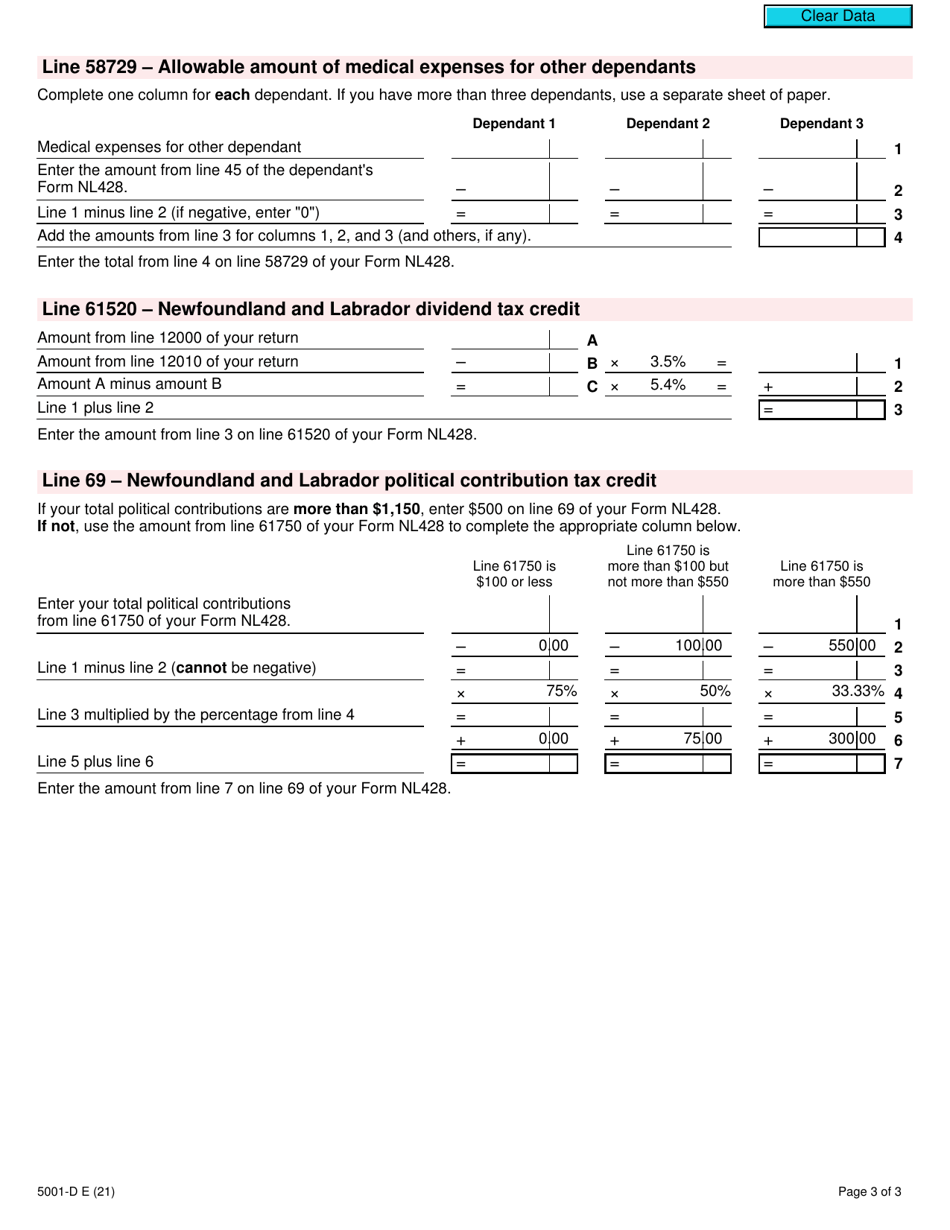

Form 5001-D Worksheet NL428 Newfoundland and Labrador - Canada

The Form 5001-D Worksheet NL428 is used in Newfoundland and Labrador, Canada, for calculating certain tax credits and deductions on your income tax return. It helps residents of Newfoundland and Labrador determine their provincial tax liability and apply applicable credits and deductions.

The Form 5001-D Worksheet NL428 in Newfoundland and Labrador, Canada is usually filed by individuals or households when filing their personal income tax return.

FAQ

Q: What is Form 5001-D?

A: Form 5001-D is a worksheet used for taxes in Newfoundland and Labrador, Canada.

Q: What is NL428?

A: NL428 is the tax form number for Newfoundland and Labrador in Canada.

Q: What is a worksheet?

A: A worksheet is a document used to calculate and organize information for taxes.

Q: Who uses Form 5001-D?

A: Residents of Newfoundland and Labrador in Canada use Form 5001-D.

Q: What is the purpose of Form 5001-D?

A: Form 5001-D is used to calculate and claim provincial tax credits in Newfoundland and Labrador.

Q: Are there any deadlines for submitting Form 5001-D?

A: The deadline for submitting Form 5001-D is usually the same as the deadline for filing your income tax return.

Q: Can Form 5001-D be filed electronically?

A: Yes, Form 5001-D can be filed electronically through the CRA's Netfile system.

Q: What should I do if I need help filling out Form 5001-D?

A: If you need help filling out Form 5001-D, you can seek assistance from a tax professional or contact the Canada Revenue Agency (CRA).

Q: What happens after I submit Form 5001-D?

A: After you submit Form 5001-D, the information will be processed by the Canada Revenue Agency (CRA) and used to calculate your provincial tax credits in Newfoundland and Labrador.