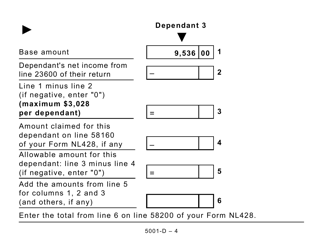

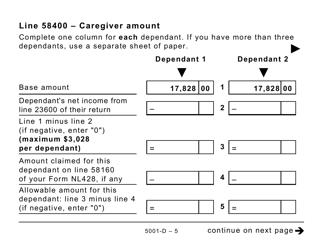

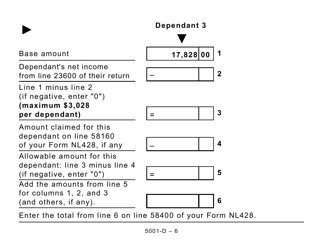

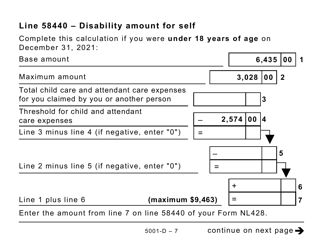

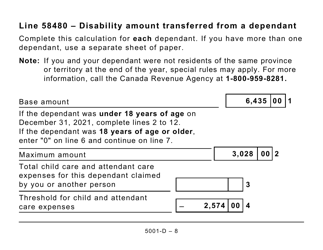

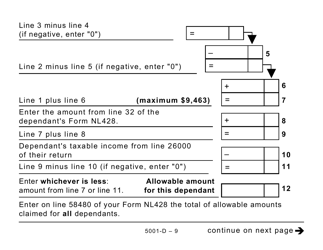

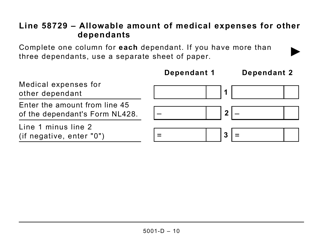

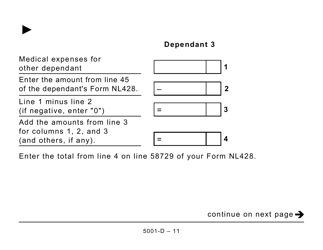

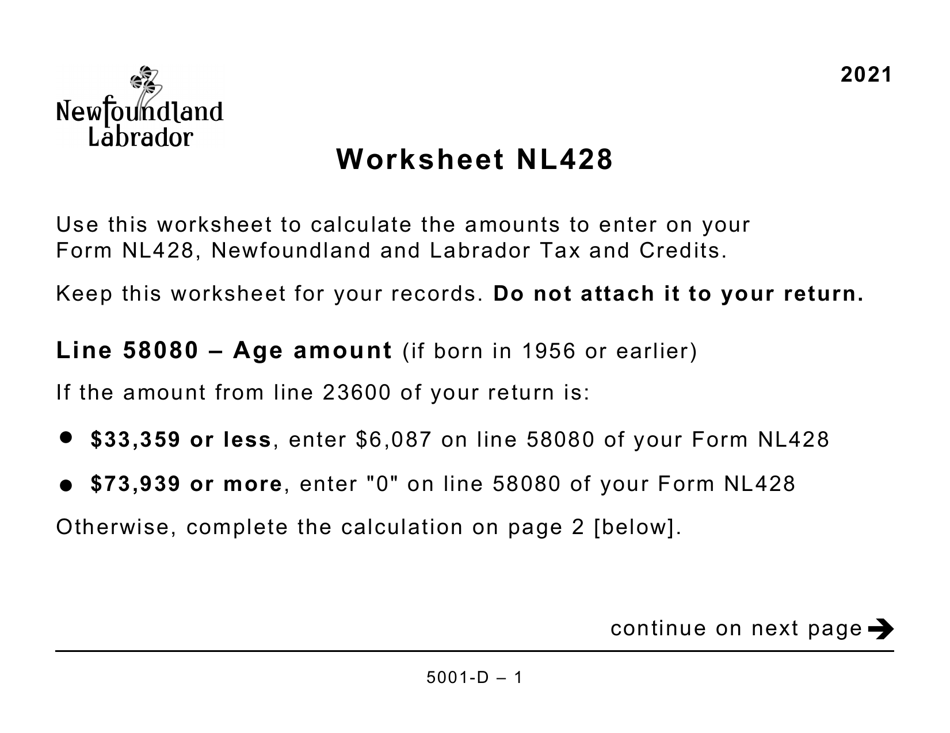

Form 5001-D Worksheet NL428 Newfoundland and Labrador (Large Print) - Canada

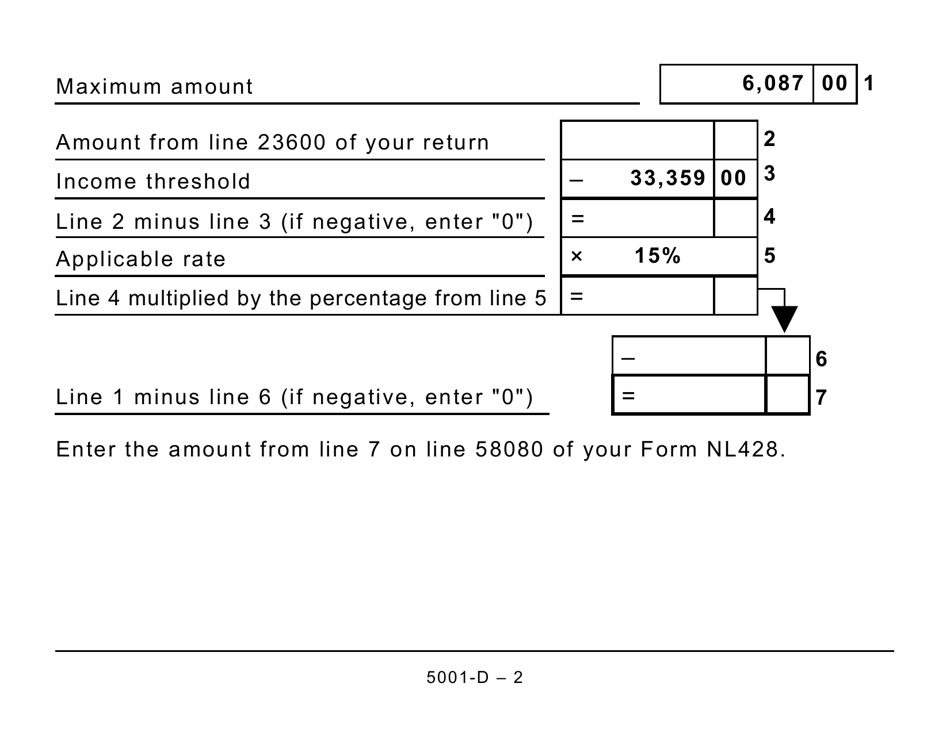

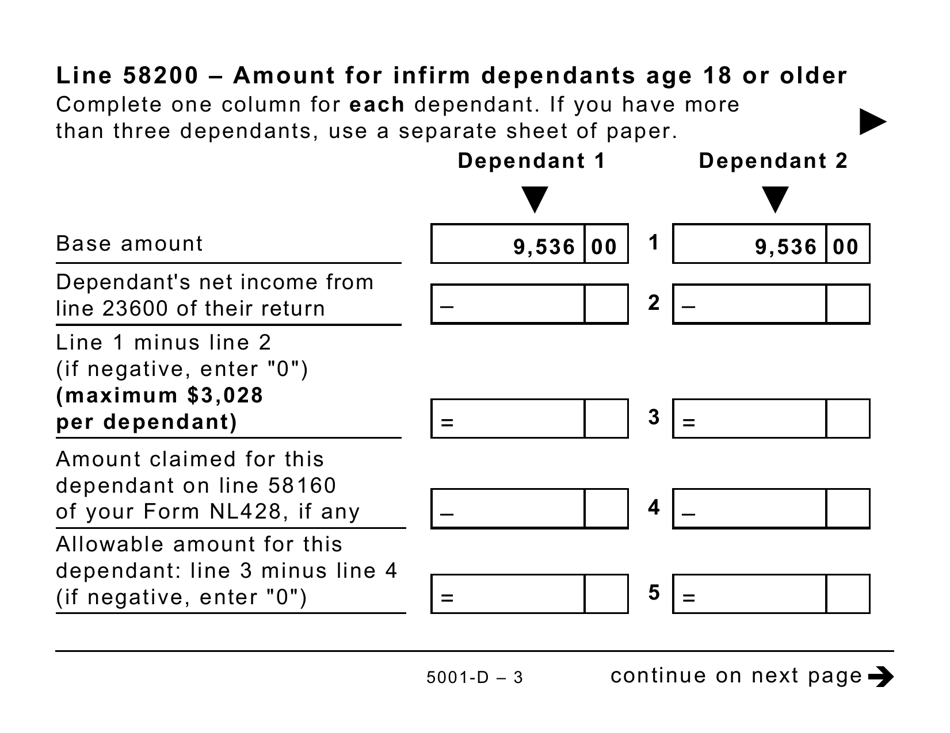

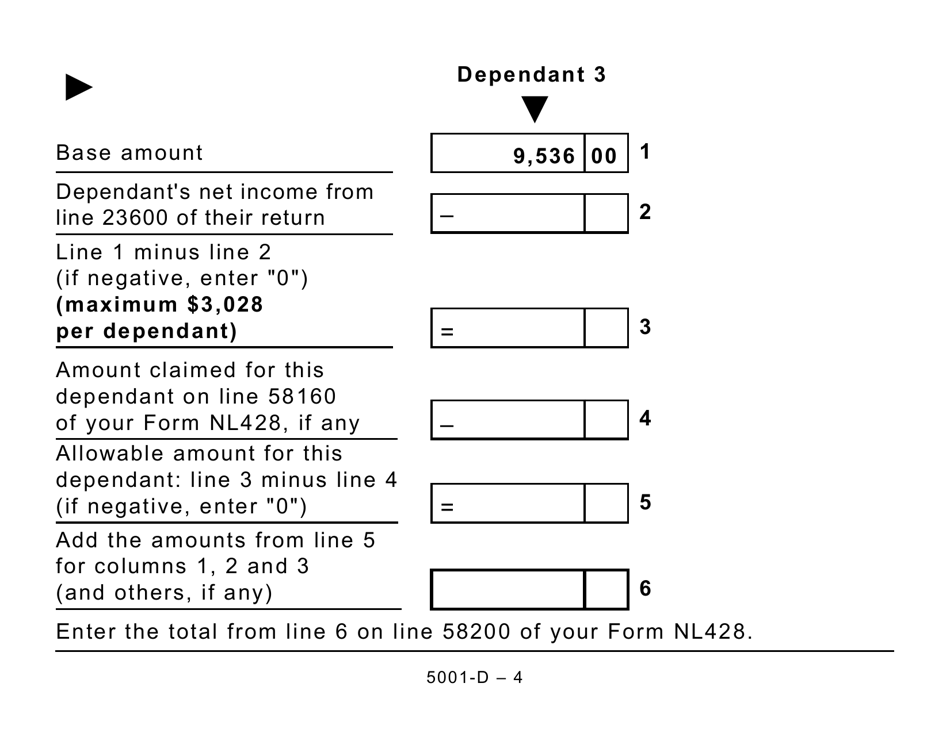

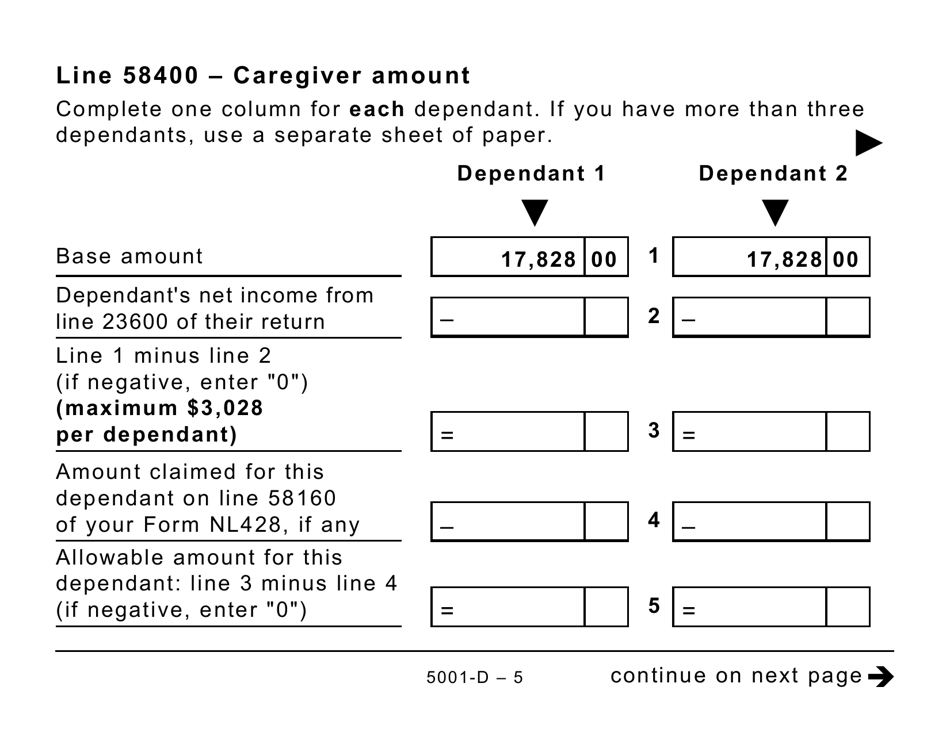

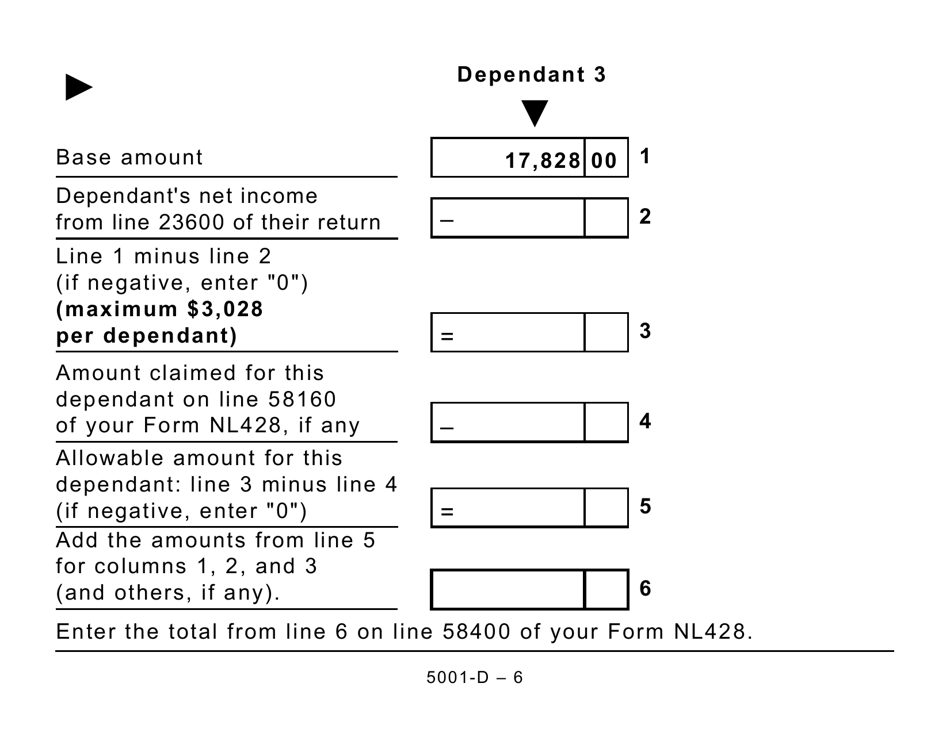

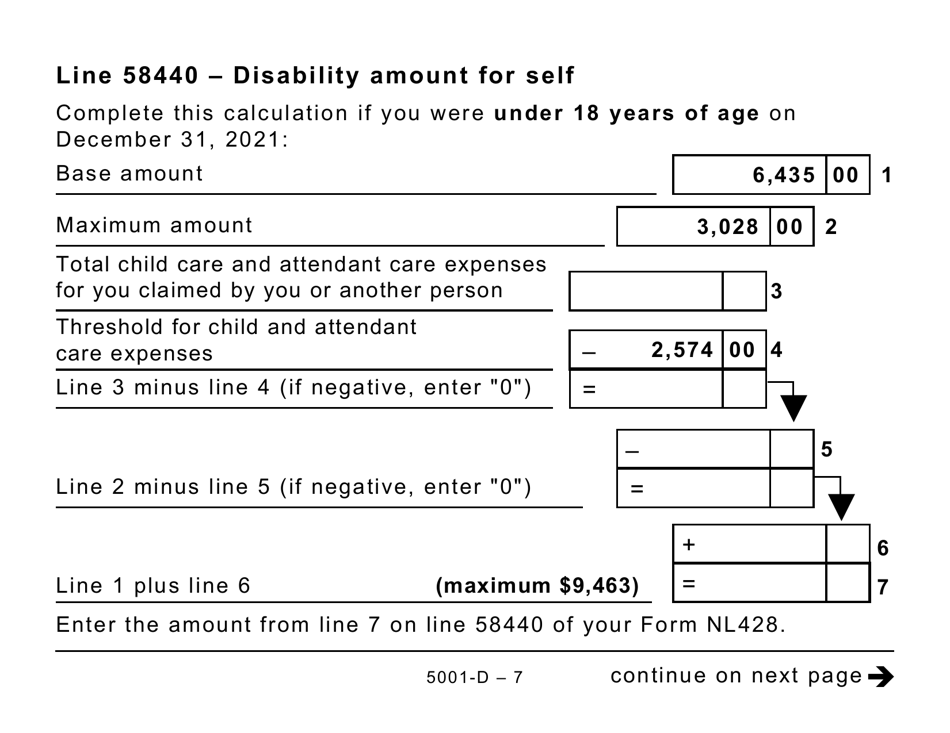

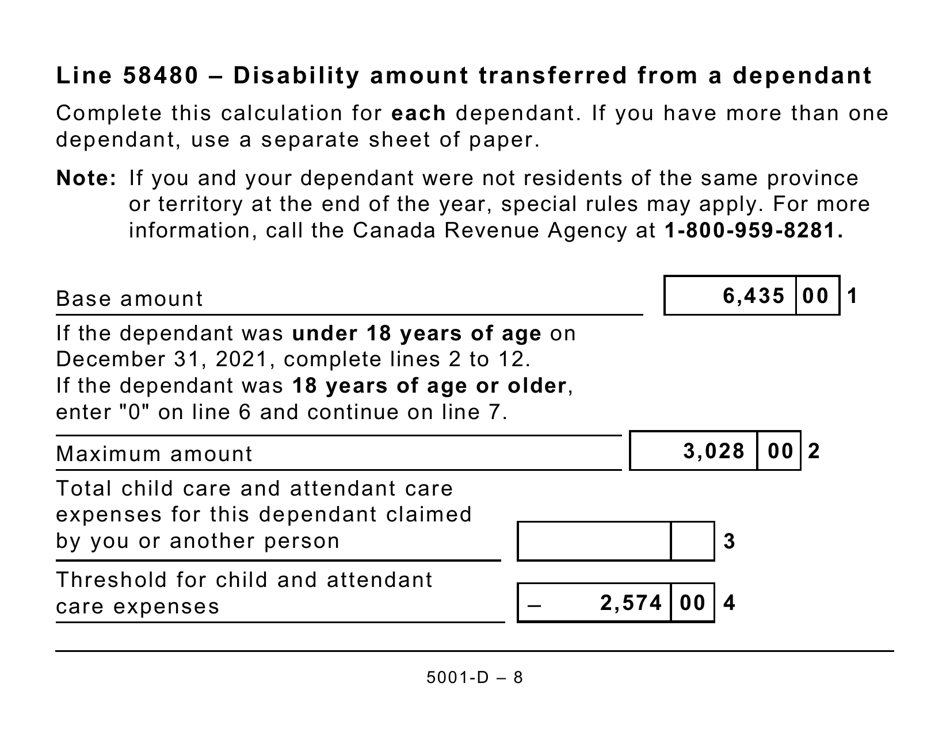

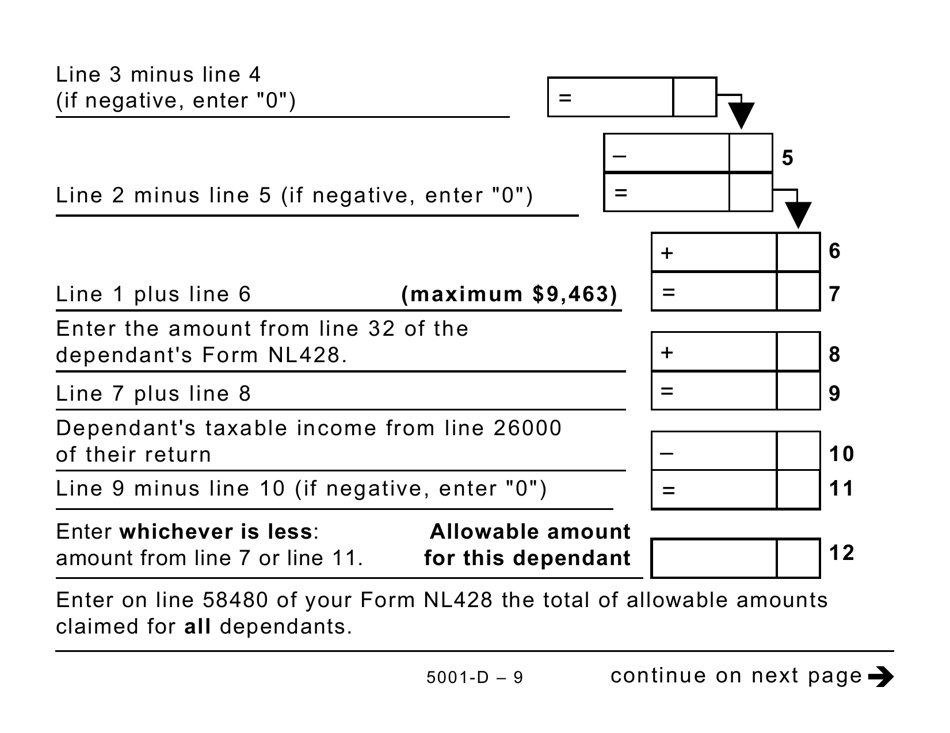

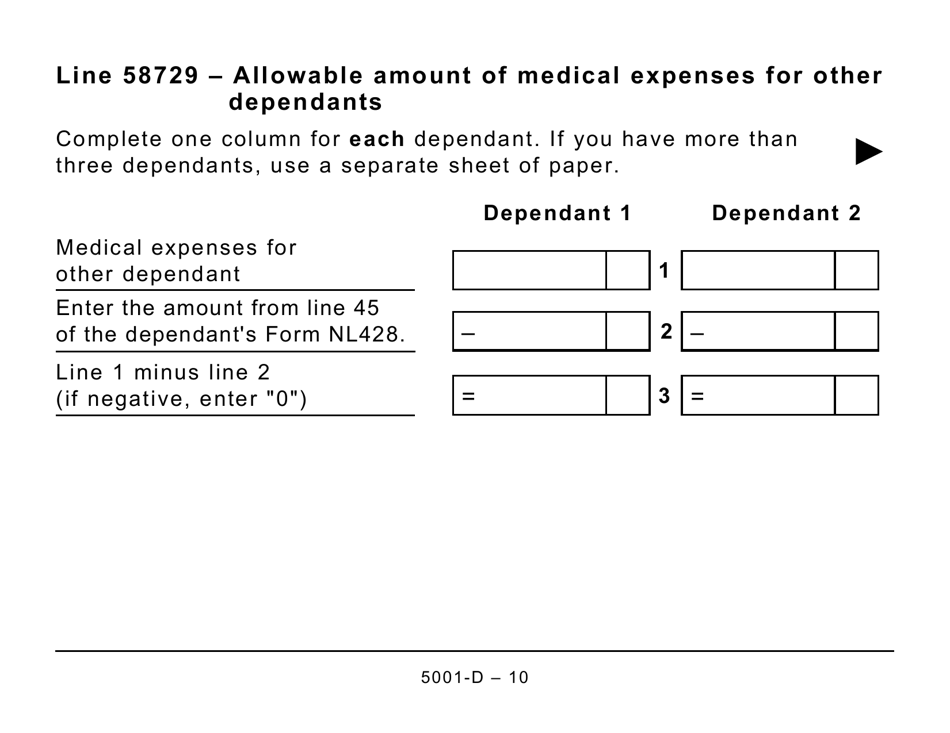

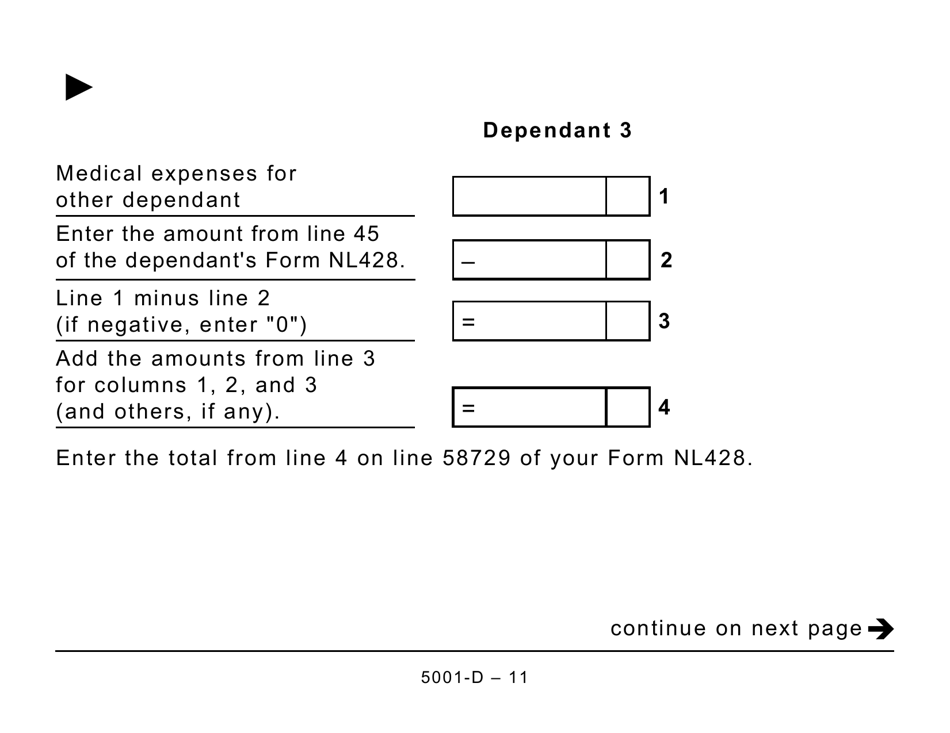

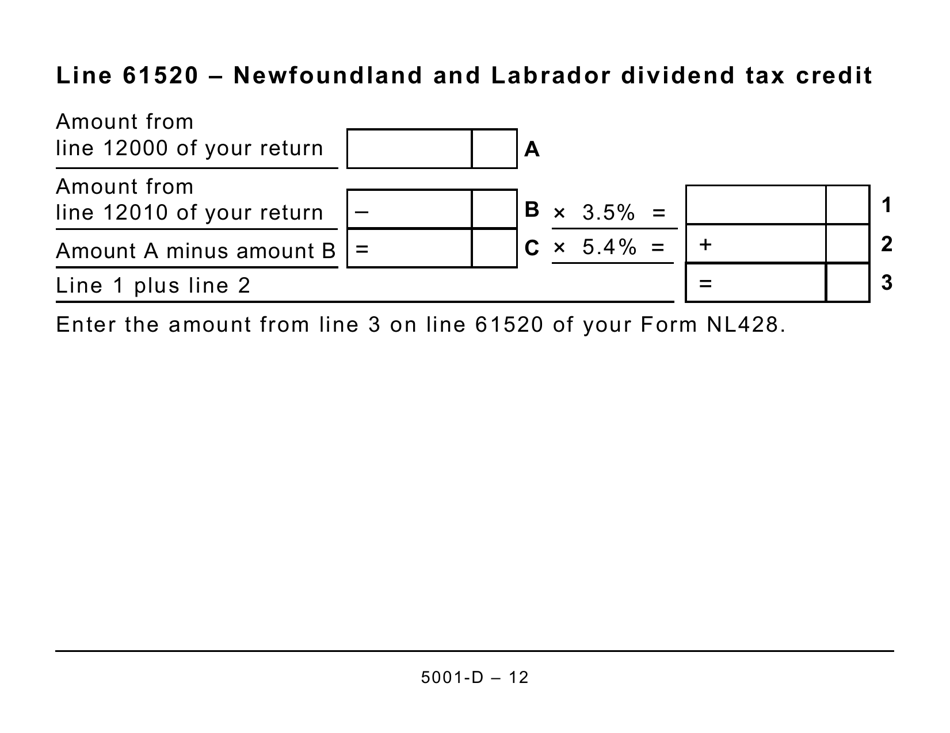

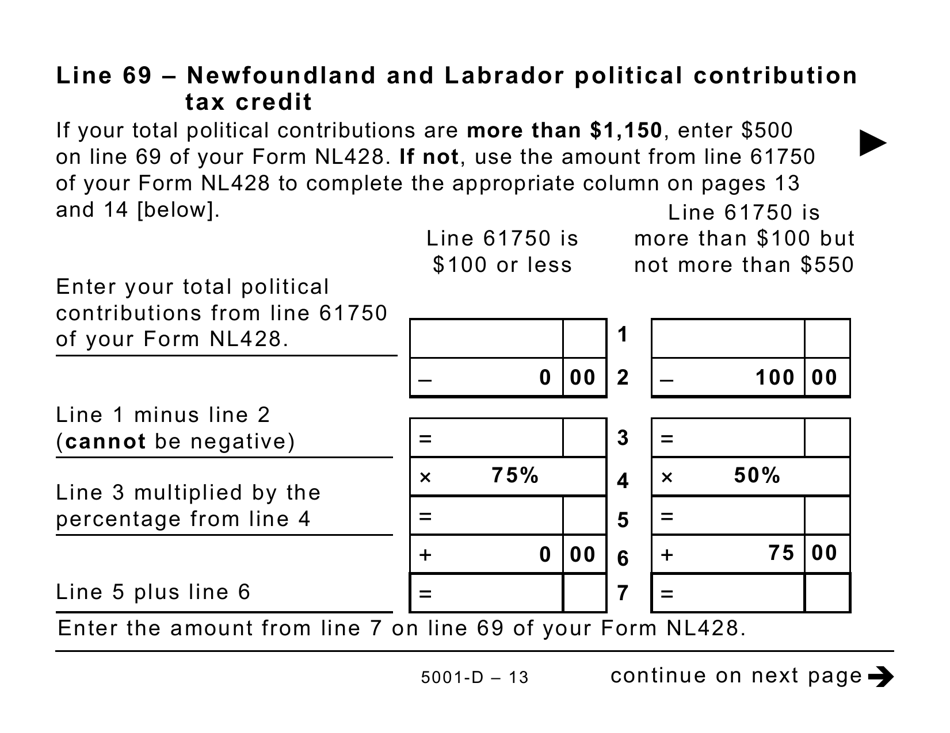

Form 5001-D Worksheet NL428 Newfoundland and Labrador (Large Print) is a tax form used in Canada, specifically in the province of Newfoundland and Labrador. It is used to calculate and report tax liabilities for individuals living in this province.

The Form 5001-D Worksheet NL428 Newfoundland and Labrador (Large Print) in Canada is typically filed by individuals who reside in Newfoundland and Labrador and require a large print format due to visual impairments.

FAQ

Q: What is Form 5001-D Worksheet NL428?

A: Form 5001-D Worksheet NL428 is a tax form used in Newfoundland and Labrador, Canada.

Q: Who can use Form 5001-D Worksheet NL428?

A: Residents of Newfoundland and Labrador who need to calculate their provincial tax credits can use this form.

Q: What is the purpose of Form 5001-D Worksheet NL428?

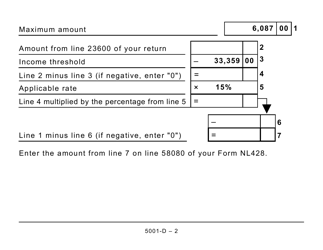

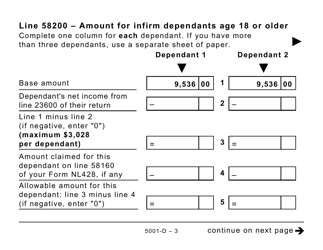

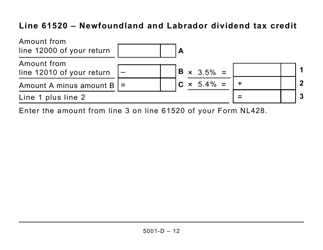

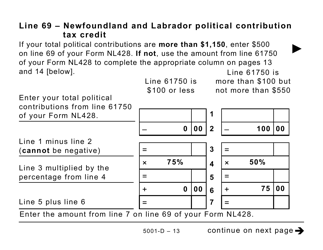

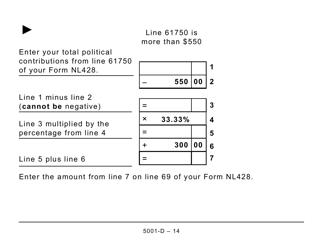

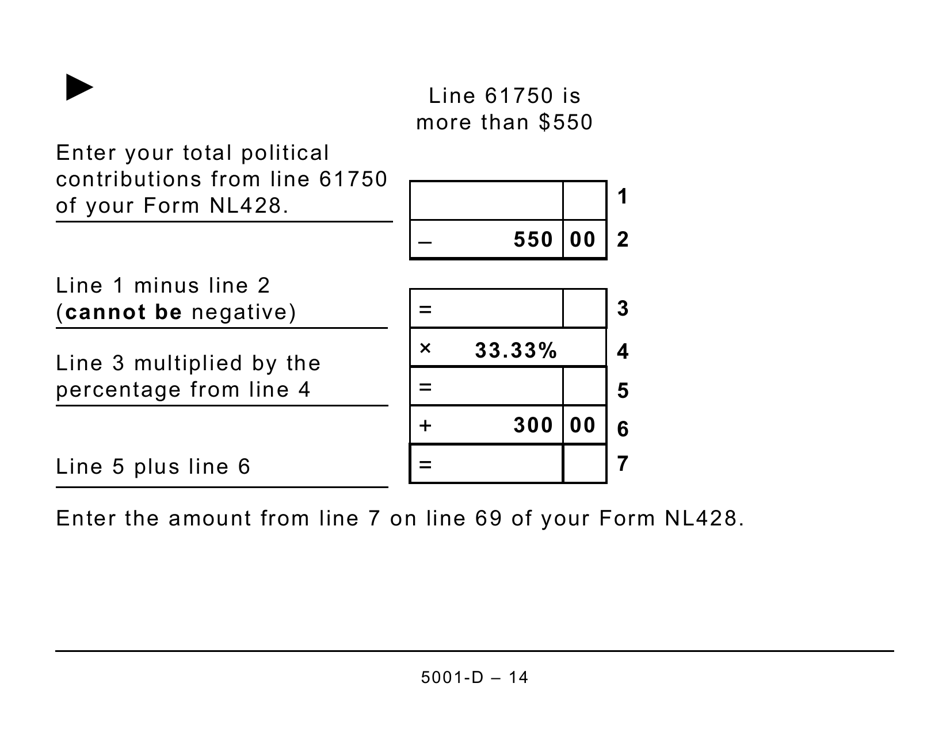

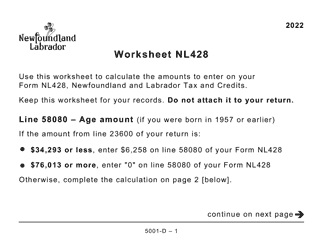

A: The purpose of this form is to help individuals calculate their provincial tax credits and determine the amount they can claim on their tax return.

Q: Is Form 5001-D Worksheet NL428 mandatory?

A: No, this form is not mandatory. It is only necessary for individuals who want to claim provincial tax credits in Newfoundland and Labrador.

Q: What information do I need to complete Form 5001-D Worksheet NL428?

A: You will need information about your income, deductions, and credits to complete this form.

Q: Is there a deadline for submitting Form 5001-D Worksheet NL428?

A: The deadline for submitting this form is the same as the deadline for filing your tax return, which is typically April 30th of each year.

Q: Is there a fee to file Form 5001-D Worksheet NL428?

A: No, there is no fee to file this form. It is provided free of charge by the Canadian Revenue Agency.

Q: What should I do if I need help completing Form 5001-D Worksheet NL428?

A: If you need assistance with this form, you can consult the instructions provided by the Canadian Revenue Agency or seek advice from a tax professional.