This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5001-S2 Schedule NL(S2)

for the current year.

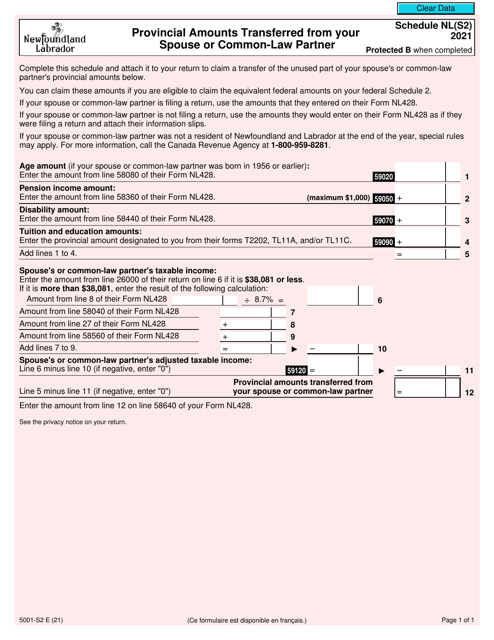

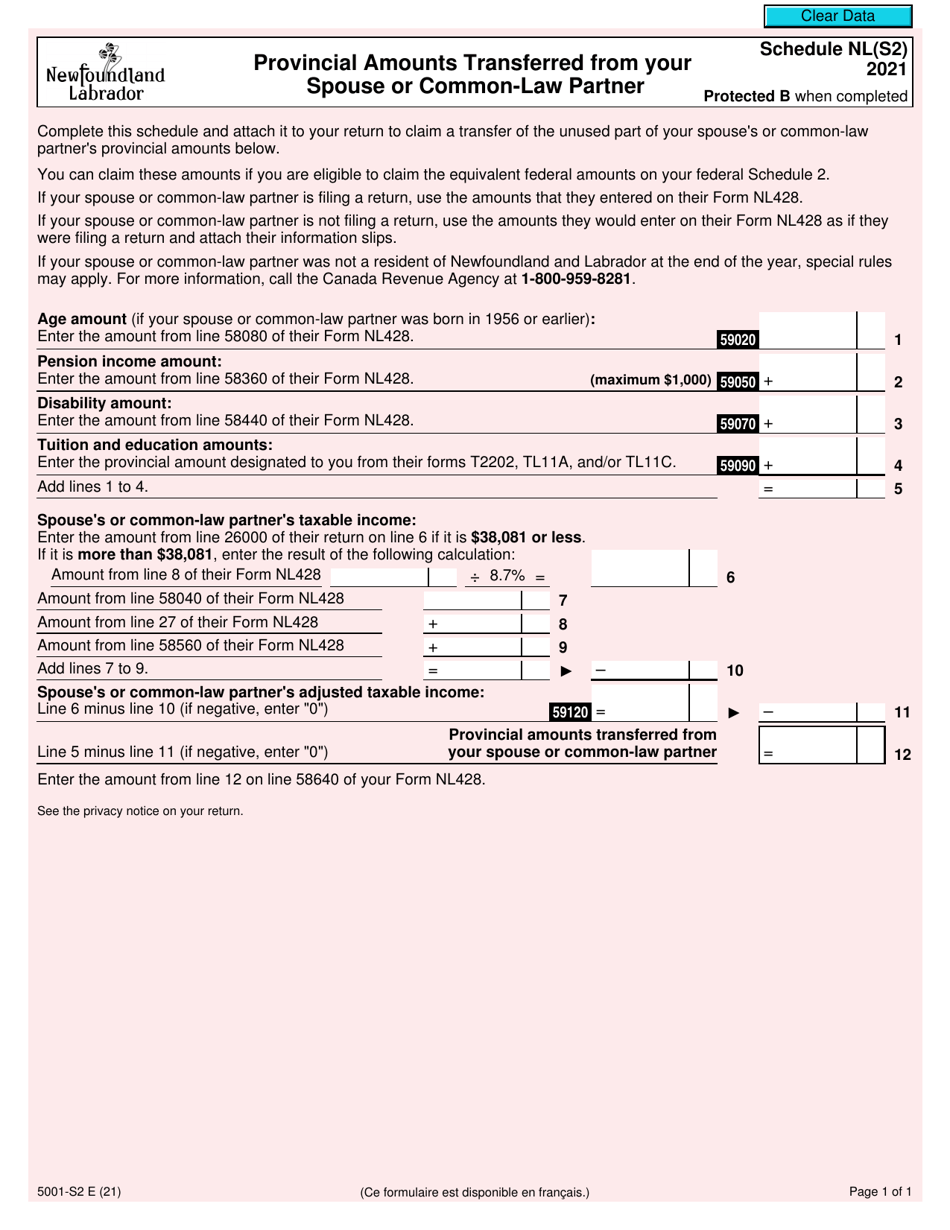

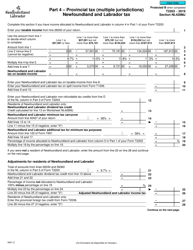

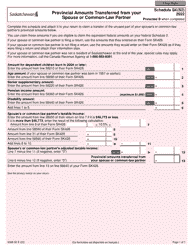

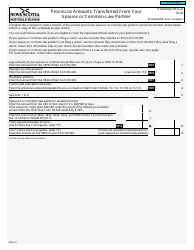

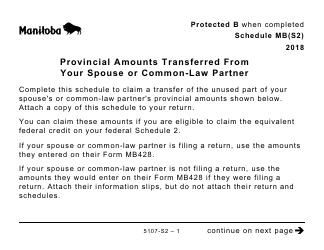

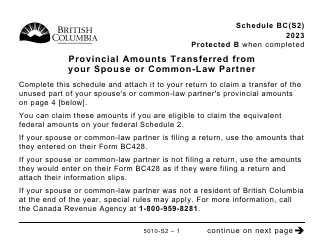

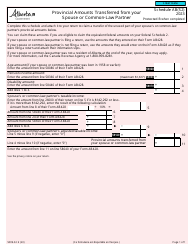

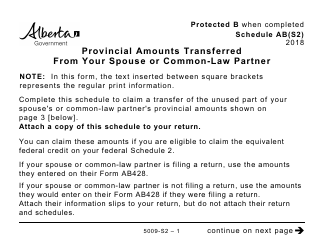

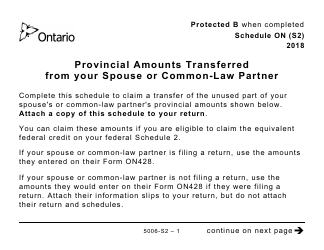

Form 5001-S2 Schedule NL(S2) Provincial Amounts Transferred From Your Spouse or Common-Law Partner - Newfoundland and Labrador - Canada

Form 5001-S2 Schedule NL(S2) is used in Canada to report the amounts transferred from your spouse or common-law partner for Newfoundland and Labrador provincial tax purposes. It helps calculate your provincial tax obligations accurately.

FAQ

Q: What is Form 5001-S2 Schedule NL(S2)?

A: Form 5001-S2 Schedule NL(S2) is a tax form used in Newfoundland and Labrador, Canada.

Q: What is the purpose of Form 5001-S2 Schedule NL(S2)?

A: The purpose of Form 5001-S2 Schedule NL(S2) is to report Provincial Amounts Transferred From Your Spouse or Common-Law Partner in Newfoundland and Labrador.

Q: What information is required on Form 5001-S2 Schedule NL(S2)?

A: Form 5001-S2 Schedule NL(S2) requires you to provide details of the provincial amounts transferred from your spouse or common-law partner.

Q: Who needs to file Form 5001-S2 Schedule NL(S2)?

A: Residents of Newfoundland and Labrador who have transferred provincial amounts from their spouse or common-law partner need to file Form 5001-S2 Schedule NL(S2).

Q: Is Form 5001-S2 Schedule NL(S2) only for residents of Newfoundland and Labrador?

A: Yes, Form 5001-S2 Schedule NL(S2) is specific to residents of Newfoundland and Labrador in Canada.

Q: When is the deadline to file Form 5001-S2 Schedule NL(S2)?

A: The deadline to file Form 5001-S2 Schedule NL(S2) is usually April 30th of the following tax year.

Q: Are there any penalties for late filing of Form 5001-S2 Schedule NL(S2)?

A: Late filing of Form 5001-S2 Schedule NL(S2) may result in penalties and interest charges. It is important to file on time to avoid these penalties.

Q: Can I e-file Form 5001-S2 Schedule NL(S2)?

A: No, currently Form 5001-S2 Schedule NL(S2) cannot be e-filed. It must be filed by mail or in person.

Q: Do I need to submit any supporting documents with Form 5001-S2 Schedule NL(S2)?

A: No, you generally do not need to submit supporting documents with Form 5001-S2 Schedule NL(S2). However, it is important to keep the supporting documents in case the CRA requests them later.