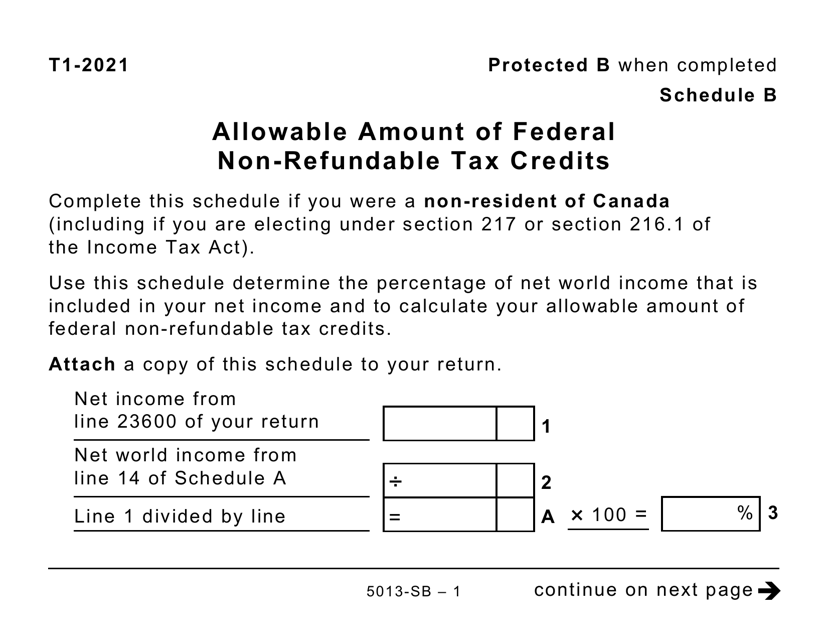

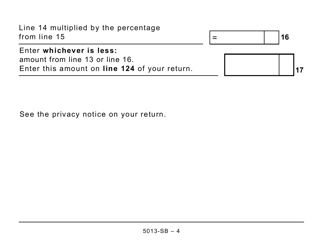

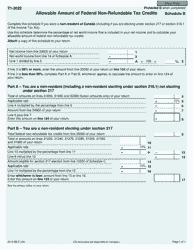

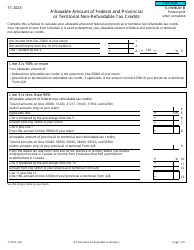

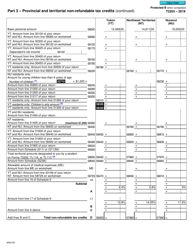

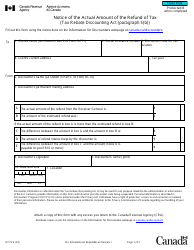

Form 5013-SB Schedule B Allowable Amount of Federal Non-refundable Tax Credits (Large Print) - Canada

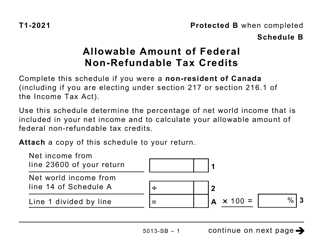

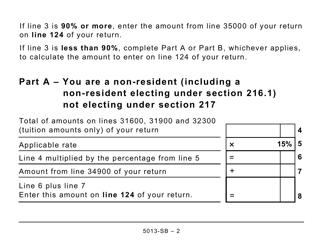

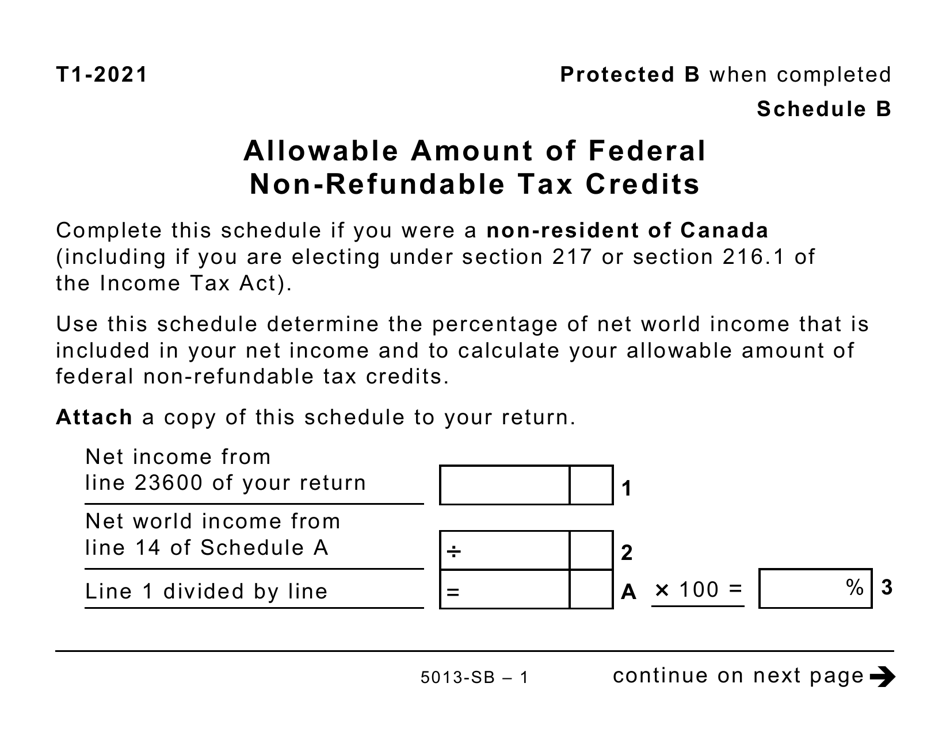

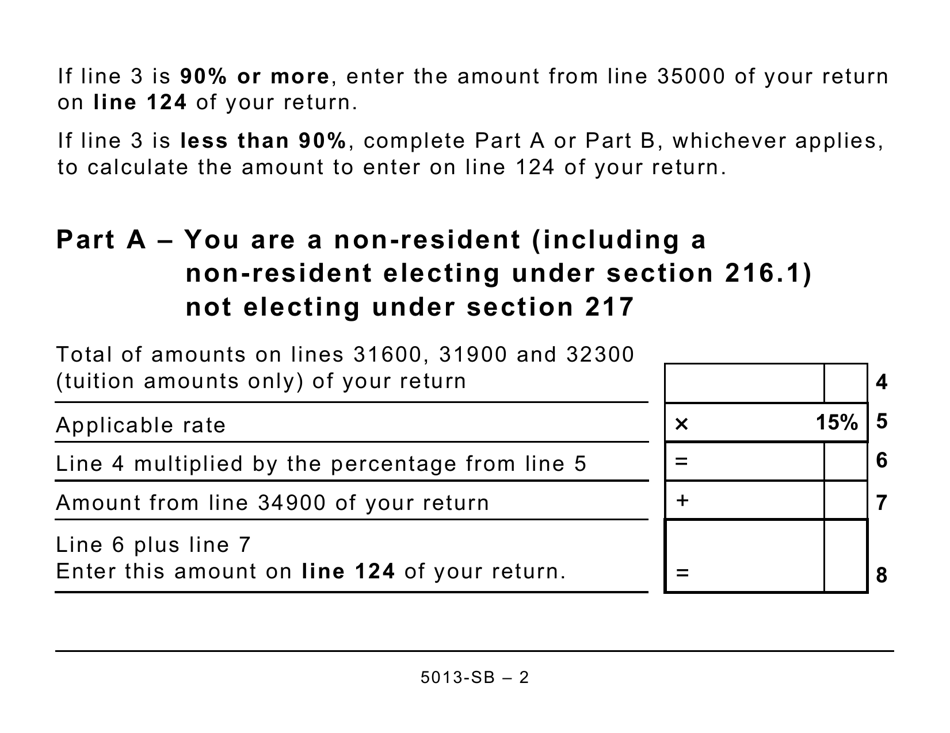

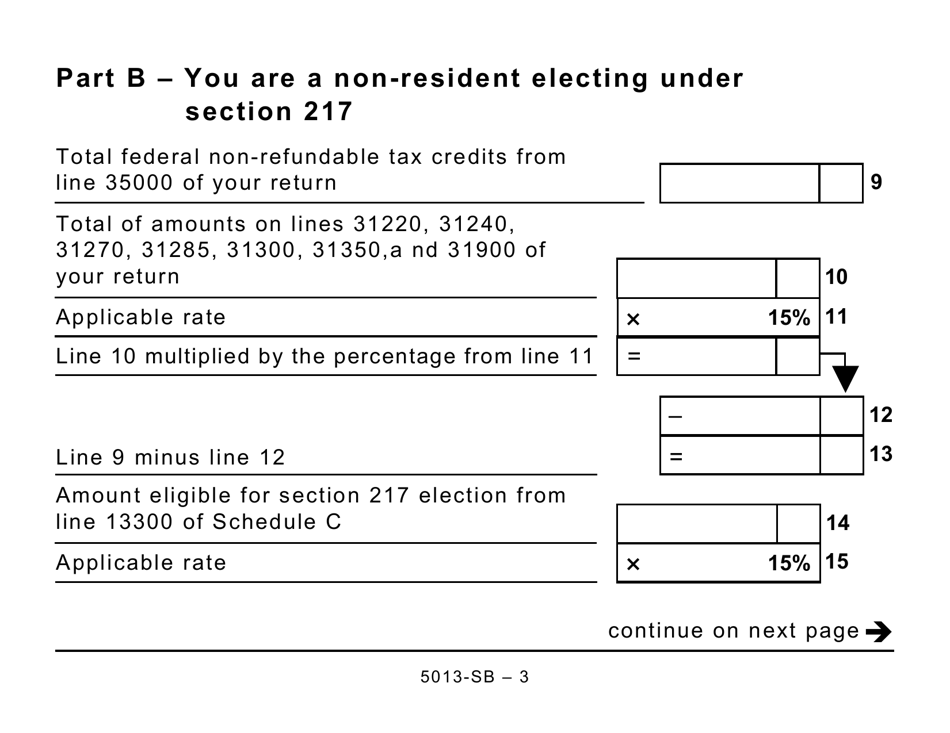

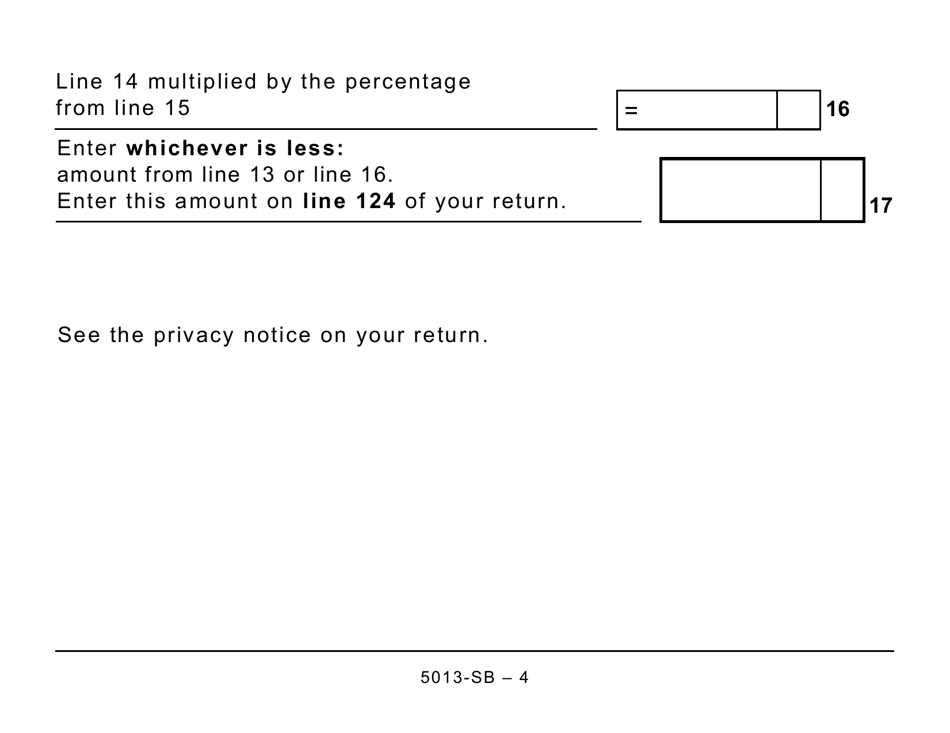

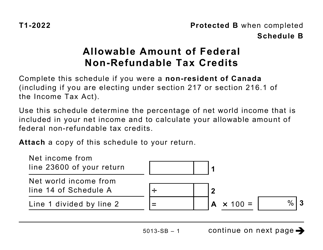

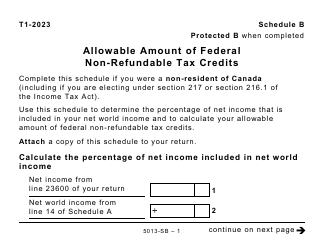

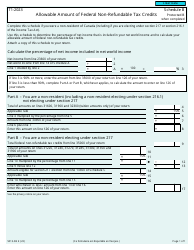

Form 5013-SB Schedule B Allowable Amount of Federal Non-refundable Tax Credits (Large Print) in Canada is used to calculate the total amount of federal non-refundable tax credits that can be claimed on your tax return. It helps you determine the maximum amount you are eligible to claim for various tax credits.

FAQ

Q: What is Form 5013-SB Schedule B?

A: Form 5013-SB Schedule B is a form used in Canada to calculate the allowable amount of federal non-refundable tax credits.

Q: What is the purpose of Form 5013-SB Schedule B?

A: The purpose of Form 5013-SB Schedule B is to determine the amount of federal non-refundable tax credits that can be claimed.

Q: Who should use Form 5013-SB Schedule B?

A: Individuals in Canada who are eligible for federal non-refundable tax credits should use Form 5013-SB Schedule B to calculate their allowable amount.

Q: What are federal non-refundable tax credits?

A: Federal non-refundable tax credits are deductions that can be claimed on your Canadian income tax return to reduce the amount of tax you owe.

Q: What is the allowable amount of federal non-refundable tax credits?

A: The allowable amount of federal non-refundable tax credits is the maximum amount you can claim.

Q: Why is Form 5013-SB Schedule B in large print?

A: Form 5013-SB Schedule B is available in large print to accommodate individuals with visual impairments.

Q: When is Form 5013-SB Schedule B due?

A: Form 5013-SB Schedule B is typically due at the same time as your Canadian income tax return, which is April 30th for most individuals.

Q: Can I claim federal non-refundable tax credits if I didn't file a tax return?

A: No, you must file a Canadian income tax return in order to claim federal non-refundable tax credits.

Q: What should I do if I need help with Form 5013-SB Schedule B?

A: If you need assistance with Form 5013-SB Schedule B, you can seek help from a tax professional or contact the Canada Revenue Agency (CRA) for guidance.