This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5013-SC Schedule C

for the current year.

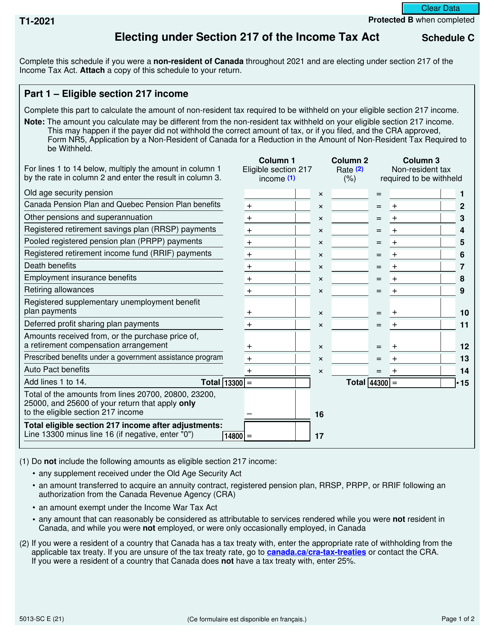

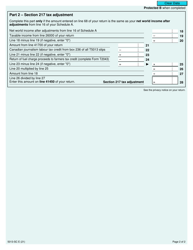

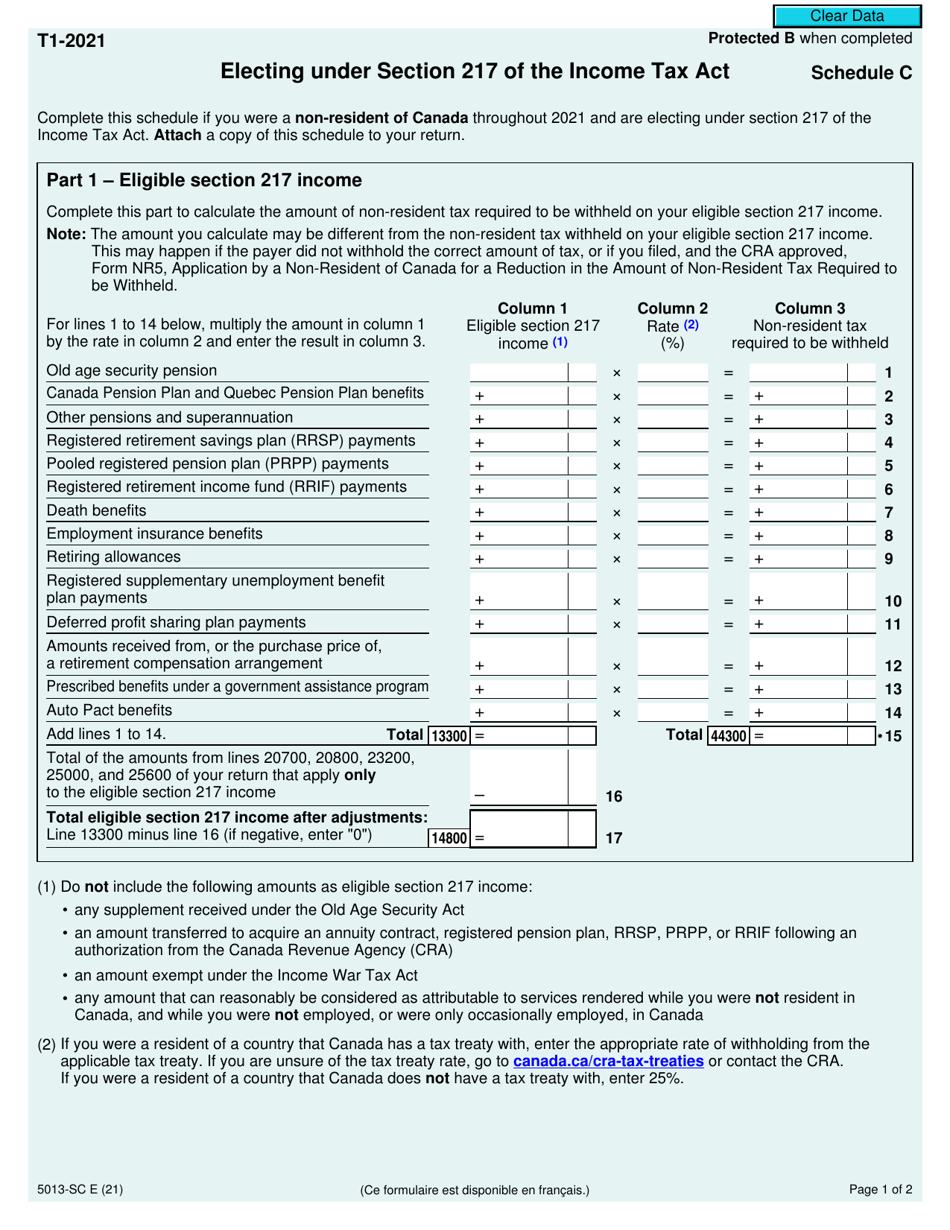

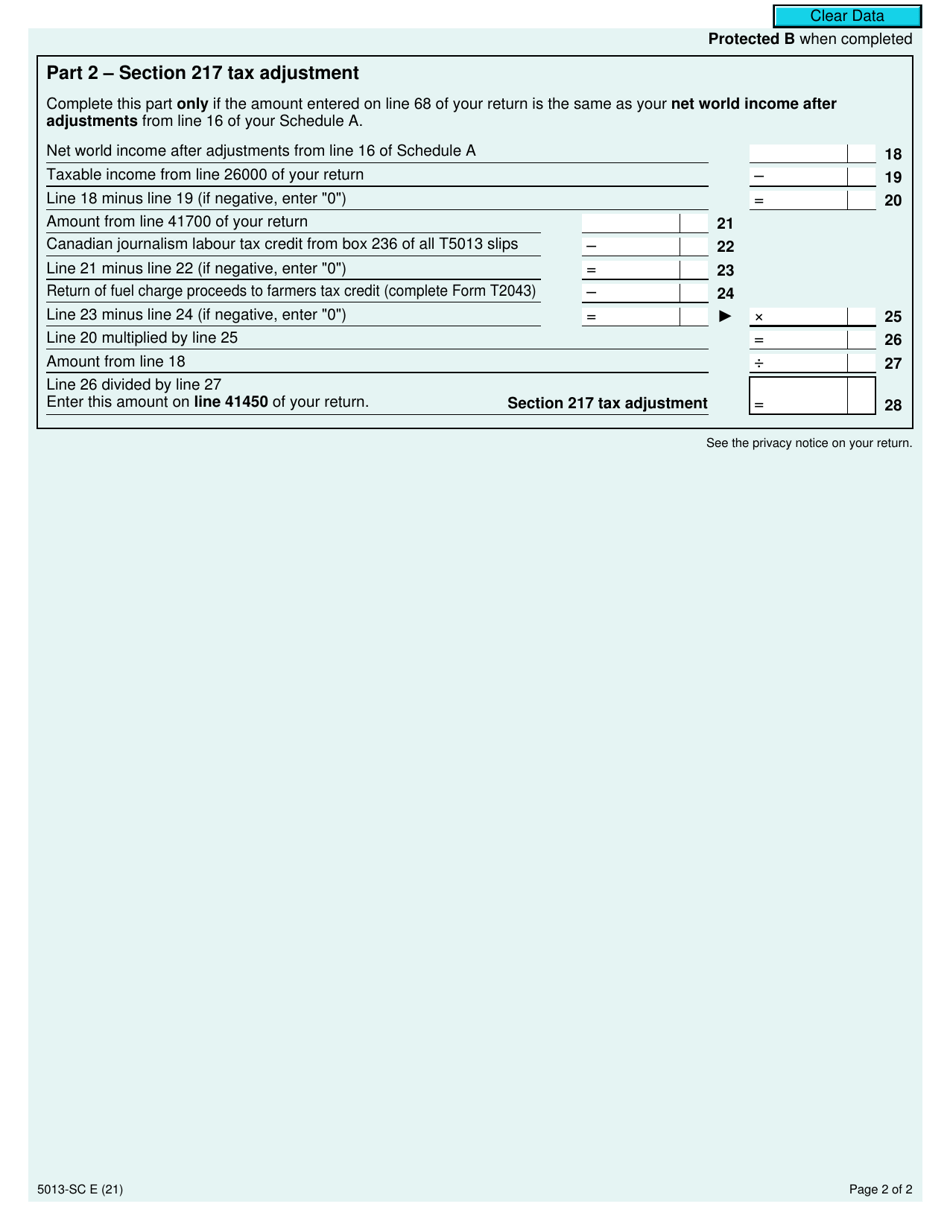

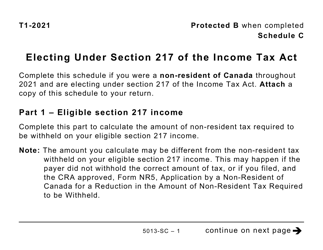

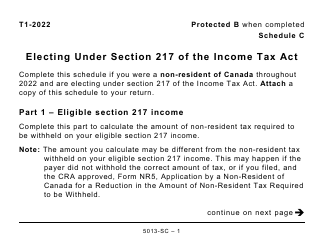

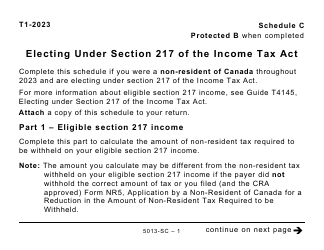

Form 5013-SC Schedule C Electing Under Section 217 of the Income Tax Act - Canada

Form 5013-SC Schedule C Electing Under Section 217 of the Income Tax Act - Canada is used to elect that a non-resident individual or a deemed resident of Canada is taxed under section 217 of the Income Tax Act. This allows certain deductions and benefits related to employment income earned in Canada.

FAQ

Q: What is Form 5013-SC Schedule C?

A: Form 5013-SC Schedule C is a specific tax form used in Canada.

Q: What does Form 5013-SC Schedule C pertain to?

A: Form 5013-SC Schedule C pertains to electing under Section 217 of the Canadian Income Tax Act.

Q: What is Section 217 of the Income Tax Act?

A: Section 217 of the Income Tax Act in Canada allows certain individuals to elect to be taxed on their Canadian-source income only, instead of their worldwide income.

Q: Who is eligible to use Form 5013-SC Schedule C?

A: Individuals who are non-residents of Canada and have Canadian-source income can use Form 5013-SC Schedule C to make the election under Section 217.

Q: What information is required on Form 5013-SC Schedule C?

A: Form 5013-SC Schedule C requires information such as the taxpayer's personal details, income, deductions, and any taxes already paid.

Q: Is the use of Form 5013-SC Schedule C mandatory?

A: No, the use of Form 5013-SC Schedule C is optional. It allows eligible individuals to make the election under Section 217, but they are not required to do so.

Q: Can I file Form 5013-SC Schedule C electronically?

A: Currently, Form 5013-SC Schedule C cannot be filed electronically. It must be filed by mail or in person with the CRA.