This version of the form is not currently in use and is provided for reference only. Download this version of

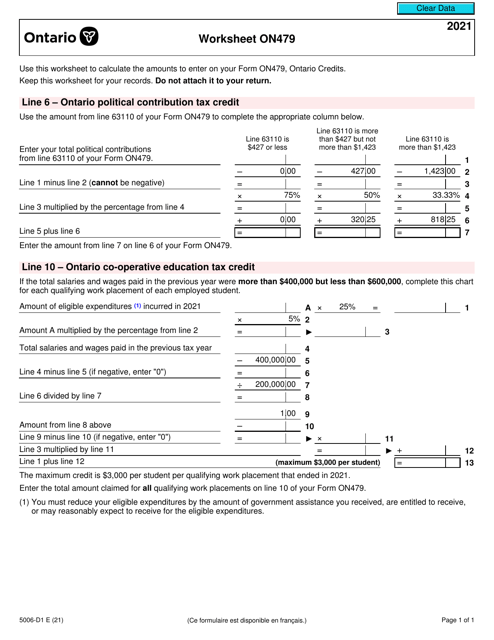

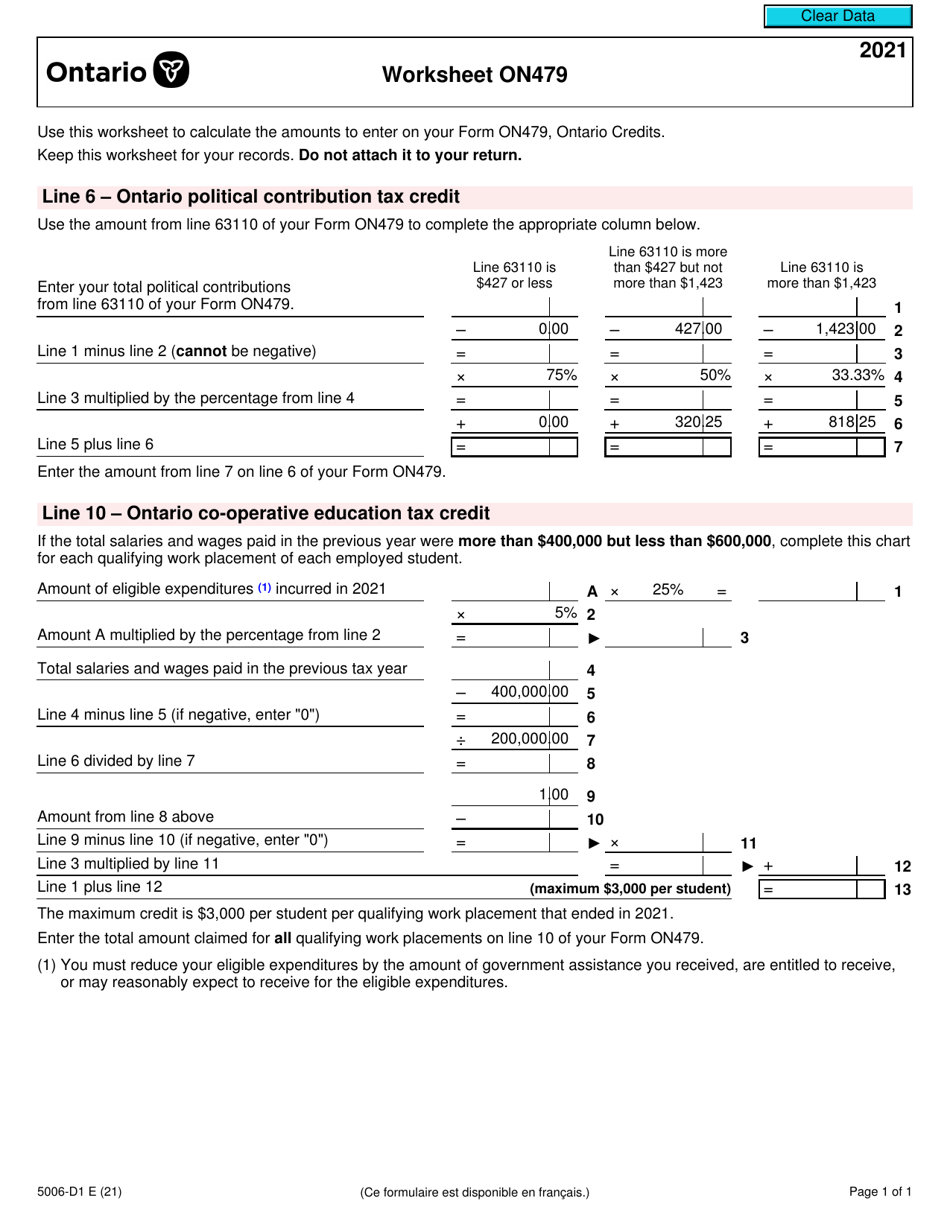

Form 5006-D1 Worksheet ON479

for the current year.

Form 5006-D1 Worksheet ON479 Ontario - Canada

Form 5006-D1 Worksheet ON479 is used in Ontario, Canada for calculating the Ontario tax credits for businesses. It helps determine the amount of tax credit that can be claimed on the Ontario Corporate Income Tax Return.

The Form 5006-D1 Worksheet ON479 Ontario - Canada is filed by individuals in Ontario, Canada when they are reporting income from self-employment or partnership.

FAQ

Q: What is Form 5006-D1?

A: Form 5006-D1 is a worksheet specific to the ON479 tax form in Ontario, Canada.

Q: What is the ON479 tax form?

A: The ON479 is the form used to claim the Ontario Senior Homeowners' Property Tax Grant.

Q: What is the purpose of Form 5006-D1?

A: The purpose of Form 5006-D1 is to calculate and determine the amount of the Ontario Senior Homeowners' Property Tax Grant.

Q: Who is eligible to claim the Ontario Senior Homeowners' Property Tax Grant?

A: To be eligible for the grant, you must be 65 years of age or older, own or rent a principal residence in Ontario, and meet certain income requirements.

Q: Are there any deadlines for filing Form 5006-D1?

A: Yes, the deadline for filing Form 5006-D1 is generally September 30th of the year following the taxation year for which you are claiming the grant.

Q: What documents do I need to include with Form 5006-D1?

A: You may be required to include supporting documents such as property tax statements or rental receipts. Check the form instructions for specific requirements.

Q: Can I file Form 5006-D1 electronically?

A: No, Form 5006-D1 cannot be filed electronically. It must be filled out and sent by mail.