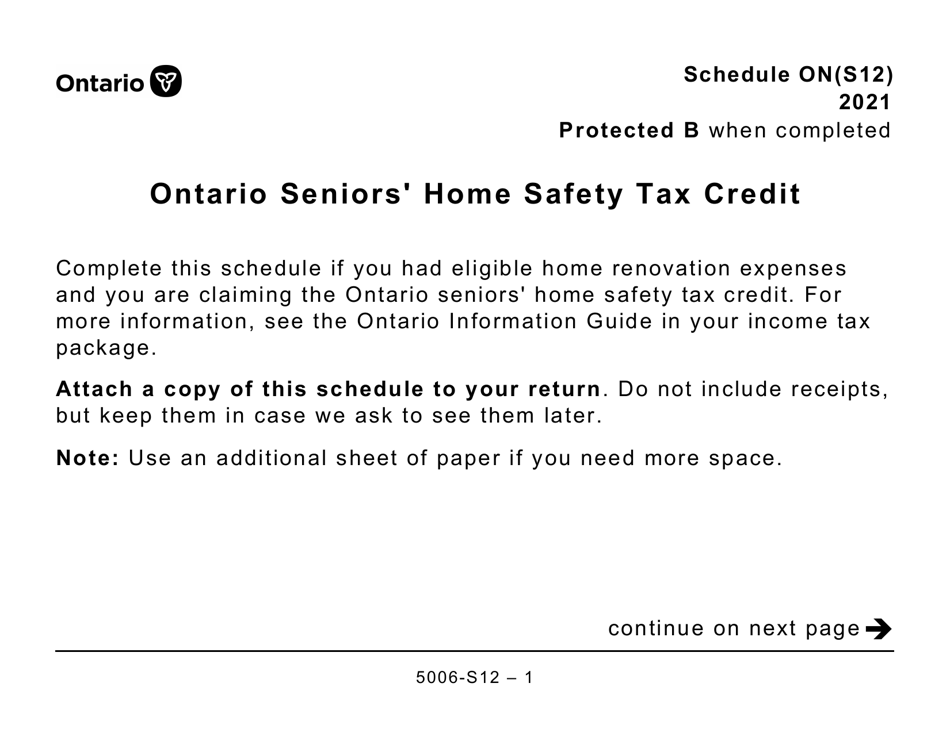

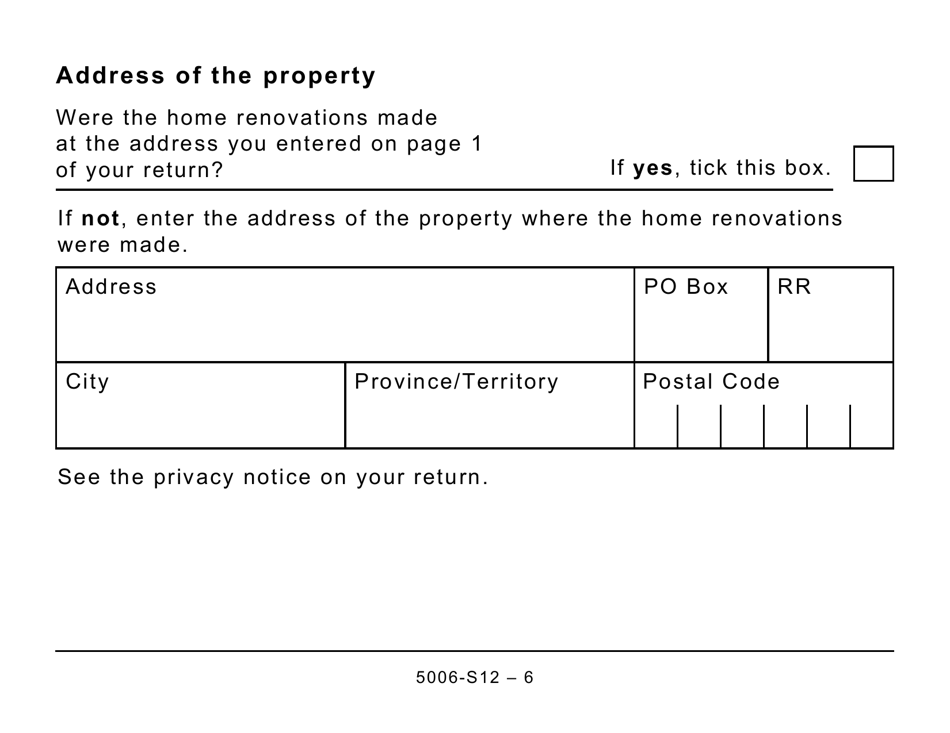

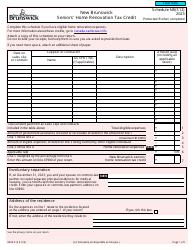

Form 5006-S12 Schedule ON(S12) Ontario Seniors' Home Safety Tax Credit (Large Print) - Canada

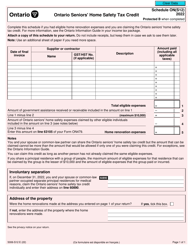

Form 5006-S12 Schedule ON(S12) in Canada is used for claiming the Ontario Seniors' Home SafetyTax Credit. This credit aims to provide financial assistance to seniors for the costs incurred on making their homes safer and more accessible. The Large Print version of the form is available to accommodate individuals with visual impairments.

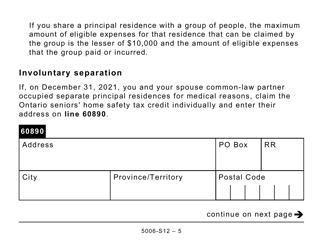

The Form 5006-S12 Schedule ON(S12) Ontario Seniors' Home Safety Tax Credit (Large Print) in Canada is typically filed by Ontario residents who are eligible for the Ontario Seniors' Home Safety Tax Credit.

FAQ

Q: What is Form 5006-S12 Schedule ON?

A: Form 5006-S12 Schedule ON is the Ontario Seniors' Home Safety Tax Credit (Large Print) form in Canada.

Q: What is the purpose of Form 5006-S12 Schedule ON?

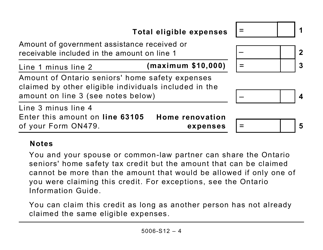

A: The purpose of Form 5006-S12 Schedule ON is to claim the Ontario Seniors' Home Safety Tax Credit.

Q: Who is eligible for the Ontario Seniors' Home Safety Tax Credit?

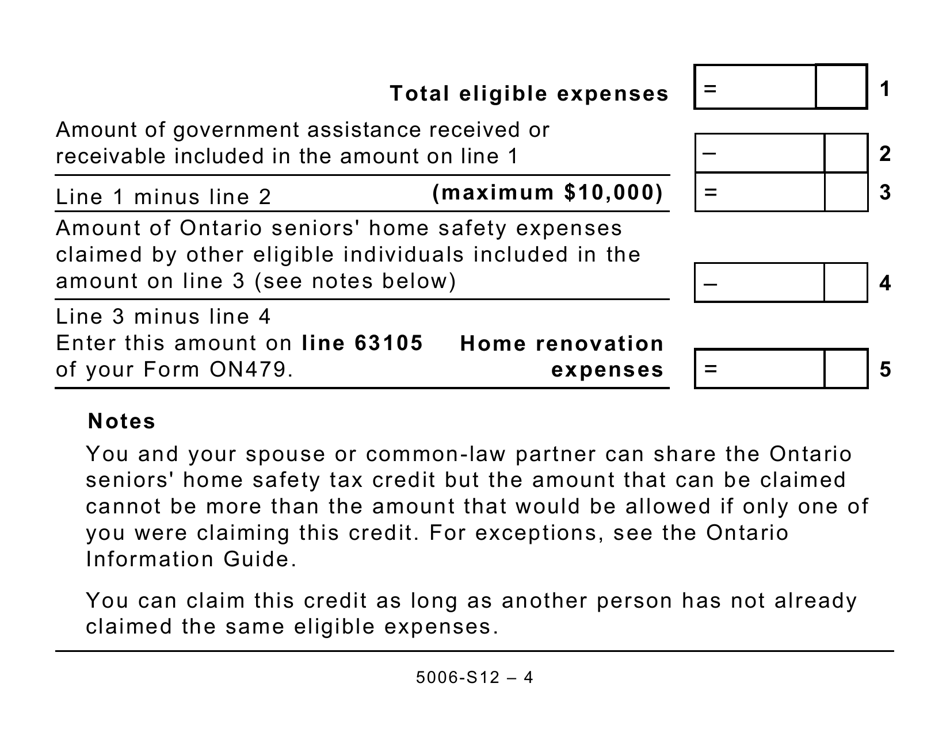

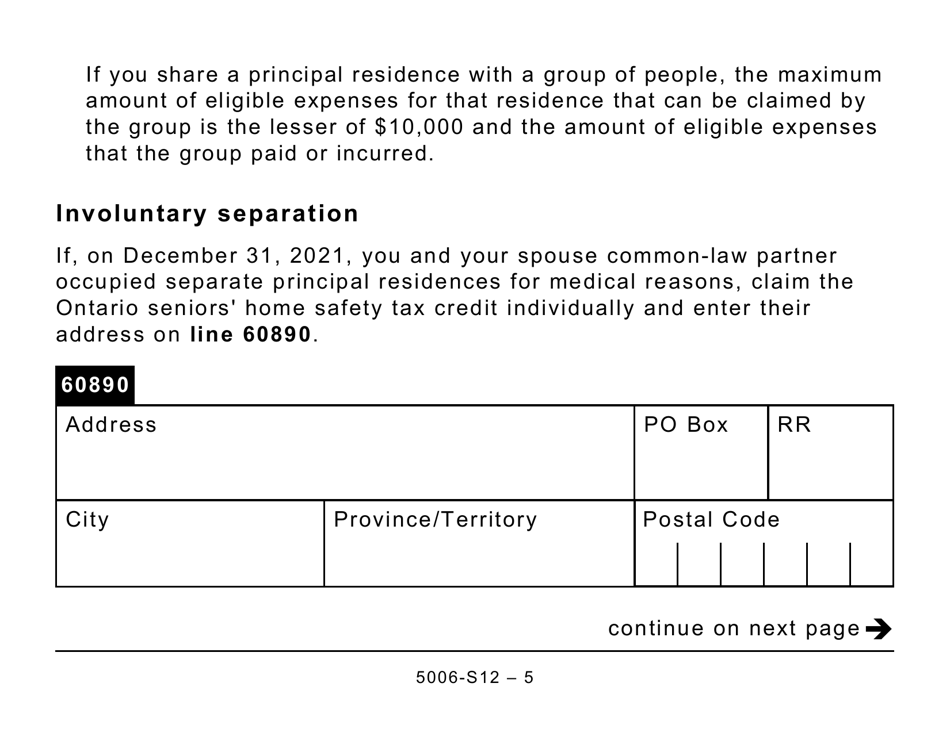

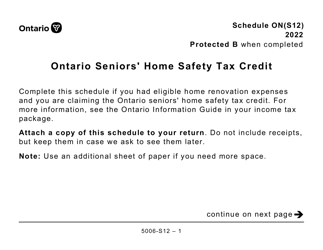

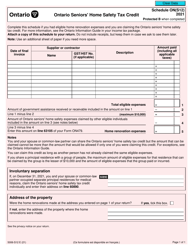

A: Seniors aged 65 or older who made eligible expenses for home renovations to improve safety and accessibility may be eligible for the tax credit.

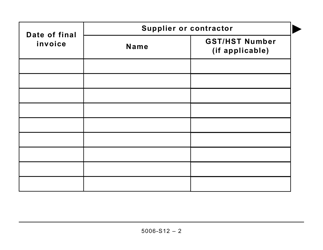

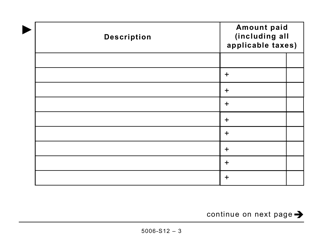

Q: What expenses are eligible for the Ontario Seniors' Home Safety Tax Credit?

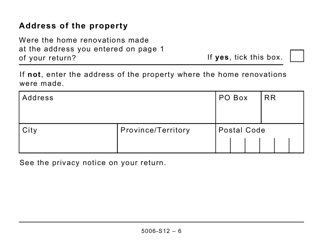

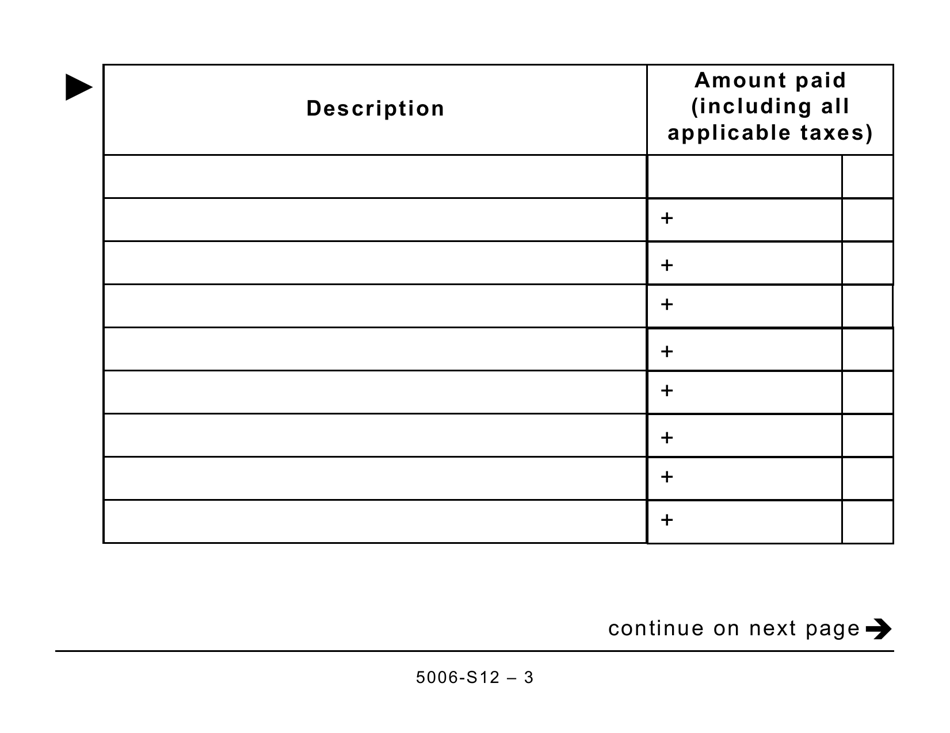

A: Expenses related to home renovations for safety and accessibility, such as installing grab bars or wheelchair ramps, may be eligible for the tax credit.

Q: How much is the Ontario Seniors' Home Safety Tax Credit?

A: The tax credit is worth 25% of eligible expenses, up to a maximum credit of $2,500.

Q: How do I claim the Ontario Seniors' Home Safety Tax Credit?

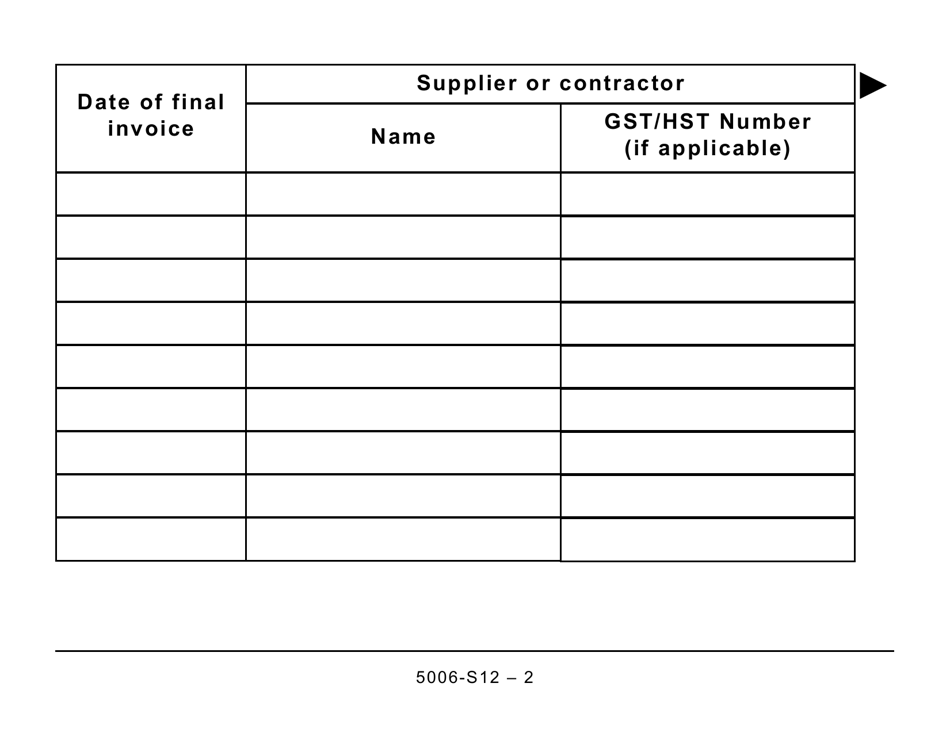

A: To claim the tax credit, you need to complete and file Form 5006-S12 Schedule ON along with your personal income tax return.

Q: Is the Ontario Seniors' Home Safety Tax Credit refundable?

A: No, the tax credit is non-refundable, which means it can only be used to reduce your tax owing.

Q: Can I claim the Ontario Seniors' Home Safety Tax Credit for expenses incurred in previous years?

A: No, the tax credit can only be claimed for expenses incurred in the current tax year.

Q: Is there an income limit to qualify for the Ontario Seniors' Home Safety Tax Credit?

A: No, there is no income limit to qualify for the tax credit.