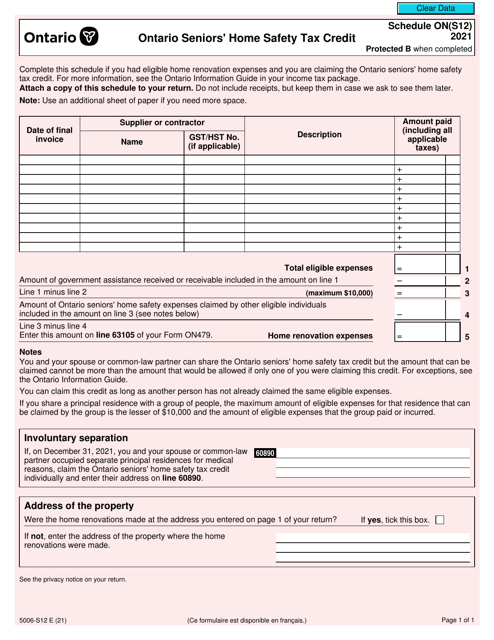

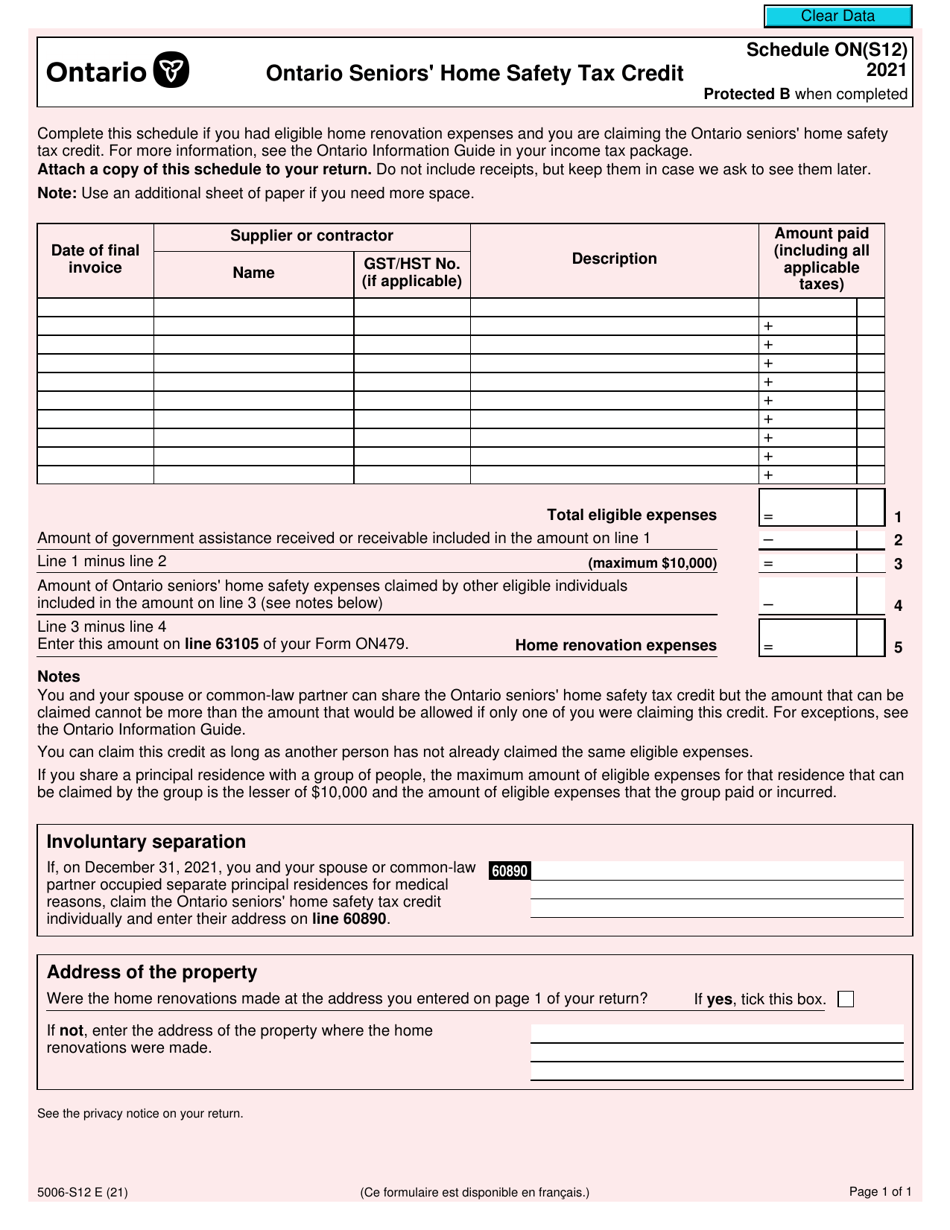

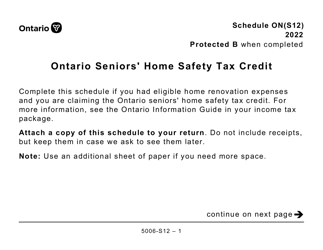

Form 5006-S12 Schedule ON(S12) Ontario Seniors' Home Safety Tax Credit - Canada

Form 5006-S12 Schedule ON(S12) Ontario Seniors' Home Safety Tax Credit is for residents in Ontario, Canada who are seniors and want to claim the tax credit for eligible expenses related to making their homes safer.

The Form 5006-S12 Schedule ON(S12) Ontario Seniors' Home Safety Tax Credit in Canada is filed by eligible seniors who want to claim this tax credit.

FAQ

Q: What is Form 5006-S12?

A: Form 5006-S12 is a schedule used for claiming the Ontario Seniors' Home Safety Tax Credit in Canada.

Q: What is the Ontario Seniors' Home Safety Tax Credit?

A: The Ontario Seniors' Home Safety Tax Credit is a tax credit available to seniors in Ontario to help cover the costs of making their homes safer and more accessible.

Q: How do I qualify for the Ontario Seniors' Home Safety Tax Credit?

A: To qualify, you must be a senior (65 years or older) residing in Ontario and have paid for eligible expenses related to home renovations or modifications.

Q: What expenses are eligible for the Ontario Seniors' Home Safety Tax Credit?

A: Eligible expenses include renovations or improvements that make your home safer or more accessible, such as grab bars, wheelchair ramps, and stair lifts.

Q: How much is the Ontario Seniors' Home Safety Tax Credit?

A: The tax credit is calculated as 25% of eligible expenses, up to a maximum of $2,500.

Q: How do I claim the Ontario Seniors' Home Safety Tax Credit?

A: To claim the credit, you need to complete Form 5006-S12 and include it with your income tax return for the year.

Q: Is the Ontario Seniors' Home Safety Tax Credit refundable?

A: No, the credit is non-refundable, meaning it can only be used to reduce your tax payable to zero.

Q: Can I claim the Ontario Seniors' Home Safety Tax Credit for expenses incurred in previous years?

A: No, the credit is only available for expenses incurred in the current tax year.

Q: Are there any income limitations to qualify for the Ontario Seniors' Home Safety Tax Credit?

A: No, there are no income limitations to qualify for the credit. All eligible seniors can claim it.

Q: Can I claim the Ontario Seniors' Home Safety Tax Credit for expenses paid by insurance?

A: No, expenses that have been reimbursed or are eligible for reimbursement through insurance cannot be claimed for the credit.