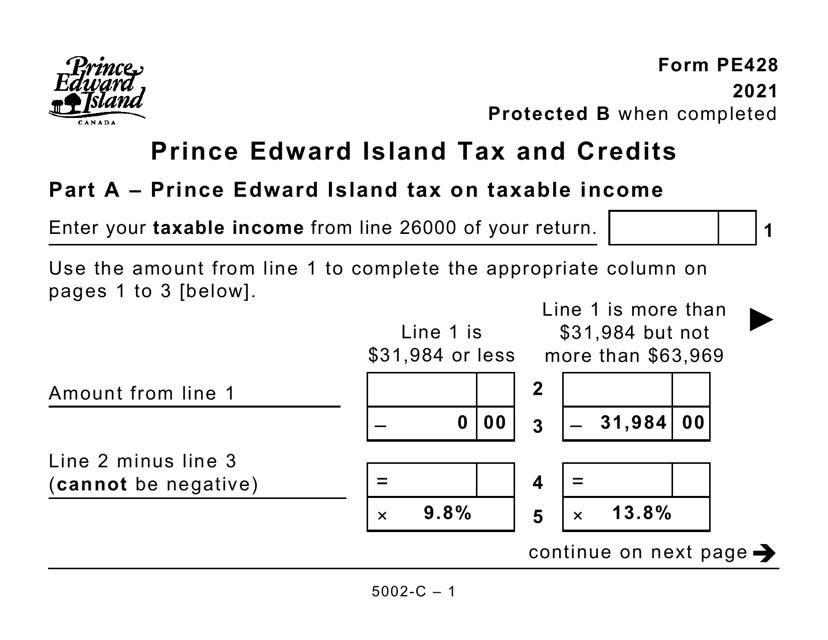

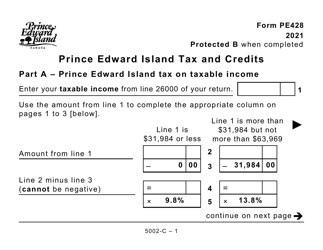

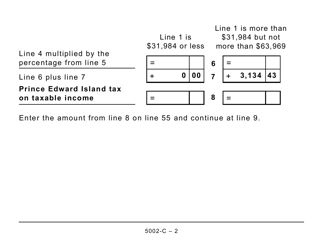

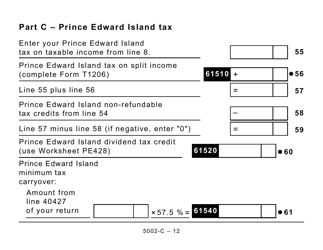

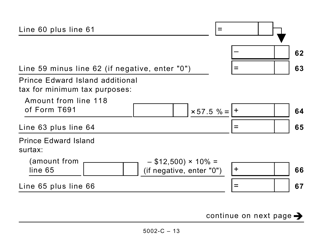

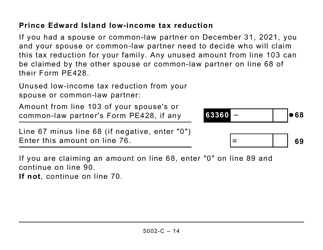

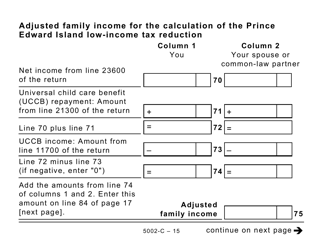

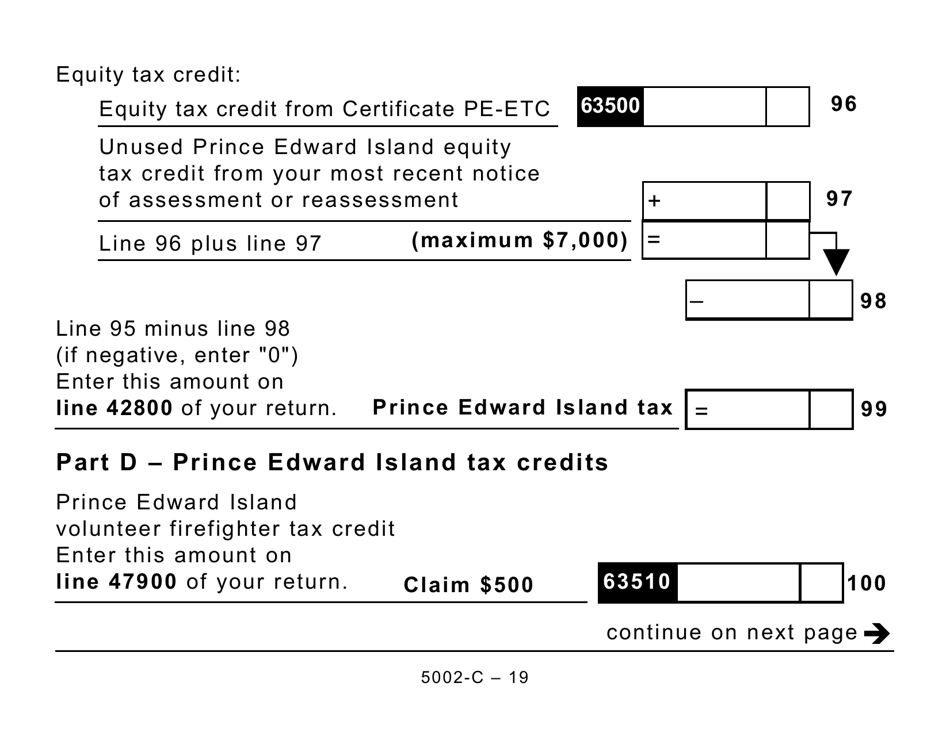

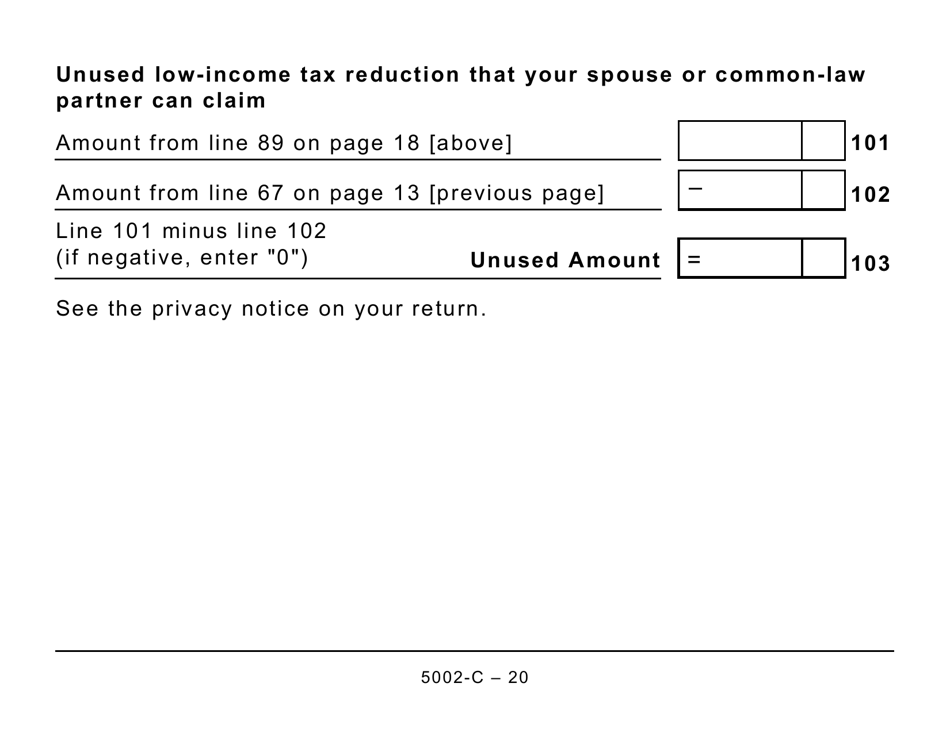

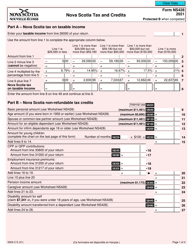

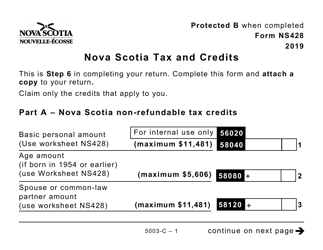

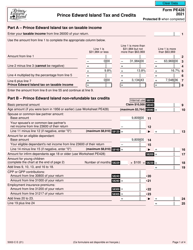

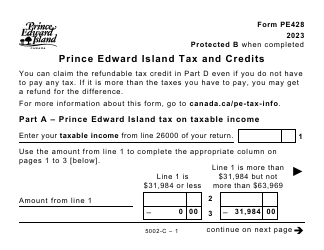

Form PE428 (5002-C) Prince Edward Island Tax and Credits (Large Print) - Canada

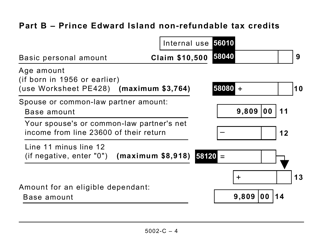

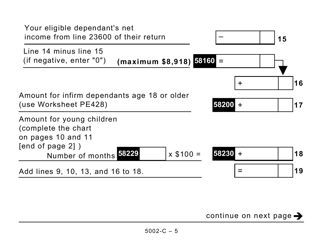

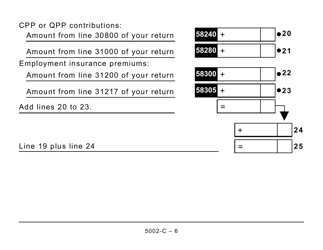

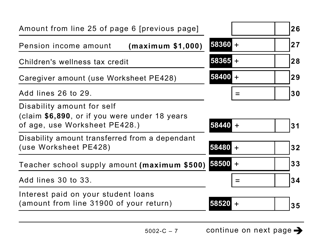

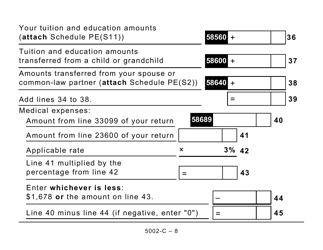

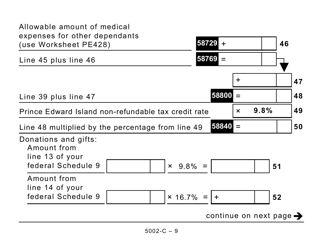

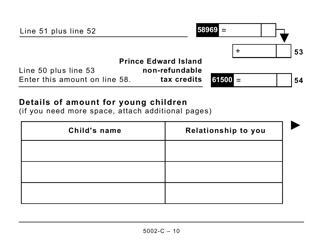

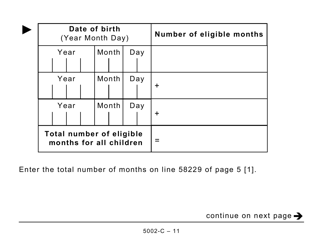

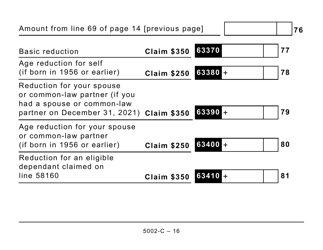

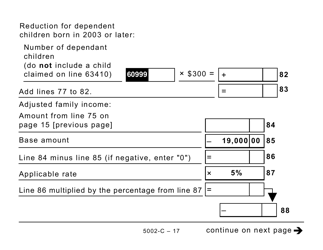

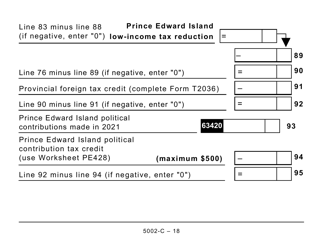

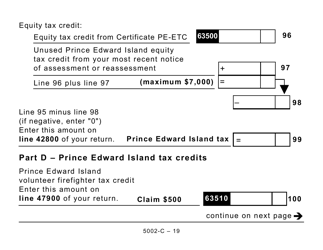

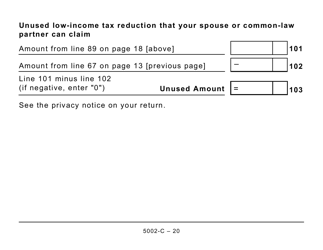

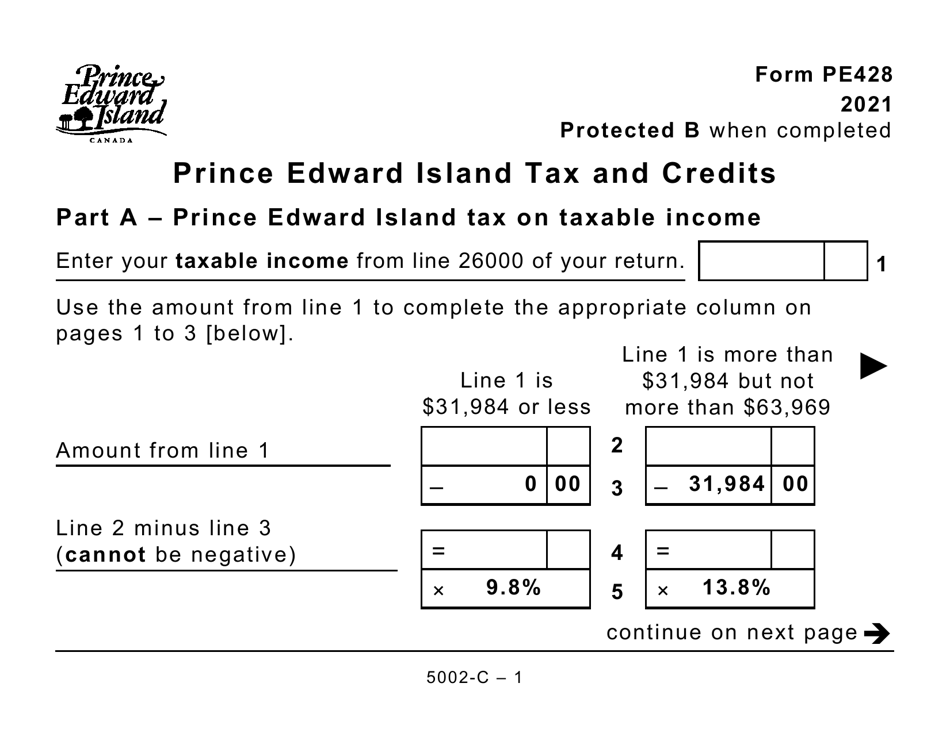

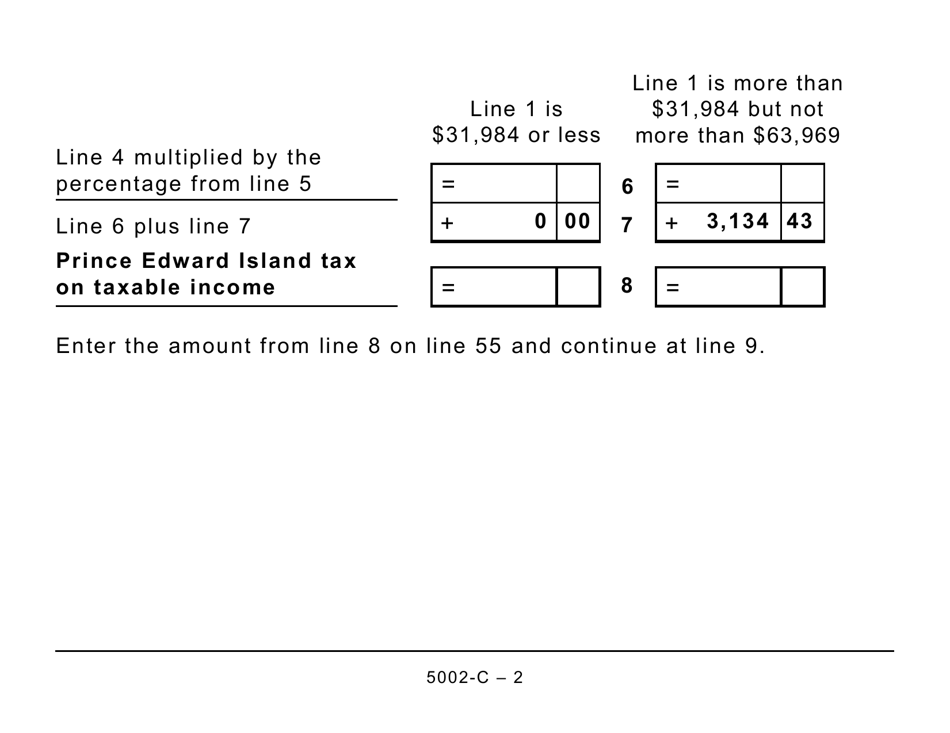

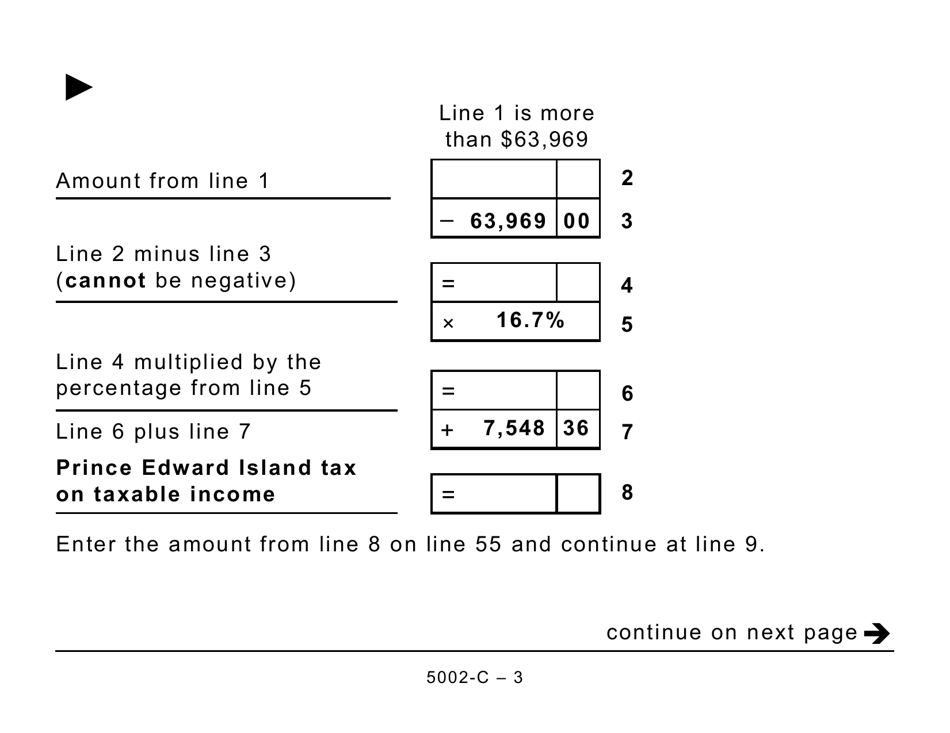

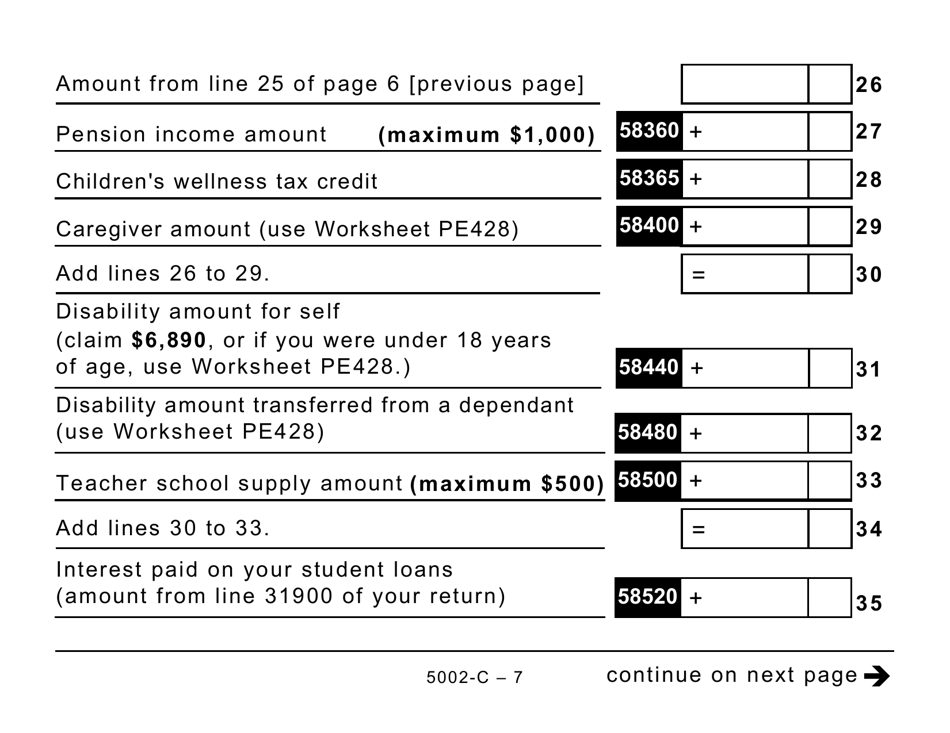

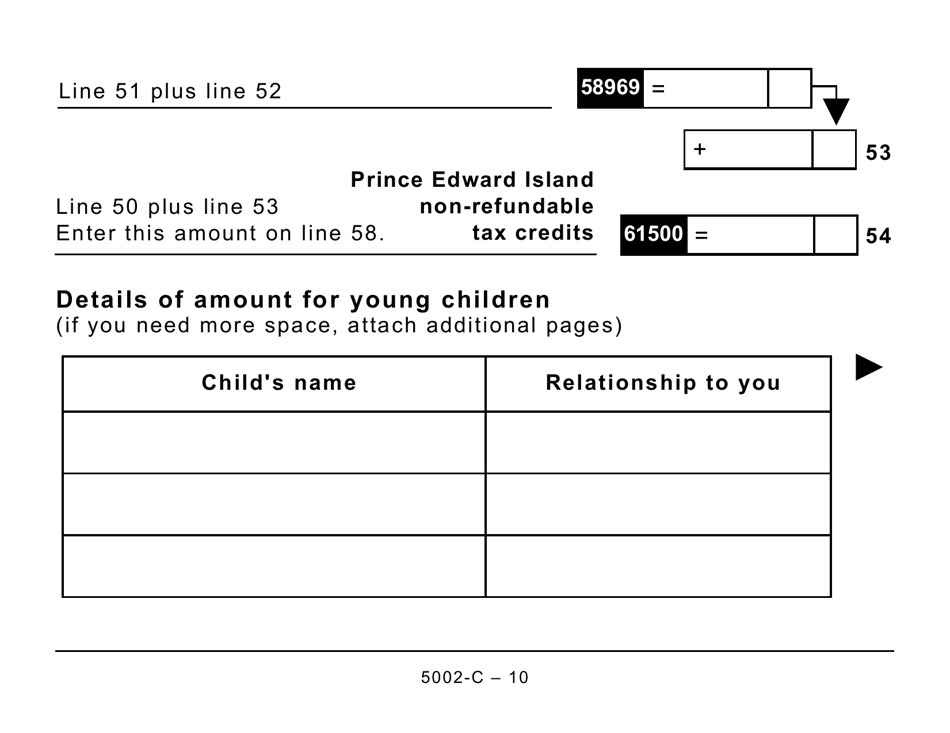

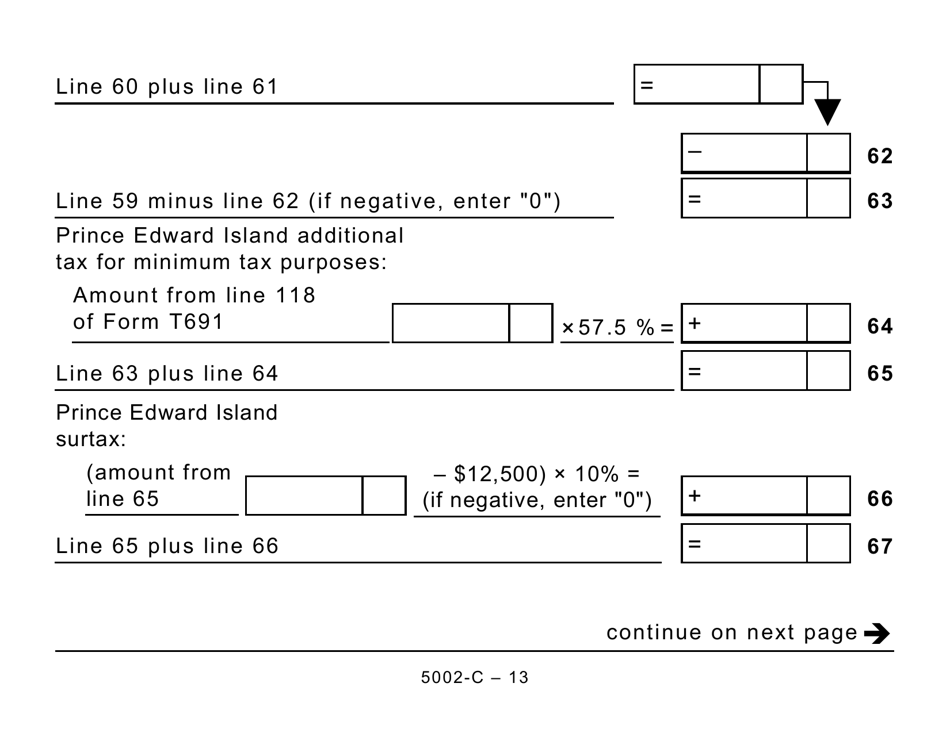

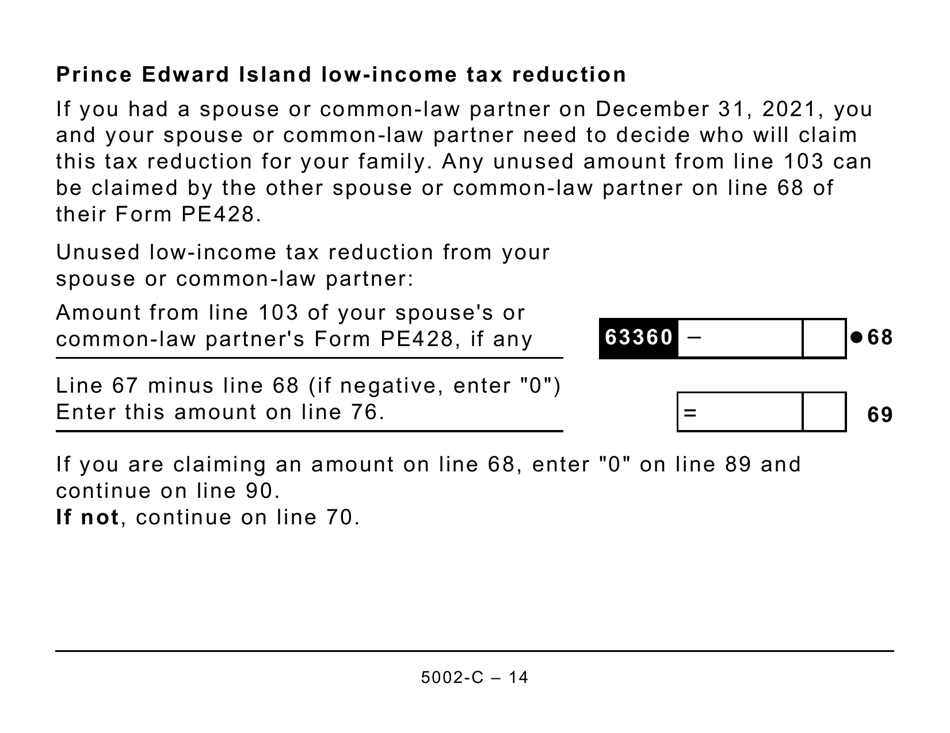

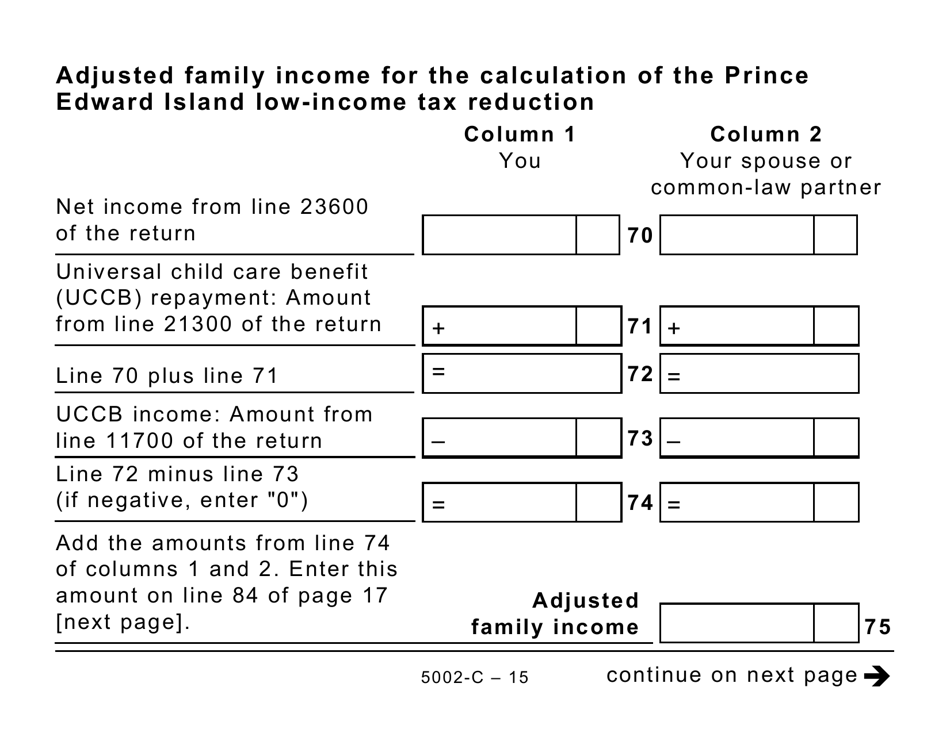

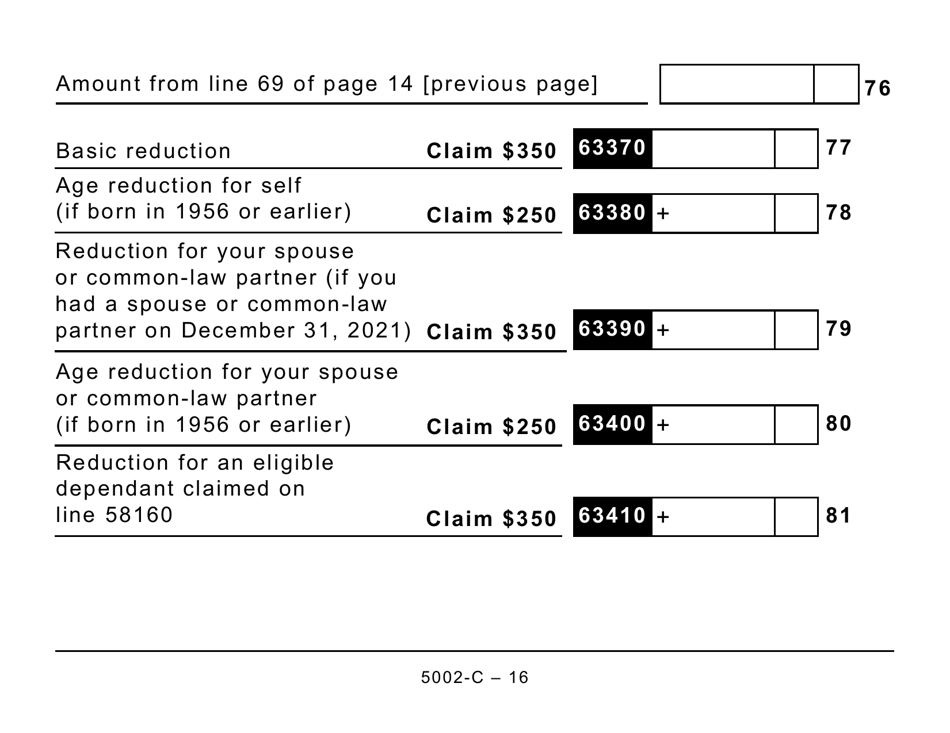

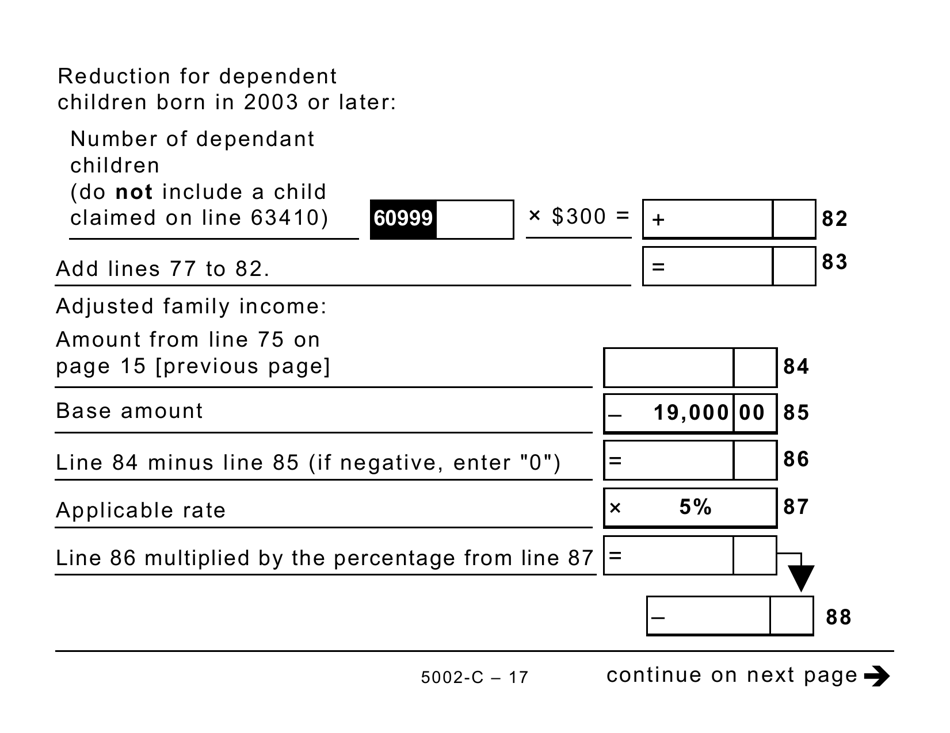

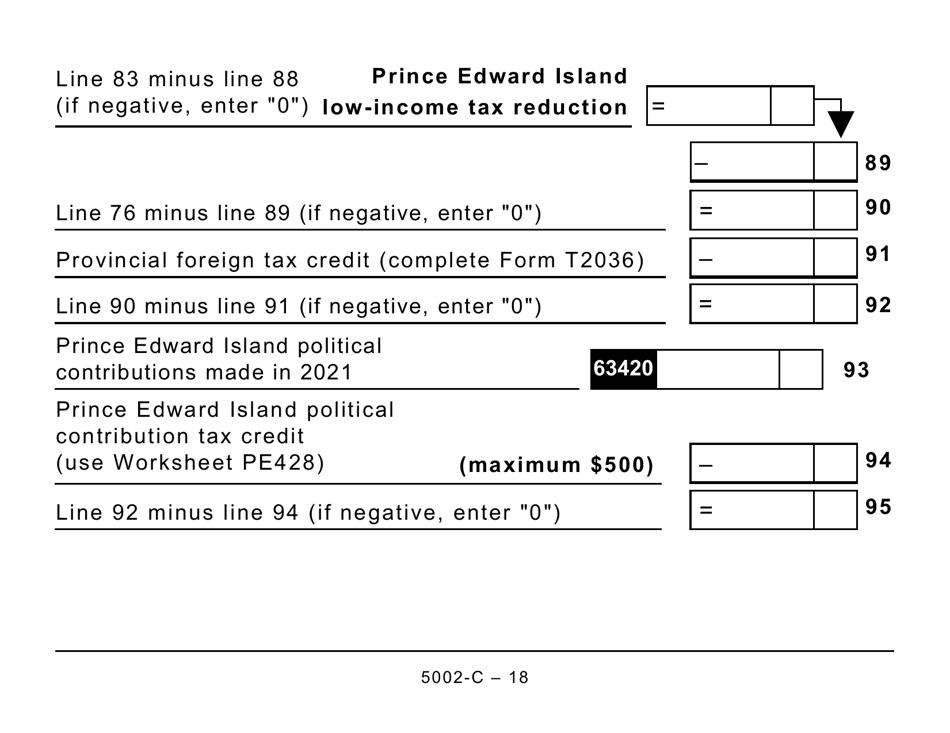

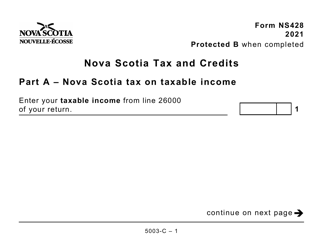

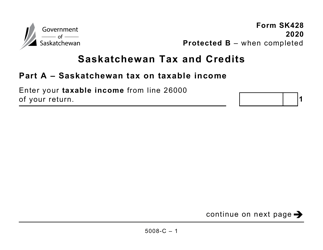

Form PE428 (5002-C) Prince Edward Island Tax and Credits (Large Print) is used by individuals in the Canadian province of Prince Edward Island to report their income and claim tax credits. This particular version of the form is designed for individuals who require a large print format for easier readability. It helps residents of Prince Edward Island fulfill their tax obligations and make use of applicable tax credits available in the province.

The Form PE428 (5002-C) Prince Edward Island Tax and Credits (Large Print) in Canada is typically filed by individuals who are residents of Prince Edward Island and need to report their income, claim tax credits, and pay any applicable taxes to the provincial government. It is important to note that this form is specifically designed for individuals who require a large print format due to visual impairments.

FAQ

Q: What is Form PE428 (5002-C)?

A: Form PE428 (5002-C) is a tax form specific to residents of Prince Edward Island, Canada. It is used to calculate and report provincial tax liability and claim any applicable tax credits.

Q: Who is required to file Form PE428 (5002-C)?

A: Residents of Prince Edward Island, Canada, who have income to report and are liable for provincial taxes are required to file Form PE428 (5002-C).

Q: What is the purpose of Form PE428 (5002-C)?

A: The purpose of Form PE428 (5002-C) is to determine the amount of provincial tax owed by residents of Prince Edward Island and to claim any eligible tax credits.

Q: What information is required to complete Form PE428 (5002-C)?

A: To complete Form PE428 (5002-C), you will need to provide personal information such as your name, address, social insurance number, as well as details about your income, deductions, and credits.

Q: When is the deadline to file Form PE428 (5002-C)?

A: The deadline to file Form PE428 (5002-C) is generally April 30th, or June 15th if you or your spouse or common-law partner is self-employed.

Q: Are there any penalties for filing Form PE428 (5002-C) late?

A: Yes, there may be penalties for filing Form PE428 (5002-C) late. It is important to file your taxes on time to avoid late filing penalties and interest charges on any amount owing.

Q: Can I electronically file Form PE428 (5002-C)?

A: Yes, you can electronically file Form PE428 (5002-C) using certified tax software or through the CRA's Netfile system.

Q: Are there any tax credits available on Form PE428 (5002-C)?

A: Yes, there are various tax credits available on Form PE428 (5002-C) for residents of Prince Edward Island, such as the provincial sales tax credit, property tax credit, and energy efficiency tax credit.

Q: What should I do with Form PE428 (5002-C) after completing it?

A: After completing Form PE428 (5002-C), you should keep a copy for your records and mail the original to the Canada Revenue Agency along with any supporting documents, if required.