This version of the form is not currently in use and is provided for reference only. Download this version of

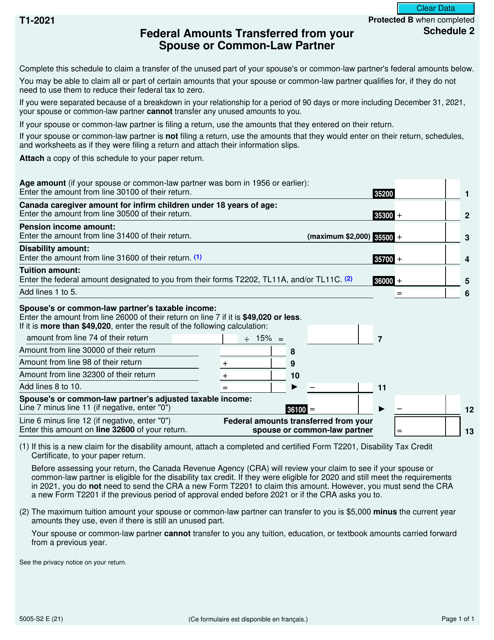

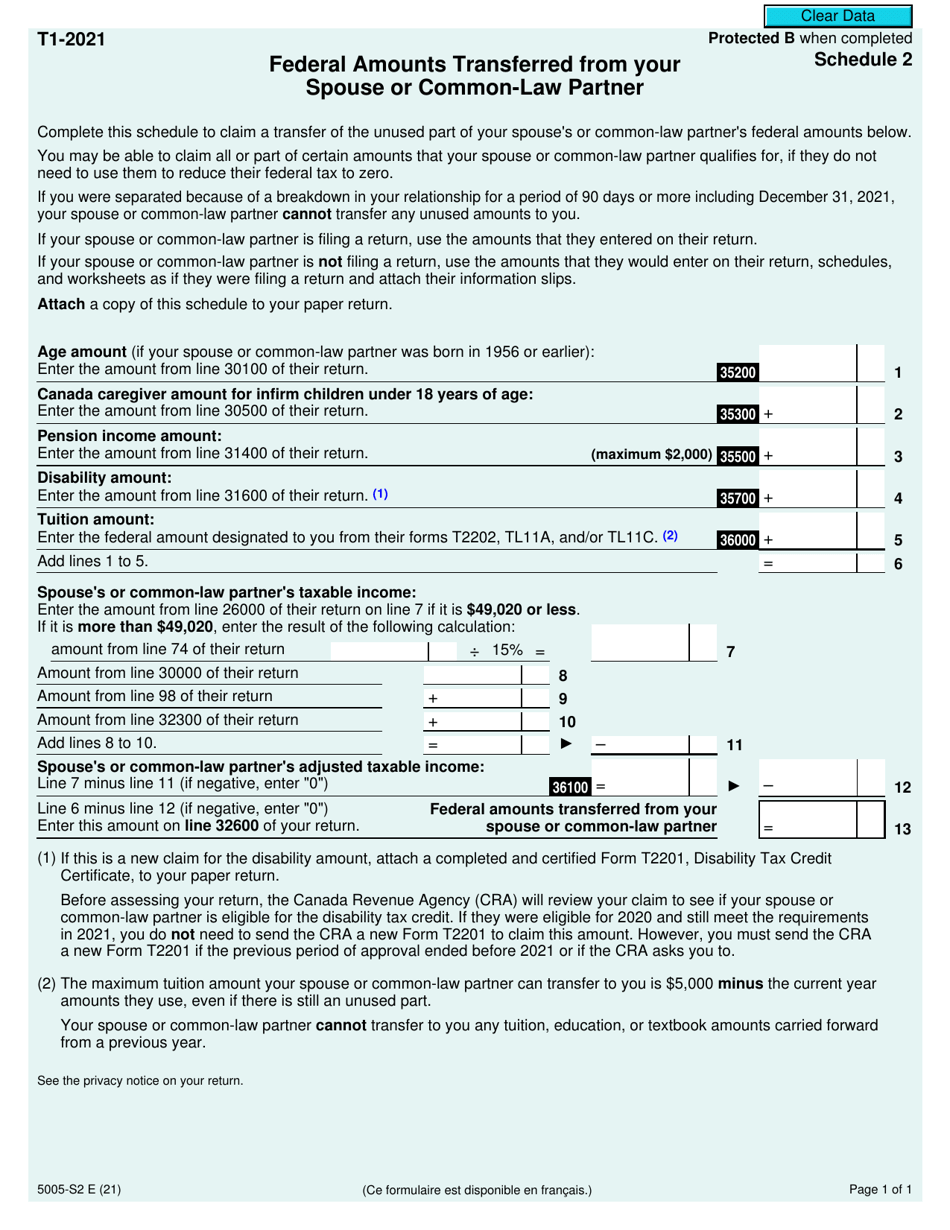

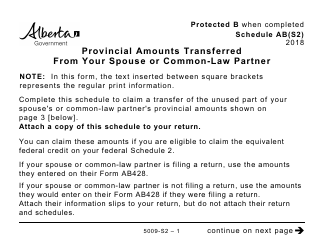

Form 5005-S2 Schedule 2

for the current year.

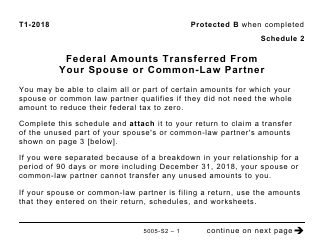

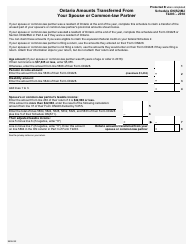

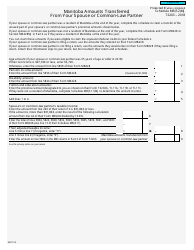

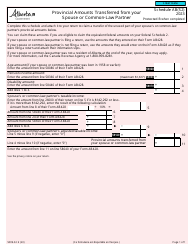

Form 5005-S2 Schedule 2 Federal Amounts Transferred From Your Spouse or Common-Law Partner - Canada

Form 5005-S2 Schedule 2 Federal Amounts Transferred From Your Spouse or Common-Law Partner in Canada is used to report the transfer of certain federal tax credits from your spouse or common-law partner to you. It helps to optimize the use of these credits between the two individuals.

The Form 5005-S2 Schedule 2 Federal Amounts Transferred From Your Spouse or Common-Law Partner in Canada is filed by the individual who is transferring federal amounts to their spouse or common-law partner.

FAQ

Q: What is Form 5005-S2?

A: Form 5005-S2 is a schedule of the Canadian tax form used to report federal amounts transferred from your spouse or common-law partner.

Q: What is the purpose of Schedule 2?

A: Schedule 2 is used to report any federal amounts that you are transferring from your spouse or common-law partner for tax purposes.

Q: Who needs to complete Schedule 2?

A: You need to complete Schedule 2 if you are transferring federal amounts from your spouse or common-law partner for tax purposes.

Q: What are federal amounts transferred from your spouse or common-law partner?

A: Federal amounts transferred from your spouse or common-law partner refer to any tax credits or deductions that your spouse or partner is transferring to you.

Q: Are there any specific requirements for completing Schedule 2?

A: Yes, there are specific requirements for completing Schedule 2 such as providing the necessary information about your spouse or common-law partner and the federal amounts being transferred.

Q: When is the deadline for submitting Schedule 2?

A: The deadline for submitting Schedule 2 is usually the same as the deadline for filing your income tax return, which is April 30th of each year, or June 15th for self-employed individuals.

Q: What should I do if I made a mistake on Schedule 2?

A: If you made a mistake on Schedule 2, you should correct it as soon as possible by contacting the CRA and providing them with the correct information.

Q: Do I need to keep a copy of Schedule 2 for my records?

A: Yes, it is recommended to keep a copy of Schedule 2 for your records in case the CRA requests it for verification or audits.