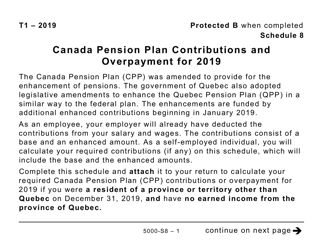

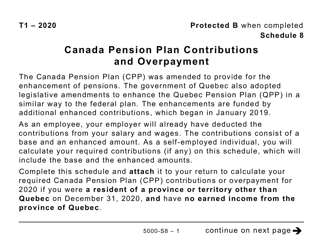

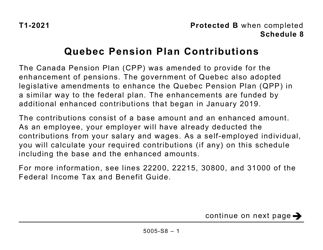

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5005-S8 Schedule 8

for the current year.

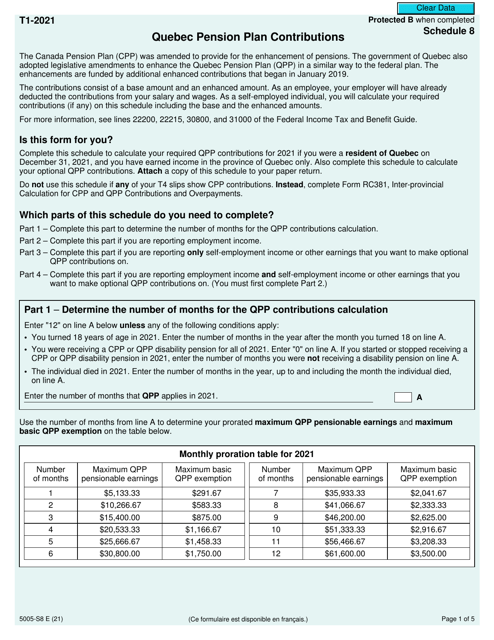

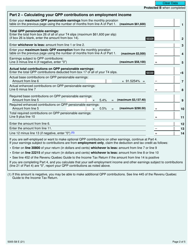

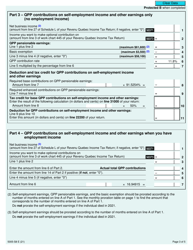

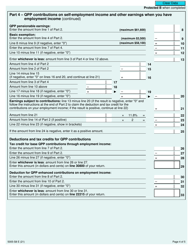

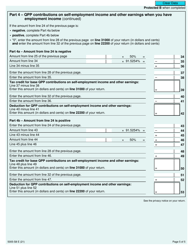

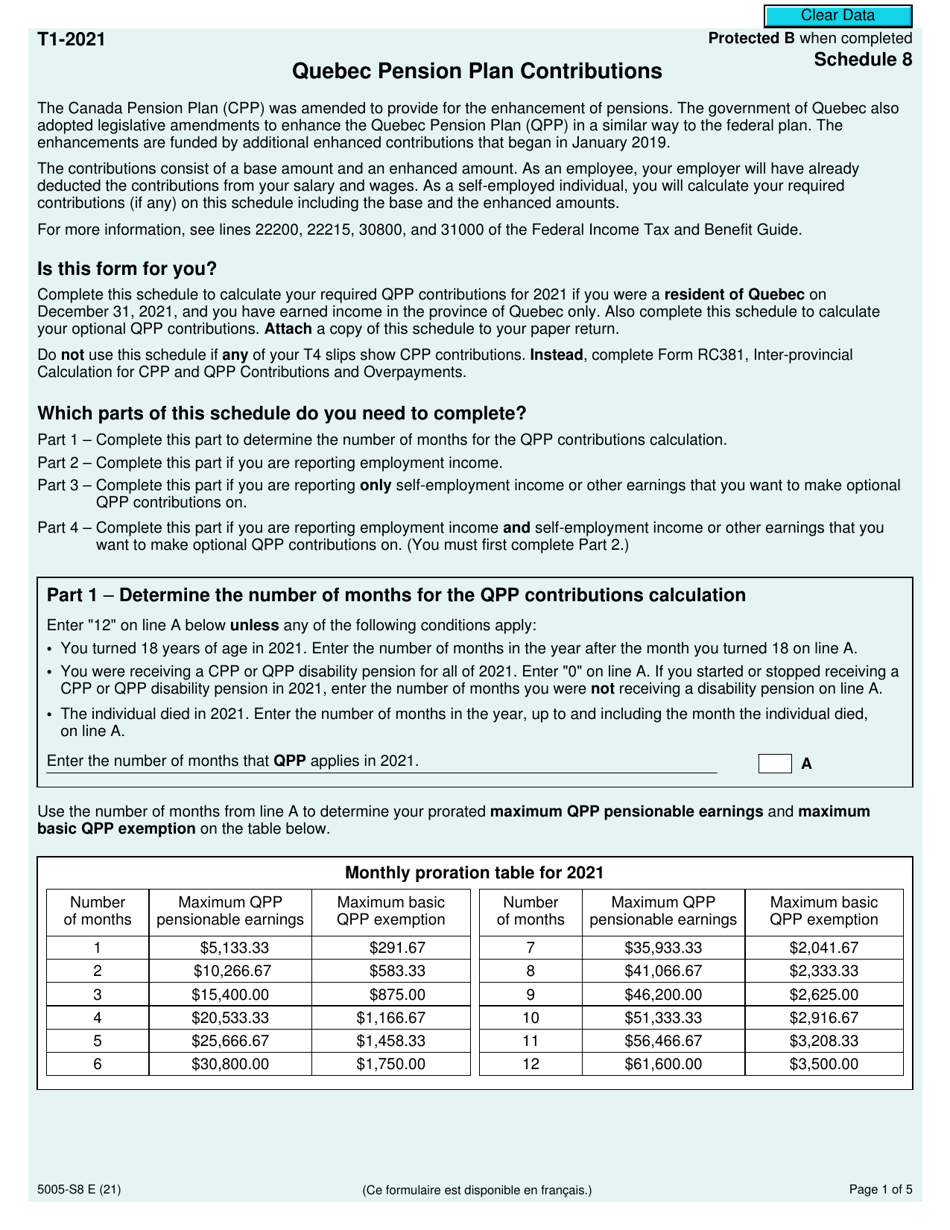

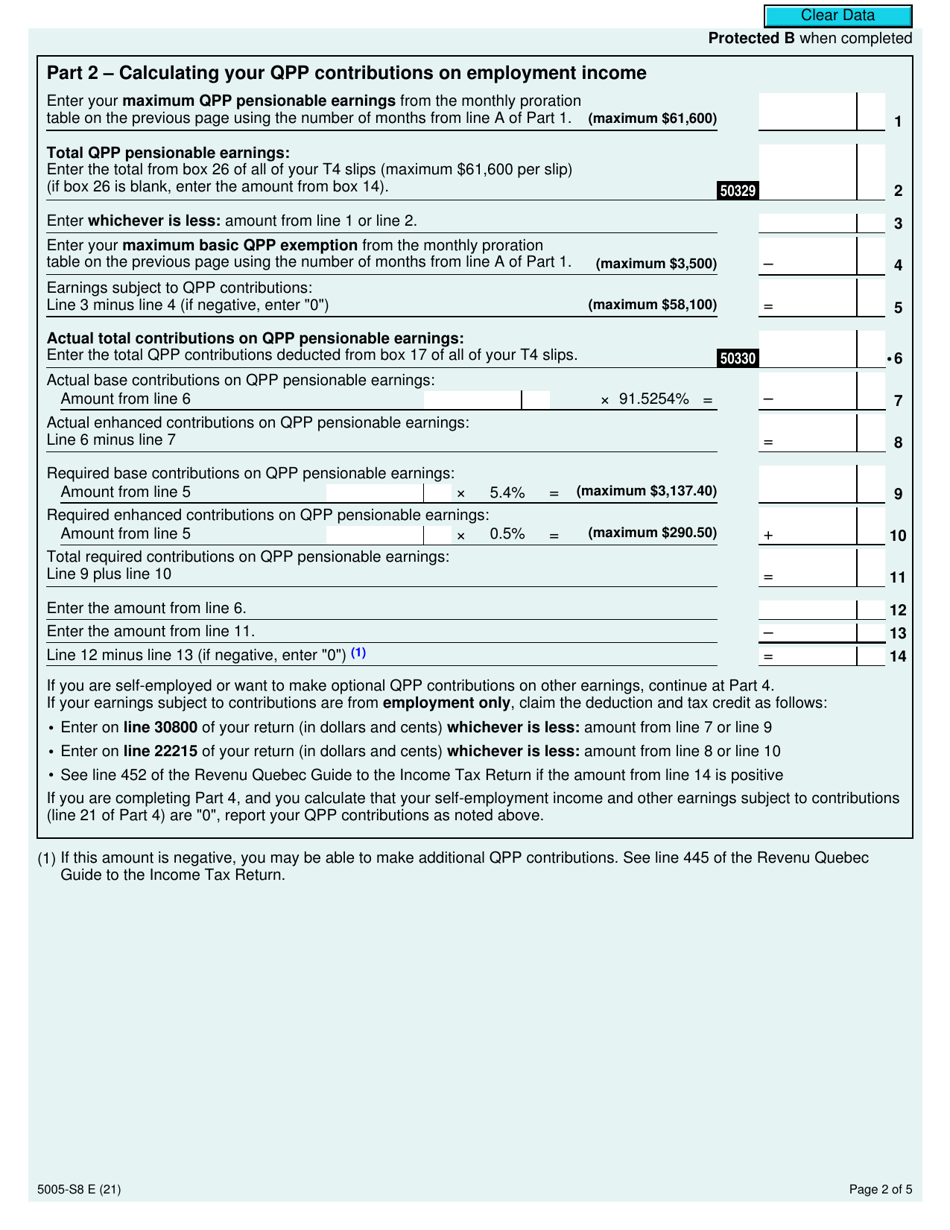

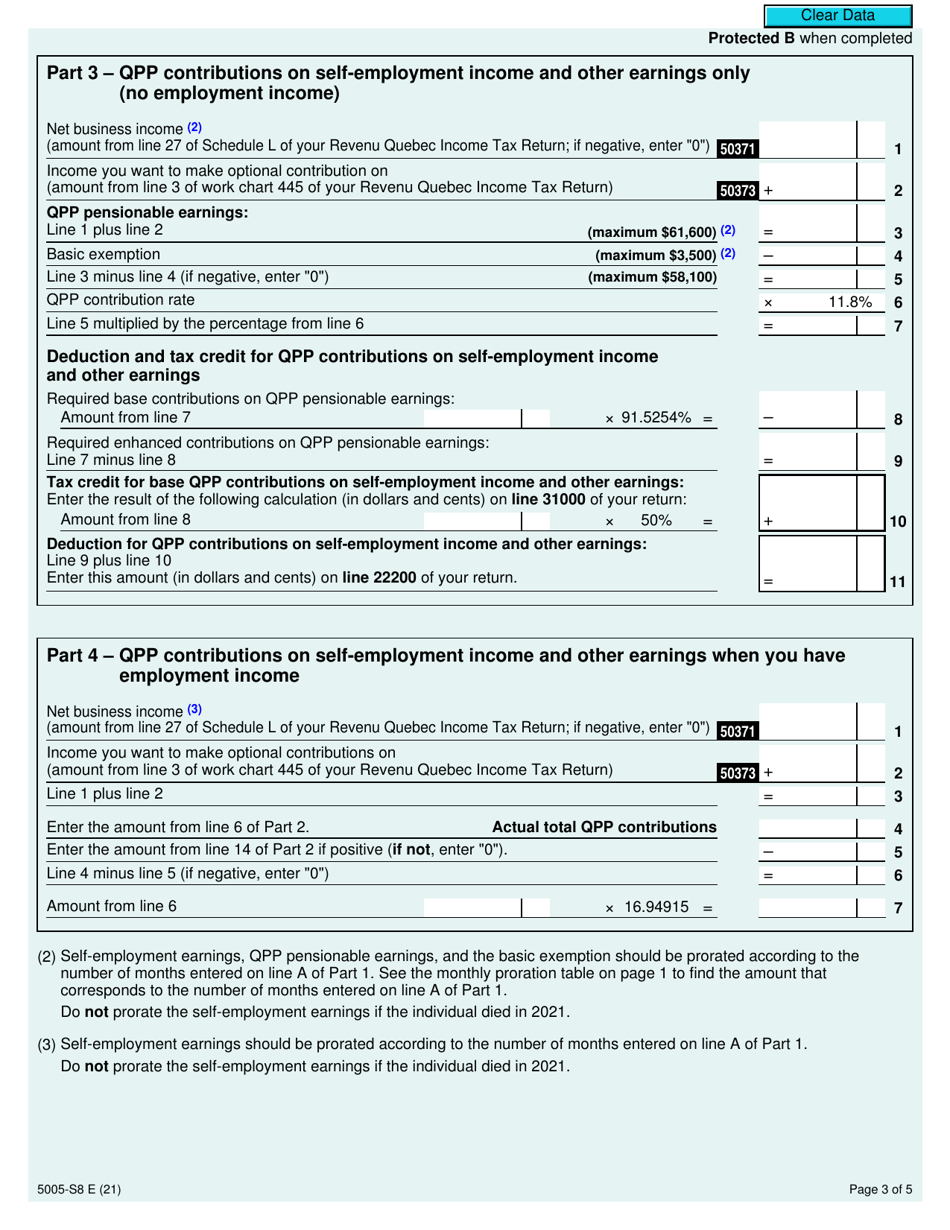

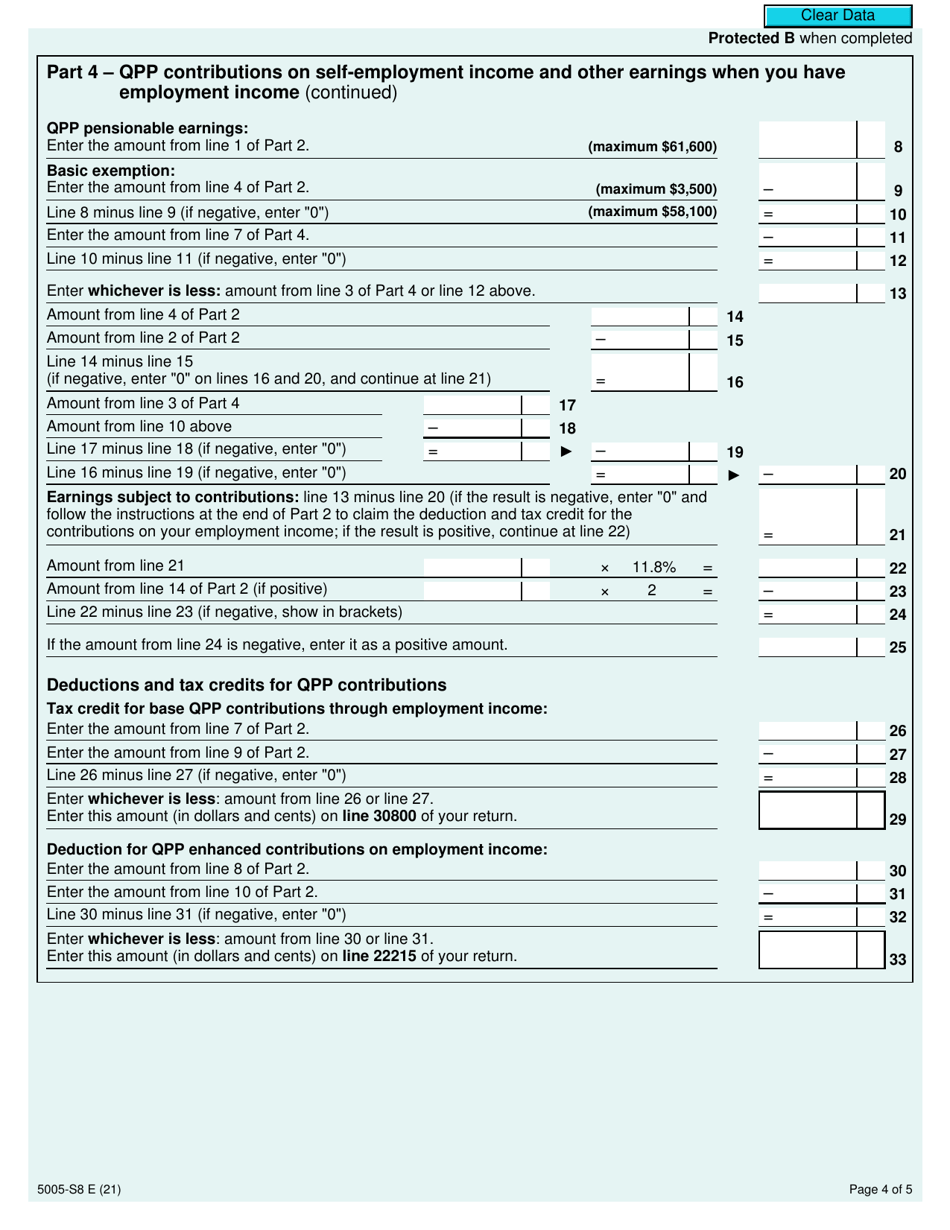

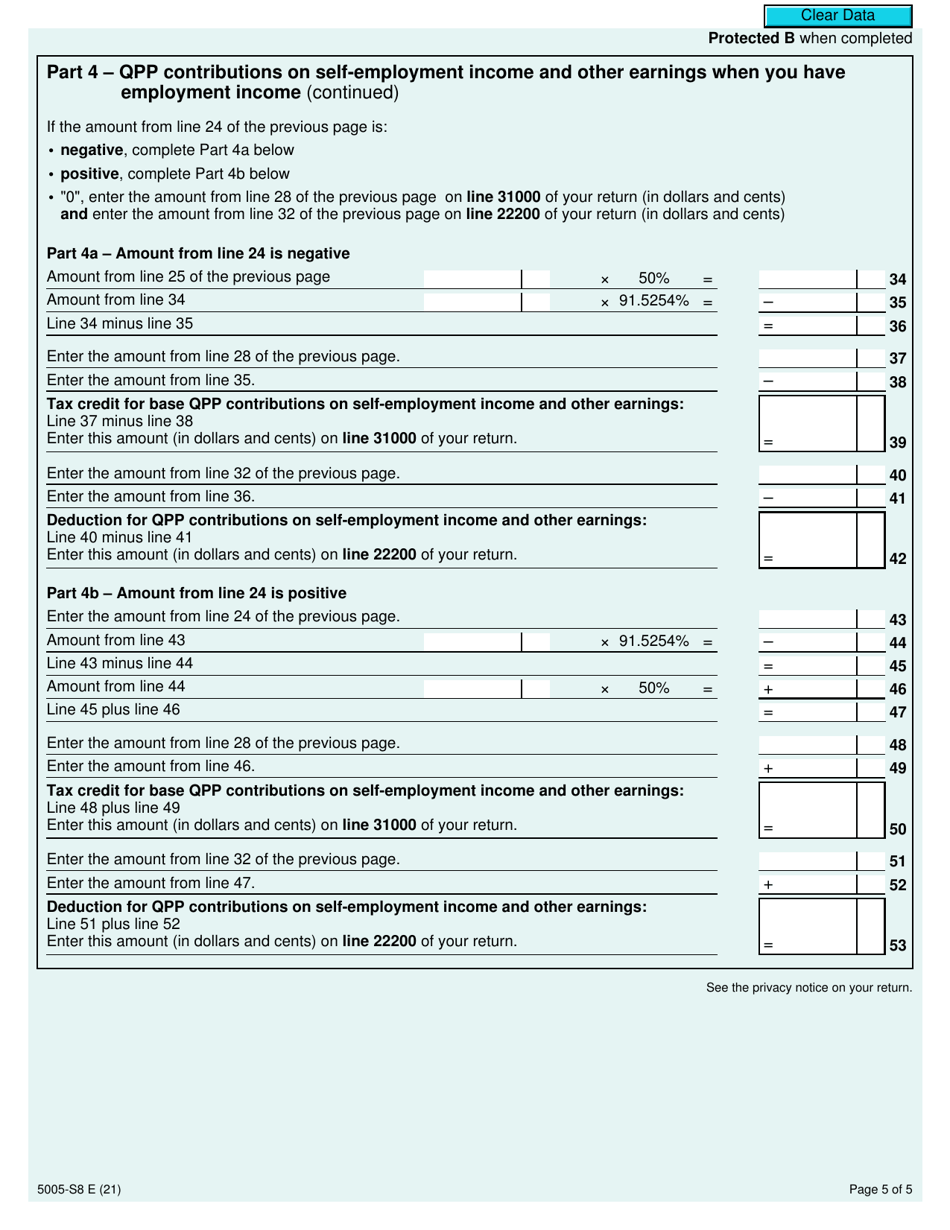

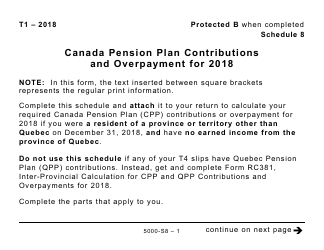

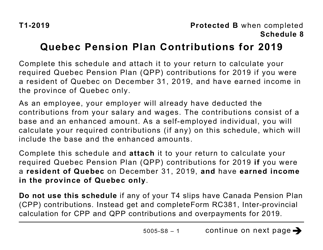

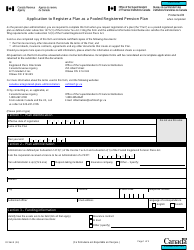

Form 5005-S8 Schedule 8 Quebec Pension Plan Contributions - Canada

Form 5005-S8 Schedule 8 Quebec Pension Plan Contributions in Canada is used to report contributions made to the Quebec Pension Plan (QPP). It calculates the amount of contributions made by an individual or a business towards the QPP for tax purposes.

The form 5005-S8 Schedule 8 Quebec Pension Plan Contributions in Canada is filed by individuals who are residents of Quebec and contribute to the Quebec Pension Plan.

FAQ

Q: What is Form 5005-S8?

A: Form 5005-S8 is a tax form for reporting Quebec Pension Plan contributions in Canada.

Q: What is Schedule 8?

A: Schedule 8 is a specific section of the Form 5005-S8 that is used to report Quebec Pension Plan contributions.

Q: What are Quebec Pension Plan contributions?

A: Quebec Pension Plan contributions are payments made by individuals in Quebec to fund their retirement benefits.

Q: Who needs to complete Form 5005-S8 Schedule 8?

A: Individuals who are residents of Quebec and have made contributions to the Quebec Pension Plan need to complete Form 5005-S8 Schedule 8.

Q: How do I complete Form 5005-S8 Schedule 8?

A: To complete Form 5005-S8 Schedule 8, you need to provide details about your Quebec Pension Plan contributions and calculate the total amount contributed.

Q: Is Form 5005-S8 Schedule 8 required for all Canadians?

A: No, Form 5005-S8 Schedule 8 is specifically for residents of Quebec who have made contributions to the Quebec Pension Plan.