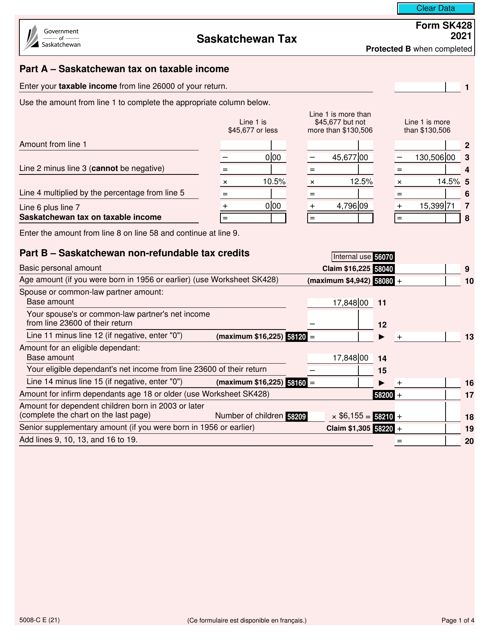

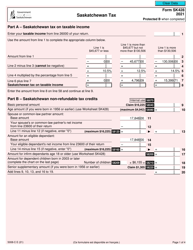

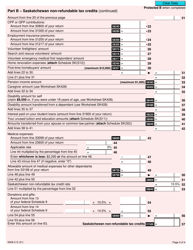

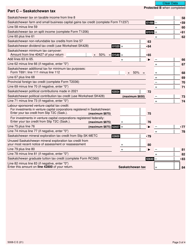

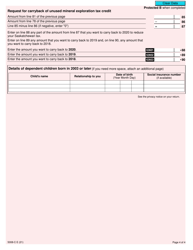

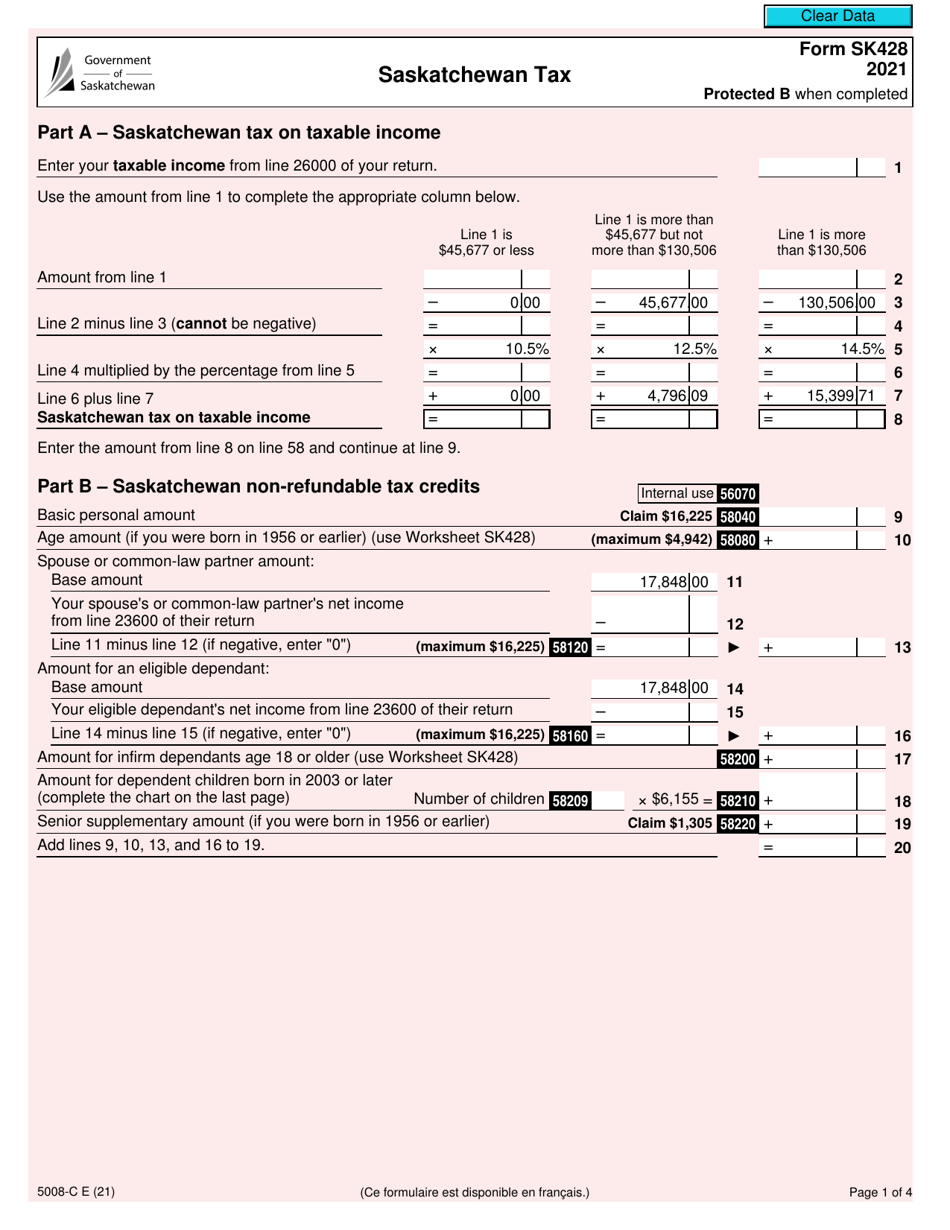

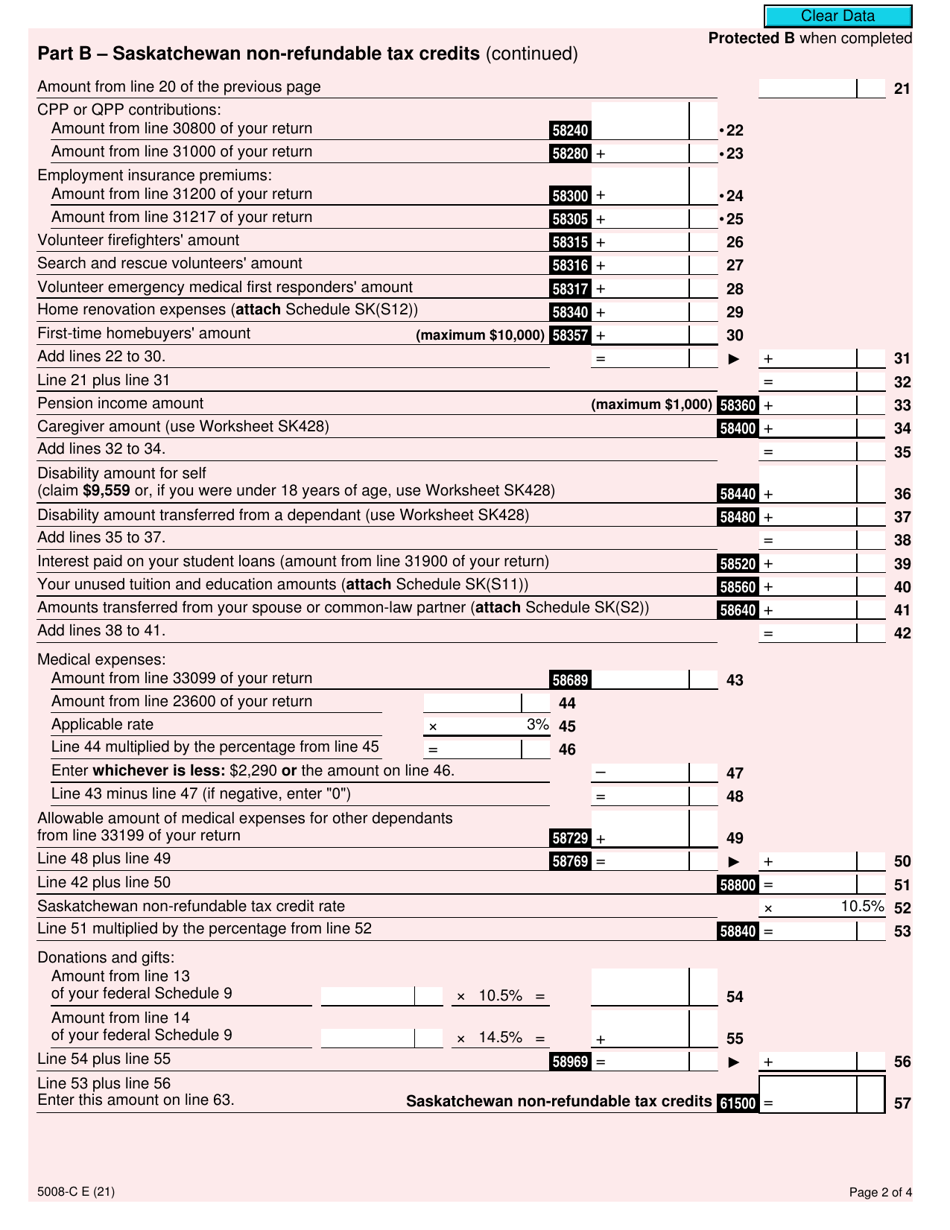

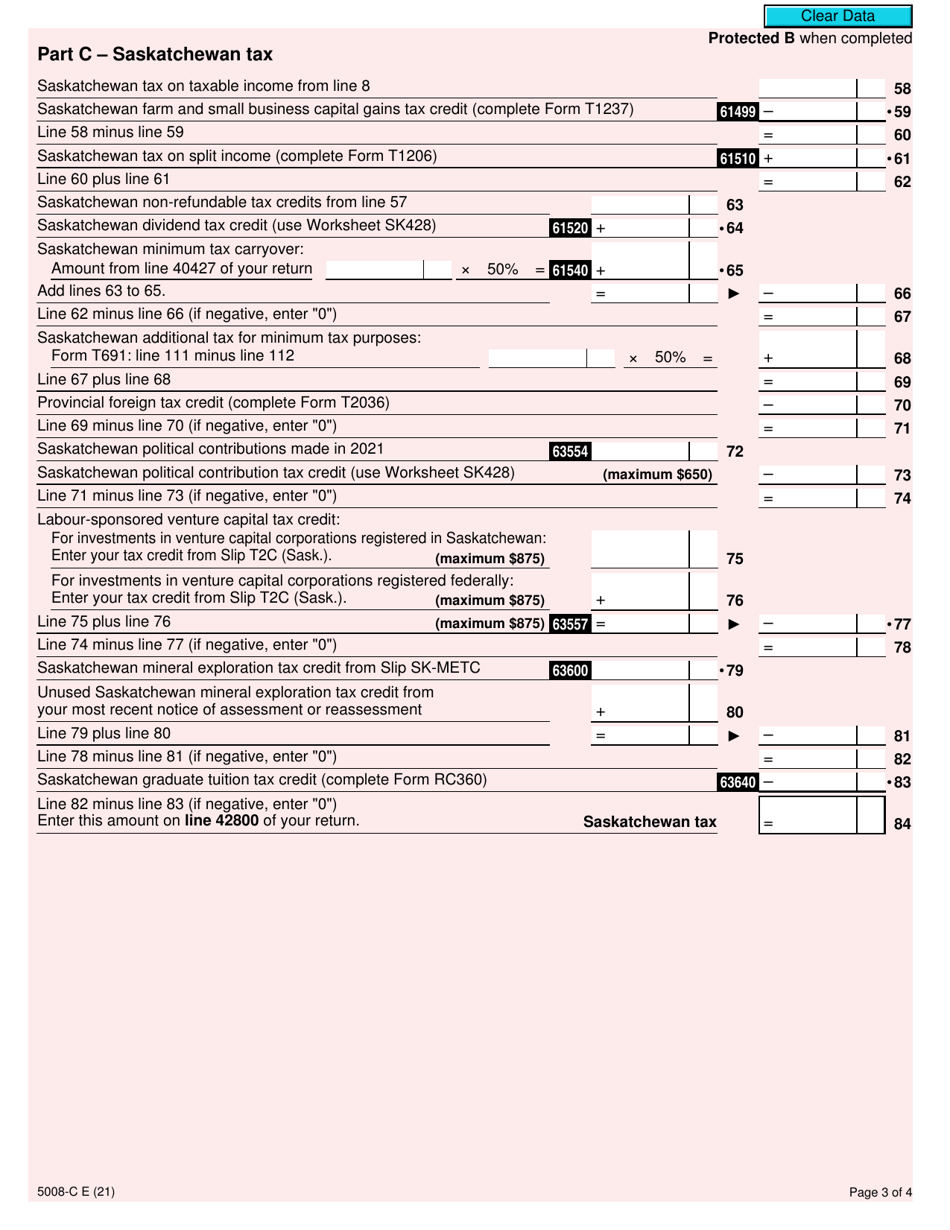

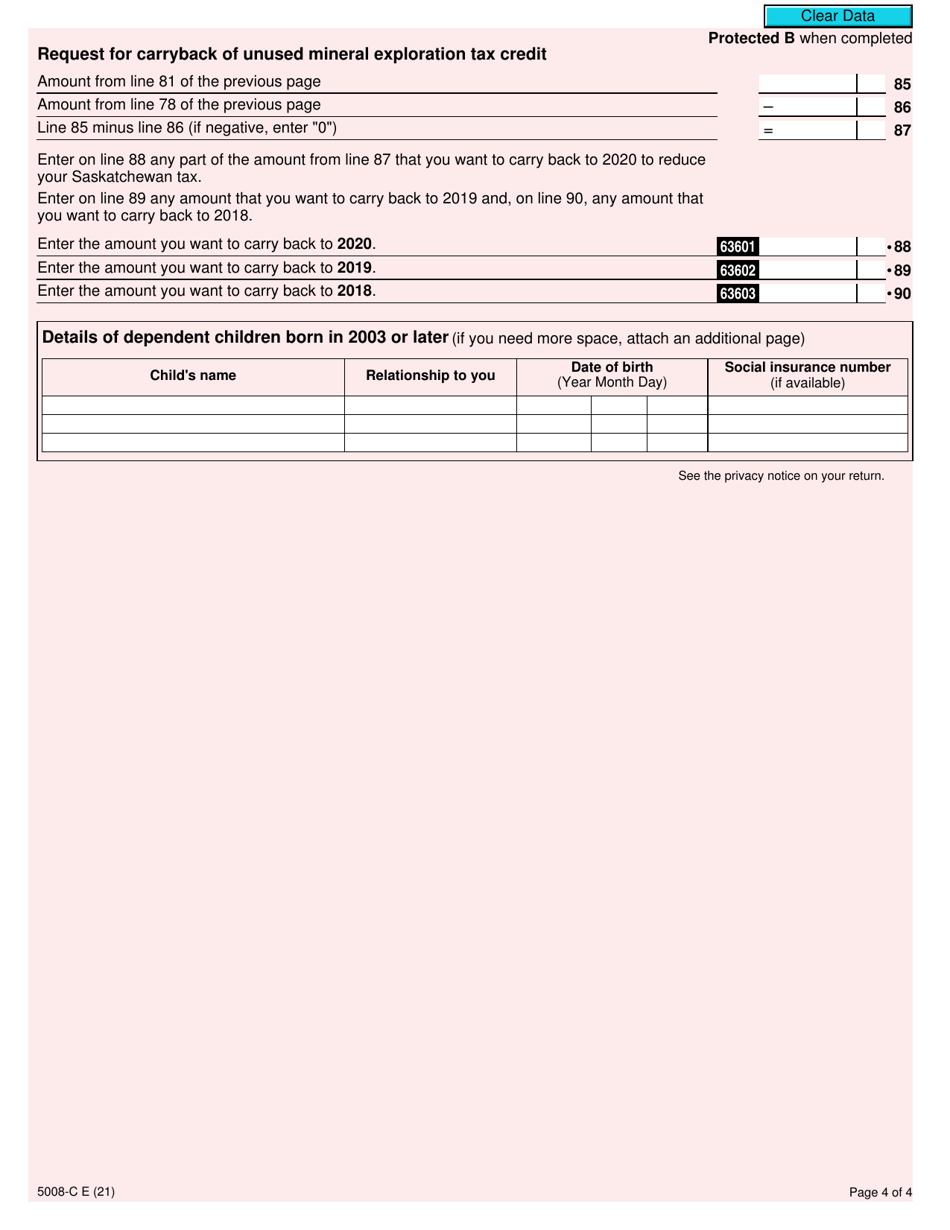

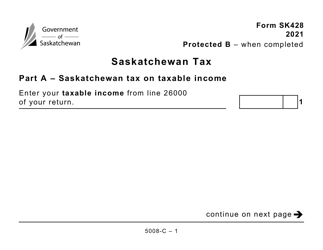

Form SK428 (5008-C) Saskatchewan Tax - Canada

Form SK428 (5008-C) Saskatchewan Tax - Canada is used to calculate and report your provincial tax liability in the province of Saskatchewan, Canada. It is specifically for residents of Saskatchewan who need to file their provincial taxes.

The Form SK428 (5008-C) Saskatchewan Tax in Canada is filed by individuals who are residents of Saskatchewan and need to report their provincial income tax.

FAQ

Q: What is Form SK428 (5008-C)?

A: Form SK428 (5008-C) is the Saskatchewan Tax form in Canada.

Q: Who needs to fill out Form SK428 (5008-C)?

A: Residents of Saskatchewan in Canada who need to report their provincial taxes.

Q: What information is required on Form SK428 (5008-C)?

A: Form SK428 (5008-C) requires information about your income, deductions, and credits for Saskatchewan taxes.

Q: When is the deadline for filing Form SK428 (5008-C)?

A: The deadline for filing Form SK428 (5008-C) is usually April 30th, unless it falls on a weekend or holiday, in which case it is the next business day.

Q: What happens if I don't file Form SK428 (5008-C)?

A: If you are required to file Form SK428 (5008-C) and fail to do so, you may face penalties and interest charges.