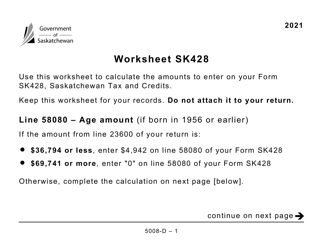

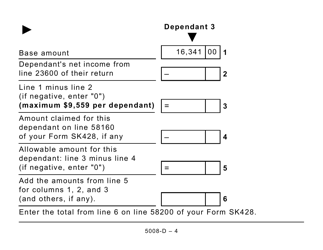

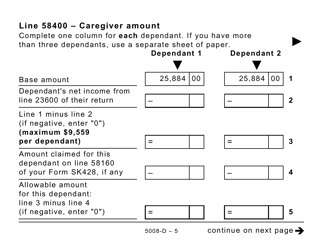

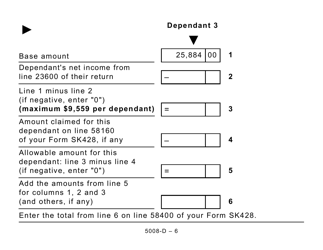

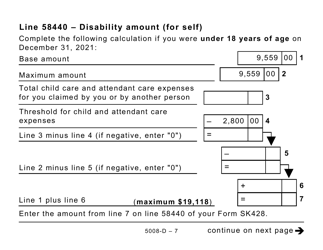

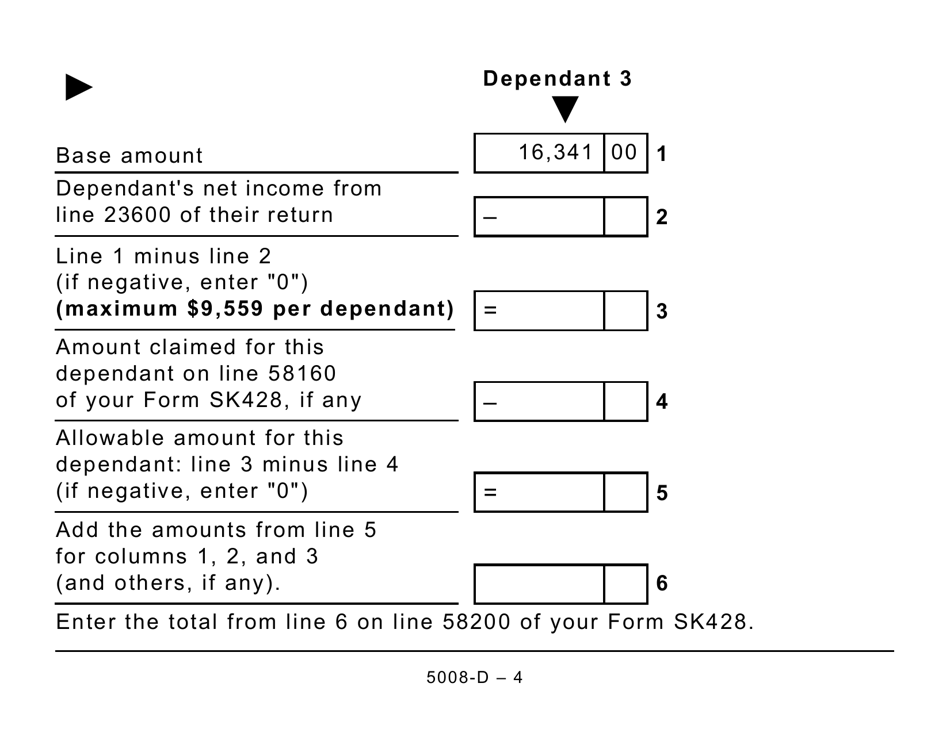

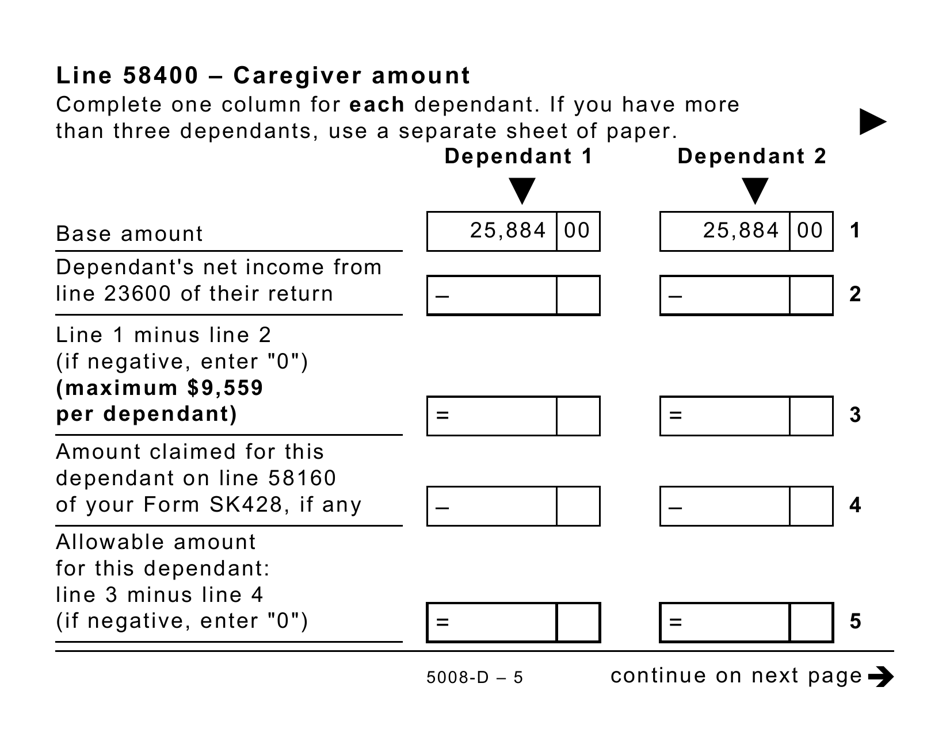

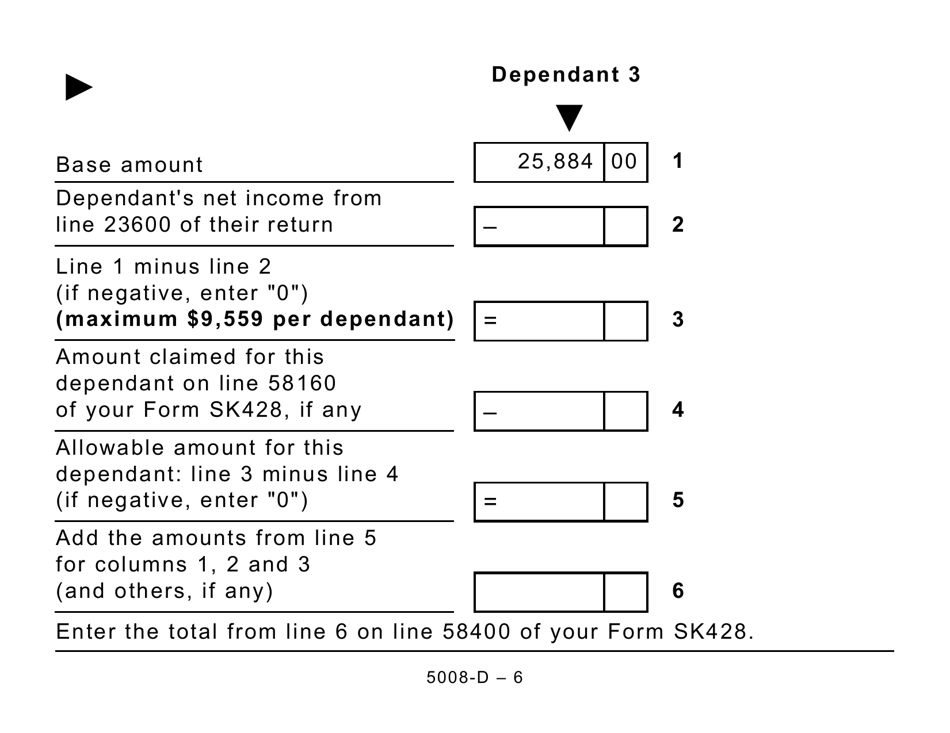

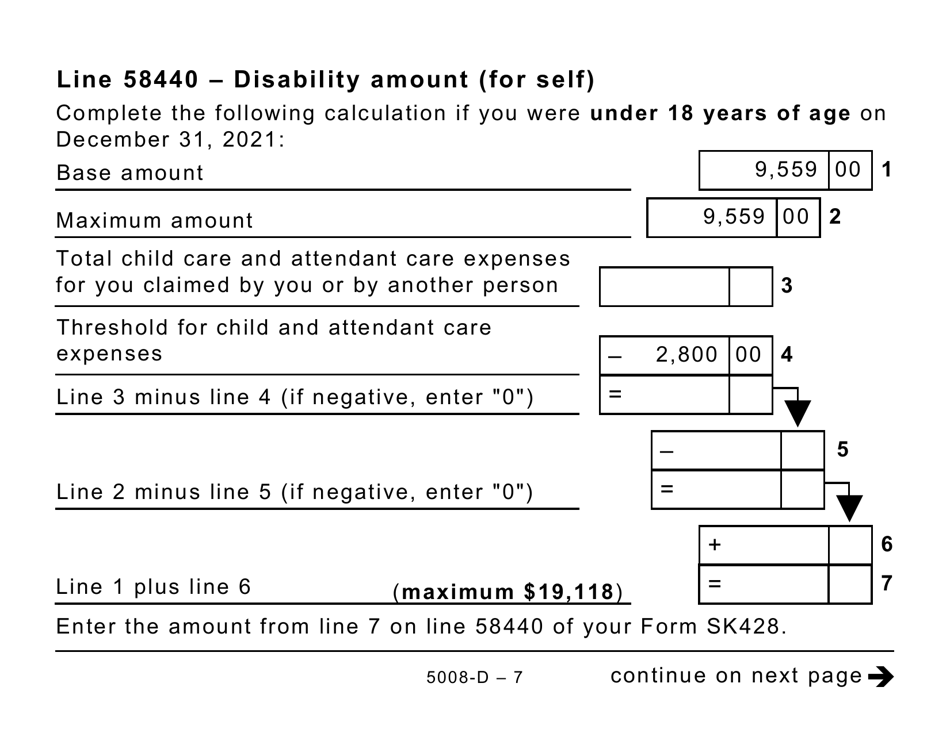

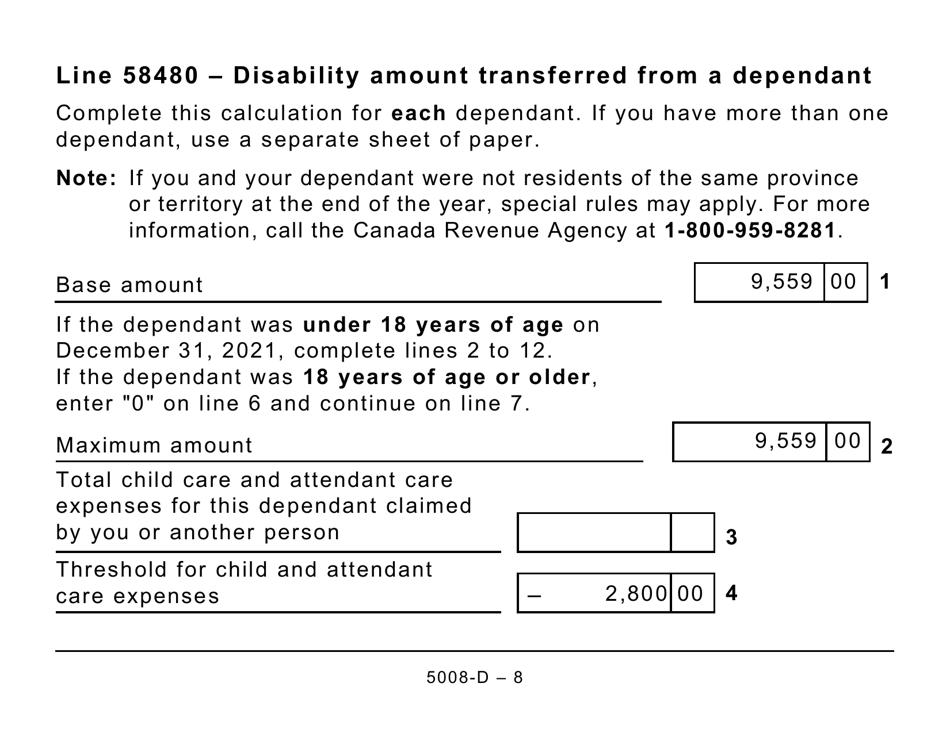

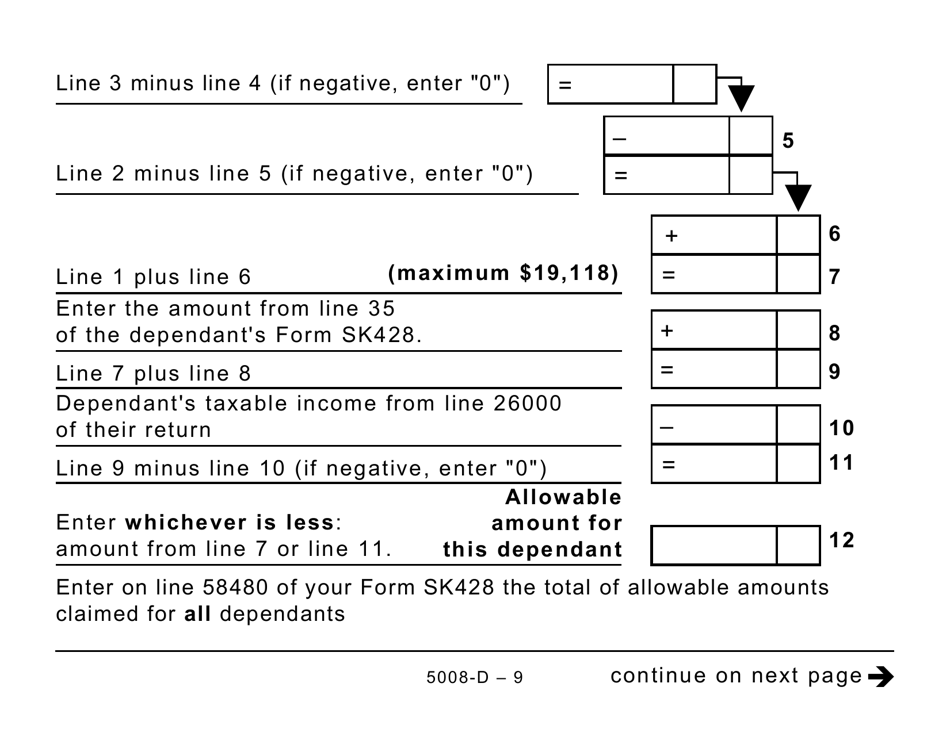

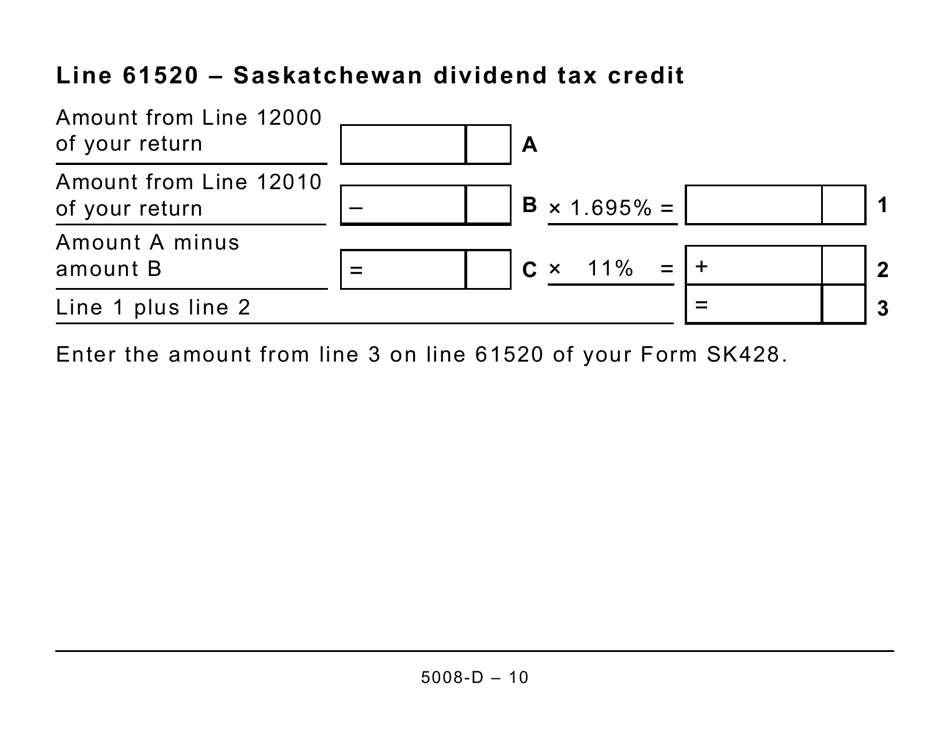

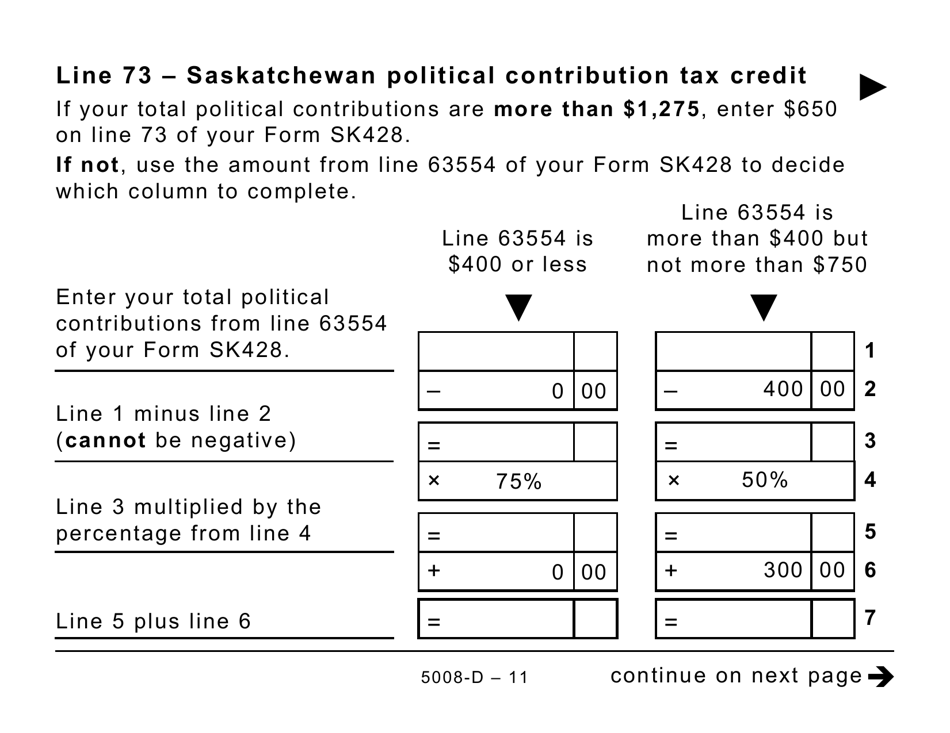

Form 5008-D Worksheet SK428 Saskatchewan Tax (Large Print) - Canada

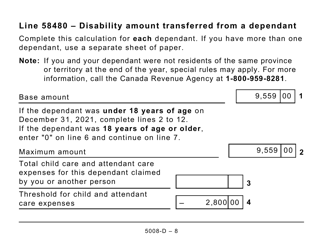

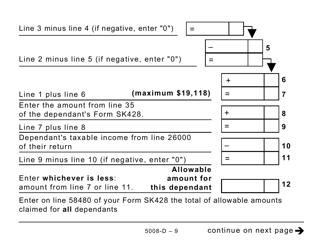

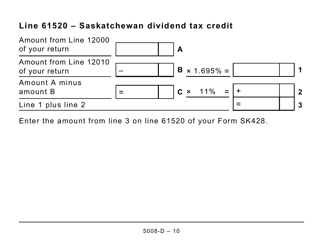

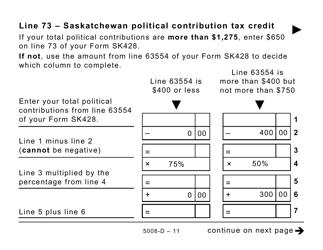

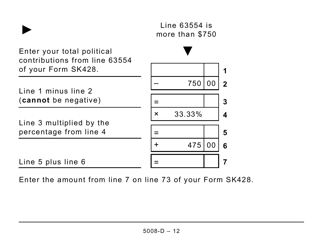

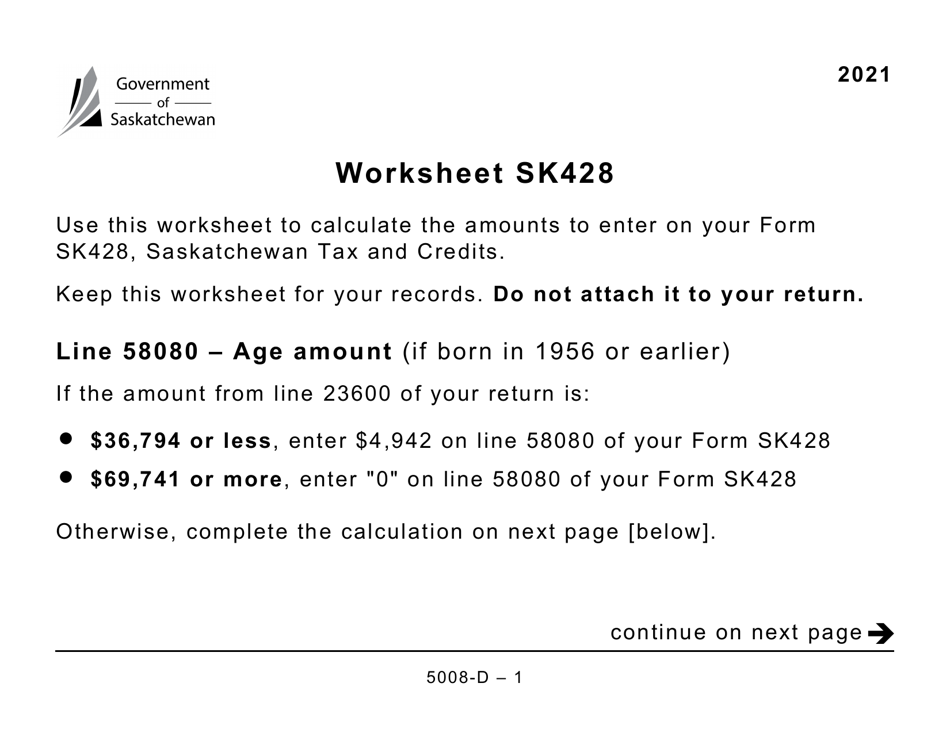

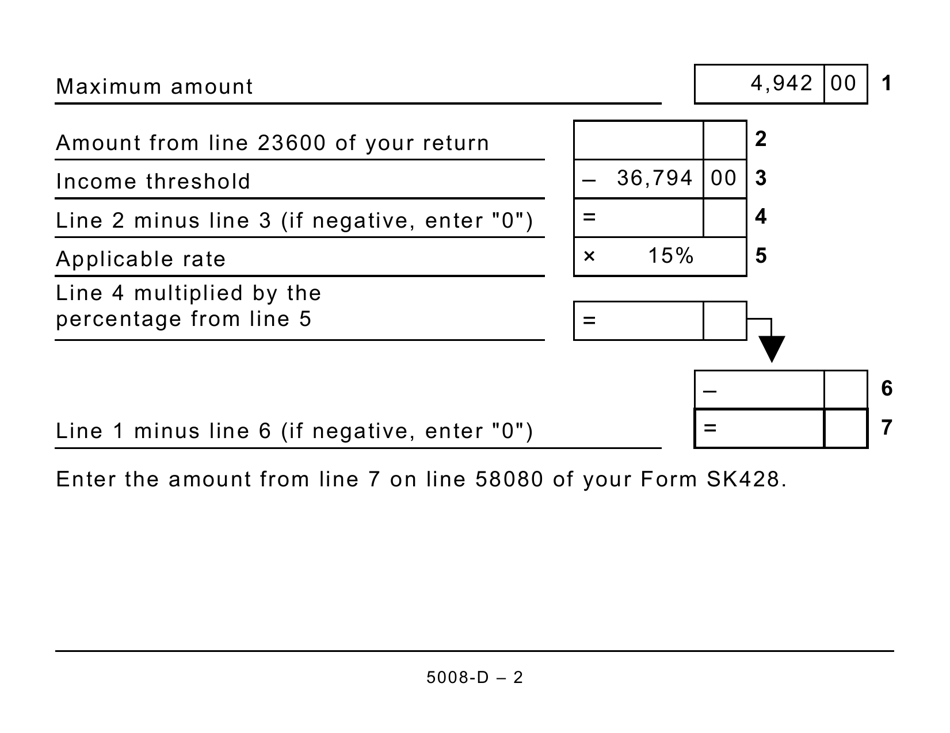

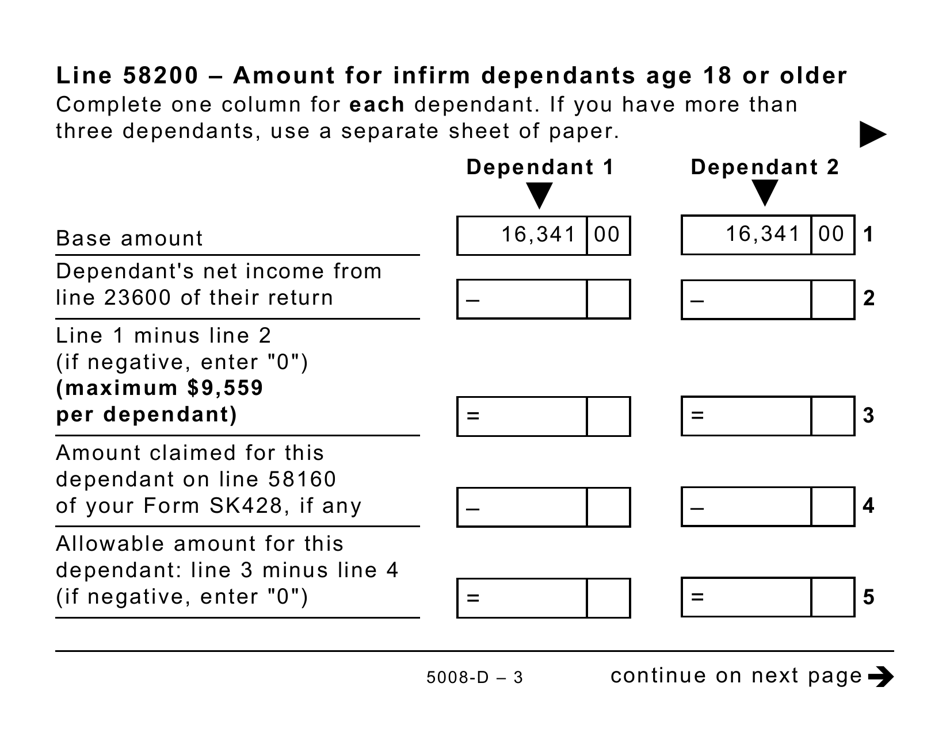

Form 5008-D Worksheet SK428 Saskatchewan Tax (Large Print) - Canada is a worksheet used to calculate the provincial tax owed in the province of Saskatchewan.

The taxpayer who resides in Saskatchewan, Canada, is responsible for filing the Form 5008-D Worksheet SK428 Saskatchewan Tax (Large Print).

FAQ

Q: What is form 5008-D?

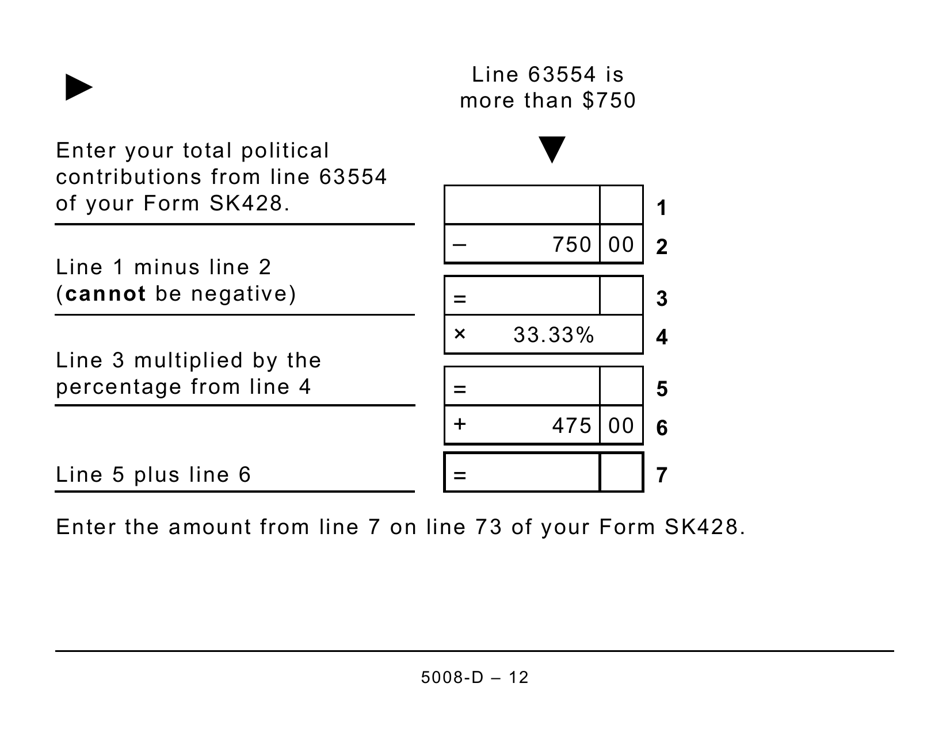

A: Form 5008-D is a worksheet used for calculating Saskatchewan tax in Canada.

Q: What is SK428?

A: SK428 is the code used for the Saskatchewan tax return form in Canada.

Q: Who needs to use form 5008-D?

A: Residents of Saskatchewan who need to calculate their provincial tax in Canada.

Q: Is form 5008-D available in large print?

A: Yes, form 5008-D is available in large print for individuals who require it.

Q: Can form 5008-D be filed electronically?

A: No, form 5008-D cannot be filed electronically and must be submitted in paper format.

Q: What information is required to complete form 5008-D?

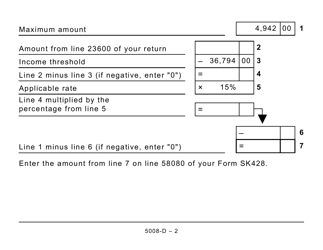

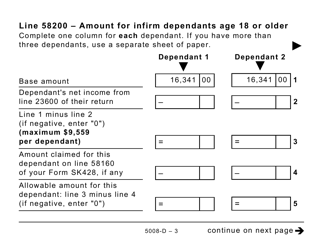

A: Form 5008-D requires information such as income, deductions, and tax credits specific to Saskatchewan.

Q: Can I use form 5008-D if I am not a resident of Saskatchewan?

A: No, form 5008-D is specifically for residents of Saskatchewan only.

Q: When is the deadline to file form 5008-D?

A: The deadline to file form 5008-D is usually April 30th of the following year, unless extended by the CRA.

Q: What should I do if I make a mistake on form 5008-D?

A: If you make a mistake on form 5008-D, you should correct it and submit a revised form to the CRA.