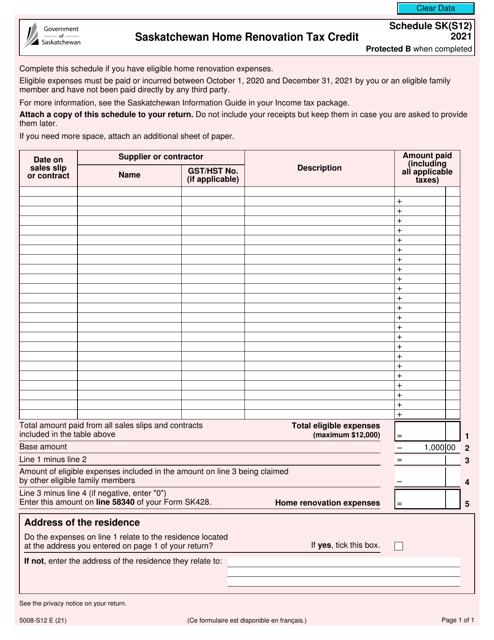

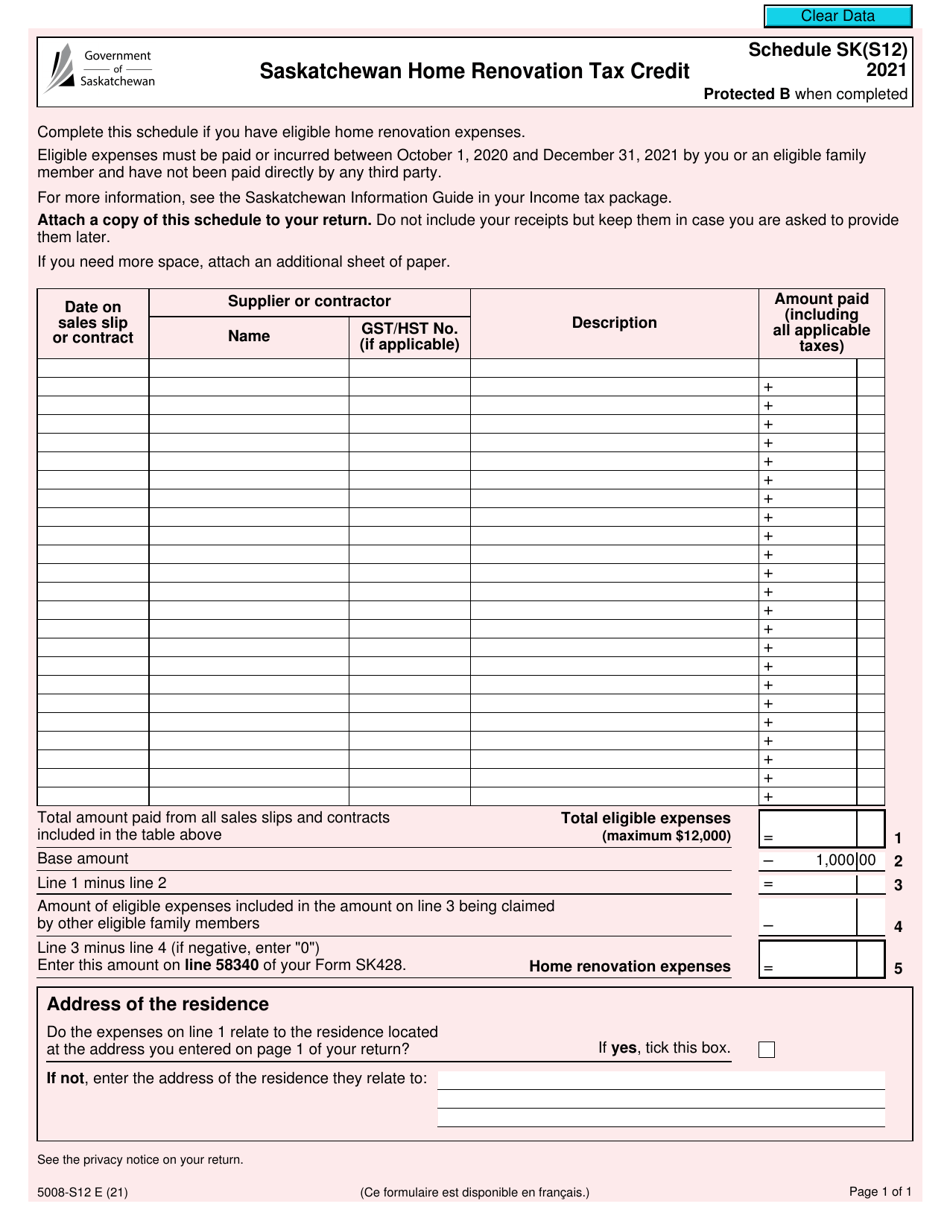

Form 5008-S12 Schedule SK(S12) Saskatchewan Home Renovation Tax Credit - Saskatchewan, Canada

Form 5008-S12 Schedule SK(S12) is used for claiming the Saskatchewan Home RenovationTax Credit in Saskatchewan, Canada. This credit allows residents to claim eligible expenses for home renovations or improvements on their provincial tax return.

The Form 5008-S12 Schedule SK(S12) for the Saskatchewan Home Renovation Tax Credit in Saskatchewan, Canada is filed by individual taxpayers who are claiming this tax credit.

FAQ

Q: What is Form 5008-S12?

A: Form 5008-S12 is the Schedule SK(S12) used for claiming the Saskatchewan Home Renovation Tax Credit.

Q: What is the Saskatchewan Home Renovation Tax Credit?

A: The Saskatchewan Home Renovation Tax Credit is a tax credit available to residents of Saskatchewan, Canada, who have made eligible home renovation expenses.

Q: Who is eligible for the Saskatchewan Home Renovation Tax Credit?

A: Residents of Saskatchewan, Canada, who have made eligible home renovation expenses are eligible for the tax credit.

Q: What are eligible home renovation expenses?

A: Eligible home renovation expenses include expenses related to improving, maintaining, or repairing a principal residence in Saskatchewan.

Q: How do I claim the Saskatchewan Home Renovation Tax Credit?

A: You can claim the tax credit by completing Form 5008-S12 (Schedule SK(S12)) and including it with your Saskatchewan personal income tax return.

Q: When is the deadline to claim the Saskatchewan Home Renovation Tax Credit?

A: The deadline to claim the tax credit is usually the same as the deadline to file your Saskatchewan personal income tax return, which is April 30th of the following year.

Q: Is there a maximum amount I can claim for the Saskatchewan Home Renovation Tax Credit?

A: Yes, there is a maximum claim amount for the tax credit, which is currently set at $2,100.

Q: Are there any other requirements to be eligible for the Saskatchewan Home Renovation Tax Credit?

A: Yes, there are additional requirements, such as having paid the renovation expenses yourself and having the supporting documentation to prove the expenses.

Q: Can I claim the Saskatchewan Home Renovation Tax Credit for rental properties?

A: No, the tax credit is only available for expenses related to improving, maintaining, or repairing a principal residence in Saskatchewan.