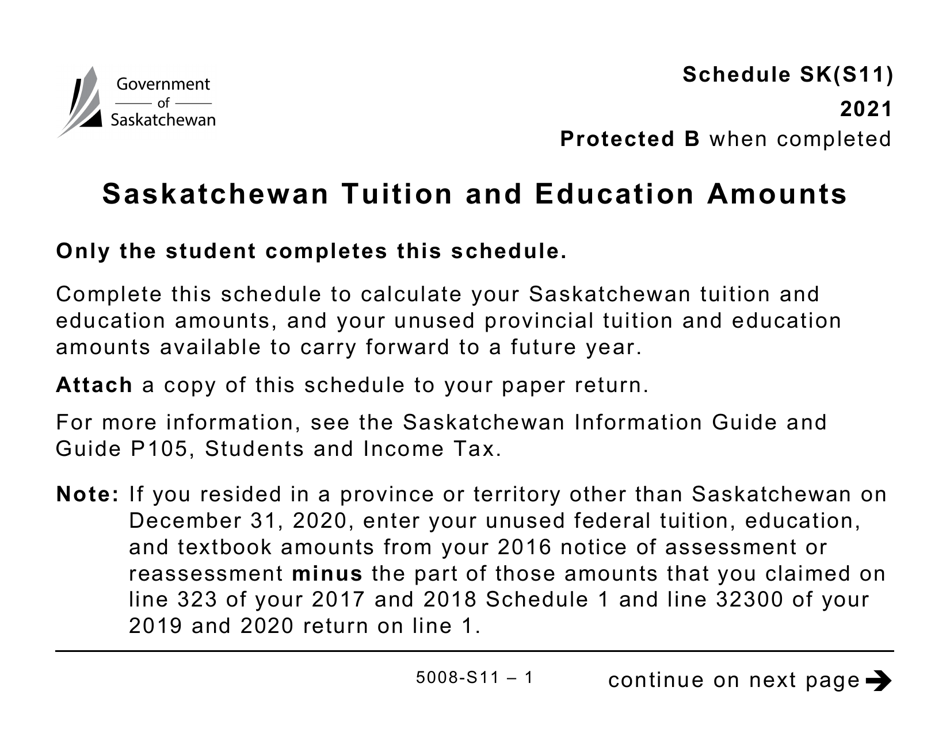

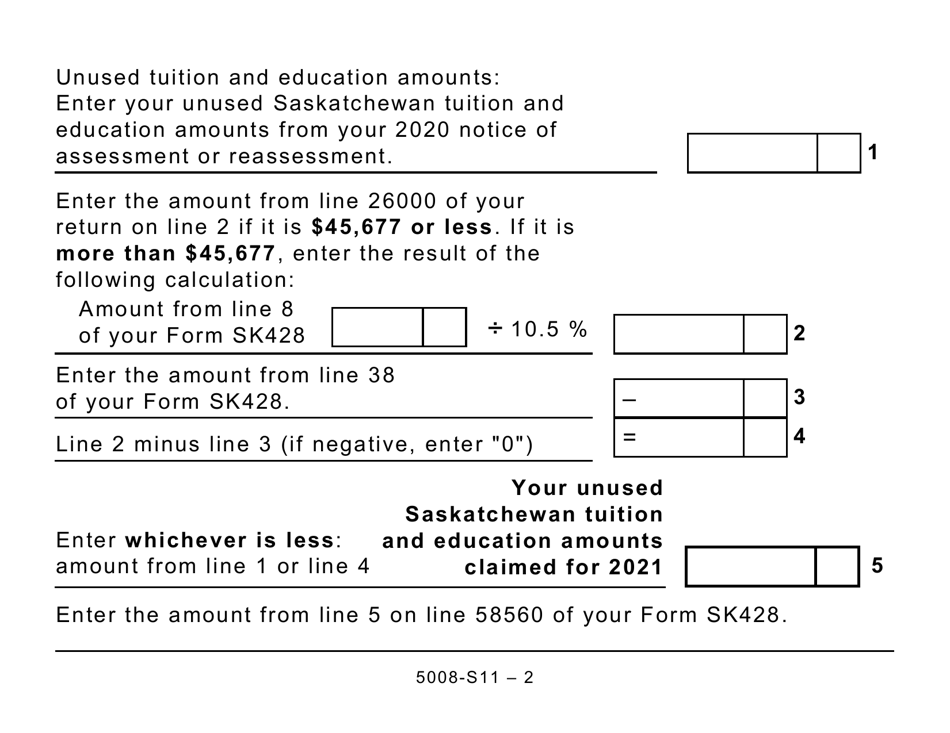

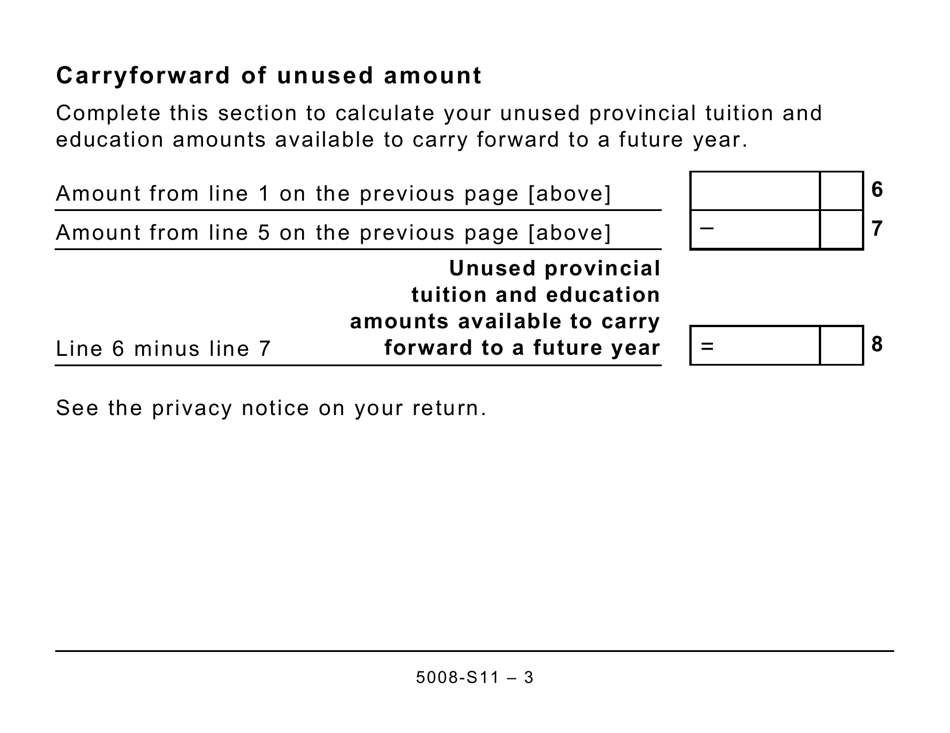

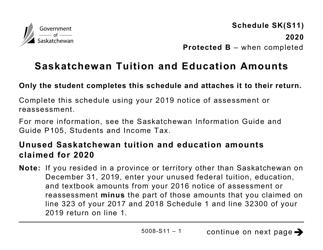

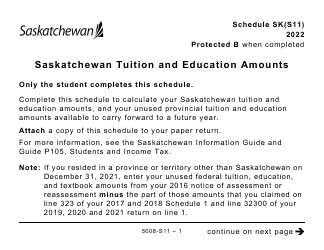

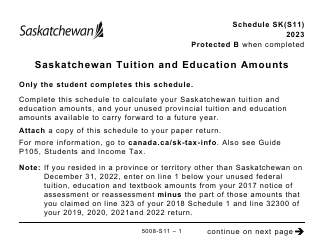

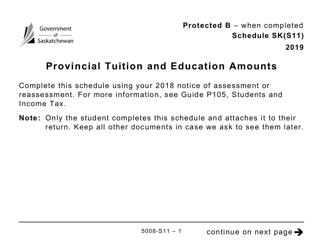

Form 5008-S11 Schedule SK(S11) Saskatchewan Tuition and Education Amounts (Large Print) - Canada

The Form 5008-S11 Schedule SK(S11) Saskatchewan Tuition and Education Amounts (Large Print) is used in Canada to claim the tuition and education expenses for residents of Saskatchewan.

The taxpayer or the person claiming the tuition and education amounts in Saskatchewan would file Form 5008-S11 Schedule SK(S11) in Canada.

FAQ

Q: What is Form 5008-S11 Schedule SK?

A: Form 5008-S11 Schedule SK is a tax form used in Canada to claim the Saskatchewan tuition and education amounts.

Q: What is the purpose of Form 5008-S11 Schedule SK?

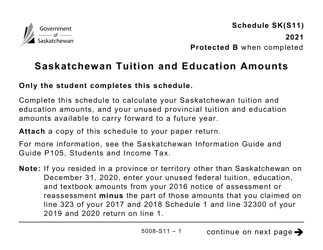

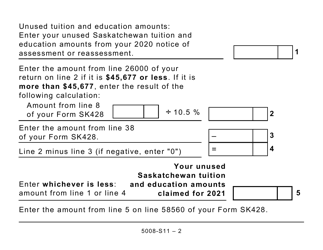

A: The purpose of Form 5008-S11 Schedule SK is to calculate and claim the tuition and education amounts for residents of Saskatchewan.

Q: Who can use Form 5008-S11 Schedule SK?

A: Residents of Saskatchewan who have paid eligible tuition fees or education amounts can use Form 5008-S11 Schedule SK to claim tax credits.

Q: Do I need to file Form 5008-S11 Schedule SK?

A: Whether or not you need to file Form 5008-S11 Schedule SK depends on your individual tax situation. Consult the CRA guidelines or a tax professional to determine if you should file this form.