This version of the form is not currently in use and is provided for reference only. Download this version of

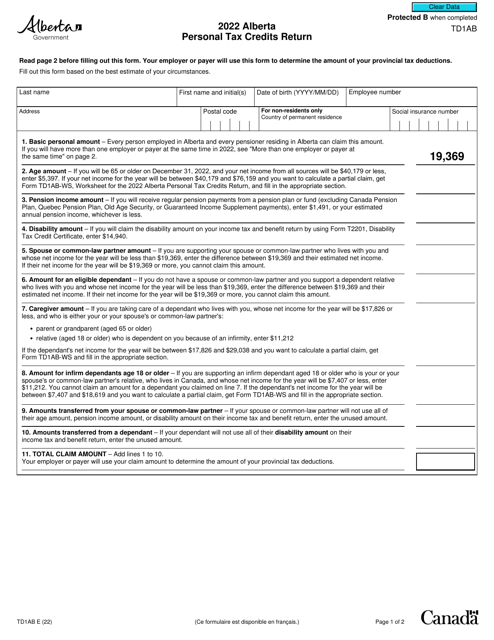

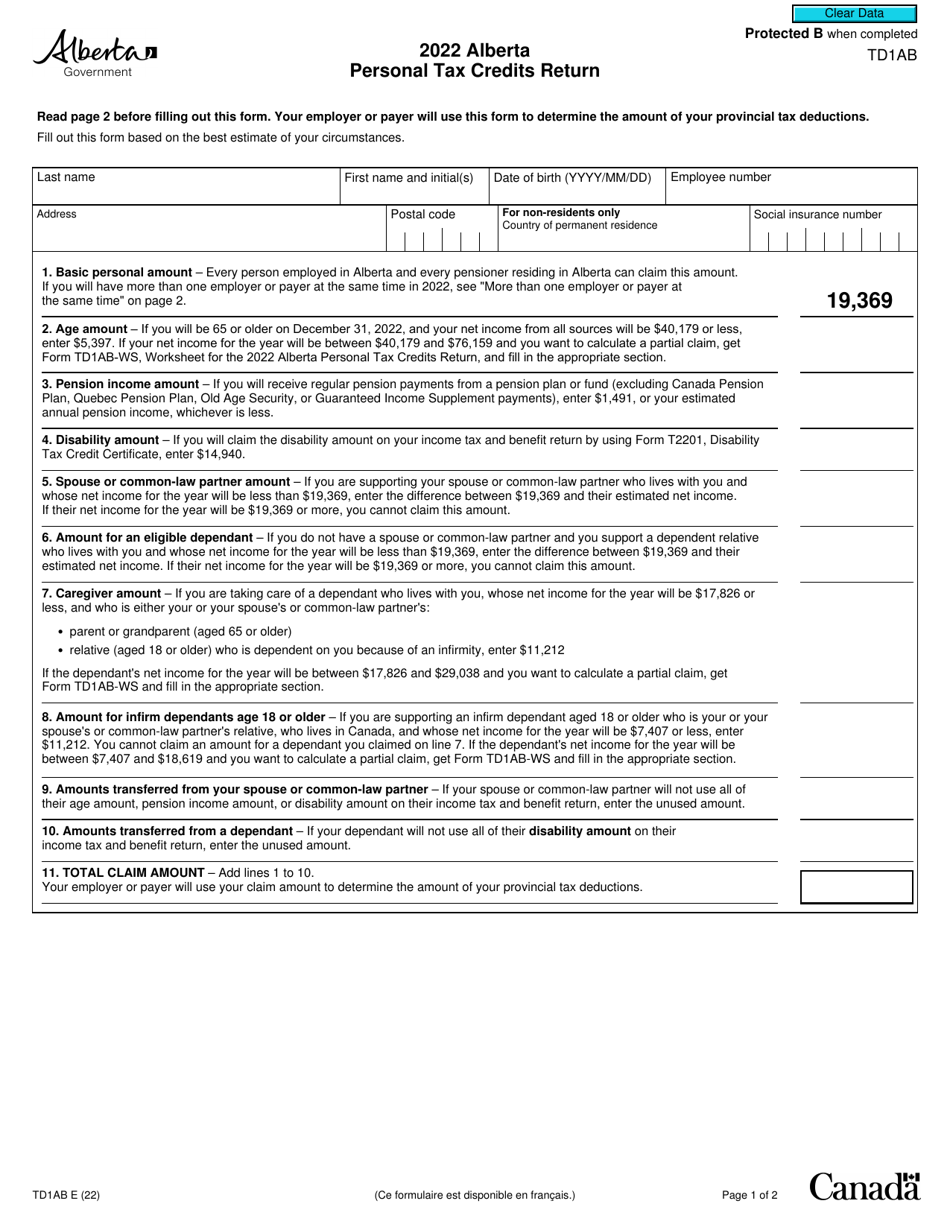

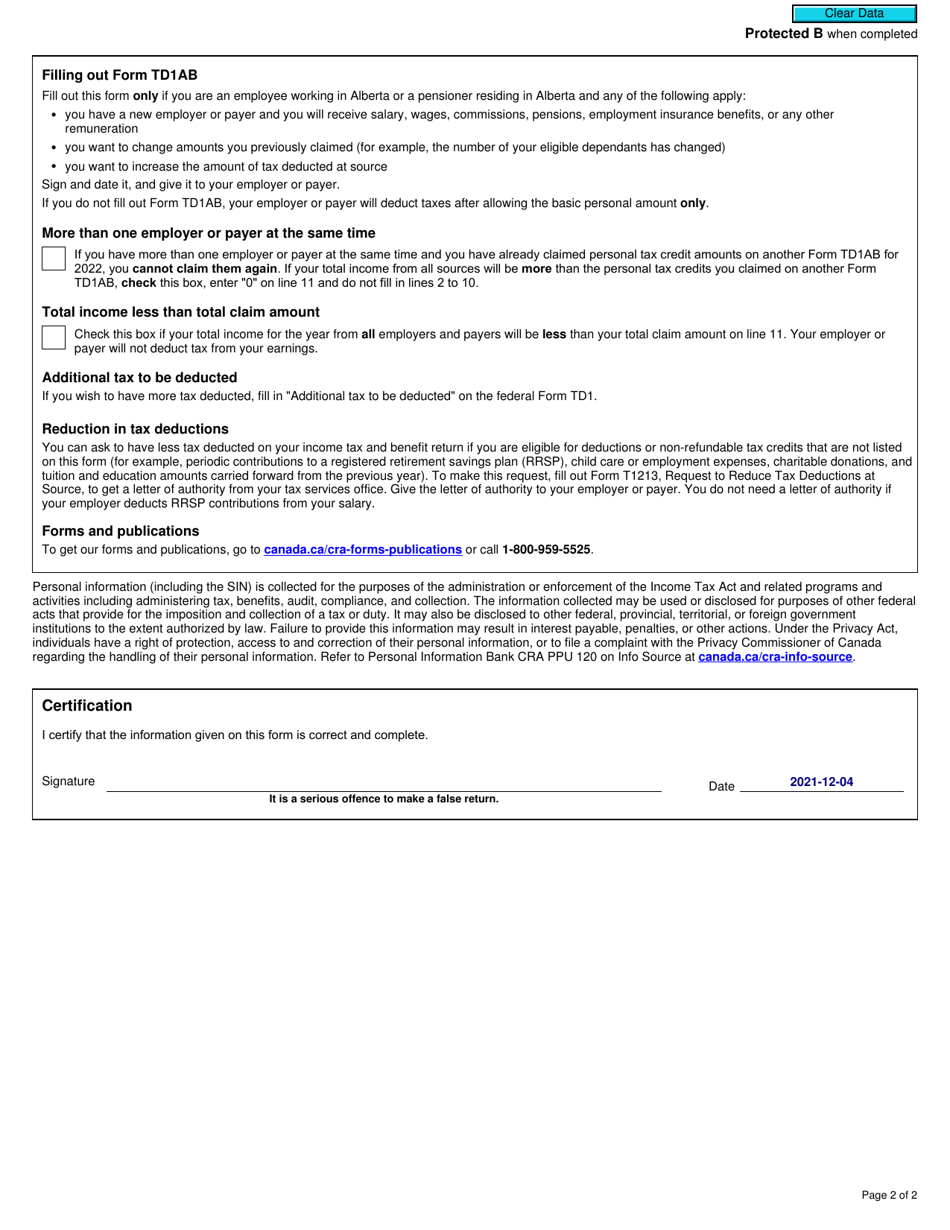

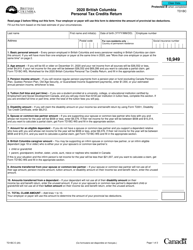

Form TD1AB

for the current year.

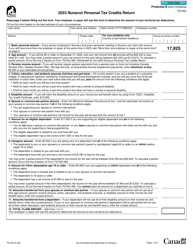

Form TD1AB Alberta Personal Tax Credits Return - Canada

Form TD1AB Alberta Personal Tax Credits Return is a document used by residents of Alberta, Canada to determine the amount of their provincial tax credits. It is used to calculate the tax deductions that can be claimed on their income tax return in order to reduce the amount of tax owed to the provincial government.

The Form TD1AB Alberta Personal Tax Credits Return in Canada is filed by residents of Alberta who want to claim personal tax credits.

FAQ

Q: What is Form TD1AB?

A: Form TD1AB is the Alberta Personal Tax Credits Return form for residents of Alberta, Canada.

Q: Who needs to fill out Form TD1AB?

A: Residents of Alberta, Canada who want to claim certain tax credits on their income tax return need to fill out Form TD1AB.

Q: What are personal tax credits?

A: Personal tax credits are deductions that can reduce the amount of income tax you owe. They represent expenses or situations that the government considers in determining how much tax you should pay.

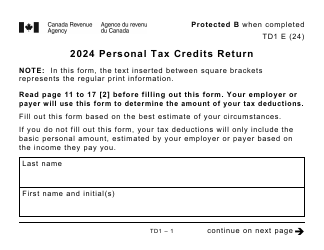

Q: What information is required on Form TD1AB?

A: Form TD1AB requires you to provide your personal information, such as your name, address, and social insurance number. It also asks you to indicate which tax credits you are eligible to claim.

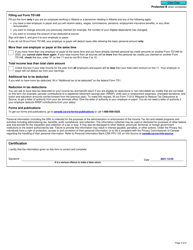

Q: When should I submit Form TD1AB?

A: You should submit Form TD1AB to your employer as soon as possible, preferably at the start of your employment or whenever your personal tax situation changes.

Q: Do I need to submit Form TD1AB every year?

A: You should submit a new Form TD1AB to your employer every year, or whenever your personal tax situation changes.

Q: Can I claim tax credits listed on Form TD1AB on my tax return?

A: Yes, if you are eligible and have filled out Form TD1AB correctly, you can claim the tax credits listed on the form on your income tax return.

Q: What should I do if I'm not sure which tax credits I'm eligible for?

A: If you're unsure, you can consult the Canada Revenue Agency or a tax professional to determine which tax credits you may be eligible for.

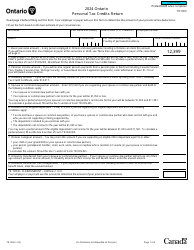

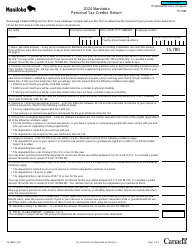

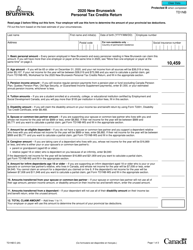

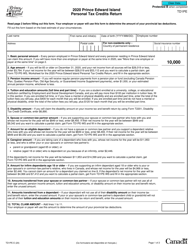

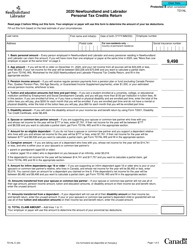

Q: Are there other provincial specific tax credits forms?

A: Yes, each province in Canada may have its own specific tax credits forms. Be sure to check with the appropriate provincial tax authority for the specific form applicable to your province.