This version of the form is not currently in use and is provided for reference only. Download this version of

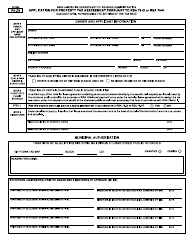

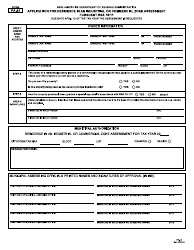

Form PA-29

for the current year.

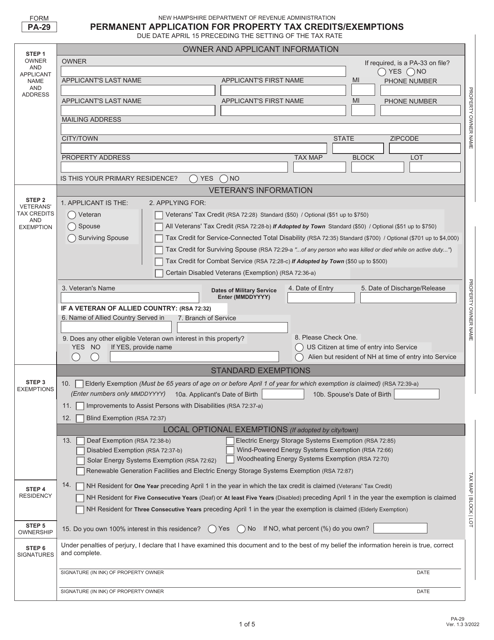

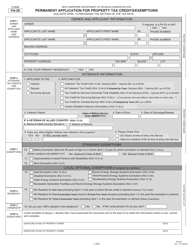

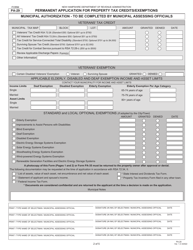

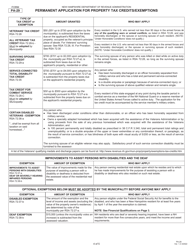

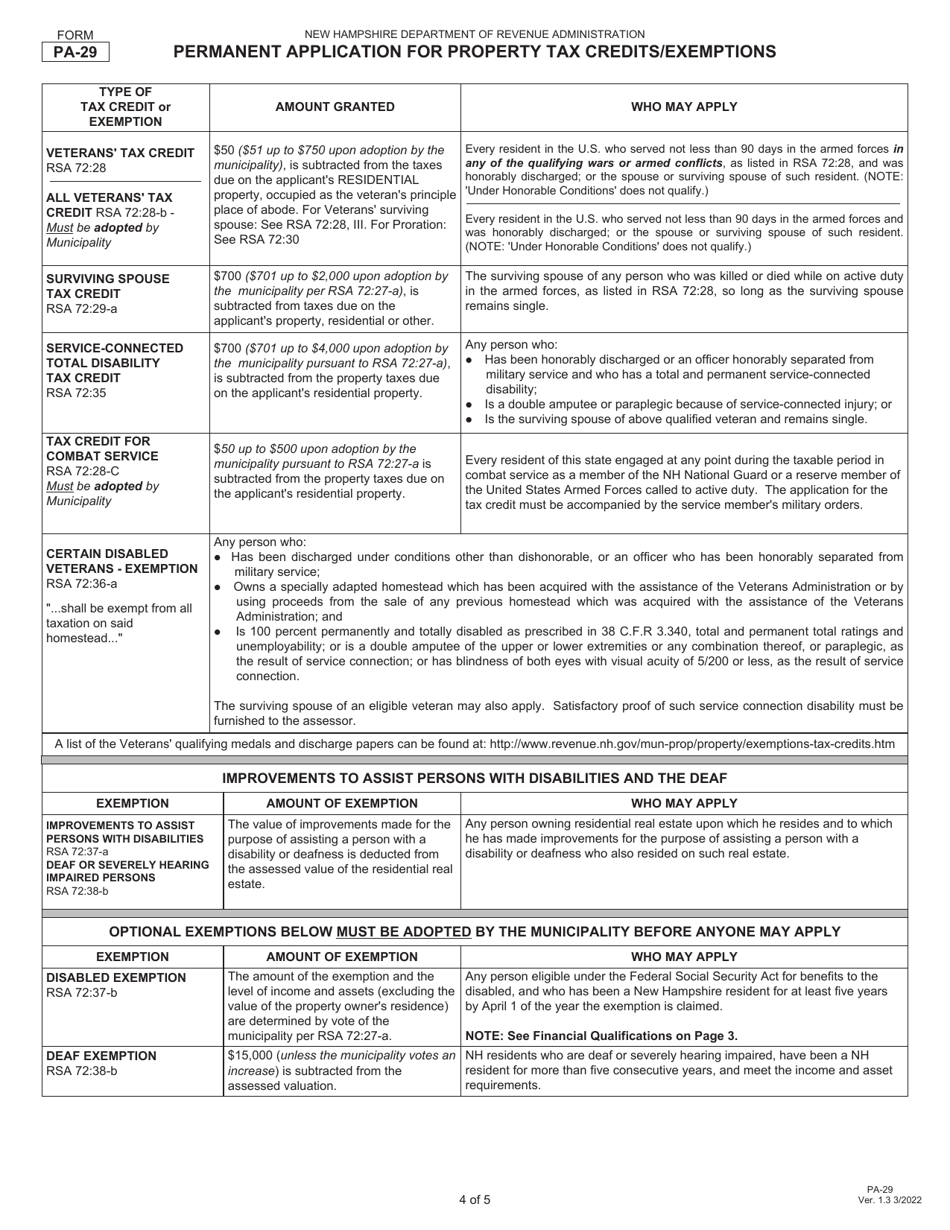

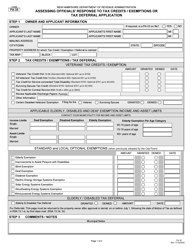

Form PA-29 Permanent Application for Property Tax Credits / Exemptions - New Hampshire

What Is Form PA-29?

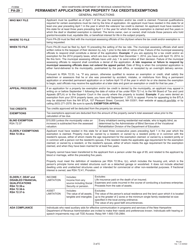

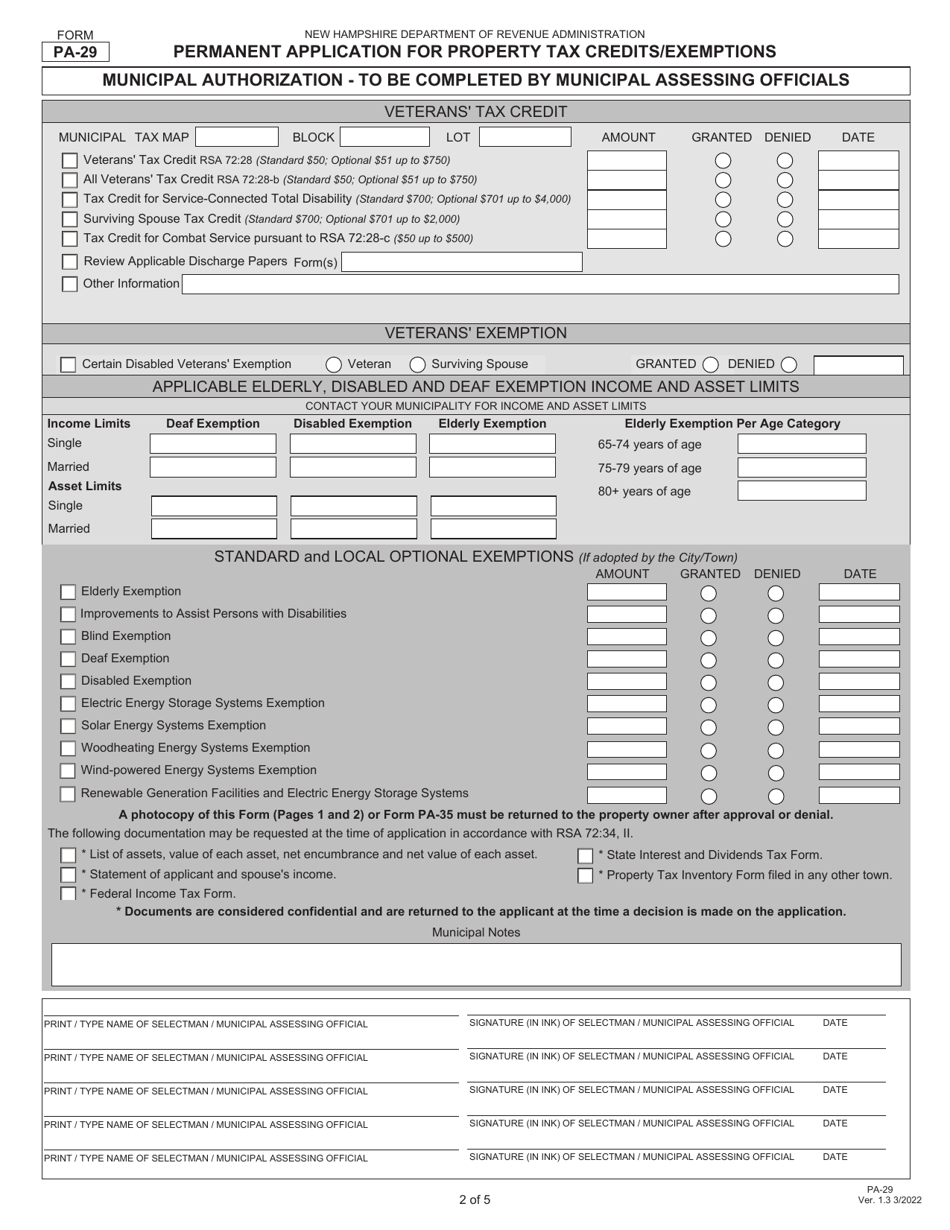

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

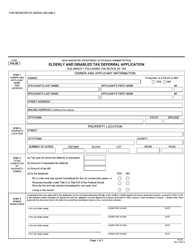

Q: What is Form PA-29?

A: Form PA-29 is the Permanent Application for Property Tax Credits/Exemptions in New Hampshire.

Q: What is the purpose of Form PA-29?

A: The purpose of Form PA-29 is to apply for property tax credits or exemptions in New Hampshire.

Q: Who needs to fill out Form PA-29?

A: Property owners in New Hampshire who are seeking property tax credits or exemptions need to fill out Form PA-29.

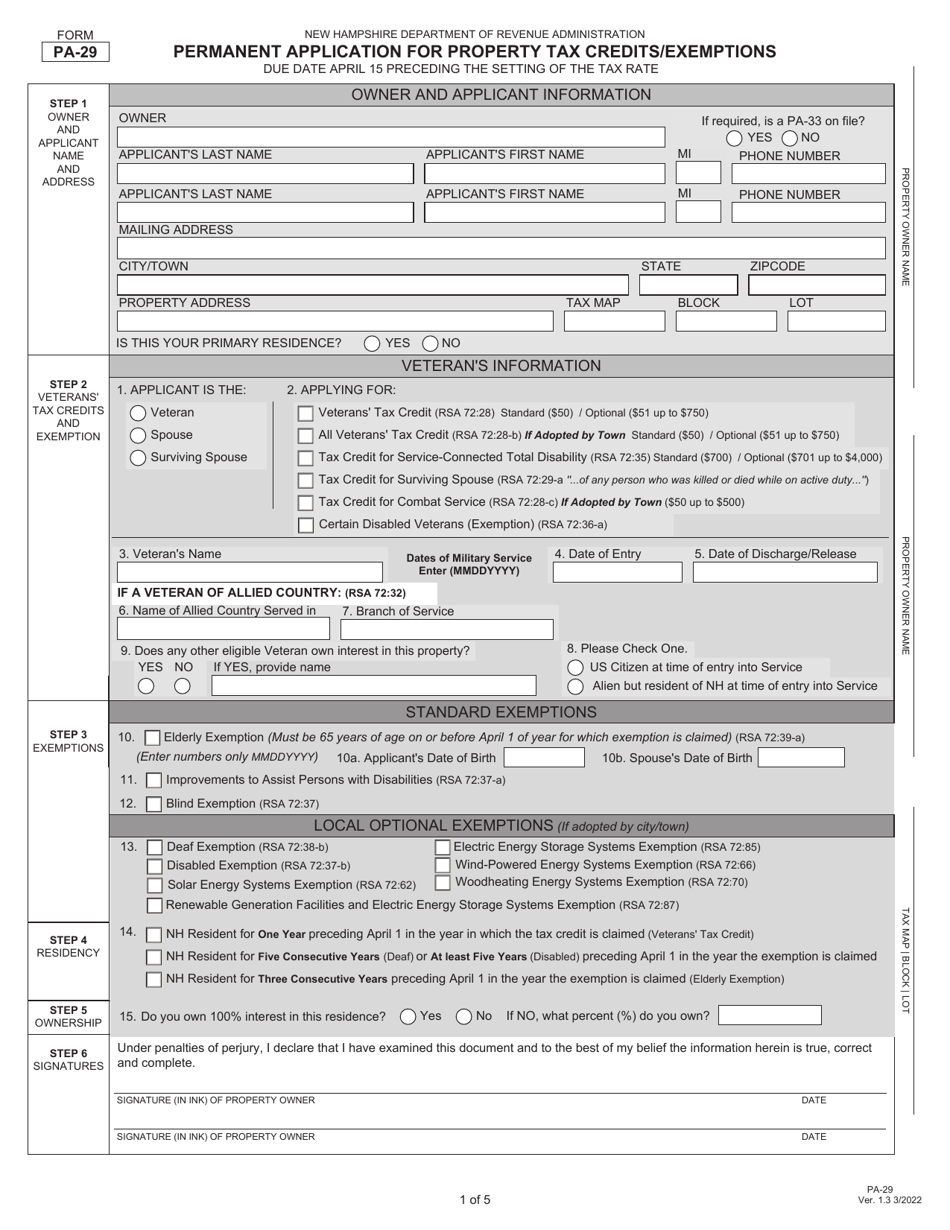

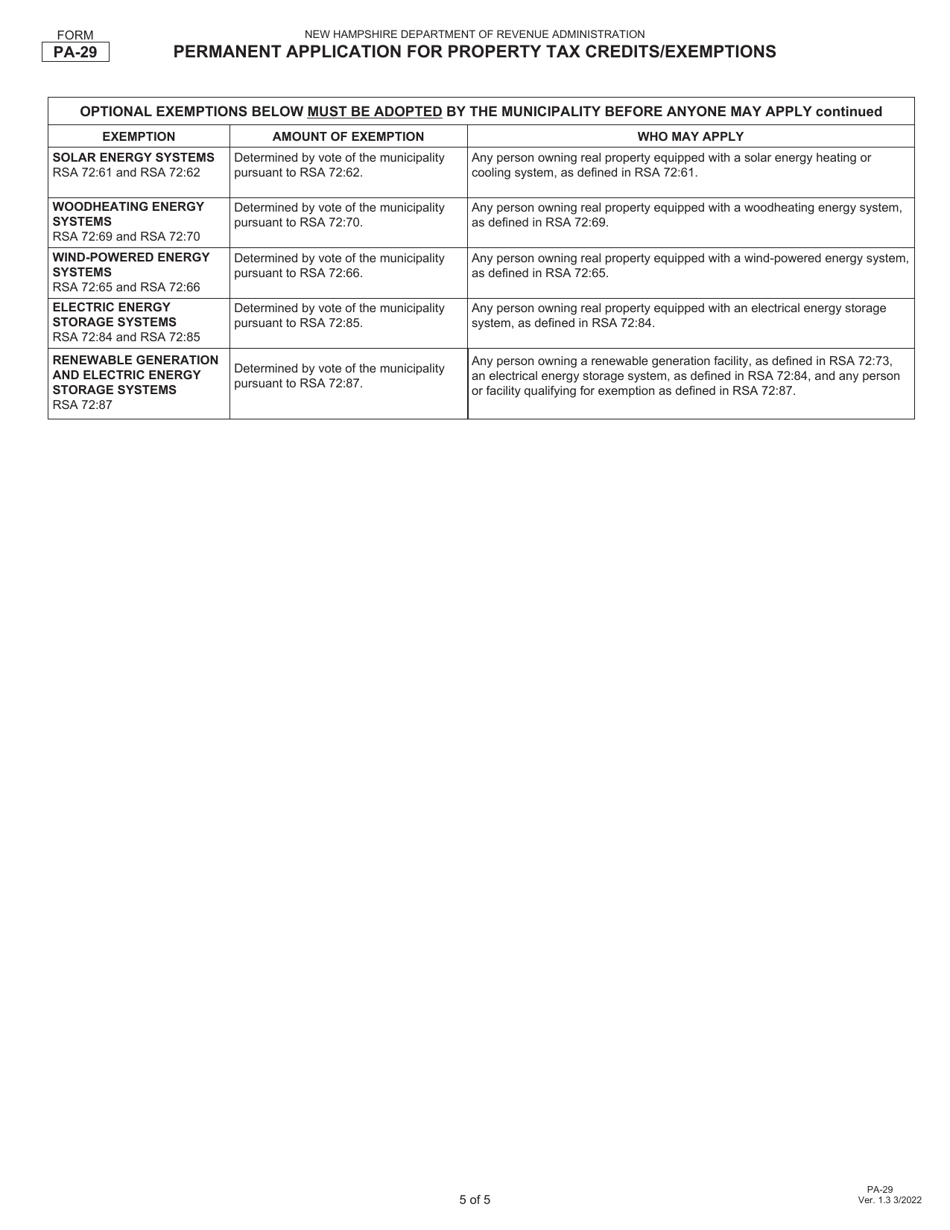

Q: What types of credits or exemptions are available?

A: The credits or exemptions available include elderly exemptions, disabled veteran exemptions, and blind exemptions, among others.

Q: When is the deadline to submit Form PA-29?

A: The deadline for submitting Form PA-29 is typically April 15th, but it is recommended to check with your local town or city office for the specific deadline.

Q: Are there any fees associated with filing Form PA-29?

A: There are no fees associated with filing Form PA-29.

Q: What documentation do I need to submit with Form PA-29?

A: The specific documentation required may vary depending on the type of credit or exemption being applied for. It is best to refer to the instructions provided with Form PA-29.

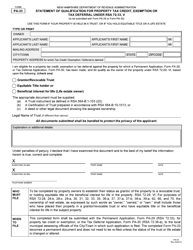

Form Details:

- Released on March 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-29 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.