This version of the form is not currently in use and is provided for reference only. Download this version of

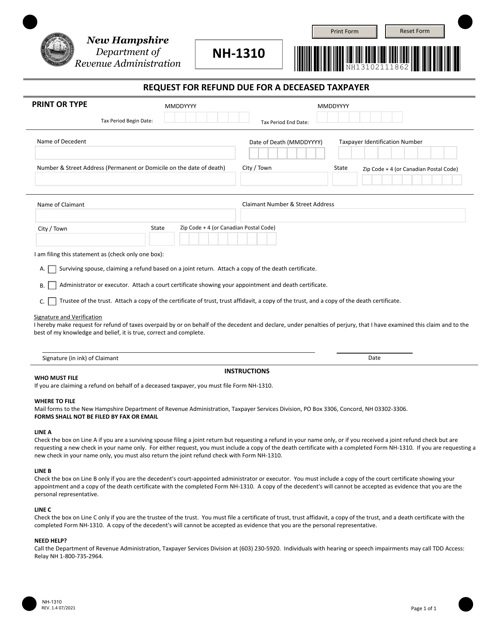

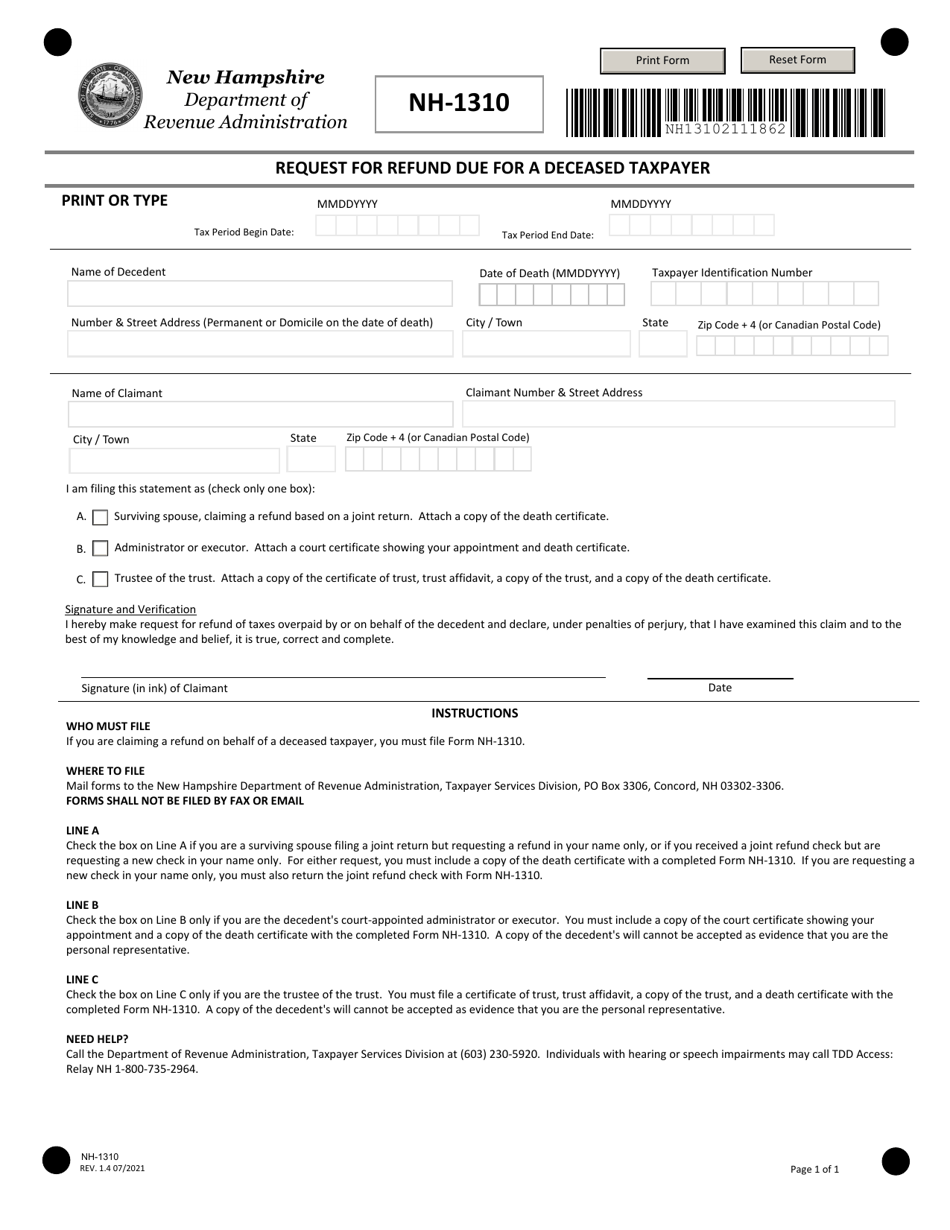

Form NH-1310

for the current year.

Form NH-1310 Request for Refund Due for a Deceased Taxpayer - New Hampshire

What Is Form NH-1310?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NH-1310?

A: NH-1310 is a form used in New Hampshire to request a refund for a deceased taxpayer.

Q: Why would someone use NH-1310?

A: NH-1310 is used to request a refund on behalf of a deceased taxpayer.

Q: Who can use NH-1310?

A: NH-1310 can be used by someone acting on behalf of a deceased taxpayer, such as an executor or administrator of their estate.

Q: How do I request a refund using NH-1310?

A: To request a refund using NH-1310, you need to complete the form with the necessary information and submit it to the appropriate tax authority in New Hampshire.

Q: Are there any fees associated with filing NH-1310?

A: There are no fees associated with filing NH-1310.

Q: What supporting documents are required with NH-1310?

A: You may be required to provide supporting documents, such as a death certificate or proof of your authority to act on behalf of the deceased taxpayer.

Q: How long does it take to process a refund request using NH-1310?

A: The processing time for a refund request using NH-1310 can vary, but it generally takes several weeks to process.

Q: Can I file NH-1310 electronically?

A: As of now, NH-1310 cannot be filed electronically. It must be submitted by mail or in person.

Q: Is NH-1310 specific to New Hampshire?

A: Yes, NH-1310 is specific to New Hampshire and is used for requesting refunds for deceased taxpayers in the state.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1310 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.