This version of the form is not currently in use and is provided for reference only. Download this version of

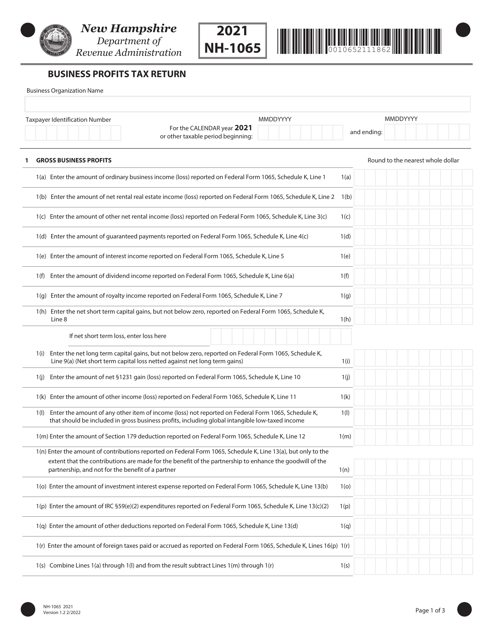

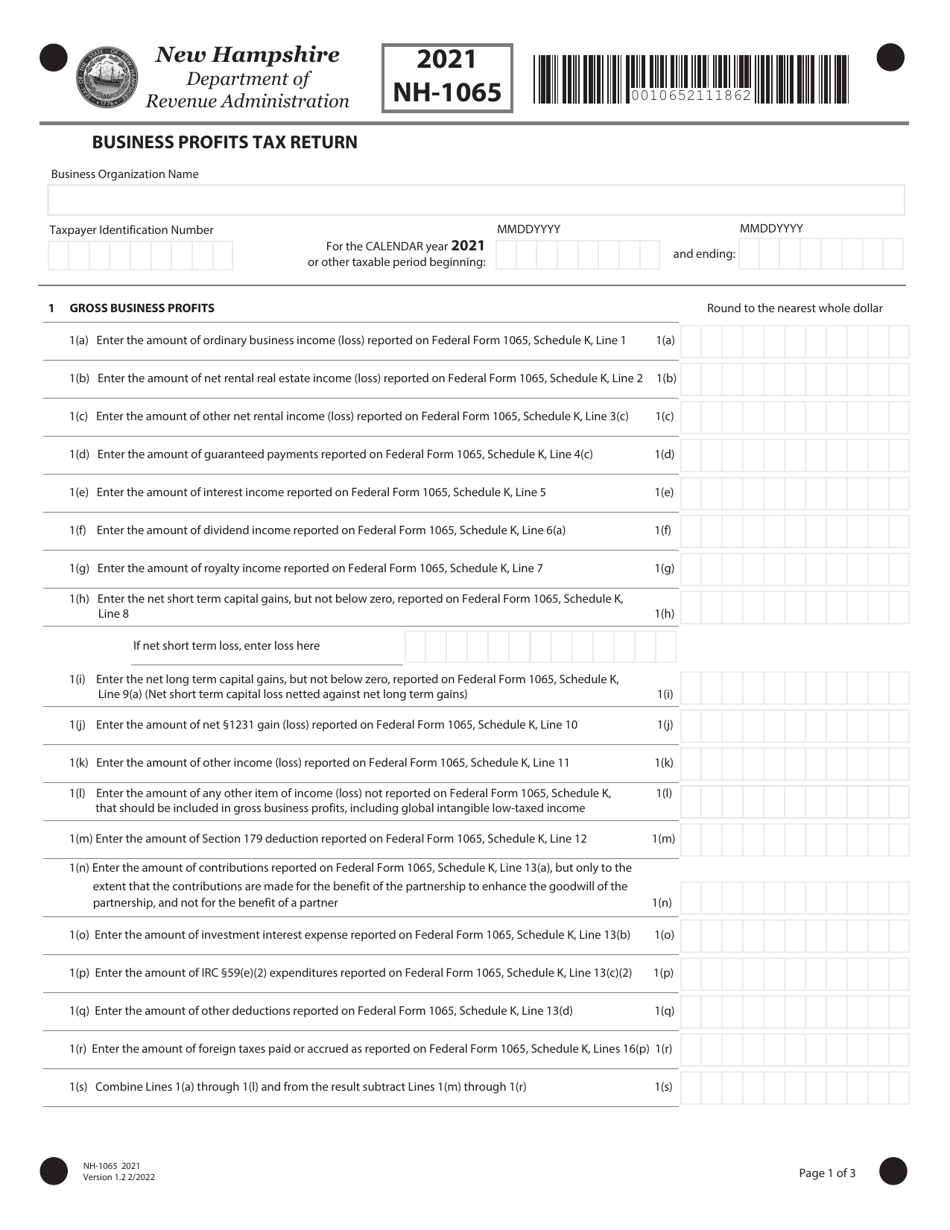

Form NH-1065

for the current year.

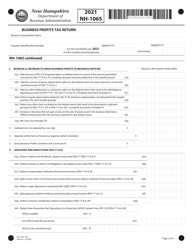

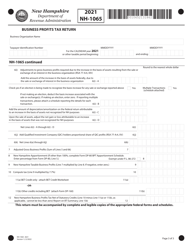

Form NH-1065 Partnership Business Profits Tax Return - New Hampshire

What Is Form NH-1065?

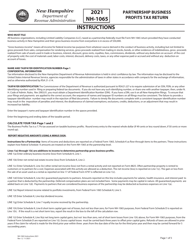

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: What is NH-1065?

A: NH-1065 is a tax form used for reporting partnership business profits in New Hampshire.

Q: Who needs to file Form NH-1065?

A: Partnerships in New Hampshire are required to file Form NH-1065.

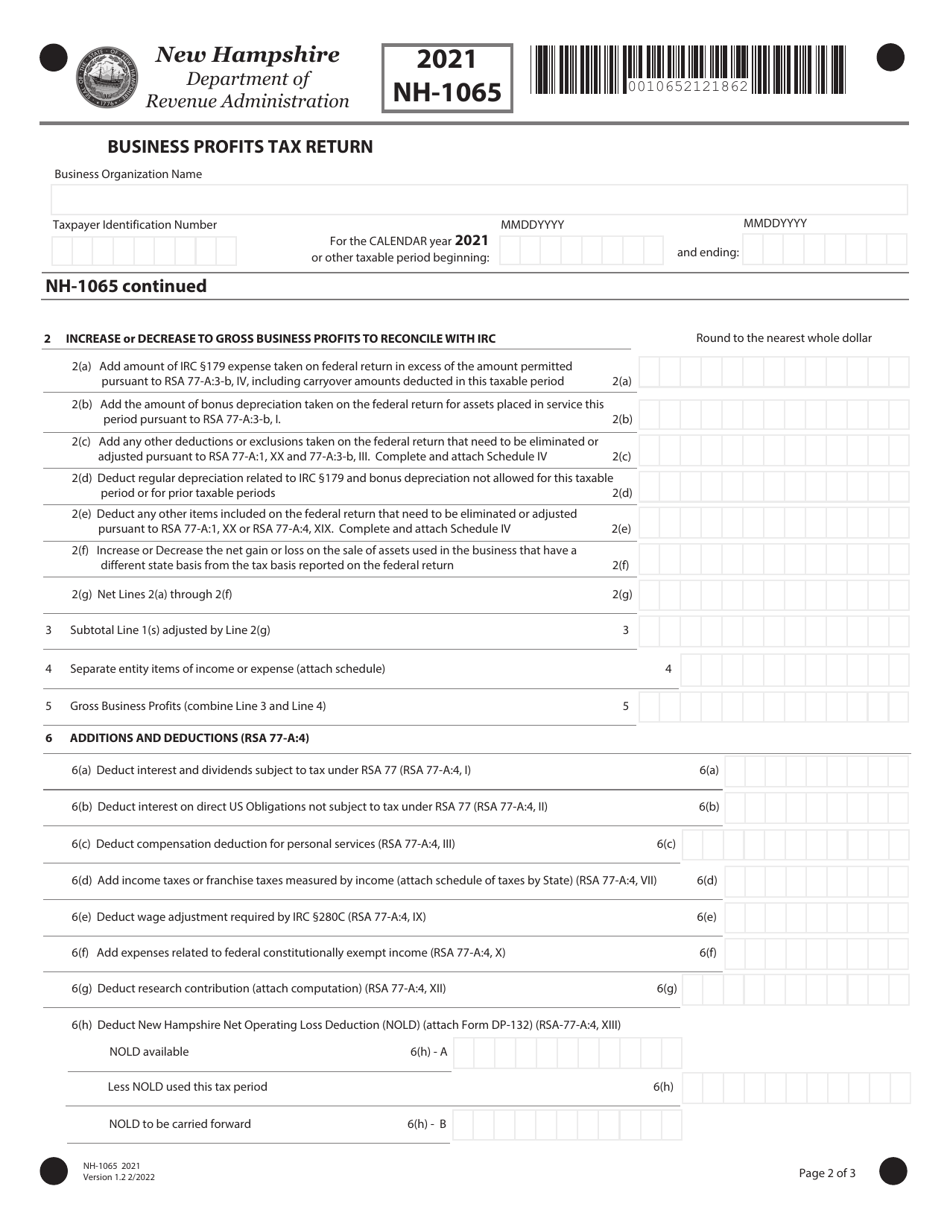

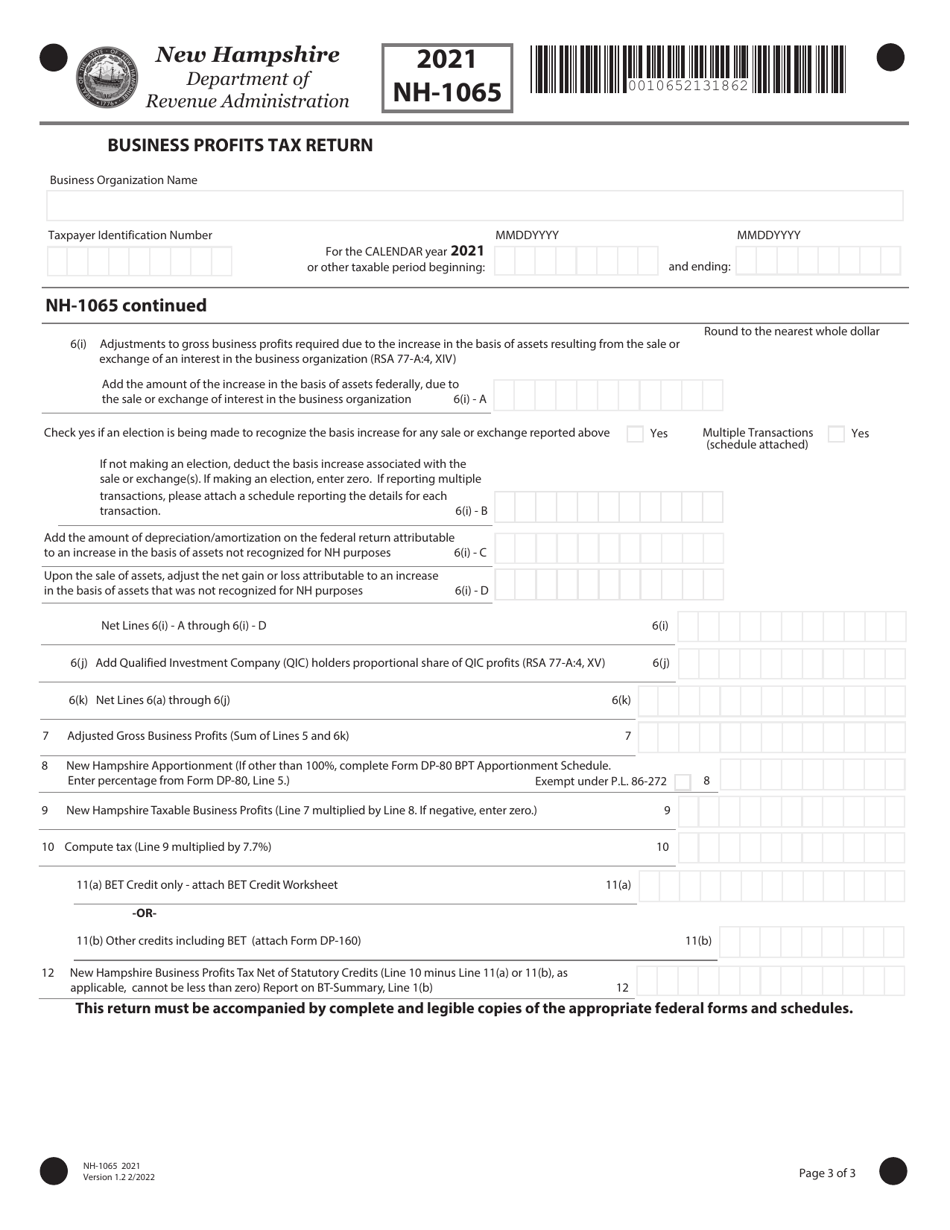

Q: What information is required on Form NH-1065?

A: Form NH-1065 requires information about the partnership's income, deductions, and credits.

Q: When is the deadline for filing Form NH-1065?

A: In New Hampshire, Form NH-1065 is due on or before April 15th.

Q: Can Form NH-1065 be filed electronically?

A: Yes, Form NH-1065 can be filed electronically using the New Hampshire Taxpayer Access Point (TAP) system.

Q: Are there any penalties for late filing of Form NH-1065?

A: Yes, there are penalties for late filing of Form NH-1065 in New Hampshire. It's important to file before the deadline to avoid penalties.

Q: Is there a separate form for Schedule K-1?

A: No, Schedule K-1 is included as part of Form NH-1065 and should be filled out accordingly.

Q: Can I get an extension to file Form NH-1065?

A: Yes, you can request an extension to file Form NH-1065 by filing Form DP-410, Application for Automatic Extension of Time to File (for Partnerships and Fiduciaries), before the original due date of the return.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1065 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.