This version of the form is not currently in use and is provided for reference only. Download this version of

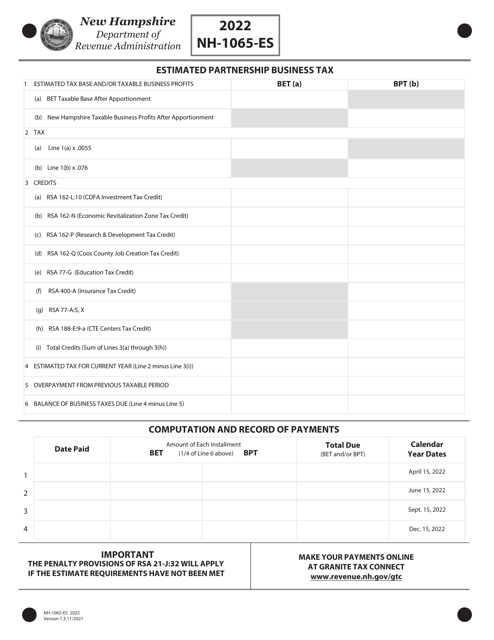

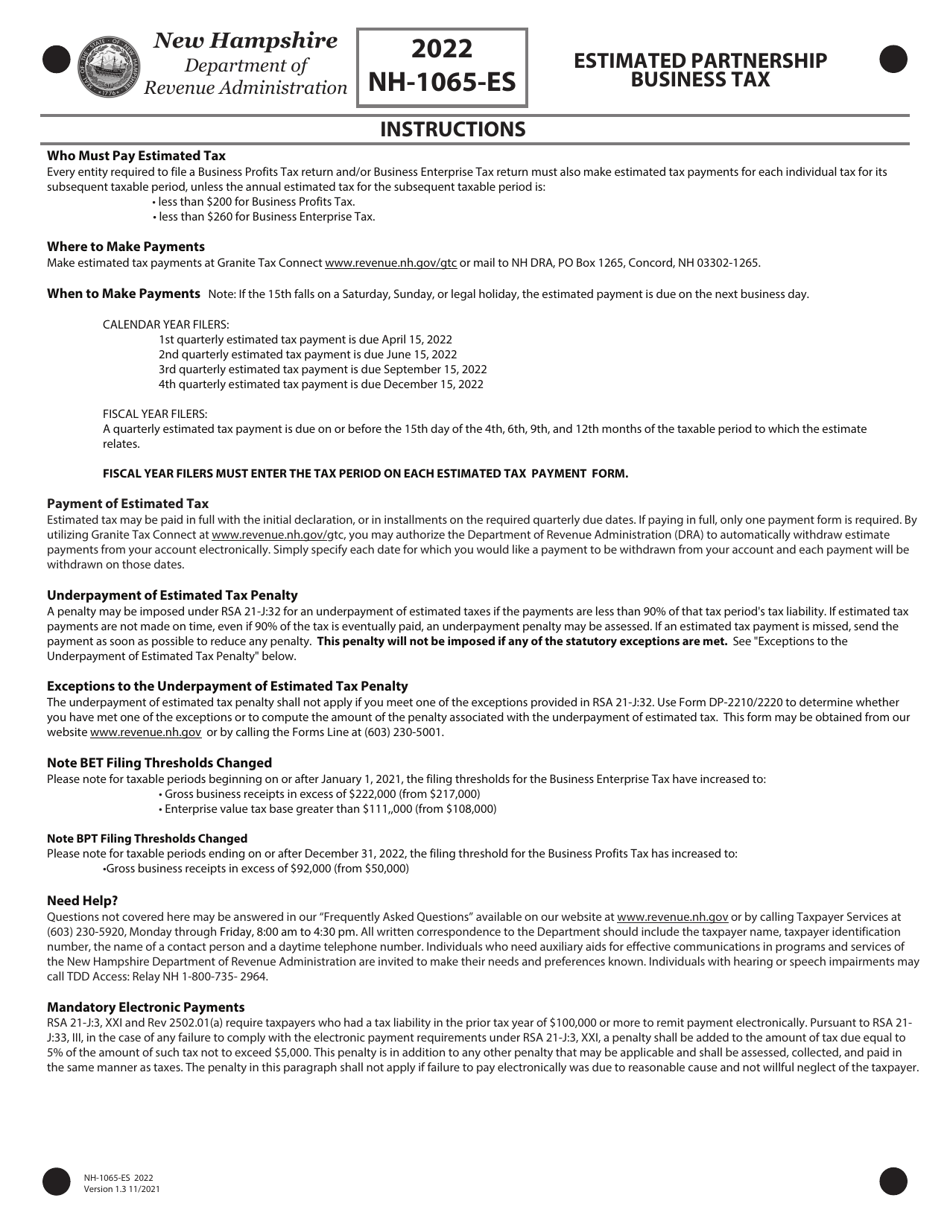

Form NH-1065-ES

for the current year.

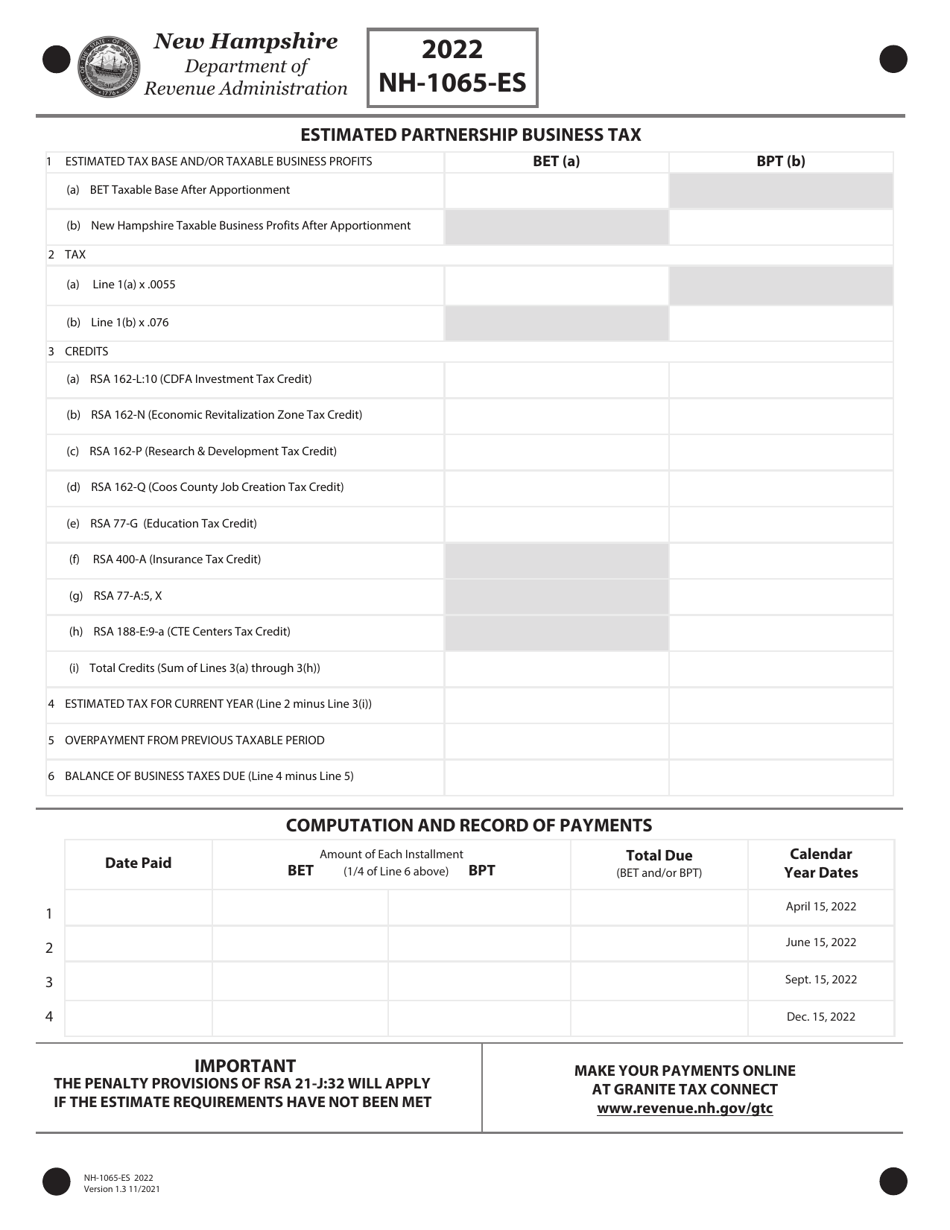

Form NH-1065-ES Estimated Partnership Business Tax - New Hampshire

What Is Form NH-1065-ES?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NH-1065-ES?

A: Form NH-1065-ES is the form used to make estimated tax payments for a partnership business in New Hampshire.

Q: Who needs to file Form NH-1065-ES?

A: Partnership businesses in New Hampshire who need to make estimated tax payments should file Form NH-1065-ES.

Q: What are estimated tax payments?

A: Estimated tax payments are periodic payments made by businesses to prepay their tax liability for the year.

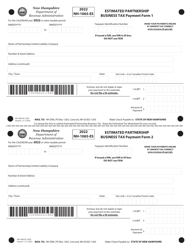

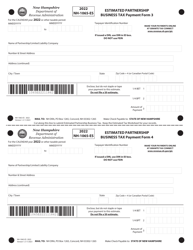

Q: When are estimated tax payments due for partnership businesses in New Hampshire?

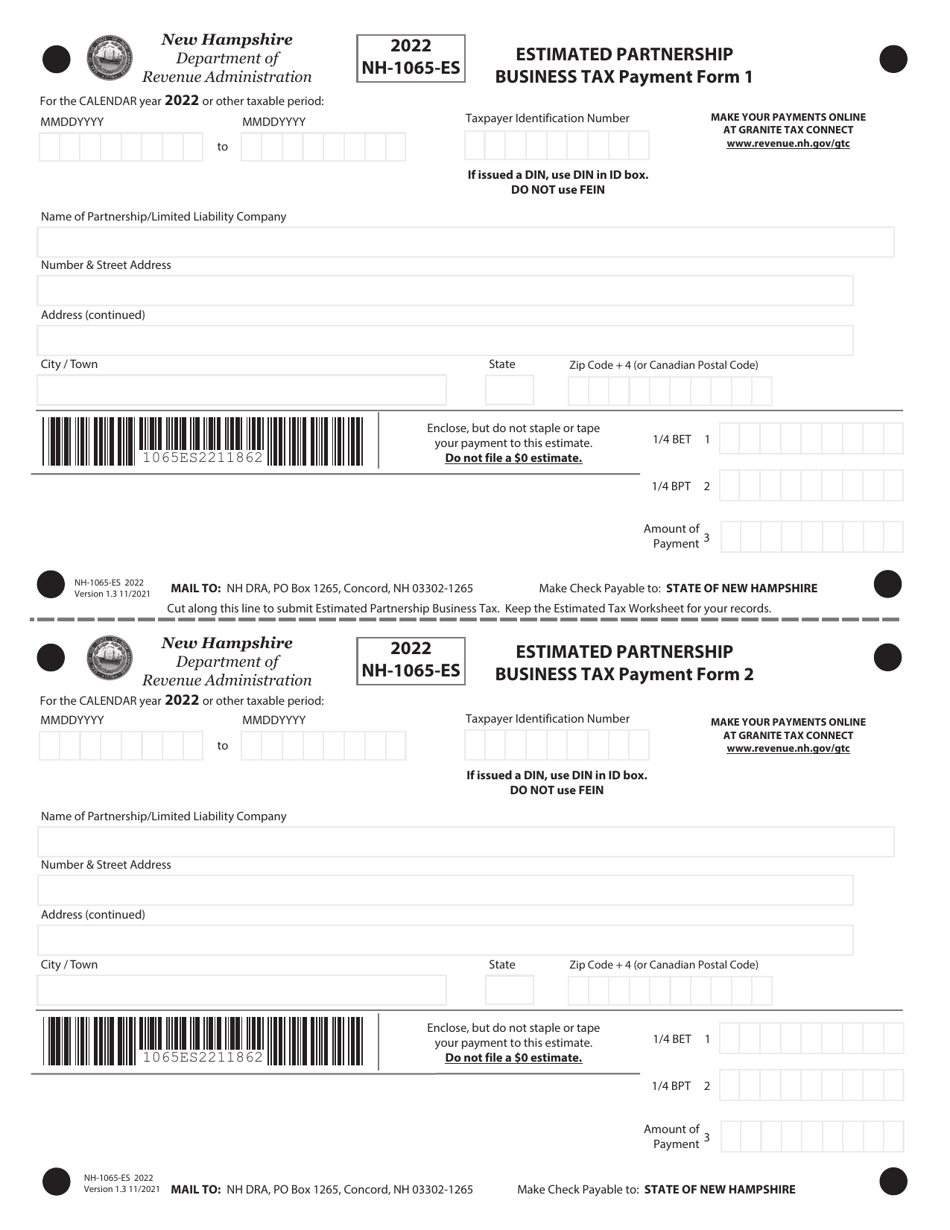

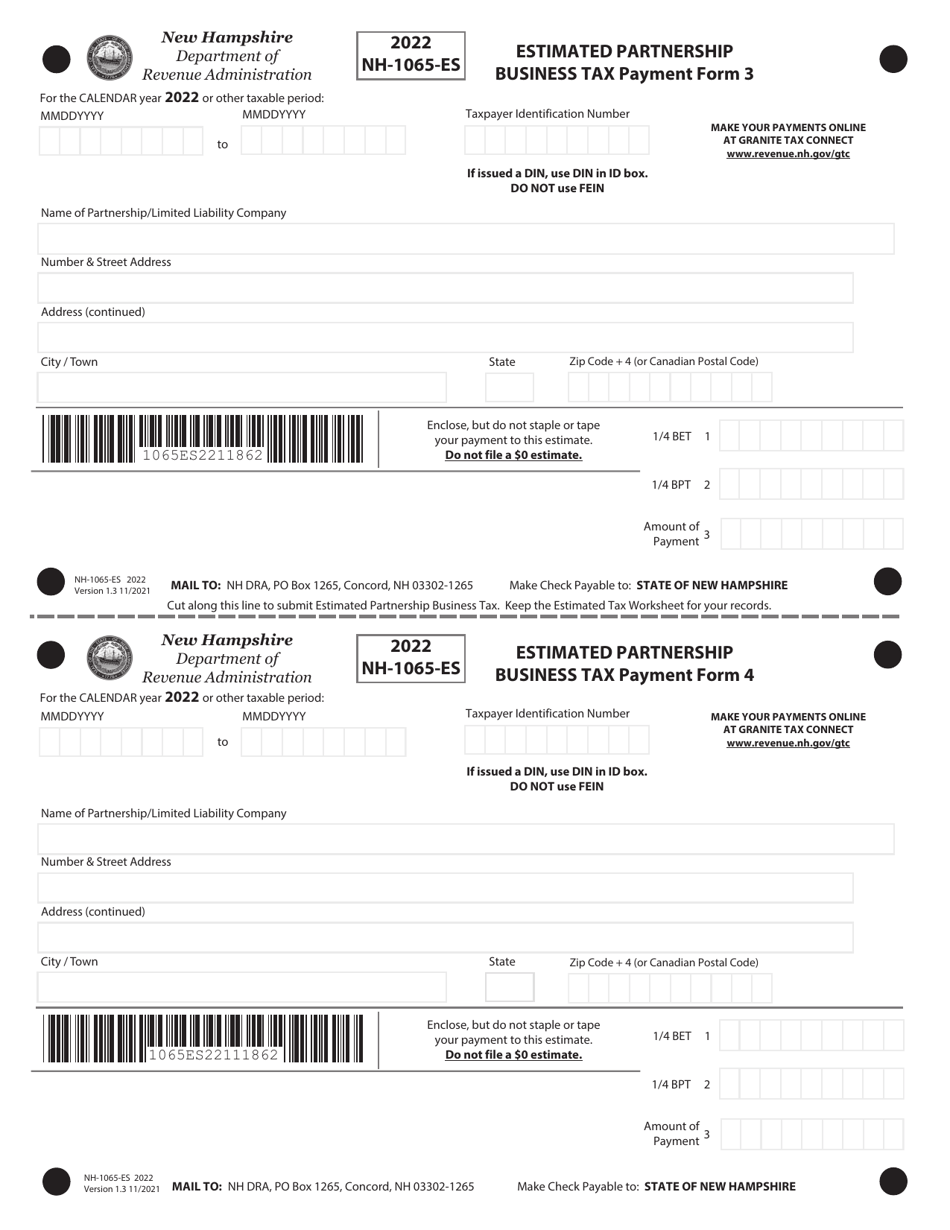

A: Estimated tax payments for partnership businesses in New Hampshire are due on the 15th day of the 4th, 6th, 9th, and 12th months of the tax year.

Q: Do I need to file Form NH-1065-ES if my partnership has no income?

A: If your partnership has no income or is exempt from New Hampshire tax, you may not need to file Form NH-1065-ES. You should consult with a tax professional or the New Hampshire Department of Revenue Administration to determine your filing requirements.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1065-ES by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.