This version of the form is not currently in use and is provided for reference only. Download this version of

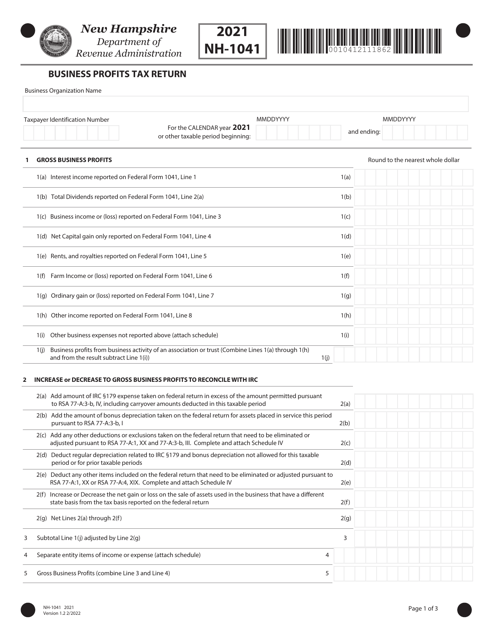

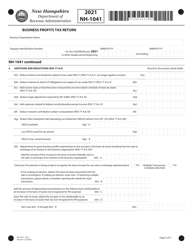

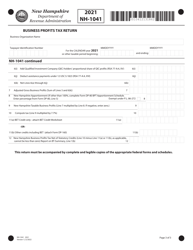

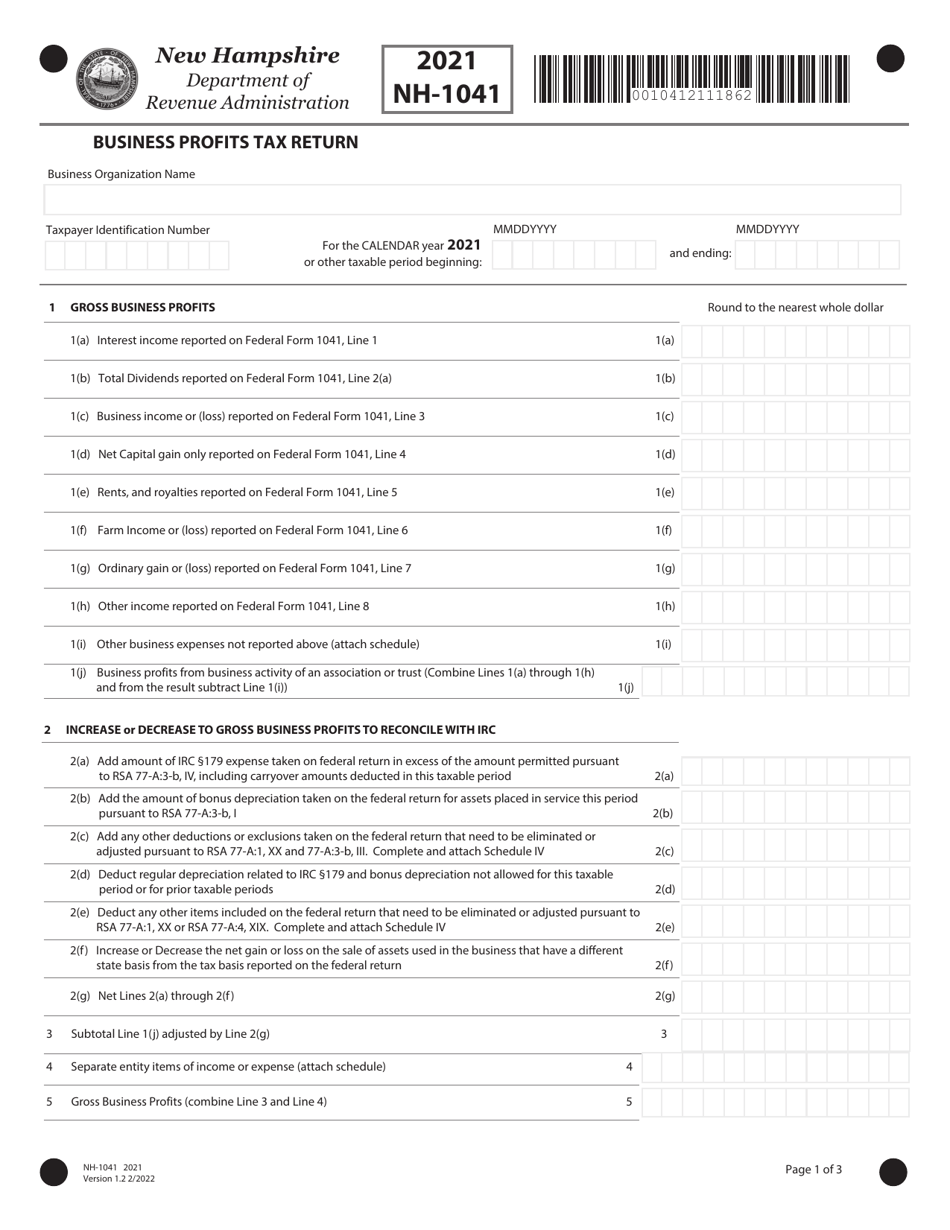

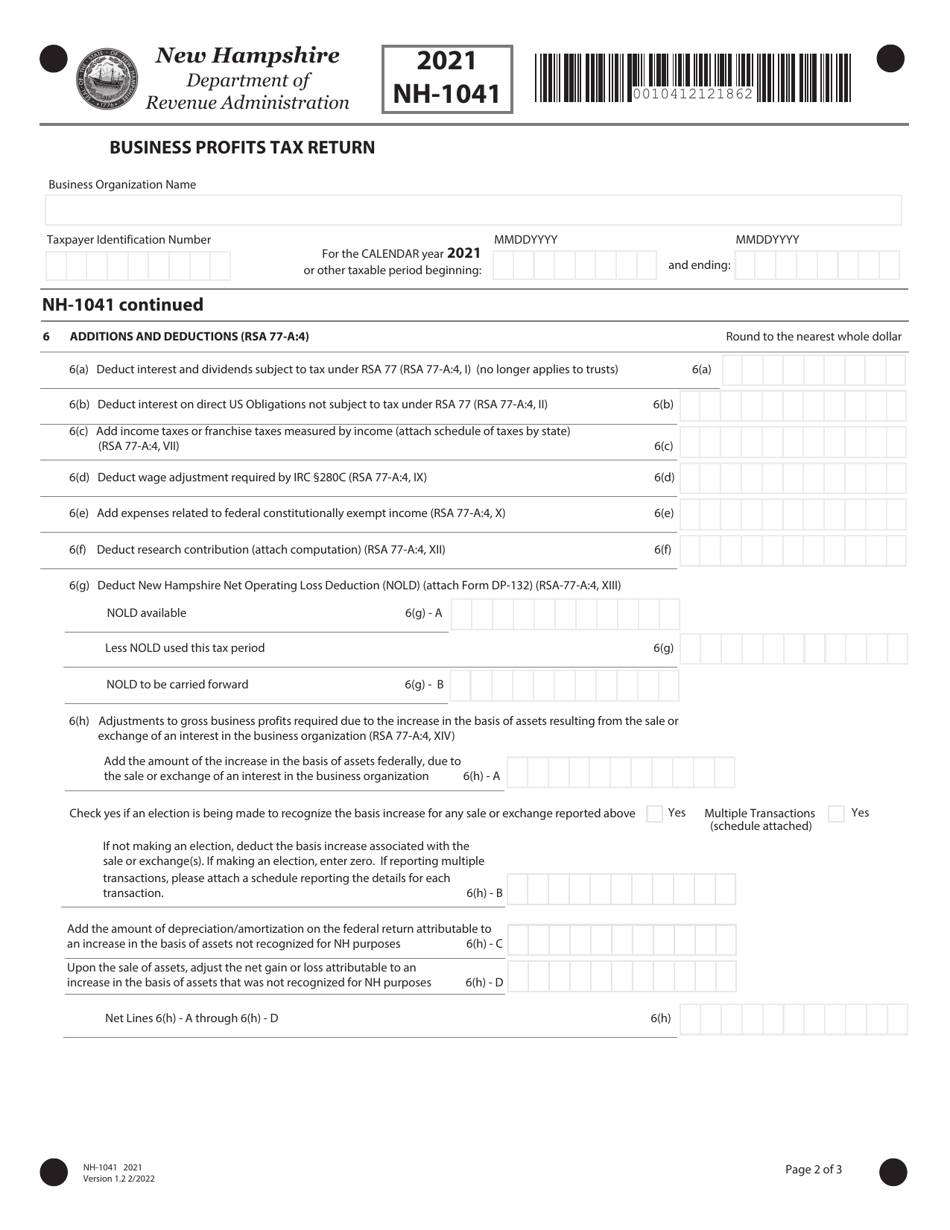

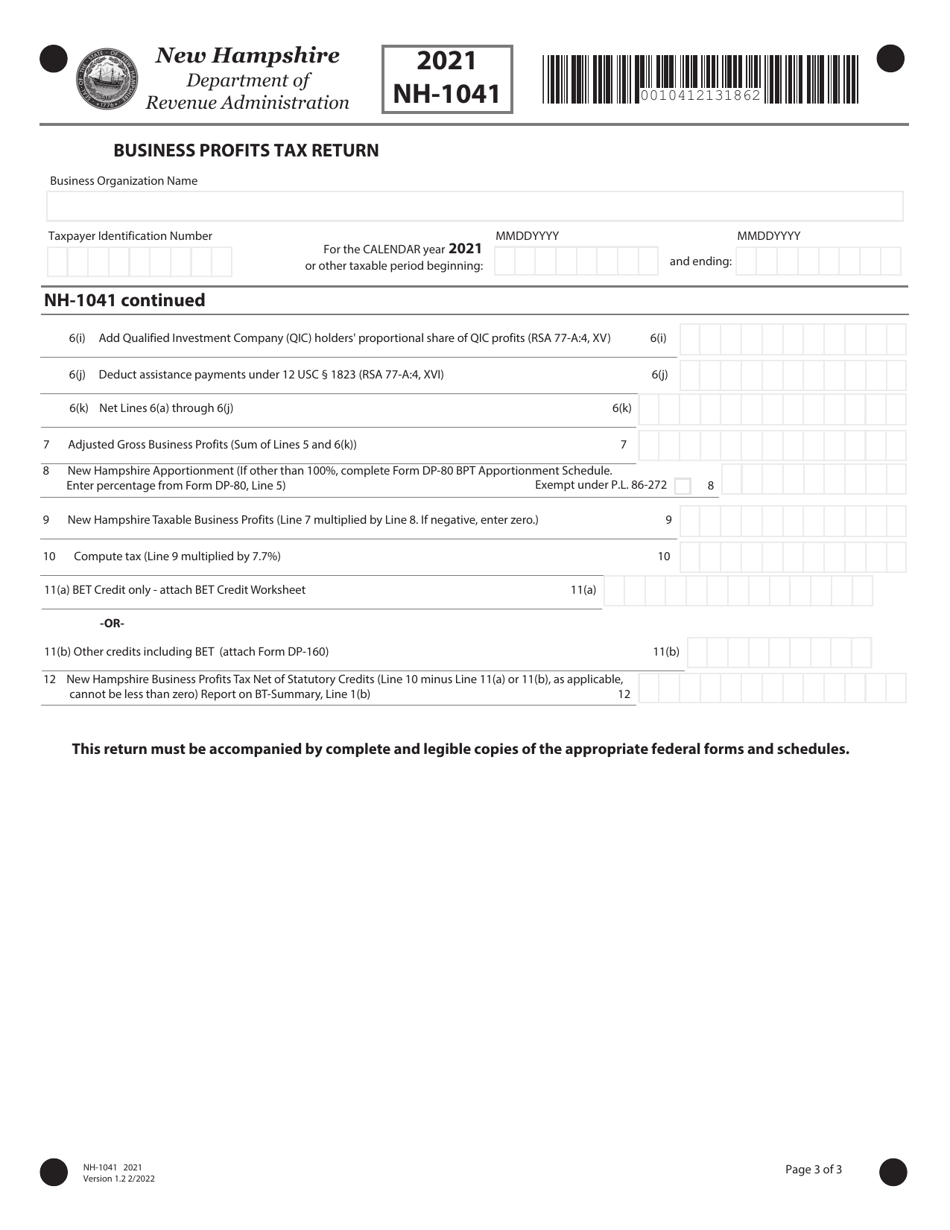

Form NH-1041

for the current year.

Form NH-1041 Fiduciary Business Profits Tax Return - New Hampshire

What Is Form NH-1041?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form NH-1041?

A: Form NH-1041 is the Fiduciary Business Profits Tax Return for filing taxes in New Hampshire.

Q: Who needs to file Form NH-1041?

A: Form NH-1041 must be filed by fiduciaries who have business profits in New Hampshire.

Q: What is a fiduciary?

A: A fiduciary is a person or organization that is responsible for managing assets or property for the benefit of someone else.

Q: What are business profits?

A: Business profits are the earnings generated from operating a business.

Q: Do I need to file Form NH-1041 if I don't have business profits?

A: No, Form NH-1041 is only required if you have business profits in New Hampshire.

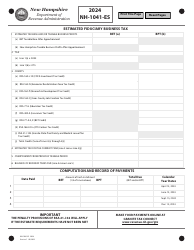

Q: When is the due date for filing Form NH-1041?

A: The due date for filing Form NH-1041 is April 15th of each year or the 15th day of the fourth month following the close of the taxable year.

Q: Are there any penalties for late filing of Form NH-1041?

A: Yes, there are penalties for late filing of Form NH-1041. It is important to file the return on time to avoid penalties and interest charges.

Q: Do I need to attach any additional documents with Form NH-1041?

A: You may need to attach schedules or additional forms depending on your specific circumstances. It is recommended to review the instructions for Form NH-1041 to determine any additional requirements.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1041 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.