This version of the form is not currently in use and is provided for reference only. Download this version of

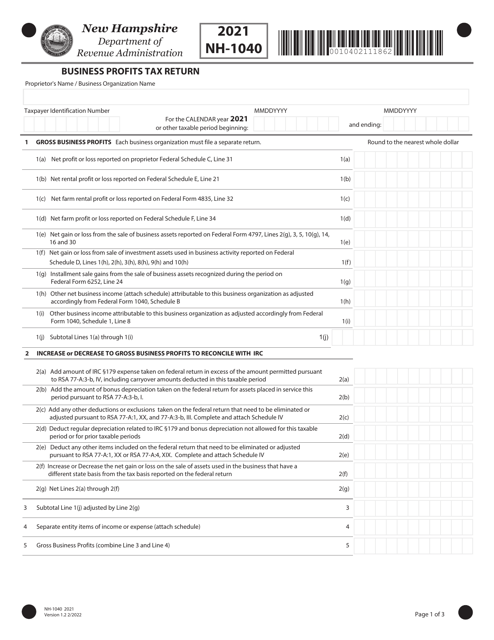

Form NH-1040

for the current year.

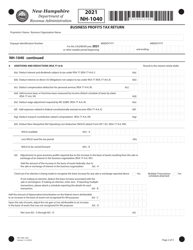

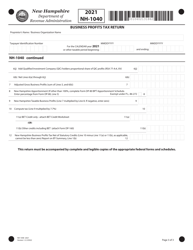

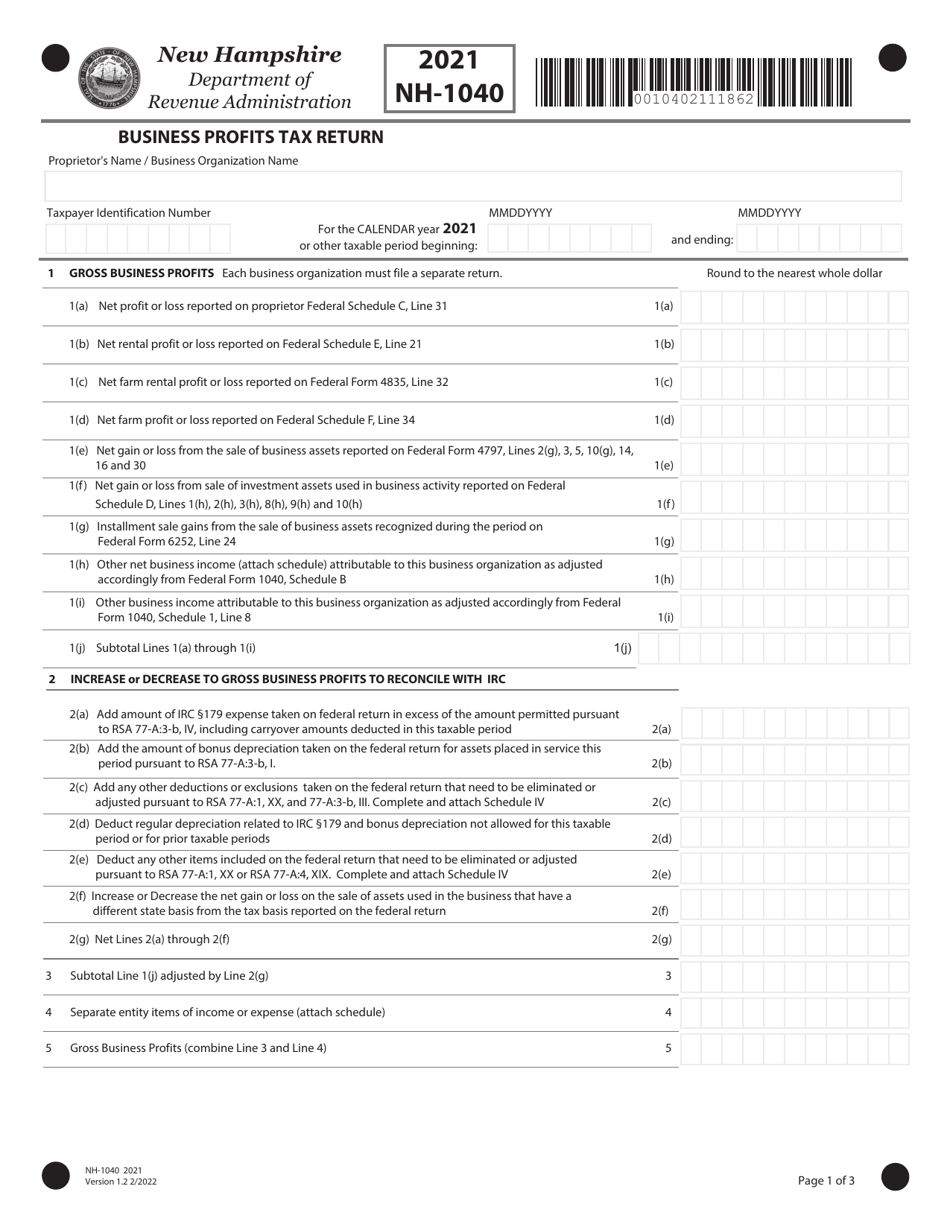

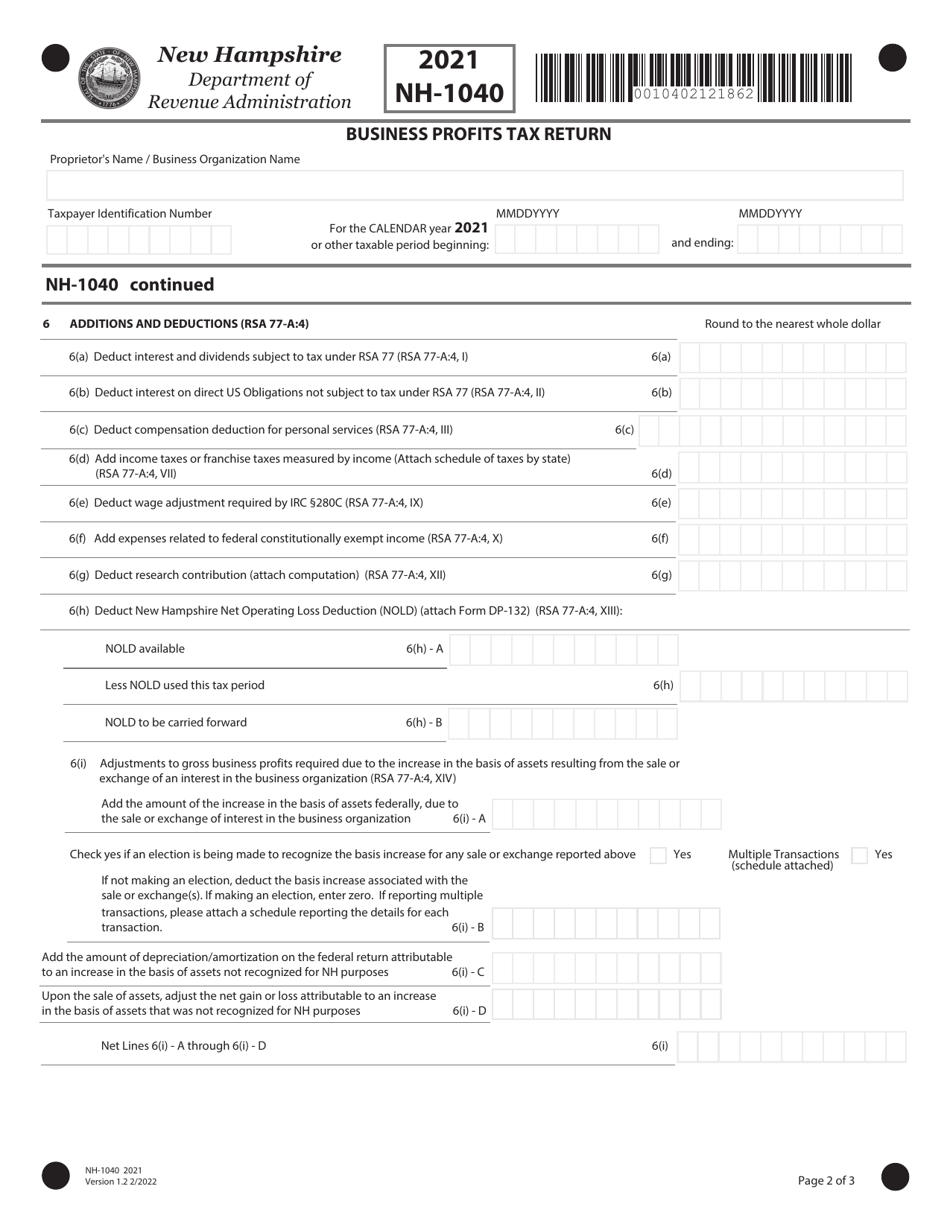

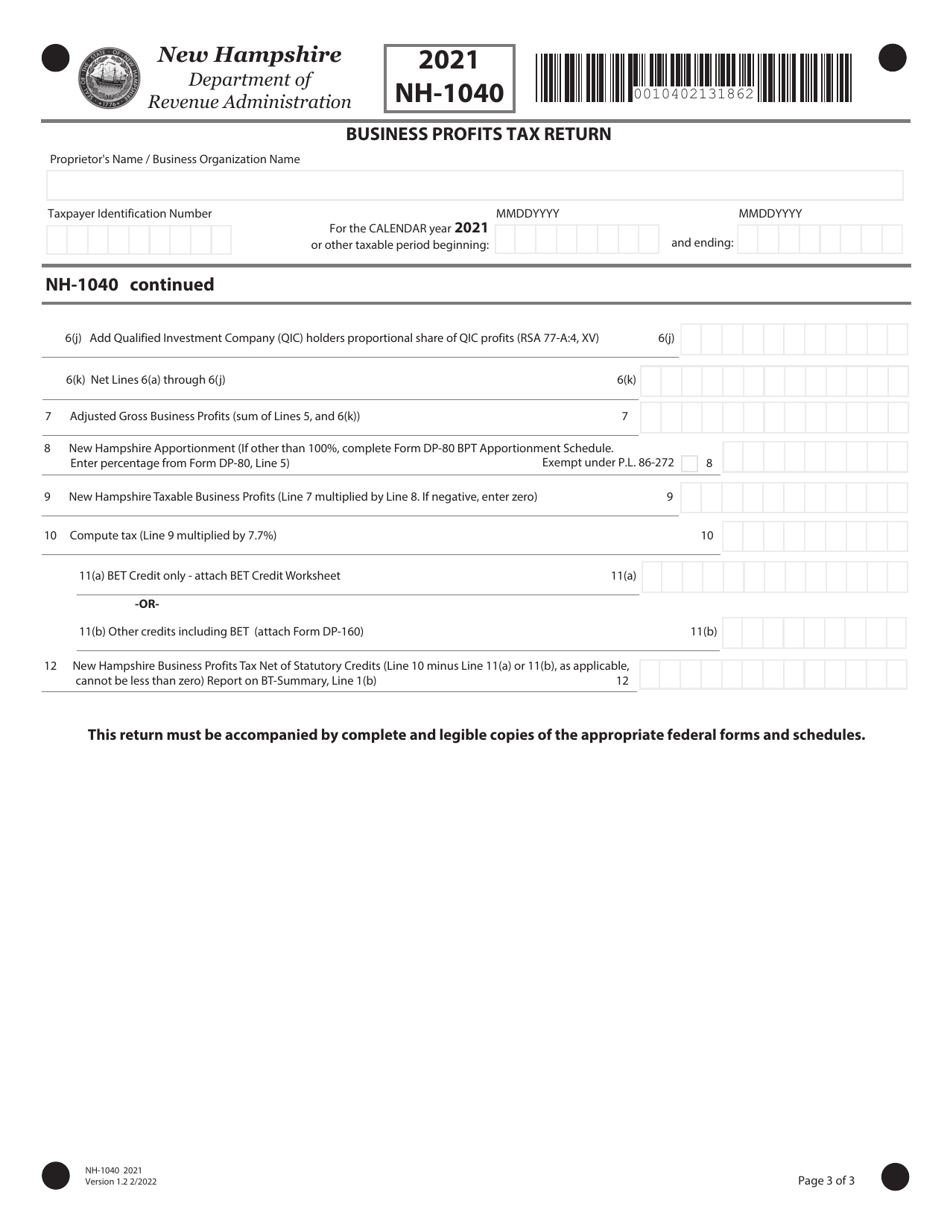

Form NH-1040 Proprietorship Business Profits Tax Return - New Hampshire

What Is Form NH-1040?

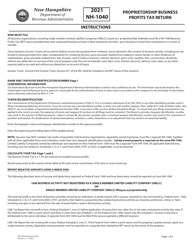

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: What is a NH-1040 Proprietorship Business Profits Tax Return?

A: It is a tax form used in New Hampshire to report business profits for sole proprietorships.

Q: Who needs to file a NH-1040 Proprietorship Business Profits Tax Return?

A: Any individual who operates a sole proprietorship in New Hampshire and earns business profits needs to file this tax return.

Q: When is the deadline to file a NH-1040 Proprietorship Business Profits Tax Return?

A: The deadline to file this tax return in New Hampshire is April 15th.

Q: Can a NH-1040 Proprietorship Business Profits Tax Return be filed electronically?

A: Yes, New Hampshire allows electronic filing of this tax return.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1040 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.