This version of the form is not currently in use and is provided for reference only. Download this version of

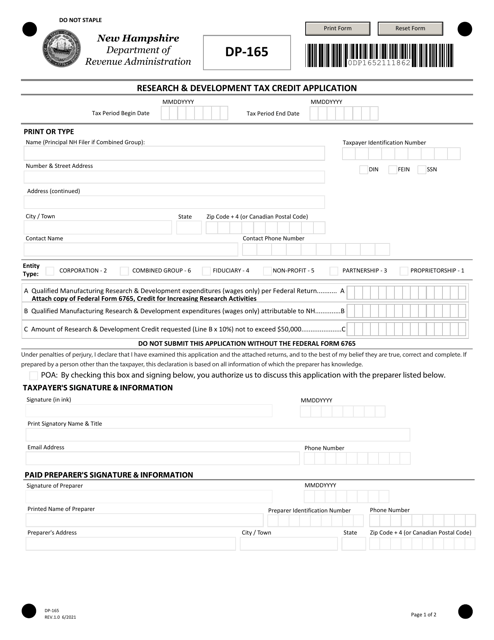

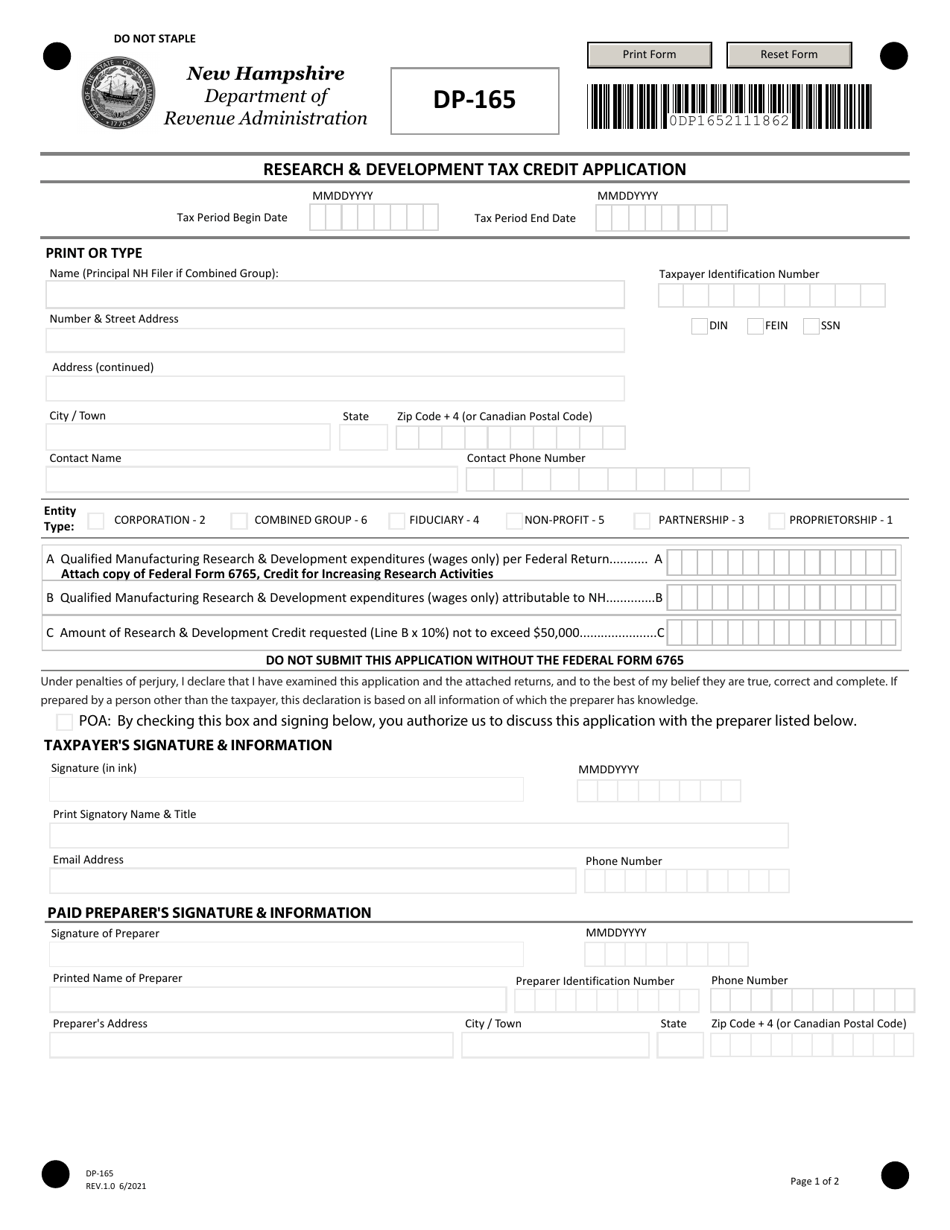

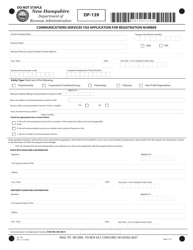

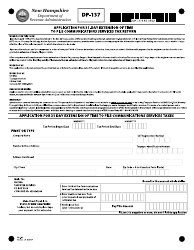

Form DP-165

for the current year.

Form DP-165 Research & Development Tax Credit Application - New Hampshire

What Is Form DP-165?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

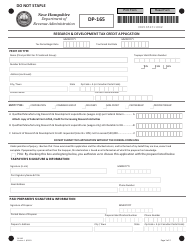

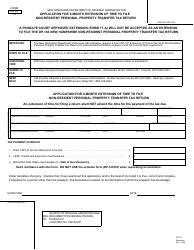

Q: What is the Form DP-165?

A: Form DP-165 is the Research & Development Tax Credit Application for New Hampshire.

Q: What is the purpose of Form DP-165?

A: The purpose of Form DP-165 is to apply for the Research & Development Tax Credit in New Hampshire.

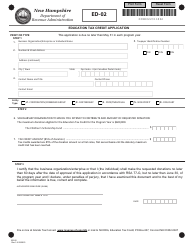

Q: Who can use Form DP-165?

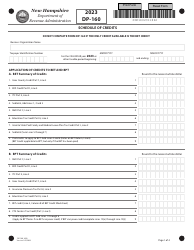

A: Any business that has conducted eligible research and development activities in New Hampshire can use Form DP-165.

Q: What are the eligible research and development activities?

A: Eligible research and development activities generally include activities aimed at discovering new knowledge or improving existing products or processes.

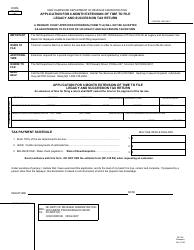

Q: Is there a deadline to submit Form DP-165?

A: Yes, Form DP-165 must be filed by the original due date of the business tax return for the tax year in which the credit is claimed.

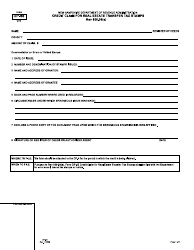

Q: What supporting documentation is required with Form DP-165?

A: You must provide detailed information about the research and development activities conducted, along with any other relevant documentation that supports your claim for the tax credit.

Q: Are there any other requirements to claim the Research & Development Tax Credit?

A: Yes, you must meet all the eligibility criteria outlined in the New Hampshire tax laws and regulations to claim the Research & Development Tax Credit.

Q: Can I file Form DP-165 electronically?

A: No, currently electronic filing is not available for Form DP-165. It must be submitted by mail.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-165 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.