This version of the form is not currently in use and is provided for reference only. Download this version of

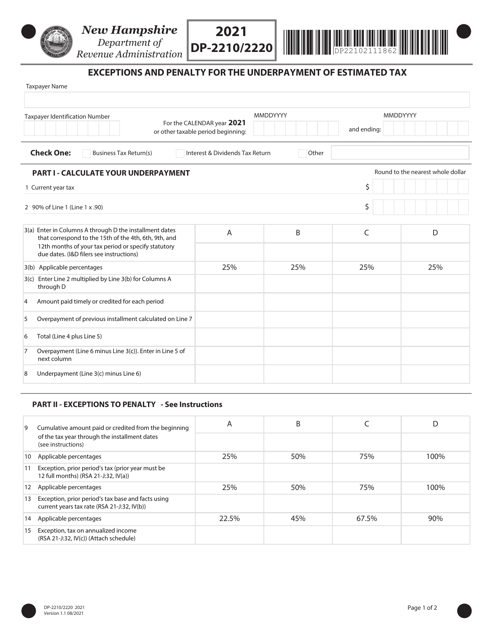

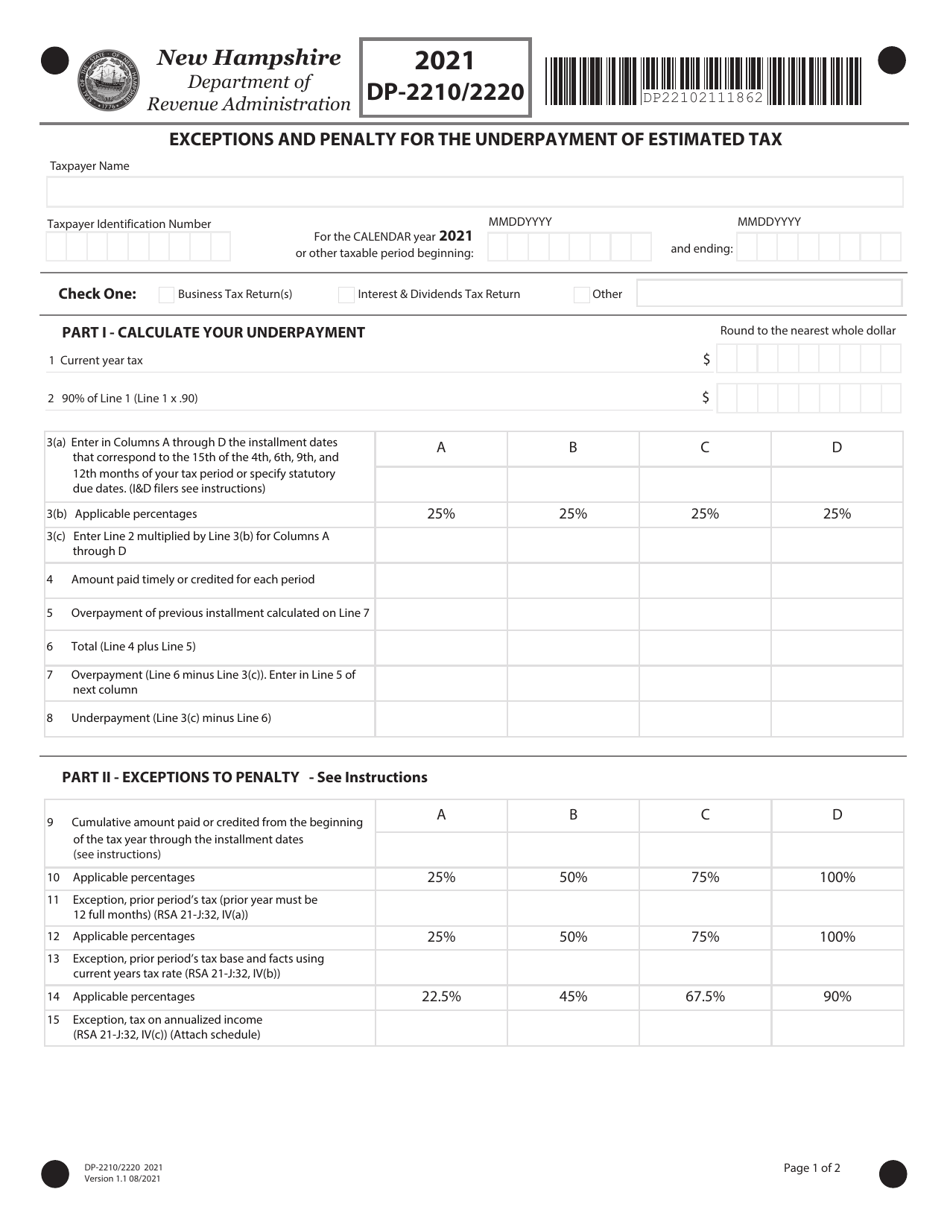

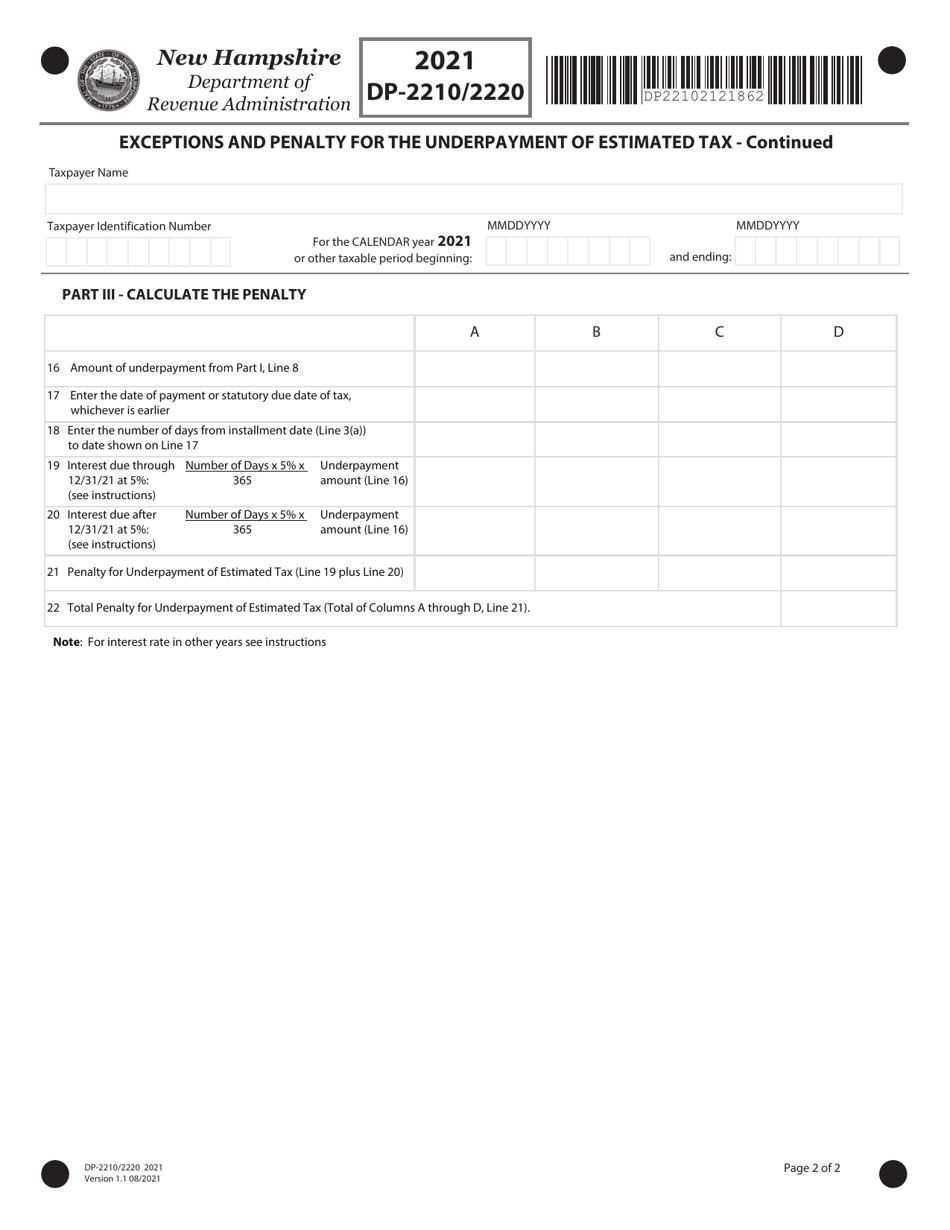

Form DP-2210/2220

for the current year.

Form DP-2210 / 2220 Exceptions and Penalty for the Underpayment of Estimated Tax - New Hampshire

What Is Form DP-2210/2220?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-2210/2220?

A: Form DP-2210/2220 is a tax form used in New Hampshire to calculate exceptions and penalties for underpayment of estimated tax.

Q: What is the purpose of Form DP-2210/2220?

A: The purpose of Form DP-2210/2220 is to determine if you owe any penalties for not paying enough estimated tax throughout the year.

Q: Who needs to file Form DP-2210/2220?

A: You need to file Form DP-2210/2220 if you are a New Hampshire resident or have income sources in New Hampshire, and you did not pay enough estimated tax during the year.

Q: How do I fill out Form DP-2210/2220?

A: To fill out Form DP-2210/2220, you will need to provide information about your estimated tax payments and your actual tax liability for the year.

Q: What happens if I don't file Form DP-2210/2220?

A: If you do not file Form DP-2210/2220 and you owe penalties for underpayment of estimated tax, you may be subject to additional interest and penalties from the state of New Hampshire.

Q: When is Form DP-2210/2220 due?

A: Form DP-2210/2220 is generally due on the same day as your New Hampshire income tax return, which is April 15th for most taxpayers.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-2210/2220 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.